JPEG’d is the leading NFT CDP platform on the market today. Recently, JPEG’d released a Report about new updates and improvements on its products in Q2/2023. So what’s special about JPEG’d’s Q2/2023 report? Let’s find out with Weakhand in this article.

Before getting into the content of the article, everyone can refer to some of the following articles to better understand:

- What is JPEG’d? JPEG’d Cryptocurrency Overview

- Series 10: Real Builder in Winter | JPEG’d – Too big of an ambition to succeed

- JPEG’d Protocol – Opens up the NFT CDP concept in the NFTFi “underground wave”.

- JPEG’d’s new Tokenomics design: An era for CDP, Ponzi but very sustainable

What is JPEG’d?

JPEG’d is a CDP platform for NFTs deployed on Ethereum that allows users to use NFTs as collateral to mint an amount of pUSD or pETH corresponding to a maximum LTV of 70%. JPEG’d applies ChainLink’s Oracles to determine the floor price of collectibles as well as determine the liquidation price of collateralized NFTs on the platform.

The goal of JPEG’d is to become a decentralized platform, not controlled by any central entity. This is done through a DAO that allows JPEG token holders (the platform’s main token) to participate in votes to build and improve products on the JPEG’d platform.

Some Updates About Products

JPEG’d Q2/2023 report is full of events as well as new product updates. Here are some notable product updates on the platform

Launch of P2P Ape Staking

JPEG’d Launches P2P Ape Staking

On May 9, 2023, JPEG’d officially announced the launch of P2P Ape Staking allowing holders of Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) or Bored Ape Kennel Club (BAKC) to stake can pair their respective NFTs with ApeCoin token holders to generate additional profits from Yuga Labs’ ApeCoin Staking program.

To date, JPEG’d has attracted more than 350,000 APEs and 188 NFTs to participate in Staking. Users can earn up to 40% yield on their NFT deposits and 70% yield on their ApeCoin deposits. In addition, JPEG’d does not charge any fees for this service. The output is provided by Yuga Labs and JPEG’d only facilitates the process to maximize benefits for users on its platform.

Launch of Milady Vaults

JPEG’d launches MIlady Vaults

JPEG’d has also allowed users to use Milady Maker as collateral to mint pETH or pUSD. This is proving to be an attractive option for Milady NFT holders as the collection quickly overtook CryptoPunks in JPEG’d deposits to claim the top spot within 21 days of its launch. eye.

Provide liquidity for iJPEG

Provide liquidity for iJPEG

iJPEG is an index that represents a basket of NFTs that allows users to have partial ownership of the blue chip NFTs it includes. With PIP-50, it has enabled iJPEG to become liquid and available for users to trade on Uniswap V3. Additionally, iJPEG also provides users with governance rights allowing the community to proactively change Blue Chip NFTs in the asset basket as well as participate in key decision-making processes. The iJPEG index currently includes the NFTs below:

NFTs in iJPEG

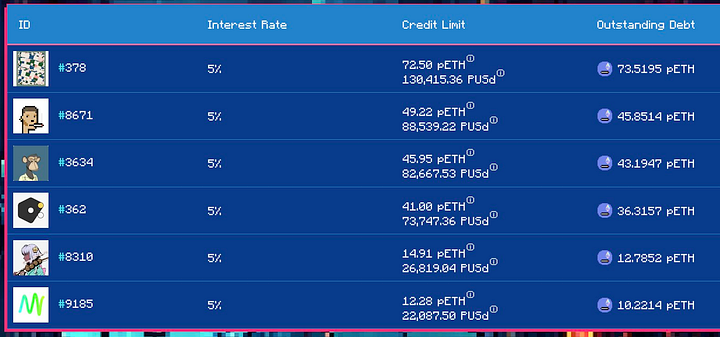

Update loan parameters and LTV enhancement mechanism

Through several PIPs, borrowing parameters and LTV boosting mechanisms have been adjusted to allow users to borrow more value from their NFTs and to improve UX.

All current collections support significantly higher LTV meaning that by default even without LTV boosting mechanisms in place users can borrow a larger amount of ETH than before. JPEG’d also introduces a 10% higher liquidation buffer – a huge increase over the previous liquidation buffer of 1%. Below is a statistical table of updated parameters for borrowers:

Statistics on updated parameters for borrowers

The updated boost mechanic features the following improvements:

- Boost LTV is now permanent with a withdrawal unlock period of 7 days. This replaces the need to track the lock duration as it will remain active until the user requests a withdrawal. Withdrawal requests can be canceled at any time.

- JPEG Boost has now been marked as having a withdrawal request and their unlock time will remain as originally set. Users can cancel their withdrawal request at any time, converting from Boost to Perpetual Boost.

- Traits Boost is now more closely monitored and updated every two weeks to accurately reflect the latest market values.

Additionally, to further improve the borrowing experience, JPEG’d has introduced a Telegram Notification bot for loan positions, some guidance on Vault management, and reduced insurance costs on loans to 2% (previously). this is 5%) + 5% liquidation penalty (previously 25%) and allows partial refunds on covered positions.

