Unibot and Telegram Bot are really creating a real craze in the Crypto market when it makes experiencing DeFi & Crypto simpler than ever. And with Telegram Bot it seems like DeFi is facing Mass Adoption and to learn about this trend, please join me in the article below.

To better understand Unibot and Telegram Bot, people can refer to some of the articles below:

- What is Unibot (UNIBOT)? Unibot Cryptocurrency Overview

- What is Collab.Land (COLLAB)? Collab.Land Cryptocurrency Overview

- What is LootBot (LOOT)? LootBot Cryptocurrency Overview

- Instructions for Using Unibot Telegram

Telegram Bots & User Experience Breakthroughs

Revolution in UI UX

Imagine in a very simple way, if usually when you want to buy a certain Altcoin on DEX, you need to find out which Blockchain that Altcoin is on, which protocol’s liquidity is the highest, where the transaction is best and the safest,… with Telegram Bot, this is like an assistant to help you in the DeFi world.

A very simple way, if you want to buy or sell a certain type of asset, you just need to give Telegram Bot a few extremely simple commands and it will do it for you. That’s all, users don’t need to search for information, connect wallets, sign transactions, etc. A huge step forward for user experience in the DeFi space.

These Telegram Bot platforms do not just stop at simple buying and selling activities, they can also follow a strategy that you create including many different activities such as buying and selling, Lending & Borrowing, providing liquidity ,… something that many Retroactive creators need a platform to do for them.

Industry market share

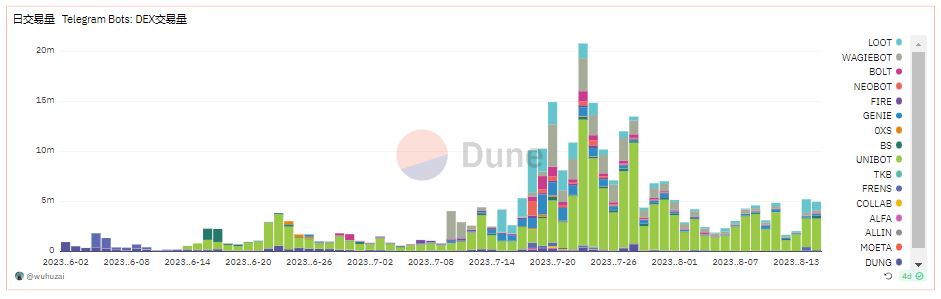

Daily transaction volume of the entire Telegram Bot industry

The trading volume generated by Telegram Bots reached more than $20M per day at the end of July 2023. This number is equivalent to the Orca platform – the largest AMM on the Solana ecosystem today, with KyberSwap – a long-standing AMM platform that has been present on 11 different Blockchains and just a little more will be equal to Trader Joe – one of the most prominent AMMs today.

Currently, Telegram Bots on average generate $5M Volume per day, although much lower than the peak but still much higher than the initial phase in the middle of this year.

Unibot Leads the Trend

Unibot is an automated bot on Telegram that provides users with a variety of experiences including:

- Limit Buy/Sell.

- Tokenomics analysis of the project you want to learn about.

- Monitor project prices.

- Copy Trading the wallet addresses you request.

- Swap across various wallets and privacy is an option.

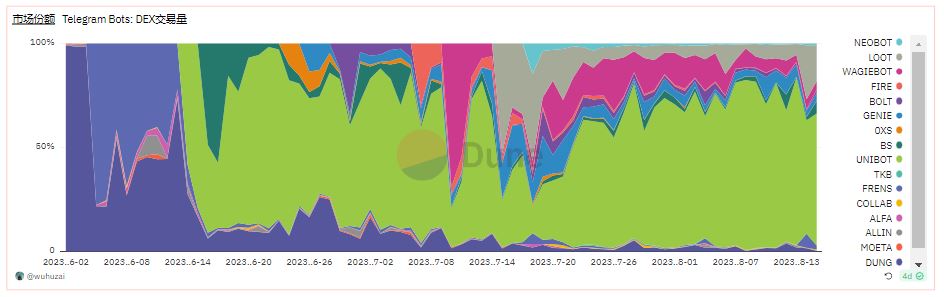

Telegram Bot industry market share (excluding Maetro Bot)

To date, Unibot has accounted for more than 60% of the total market share of the entire Telegram Bot market and according to CoinGecko, the capitalization of the entire Telegram bot market is only about $251M with Unibot leading below that, MEVFree. and PAAL AI. With such a large market share, Unibot has generated $184M Total Trading Volume and the speed is 6 times faster than direct trading on Uniswap.

Unibot also has a revenue sharing economy. But before going to how Unibot shares revenue, we need to know where Unibot’s revenue comes from:

- Transaction fees on Unibot are 1%.

