Synthetix is considered one of the OG protocols of the entire DeFi industry. On the road to regaining the throne, Synthetix is building an extremely diverse ecosystem based on its very healthy synth assets. However, it seems that the market is ignoring or not seeing what Synthetix is building.

So in this article, I and everyone will go through all the projects in the Synthetix ecosystem, see which projects are developing the most strongly in the ecosystem and together forecast the Synthetix ecosystem in the future. next time.

To understand more about this article, people can refer to some of the articles below:

- What is Synthetix (SNX)? Synthetix Cryptocurrency Overview

- What is Lyra (LYRA)? Complete Guide to Lyra Cryptocurrency

- What is Thales (THALES)? Learn About Thales Cryptocurrency

- What is Kwenta (KWENTA)? Kwenta Cryptocurrency Overview

Synthetix Ecosystem Overview

Overview of projects in the Synthetix ecosystem

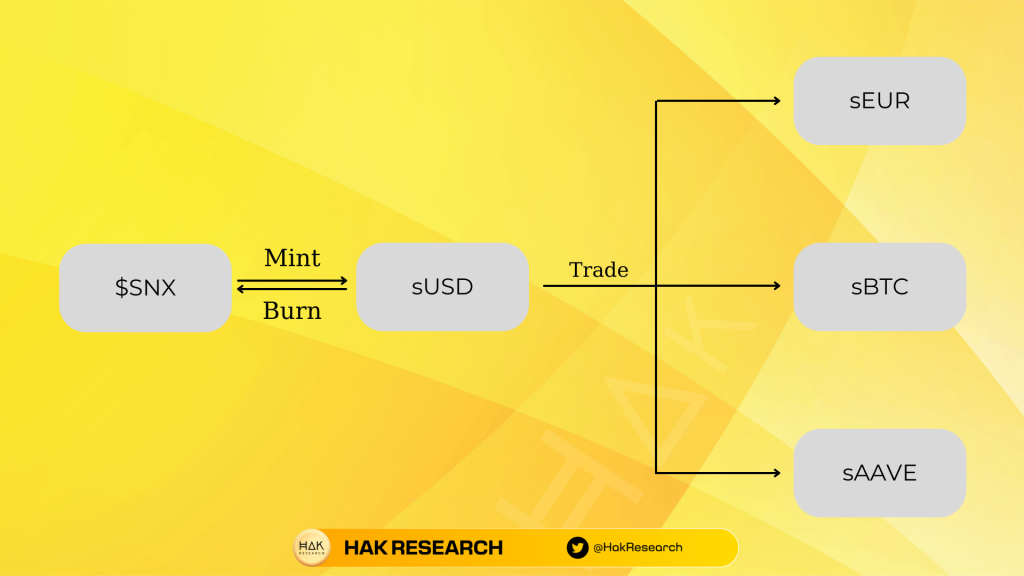

Synthetix is a protocol for issuing derivative assets (synth) built and developed on the Ethereum ecosystem. Through Synthetix, many types of assets are printed as real-world assets such as commodities, fiat currencies (INR, EUR, USD) and cryptocurrency (ETH, BTC, LINK).

Through the operating mechanism of Synthetix, Synthetix is the place where synth assets are minted based on the collateral that is SNX – the native token of Synthetix. Besides, Synthetix itself must build an ecosystem to be where the synth assets to be used and generate profits for users.

Synthetix’s ecosystem to date has been extremely diverse such as:

- Kwenta: Kwenta is decentralized derivatives exchange with the AMM model developed on the Optimism ecosystem (Optimistic roll-up Layer 2 on Ethereum).

- Lyra: Lyra is a decentralized options exchange based on AMM mechanism located on Optimism – L2 of Ethereum.

- Thales: Thales is an outstanding project in the BO segment of the Synthetix ecosystem. BO is a form of predicting the price of a trading currency pair in a certain period of time.

- dHEDGE: dHEDGE is an asset management protocol built on Ethereum.

Despite possessing an extremely diverse ecosystem, there are still some weaknesses that prevent Synthetix’s ecosystem from truly exploding, including:

- Risk of loan liquidation: Only using $SNX as collateral to mint sUSD leads to the risk of SNX token price (MC: >$300M) decreasing, directly affecting the C-ratio.

