Recently, the Omnichain trend is becoming exciting in the Crypto market thanks to the security elements this technology brings. One of the projects leading this technology at the present time is Wormhole. . In this article, Weakhand will provide everyone with potential projects on the Wormhole ecosystem through which people can anticipate this trend.

To understand more about this article, people can refer to some of the articles below including:

Wormhole Overview

What is a wormhole?

Wormhole is a cross-chain communication protocol developed to serve as the infrastructure for Cross-chain Bridges, Dex, etc. to operate and is supporting more than 20 different Blockchains including EVM and non-EVM. chain. chain.

On Wormhole nUsers can interact with xDapps (cross-chain decentralized applications) to transfer xAssets (cross-chain assets) between networks or access xData (cross-chain data) to provide services on the network for them.

Wormhole’s mechanism of action

Wormhole’s network is made up of 3 different parts and performs different tasks:

- Core Bridge Contract: These are smart contracts deployed on different Blockchains with two main functions: emitting EmitVAA for Guardians to read and observe and VerifyVAA so that Guardians of the above data block is correct.

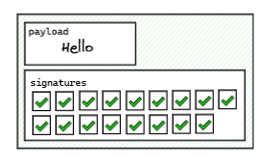

- Guardian: Includes 19 different nodes with the function of checking and confirming transactions on Omnichain in a unique way for each node. The Guardians, after performing their separate confirmations, will aggregate the signatures from the Guardians. If a transaction is agreed to by a majority of the Guardians, it will be created into a VAA.

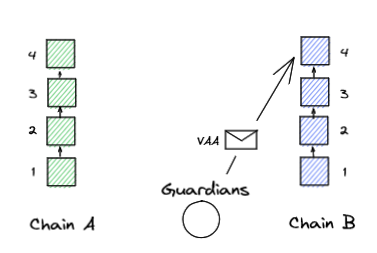

- Relayer: Is software created to automatically transfer the above signed VAAs to the target chain.

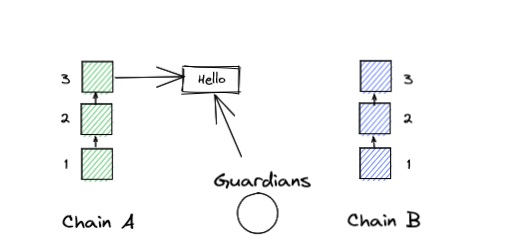

Wormhole’s operating process will take place as follows:

Step 1: The Core Bridge Contract will emit a message on chain A that is sent to the Guardians for authentication and signature generation.

Step 2: The Guardians proceed to sign the message. When the majority of the Guardians have signed, a VAA will be created and received by the Relayers.

Step 3: Relayers will receive VAA from Guardians and proceed to send VAA to chain B, the target chain.

Featured Projects on the Wormhole Ecosystem

Outstanding Bridge projects

Portal Bridge

Portal Bridge is probably the brightest name in Wormhole’s Bridge segment as this is a project built by Wormhole’s own team and then backed by Jump Crypto.

Portal went through a turbulent 2022 with the beginning of the year being hacked, the middle of the year also being involved in the collapse of LUNA-UST causing many liquidity pairs to be wiped out, and the end of the year could not avoid being involved. Although it’s coming to FTX, Portal Bridge is still standing strong with a TVL of nearly $280M.

Currently, Portal Bridge is connecting to more than 20 different Blockchains including EVM and non-EVM chains, bringing great convenience to users.

Hyphen Bridge

Hyphen Bridge is a bridge built by Biconomy’s team and is integrating Wormhole technology.

Currently, if we only compare speed and transaction fees, it can be said that Hyphen Bridge is the best bridge today, proving that the combination of the two project teams Wormhole and Biconomy is bringing high efficiency.

Outstanding DEX projects

Uniswap

Uniswap is the leading project in the entire DeFi market in the AMM DEX segment with a history of formation and development stretching from 2018 to the present.

Uniswap’s choice of which Omnichain platform to use to go multichain has caused a fierce battle between the two largest platforms currently, LayerZero and Wormhole, but the ultimate winner is still Wormhole thanks to the support of the majority of the community. copper.

Acquiring the largest DEX project at the moment will help Wormhole’s position be upgraded many times in the fight to become the largest Omnichain platform.

Hashflow

This is one of the best cross-chain DEXs currently as users can swap on the same chain or from chain A to chain with almost zero slippage rate.

For comparison, Wormhole’s current Hashflow can be considered no different from LayerZero’s Stargate when it comes to bringing the best experience to users.

Hashflow has implemented the following mechanisms to protect users from price slippage:

- Use Market Maker: Hashfolow used an offchain orderbook mechanism so the price the user is notified of before the swap will be the exact price the user receives.

- Develop tools to protect traders from MEV bots: Hashflow protects users by using cryptographic signatures to protect users from front-running.

Orca

Orca is currently an AMM using a centralized liquidity mechanism similar to the largest Uniswap v3 on Solana, so taking advantage of technology from Wormhole is obvious.

With its projections, in the future it is likely that Orca will deploy multichain to many other Blockchains such as Aptos or SUI, so using Wormhole will greatly support the process of transferring users’ assets.

Outstanding NFT projects

DeGods

Degods is a collection of 10000 different NFTs depicting deities in a variety of styles and colors.

Degods was initially launched on Solana in 2021, but later decided to move to Ethereum because of network-related problems as well as FTX’s bankruptcy which also greatly affected the overall condition of the Solana network.

Moving to Ethereum has inevitably forced Degods to use the best current communication technology on Solana from Wormhole.

y00ts

y00ts is an NFT collection consisting of 15,000 sheep with different breeds, hair styles, fur colors and equipment.

Similar to Degods, y00ts is also developed by the same parent company, Dust Labs, so Multichain like Degods is inevitable.

The y00ts collection at one point caused the entire Solana network to be heavily congested, proving how great the attraction of 15,000 NFTs of this sheep is.

Outstanding Stablecoin projects

Frax Finance

Frax Finance is currently the largest semi-algorithmic stablecoin project today with FRAX being a peg stablecoin priced with USD, FRXETH having the same value as ETH and FPI peg with the US consumer price index.

What Frax Finance needs most right now is to create a use case for the stablecoins it creates by going multichain to reach more customer files as well as large liquidity pools.

Thanks to using communication technology from Wormhole, Frax has currently brought its products to more than 11 different Blockchains, however the current problem that Frax Finance needs to solve is that liquidity is too concentrated. many on Ethereum that are not available on other chains.

Outstanding Liquid Staking projects

Lido Finance

The only Liquid Staking project currently using Wormhole’s technology is also the largest project in this segment, Lido Finance with TVL at ~$12B.

Lido has started using Wormhole’s technology since the end of 2021 with the main purpose of transferring synthetic assets such as stETH, stSOL,… between 3 Blockchains: Ethereum, Solana and Terra. The collapse of LUNA-UST also caused Lido Finance’s TVL to lose more than $7B at that time, but the project is still standing strong thanks to its trump card stETH.

Summary

Above are the outstanding projects in Wormhole’s ecosystem. You can also learn about many other projects through articles from the HakResearch website. I hope that through this article about potential projects on the Wormhole ecosystem, everyone will have a more general view as well as make predictions about future investment opportunities.