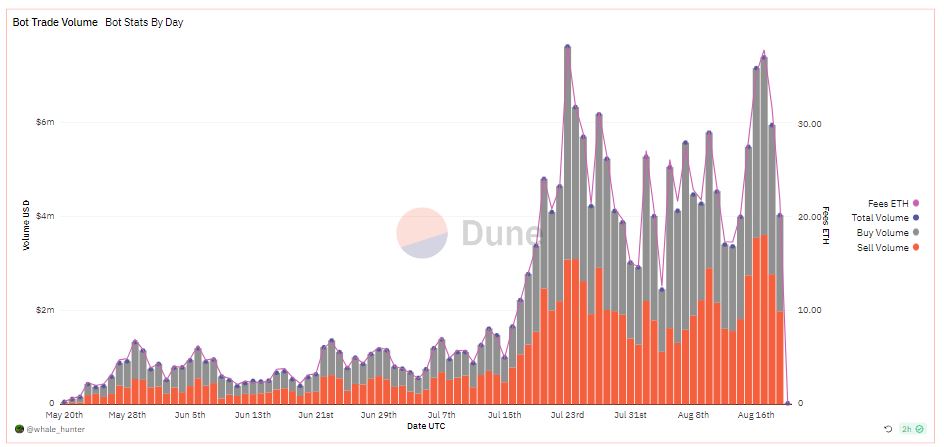

Number of daily trading volumes on Unibot

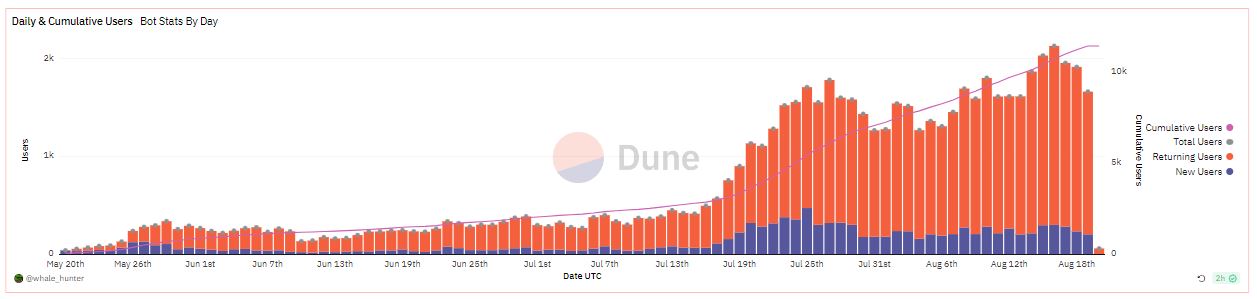

Number of daily users on Unibot

With a product that is not too different, not too “big” in terms of technology, Unibot is receiving great acceptance from users when the Total Volume of the protocol is still in a growth trend in the global context. The Telegram Bot industry is decreasing again. It seems the remaining users are flocking to Unibot.

The revenue sharing operating model allows UNIBOT holders to receive 40% of trading fees and 1% of total Unibot trading volume. In order for users to easily become part of the protocol, Unibot reduced from holding a minimum of 100 UNIBOT to only 50 and currently 10. Not only that, Unibot allows investors to use Auto mode. Compound.

Besides revenue sharing, Unibot also has some interesting features as follows:

- 20% discount on Swap transaction fees when done through Unibot.

- Join the Private Telegram channel with discussions on Market Alpha, New Features,…

- Referral program: Allows referrers to inherit 25% of trading fees from affiliates.

And to be able to enjoy maximum benefits from the protocol, users need to hold UNIBOT. It can be said that Unibot is trying to build not only a sharing economy but also a sharing community with UNIBOT holders. A direction that has many similarities with current NFT projects.

Daily revenue amount on Unibot

Along with the number of users and transaction volume remaining at a high level, the amount of fees that Unibot generates is also at a relatively high level. With a total trading volume of $185M, Unibot has shared a total of nearly $3.5M with its Token Holders.

The story of revenue sharing or what we also call Real Yield is always an attractive story for users in the downtrend and Unibot itself is not alone. Lootbot – Telegram Bot platform also commits to sharing revenue with its community. With this model, Unibot retains both its users and its Token Holder.