- Raising passive loans: For example, when you mint 100 sUSD and the total synths pool is worth 10,000 sUSD, corresponding to 1% of the total loan pool. In other protocols like AAVE, when you pay, you only have to pay 100 sUSD + interest. But at Synthetix when you pay you have to pay an amount equivalent to 1% of the loan pool. That means, if someone in this Pool uses sUSD to trade and makes a profit, the pool size increases to 11,000 sUSD. At this time, you will have to pay the corresponding debt amount of 1% * 11,000 = 110 sUSD.

That’s the risk, but if Synthetix is successful, the project’s native token, SNX, will have a huge growth momentum in the future.

Some of the prominent on-chain indicators on the Synthetix ecosystem

Overview of Synthetix

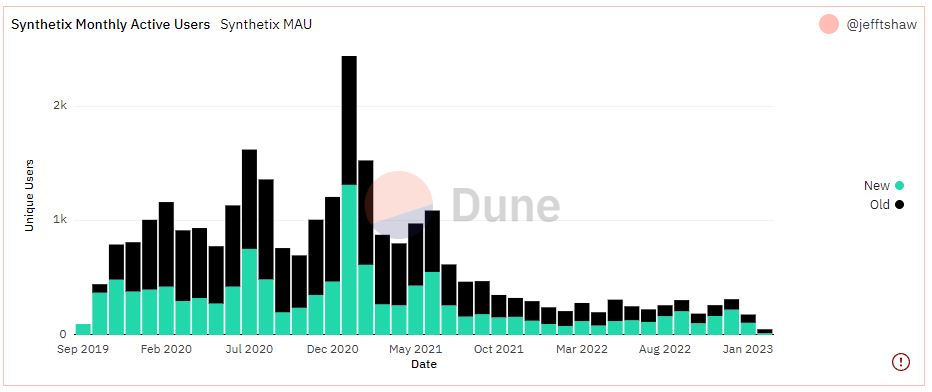

Synthetix Monthly Active Users

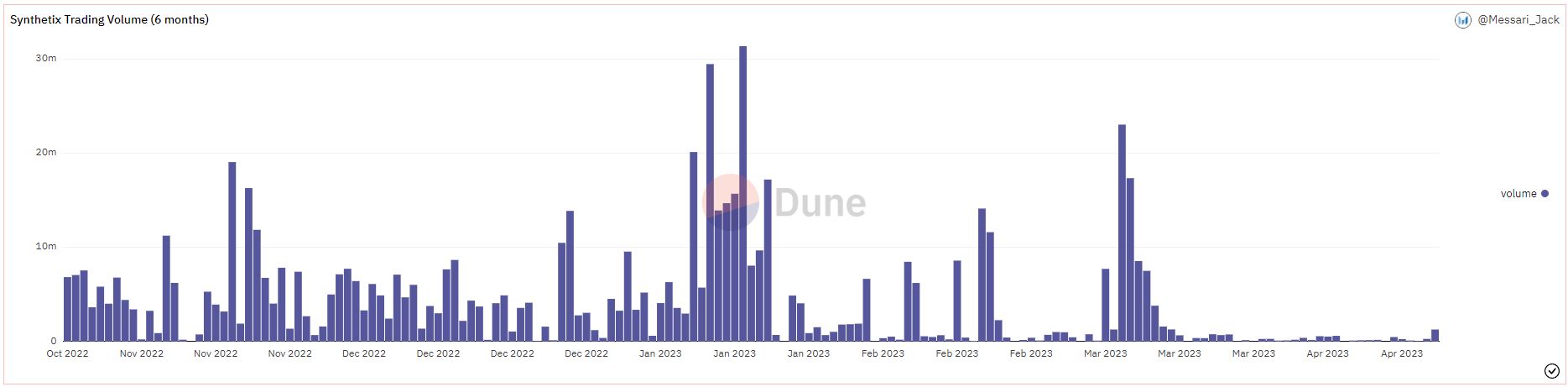

Synthetix Trading Volume

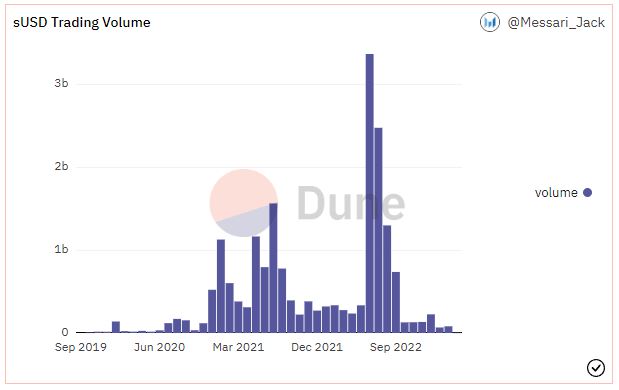

sUSD Trading Volume

sBTC and sETH Trading Volume

