It has been a long time since a project valued at up to billions of dollars launched a token and then had a large airdrop to users. After Arbitrum and Sui Network, the next name is Starknet. In this article Weakhand will give everyone a prediction of the floor price of Starknet with the STRK token.

Starknet Overview

Starknet is a Layer 2 built on the Ethereum ecosystem with Zero Knowledge Rollup technology to increase scalability while maintaining security integrity. Starknet is developed using a new programming language called Cairo, but because of that, Layer 2 will not be compatible with EVM.

Behind Starknet is the technology corporation StarkWare, the name behind other giant projects in the Crypto market such as:

- Immutubale X: A Layer 2 developed specifically for NFT and Gaming segments using StarkEX technology.

- dYdX: A Layer 2 focused on allowing people to Leveraged Trading also using StarkEX technology.

- Sorare: an NFT exchange focused on NFTs in the sports sector.

- DeversiFi: Decentralized exchange platform on the Ethereum platform that allows users to Trade, Swap, Send Token and OTC transactions right on its platform.

Factors Affecting Starknet Token Price

Tokenomics

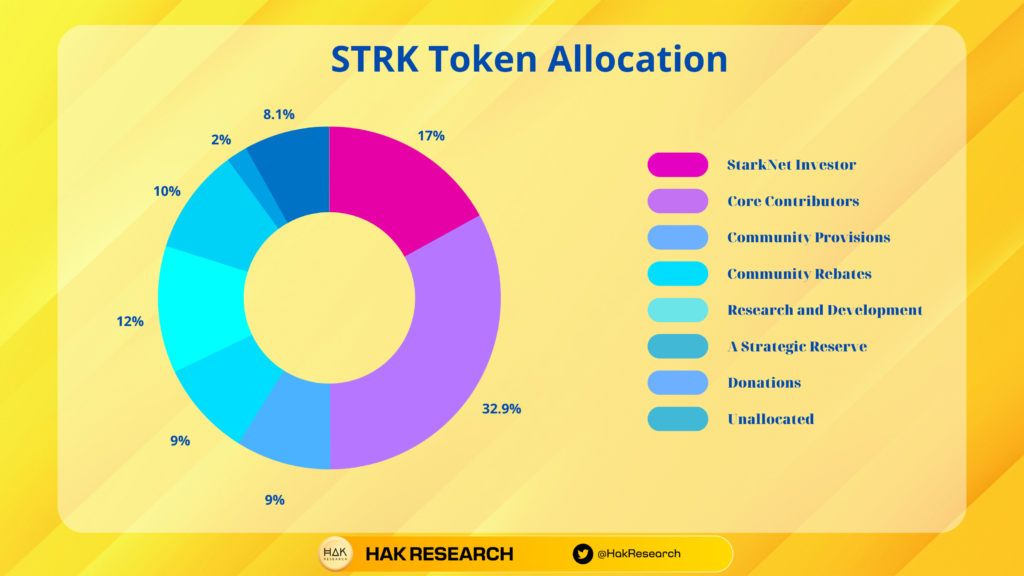

STRK tokens will be allocated as follows:

- StarkWare Investors: 17%

- Core Contributors: 32.9%

- Community Provisions: 9%

- Community Rebates: 9%

- Research and Development: 12%

- A Strategic Reserve: 10%

- Donations: 2%

- Unallocated: 8.1%

At the present time, there is no specific figure from STRK’s initial circulating supply, but we can also predict that the initial supply to the market will come from two Community Provisions sources. and Communitty Rebates with 18% equivalent to 1.8B tokens.

The team and VC token share of about 49.9% will most likely be locked for at least 1 to 1.5 years similar to dYdX. Therefore, we will not need to be too concerned about teams and investment funds holding tokens to sell in the early stages after TGE.