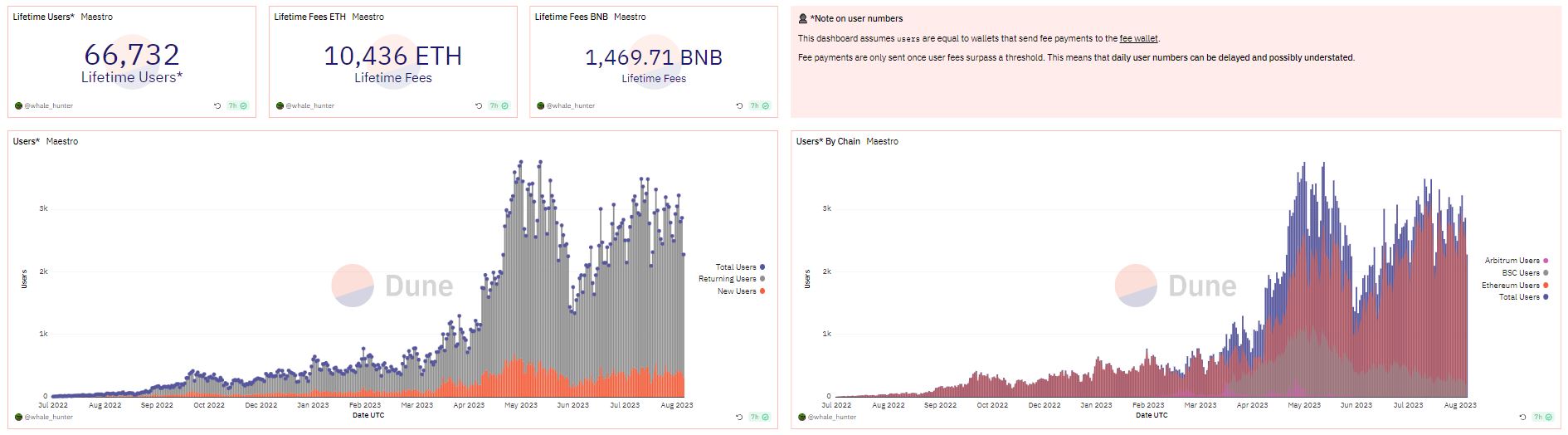

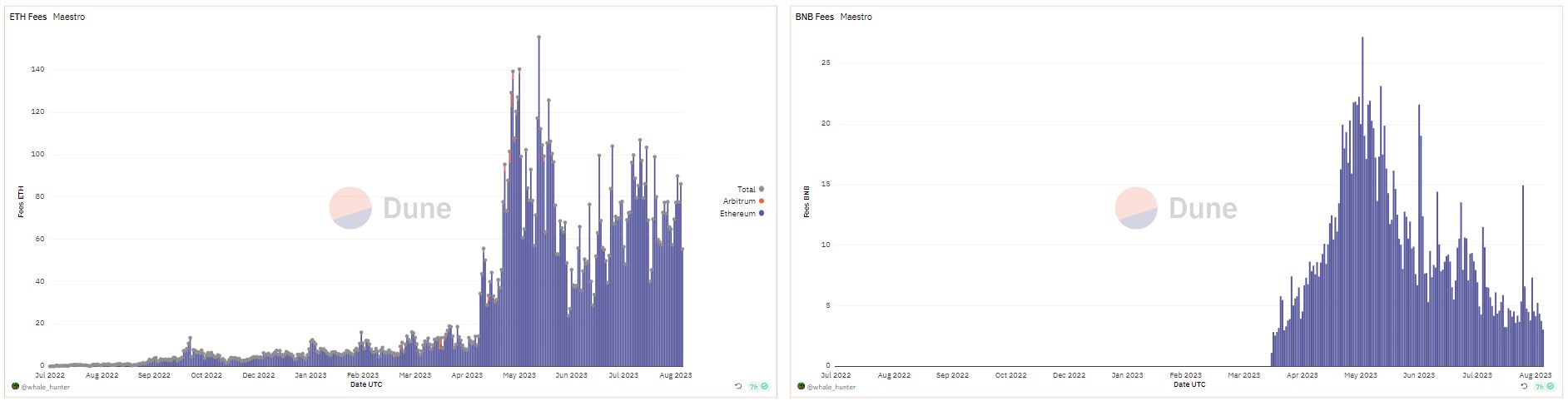

Maetro Bot – Unibot’s biggest rival

Similar to Unibot, Maetro Bot is also a Telegram Bot with a variety of strategies for basic to advanced users. Maetro Bot has not yet launched a token but is also a platform with impressive numbers.

The number of users on Maetro Bot is always maintained at about 3,000 users per day, 1,000 higher than Unibot.

The amount of transaction fees generated on Maetro Bot generates an average of about 100 ETH per day peaking at nearly 150 ETH per day. If placed next to Unibot, Maetro Bot generates less transaction fees than Unibot but not too significantly. It can be said that Maetro and Unibot are having a fierce competition.

However, if Maetro launches Native Token, the game could change a lot.

Common impressions of the Telegram Bot industry in general include:

- The product is simple and suitable for users, especially those who are confused with dozens of retroactive wallet addresses on different Blockchains.

- Relatively impressive health indicators such as Total Volume, Daily Volume, Active Users,…

- The revenue sharing model is suitable for the Downtrend situation.

Important Issues of Telegram Bot

One of the weaknesses of Telegram Bot is the return factor Security. Granting transaction rights is one of the biggest rights of users when using a wallet, because if the protocol encounters security holes, all user wallet addresses will be at risk of asset evaporation. Currently, we have not seen attacks on Telegram Bot protocols but I believe this story is sooner or later.

The Unibot project itself is one of the projects speaking out on this issue in terms of allowing users to transfer all profits to their cold wallet address. It can be said that these are only superficial solutions, there will be many other problems until the protocol is attacked.

Summary

Telegram Bot is not a groundbreaking product, but it is certainly a trendy product that meets the needs of users. Can Telegram Bot become a new trend for the future?