Most indicators such as Active Users, Trading Volume, Trading Volume of key assets such as sUSD, sBTC, sETH do not show positivity. All of this shows that a powerful Synthetix was still dormant before the collapse of Luna – UST, although it is clear that Synthetix’s position in the starting stage is not inferior to that of AAVE or Uniswap.

Lyra – The leading Options platform in the DeFi market

Up to now, Lyra is one of the most popular European-style Option projects today. I myself have also analyzed Options projects in the article Huge Growth Potential of Options In DeFi, Lyra itself has characteristics that make its protocol stand out such as:

- Simple interface that is easy to use for traders.

- Having few options prevents the protocol from having liquidity fragmentation.

- Not supporting too many assets also helps deepen liquidity on Lyra Finance.

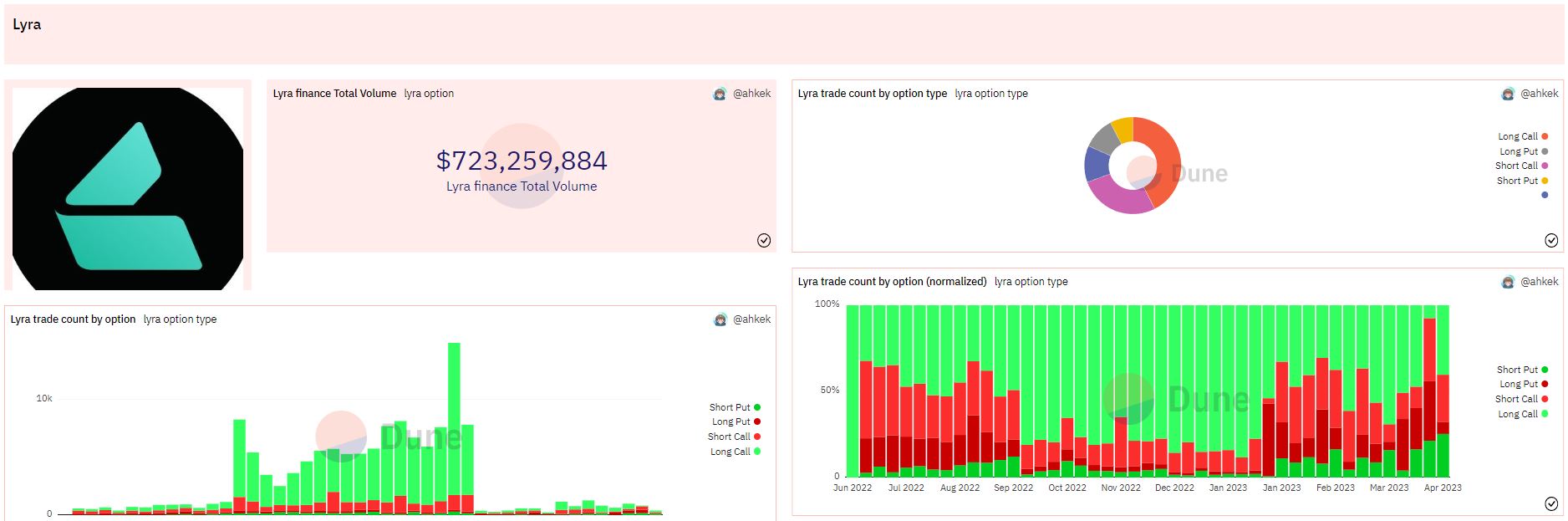

Going back a bit and looking at the Total Volume chart on Lyra, we see that Volume on Lyra increased sharply from September 2022 and maintained until mid-January 2023.