Some General Improvements

In addition to product improvements, JPEG’d’s Q2/2023 report also provides a number of general improvement proposals to make JPEG’d one of the leading CDP platforms in the NFT Lending market. . Some notable updates include:

- PIP-65 allows DAOs to use JPEG to bribe third parties to vote with CVX or veCRV on the JPEG/pETH Pool. This plays an important role in JPEG Flywheel.

- Oracles on JPEG’d have been updated to include floors on Blur.

- PIP-63 has improved access to JPEG’d auctions as users now do not need to lock a JPEG Card or JPEG token to participate in bidding in auctions.

- PIP-59 allowed the DAO to move PUSd and USDC to a new PUSd/fraxbp pool with an A factor of 100. This pool has a higher A factor than the previous liquidity pool, which should help reduce slippage when users transact with PUSd. A $250,000 PUSd swap currently has slippage of less than 0.3%.

- PIP-53 and PIP-54 enable trait boosts for rare NFTs in the Azuki and MAYC collections.

-

PIP-51 updated the insurance buyback period from 72 hours to 48 hours.

Some Statistics on the Platform

According to statistics on Defilama, of the top 5 platforms with leading TVL in the NFT Lending segment, we see that only JPEG’d was not affected too much by the collapse of Azuki and witnessed a large price decrease from the majority. Blue Chip collections.

Top 5 platforms with the largest TVL in the NFT Lending segment

Although only in third place, JPEG’d saw the most stability and steady growth in TVL while the remaining platforms all saw significant TVL declines. A typical example in this case is BendDAO when this platform has had a TVL level divided 3 times compared to the peak in February 2023.

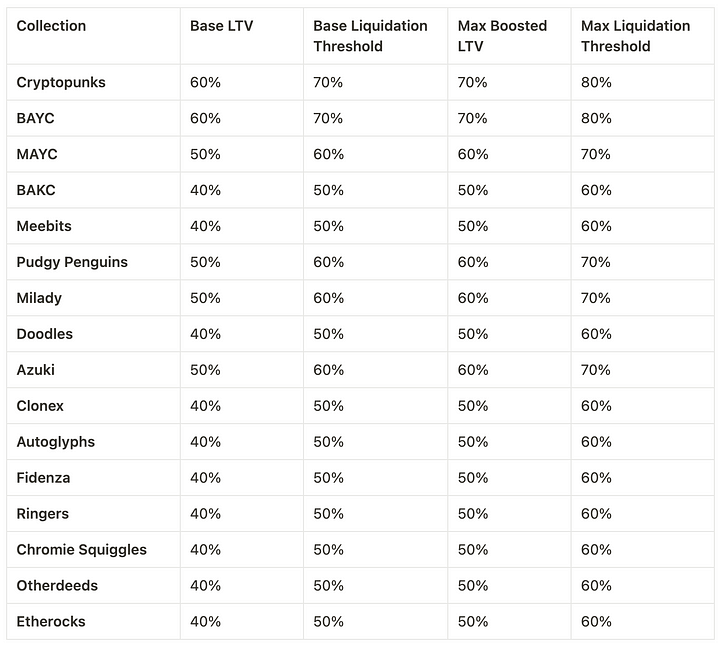

Number of NFT Deposits to JPEG’d

The number of NFTs deposited onto JPEG’d as collateral also continued to grow and reached a new ATH of 649, an increase of 8% compared to the beginning of Q2. This is thanks to the development team’s continuous efforts in delivering new products and features including those listed above.

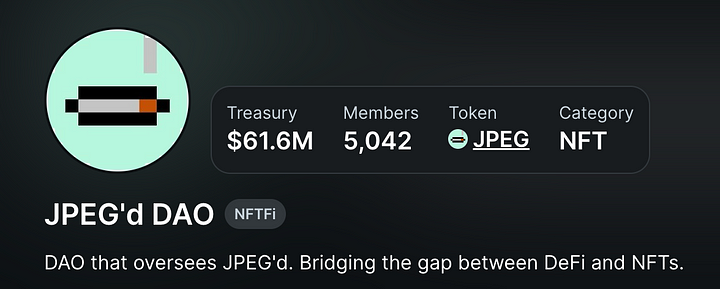

JPEG’d Treasury

JPEG’d Treasury continues to grow and is now worth over 60M USD, cementing its position as one of the largest DAO Treasurys for a project in the Crypto market. Through proposal PIP-60, allowing DAO to use 5M USD from Stablecoins in Treasury to buy more CVX and PIP-67 allowing DAO to use up to 90% of ETH in Treasury for Staking to check the yield of 4% on Staking amount.

summary

During Q2/2023, the development team worked tirelessly to improve existing products and introduce new services to the ecosystem. This has been shown through TVL parameters, the number of NFTs used as collateral reaching ATH,… even in challenging market conditions. Above is all the information about JPEG’d’s Q2/2023 report, hope everyone has received useful knowledge.