Parent company StarkWare

StarkWare is one of the largest companies in the Crypto market with a wide range of products and hundreds of thousands of users every day. Therefore, the valuation of this company through capital raising rounds also increased over time and peaked in the final round at $8B, specifically as follows:

- January 31, 2018: StarkWare successfully raised $6M in Seed Round from Pantera Capital, Polychain Capital, Vitalik,…

- July 16, 2018: StarkWare received a $12M Grant from the Ethereum Foundation.

- October 28, 2018: StarkWare successfully raised $30M in Series A round led by Paradigm, Sequoia Capital, Multicoin Capital,…

- March 24, 2021: StarkWare successfully raised $75M in Series B round and was led by Paradigm along with Pantera Capital, Sequoia,…

- November 16, 2021: StarkWare successfully raised $50M in Series C round at a valuation of $2B with the participation of Sequoia Capital, Paradigm, IOSG,…

- May 25, 2022: StarkWare successfully raised $100M in Series D round at a valuation of $8B with the participation of Greenoaks Capital, Qeuoia Capital, Paradigm,…

- July 1, 2022: StarkNet successfully raised $9M in Funding Round from Alameda Research.

STRK ecosystem and applications

Unlike other Layer 2s that only use ETH alone for fees, Starknet network users can use additional STRK tokens to pay fees for their transactions. This was mentioned in the v0.13 upgrade version of Starknet in Q1 2024 and will be tested on the net in the near future.

The Cairo programming language is one of the factors that helps Starknet achieve that easily. And the inaccessibility of such a completely new programming language also makes projects in the Starknet ecosystem completely native.

Although the number of projects in the ecosystem is not too many, they are all people who have been with Starknet since the early days, when the network was still quite rudimentary. Therefore, we can completely believe that Starknet will be one of the extremely powerful ecosystems in the coming time.

Starknet Floor List Price Prediction

Compare with projects in the StarkWare ecosystem

To be able to compare other products with Starknet without any confusion, we should only take two projects: dYdX and ImmutubleX.

|

PROJECT |

FDV ATH |

FDV CURRENT |

STRK PRICE |

|---|---|---|---|

|

IMX |

$18.62B |

$3.5B |

$0.35-$1.8 |

|

dYdX |

$26.8B |

$3.2B |

$0.32-$2.68 |

Both dYdX and IMX were listed at a time when the uptrend market was very exciting with a lot of FOMO. Although the market has had positive changes at the moment, it will be quite difficult to be like that at that time, so it is very difficult. It is difficult to see STRK’s FDV ATH on par with the above two projects.

But we cannot ignore the fact that Starknet is the project that has received the strongest investment in both resources and finance from the StarkWare family, so it is important for STRK to reach an equal or even higher FDV ATH level. can happen.

Compare with other Layer 2s

Similar to StarkWare’s internal situation, the current Layer 2 market only has two projects with tokens strong enough to stand on par with Starknet: Arbitrum and Optimism.

|

PROJECT |

FDV ATH |

FDV CURRENT |

STRK PRICE |

|---|---|---|---|

|

ARB |

$17B |

$12.4B |

$1.2-$1.7 |

|

OP |

$13.3B |

$9.4B |

$0.94-$1.3 |

In terms of ecosystem, at the present time Starknet is quite far behind if we compare with Arbitrum and Optimism when the number of users and TVL are not impressive, but the only difference of Starknet is lies in the fact that the projects are all native.

In terms of development team, Starknet is much stronger in all aspects such as technology, pricing, product development experience or even pricing experience (IMX, dYdX) when compared to Offchain. Arbitrum’s Labs or Optimism’s OP Labs.

In addition, we can also see that the market situation at the time of STRK’s TGE was better through the current BTC price of $44K, for ARB it was $27K and for OP it was $30K. From the above reasons, we can fully expect that the price at TGE of Starknet token will not be lower than the FDV ATH level of ARB or OP.

Summary

From the comparisons mentioned above, we can expect the price of STRK at TGE to reach a minimum of $1.3 to $2.6 per token. Hopefully, through this article predicting the price of Starknet’s floor list, everyone will be able to have a separate plan for selling airdrops in the near future.