Volume on Lyra increased sharply at this stage for two main reasons:

- Lyra uses OP to reward Traders.

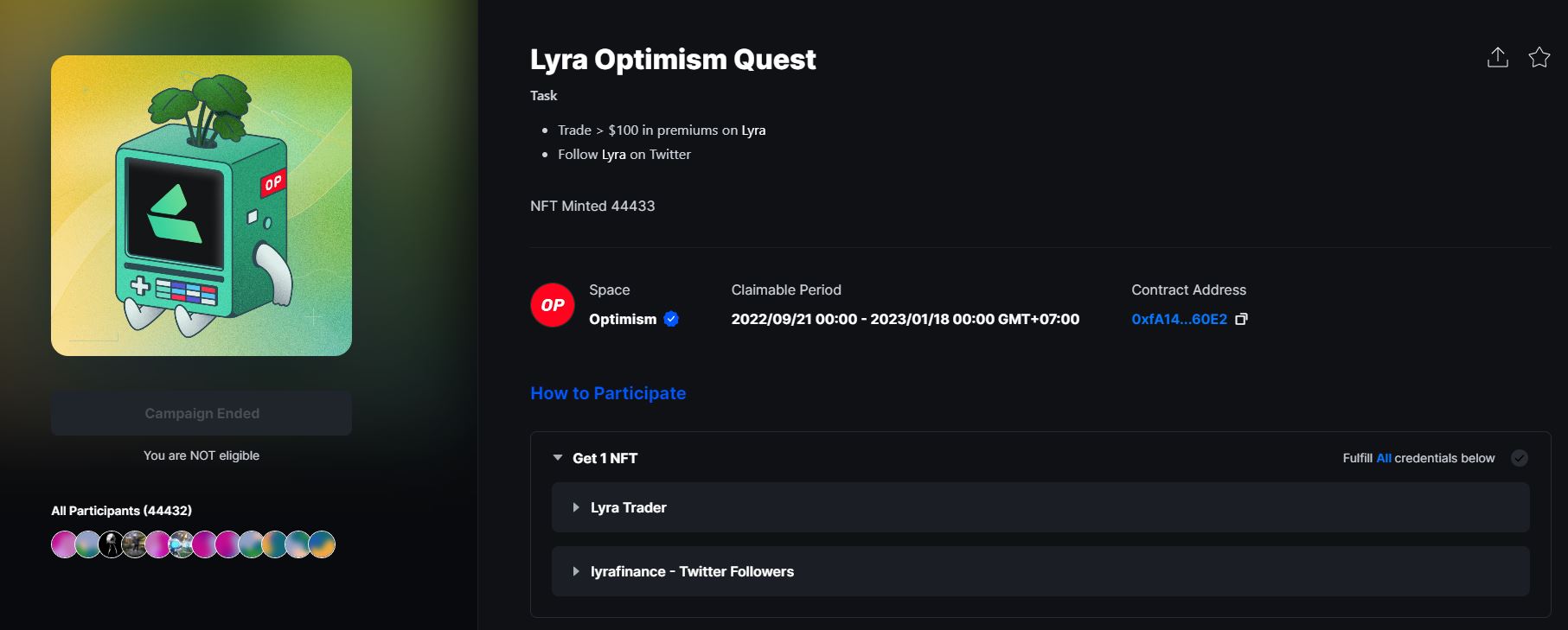

- Through this Quest, Lyra Optimism Quest has had more than 44K (accounting for nearly 25% of total users on Lyra up to this point) accounts opening Option orders on Lyra, causing Volume on Lyra Finance to skyrocket.

What’s worth pondering here is that when the motivation for traders to open orders no longer exists, the trading volume on Lyra Finance has decreased to the previous low level. This shows that Option products are not popular in the crypto market at the moment and Lyra Finance will need a lot more time in the future to develop products and educate the market.

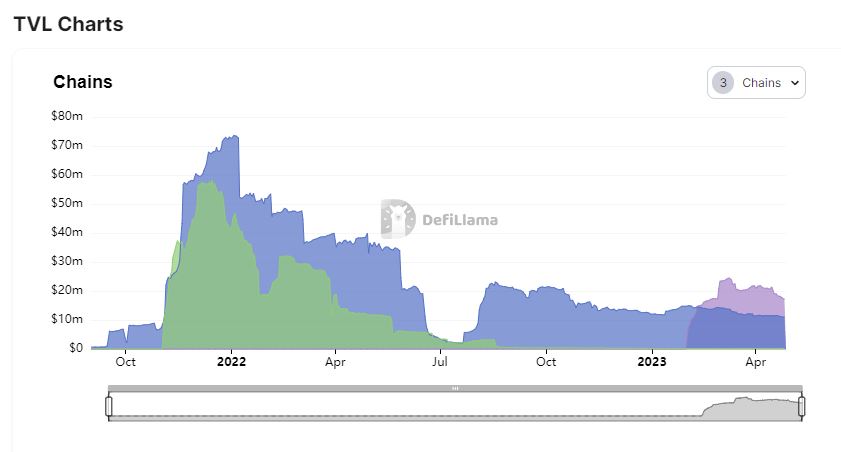

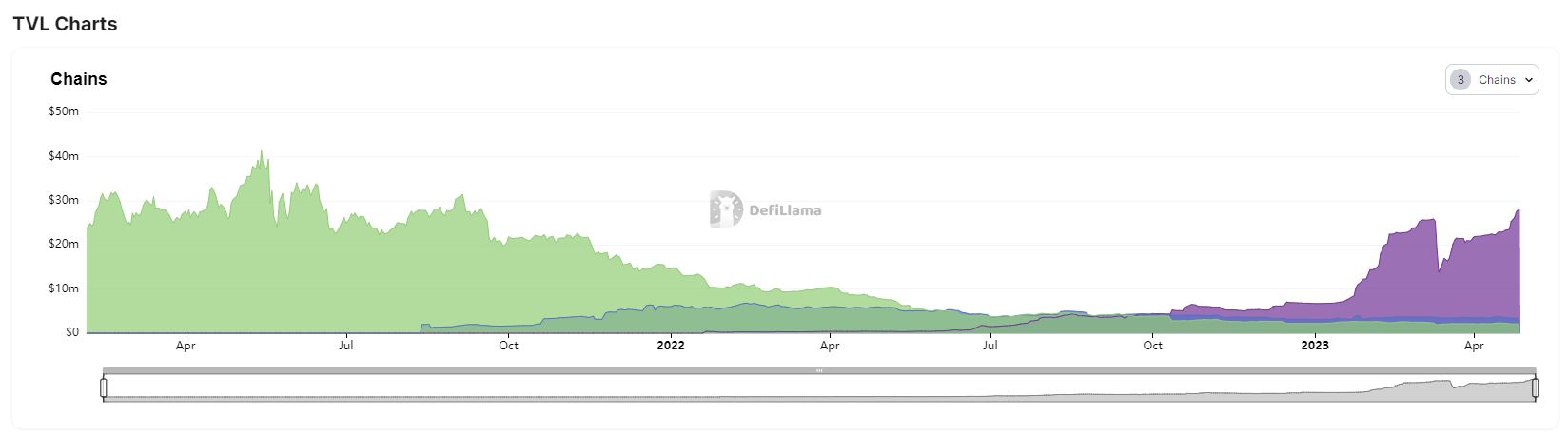

Through TVL on chains like Ethereum, Optimism or Arbitrum, we see that clearly for trading-oriented protocols, Ethereum is not the suitable land, but Optimism or Arbitrum are the suitable lands with transaction costs. cheap. When Lyra deployed on Arbitrum, TVL increased dramatically but still needs more observation in the future.

Kwenta – The project leading the Synthetix ecosystem

Kwenta is a project in the Synthetix ecosystem, next to Lyra in the Options segment, dHEDGE in the asset management segment, Thales in the BO segment, Kwenta is in charge of the Perpetual segment similar to GMX, Perpetual or dYdX but different from other platforms. If you have to build and bootstrap liquidity yourself, Kwenta is backed by Synthetix and has a lot of liquidity support.

Experience on Kwenta shows that the protocol has a number of outstanding advantages such as:

- User-friendly UI UX.

- The number of trading pairs is large.

- Transaction fees are relatively cheap.

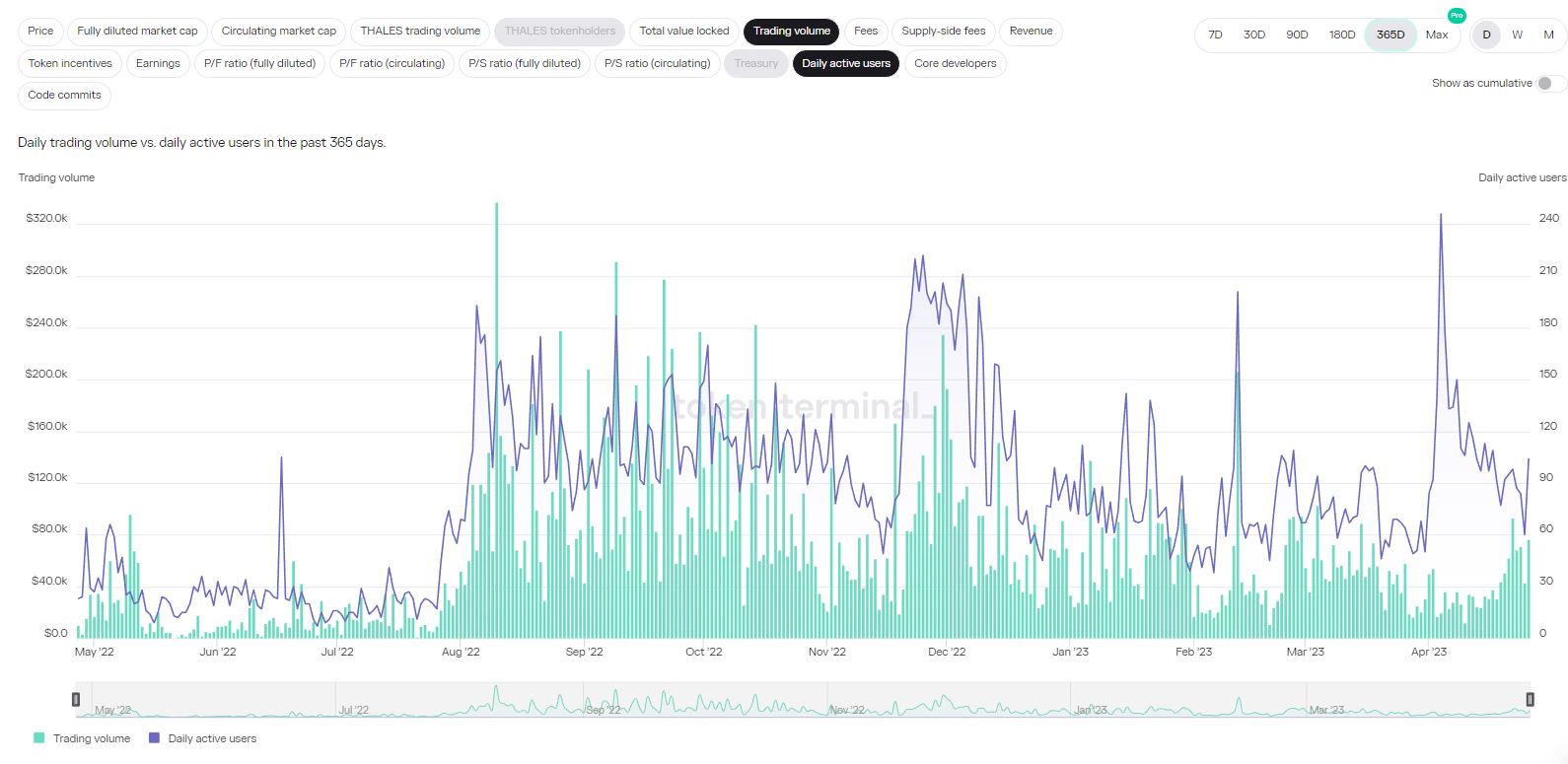

Looking at the charts of Trading Volume and Active Users, we can easily see the contrast and similarities with Lyra above.

- Active Users increased in network from September 2022 – January 2023, this is because Kwenta is also in Optimism Quest, but with only $100 volume per User to receive NFTs, Volume during this period did not grow strongly.

- Volume started to increase from February 2023 when Perpetual protocols became hot again and Kwenta used both Native Token + OP to do the Liquidity Mining program.

At present, the protocol is using many incentives to attract users and traders and we will evaluate whether it is working effectively. However, in the long term we need to see a protocol running on its own that does not rely on large incentives to be able to evaluate the effectiveness of the protocol. However, after Optimism Quest ended, the number of Active Users on Kwenta decreased sharply, which is also something worth pondering.

Apparently at that time they came to Kwenta for the sole purpose of owning the Optimism Quest NFT but they immediately left when the program ended. So will the current Liquidity Mining round face a similar situation when it ends?

The level of activity of developers on the protocol is still maintained at a high level, showing that developers are still actively working to improve, develop and upgrade the protocol.

Thales – BO project in the Synthetix ecosystem

Thales is an outstanding project in the BO segment of the Synthetix ecosystem. BO is a form of predicting the price of a trading currency pair in a certain period of time. You bet Long or Short, after the betting time the system will return the results and you will immediately know whether you won or lost. The form is extremely simple and very attractive to players and transparent because everything is on-chain.

Parameters from Token Terminal show that Thales’s daily Active Users only range from 50 – 150 users, along with a relatively modest Volume of $40K – $120K per day. The explanation for Thales not exploding with its brethren is because the project is not part of the Optimism Quest.

From my personal perspective, I see that Thales was built with a number of main goals such as:

- Built to expect to become a trend in the future.

- Build to make Synthetix’s ecosystem more diverse.

- Built so that Synthetix users have more choices.

The reality is that Thales has very few users and is only considered a piece of the puzzle to fill the Synthetix ecosystem. If the BO trend explodes in the future, Synthetix will also benefit, but this is quite difficult.

dHEDGE – Asset management platform in the Synthetix ecosystem

dHEDGE is an asset management protocol built and developed on the Ethereum ecosystem. Because it is built on Ethereum and prevents transaction fees from being too high, this protocol is not really popular until the end of 2022.

Since the time of expansion to Polygon, dHEDGE’s TVL on the energy ecosystem has grown steadily, but it was not until dHEDGE started using OP to perform Liquidity Mining that TVL on dHEDGE began to grow again. . But that also cannot confirm that dHEDGE’s TVL will continue to increase when the incentive ends.

If we look at the strength of the protocol, we will evaluate it based on the TVL of dHEDGE on Ethereum and Polygon where there is no incentive, we see that the TVL on Ethereum is gradually decreasing and the TVL on Polygon is also showing signs of decreasing. by the time. This shows that in an environment where speeds are faster and fees are cheaper, dHEDGE is not yet attractive to users.

Overall Assessment of the Synthetix Ecosystem

Factors affecting the ecosystem not yet exploding

From my perspective, there are a number of factors that have hindered the Synthetix ecosystem from exploding such as:

- Instead of focusing on building one protocol, Synthetix’s team is having to build many protocols at the same time, which may cause the product to not be at the best level as expected.

- Using synth assets is also a deterrent for new users.

- Except for the well-received Perpetual puzzle, other puzzle pieces such as Option, BO or Asset Management are not having much space to perform.

- The scope of using synth assets is limited.

Clearly, there are many factors that are causing Synthetix to not really explode and I believe that they need to build a number of new products to stay ahead of the trend or build use cases on other protocols for other resources. synth production instead of its limited scope of use.

Some factors to expect from Synthetix in the long term

Besides the negative factors, there are still positive points so we can believe and expect that Synthetix will return in the near future such as:

- The team building Synthetix is extremely talented and is still working hard on the downtrend.

- Kwenta’s success is also proof that in the future Lyra, dHEDGE or Thales also bring great success.

- If Synthetix is successful, the project’s native token, SNX, will benefit the most. Obviously, Synthetix is very interested in investors and creates an optimal model for Native Token.

Summary

Above are some updates on Weakhand’s perspective on Synthetix in particular and the Synthetix ecosystem as a whole. With a talented and hardworking team, a bright future will surely await Synthetix ahead.