Pendle Finance has made many strong moves in recent times, having just received investment from Binance Labs and Pendle launched the RWA product to target the extremely fertile but untapped billion-dollar market. much. Everyone, let’s learn about Pendle Finance’s RWA product this time through the article below.

To understand more about Pendle Finance, people can refer to the article below:

- Overview and Liquidity Flow in LSDfi

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- Pendle Finance Bright Spot Amid Cold Crypto Winter

- Pendle Wars Becomes Center of LSDfi

Pendle Launches RWA Product

Motivation to approach Real World Assets

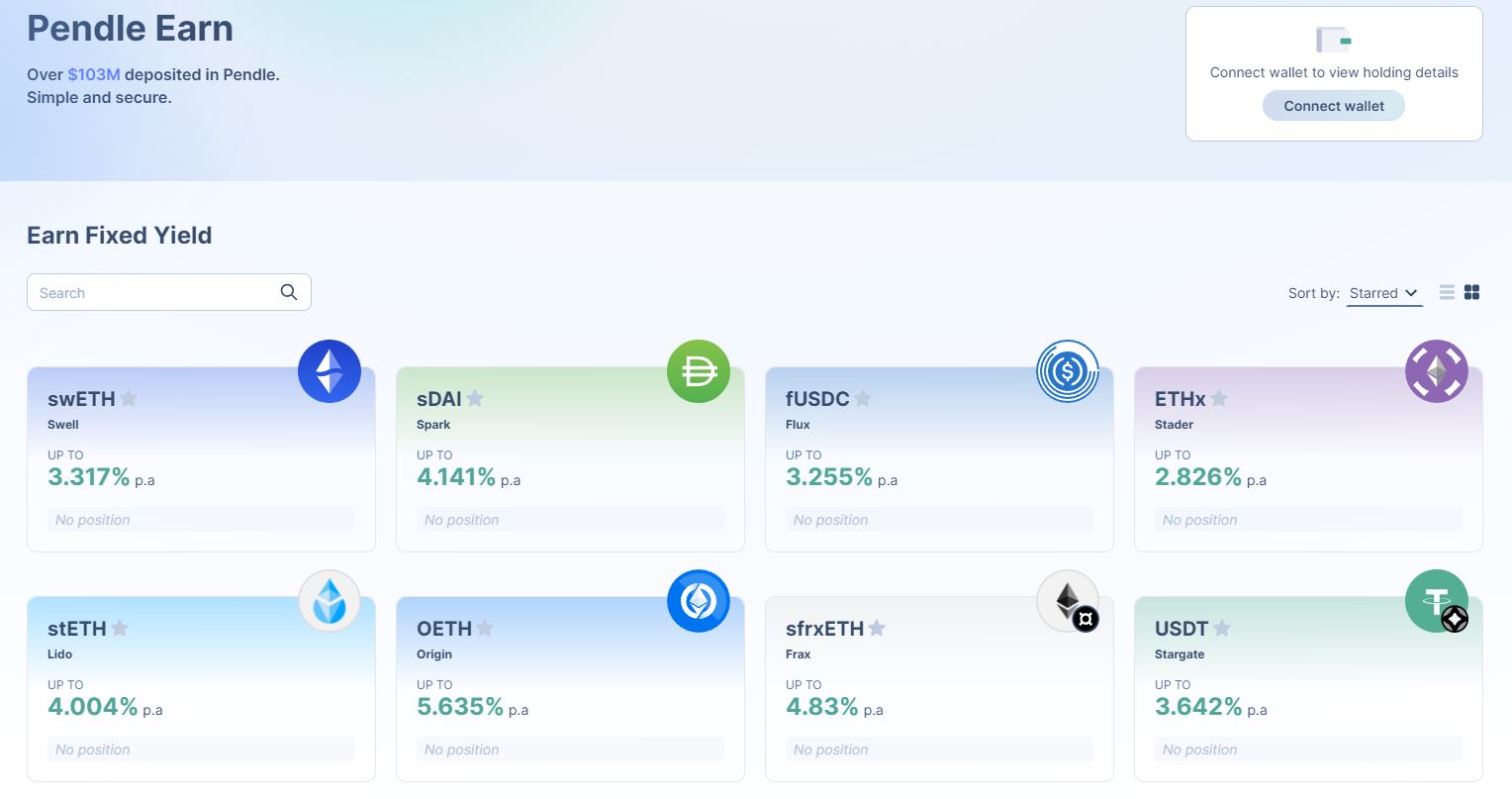

Pendle Finance is a protocol that helps users optimize profits based on yield-bearing assets (Yield-bearing Tokens). Pendle Finance has been very successful with the LSDfi market with profitable assets such as Lido Finance’s stETH, Swell Network’s swETH, Frax Finance’s sfrxETH or Stader Labs’ ETHx.

Co-founder and CTO of Pendle Finance once shared with Weakhand about Pendle’s market:

“Pendle Finance can develop on any form that generates interest, Pendle helps users bet on whether interest rates will go up or down. In the Crypto market, most assets can generate Currently, Liquid Staking Derivatives is one of the most attractive interest generating industries, which is why Pendle focused on LSD from the beginning.

Pendle very simply will follow places with high interest rates, good interest rates as long as there are large enough users there.”

In the context of the Crypto market being in the winter period, the source of profits in Crypto in general and DeFi in particular is becoming less and less attractive. Therefore, Real World Asset is expected to open a completely new market with a volume of up to hundreds of billions of dollars. It can be said that RWA is one of the industries that can change the face of DeFi in the near future. .

Next, looking beyond TradFi, in the context of inflation still being high and FED interest rates continuously increasing, the US government bond market is becoming more and more attractive in the eyes of investors because of its large liquidity. , safe and extremely attractive interest rates.

These two factors brought Pendle Finance to the Real World Asset segment.

Pendle launches Real World Asset product

Babe wake up, new Pendle RWA arc just dropped!

Featuring sDAI by @spark_protocol & fUSDC by @FluxDeFiit’s where real-world yields meet the beauty of Pendle

pic.twitter.com/7IVDPKwnt6

— Pendle (@pendle_fi) August 23, 2023

Pendle Finance has officially approached the RWA market through two types of assets: Spark Protocol’s sDAI and Flux Finance’s fUSDC.

- sDAI: Is a product of Spark Protocol and within the Maker DAO ecosystem. sDAI allows sDAI holders to automatically accumulate 5% interest over time. Spark Protocol has many products to generate profit such as Flash Loan, eMode, Isolation Mode.

- fUSDC: Is an asset belonging to Flux Finance and located in the Ondo Finance ecosystem. Lenders can earn interest on their Stablecoins by depositing their Stablecoins into the Flux Finance protocol. Stablecoin can generate profits because it is exposed to real-world assets through Ondo Finance such as government bonds, corporate bonds,…

Currently, users can deposit their sDAI and fUSDC into Pendle Finance for additional profits.

With Real World Asset, Pendle Finance’s TVL, users, Revenue,… continue to have incredible growth after the TVL boom along with the LSD and LSDfi trends. This somewhere proves Vu’s point of view: “Pendle very simply will follow places with high interest rates, good interest rates as long as there are large enough users there.”

Pendle Finance’s growth with RWA

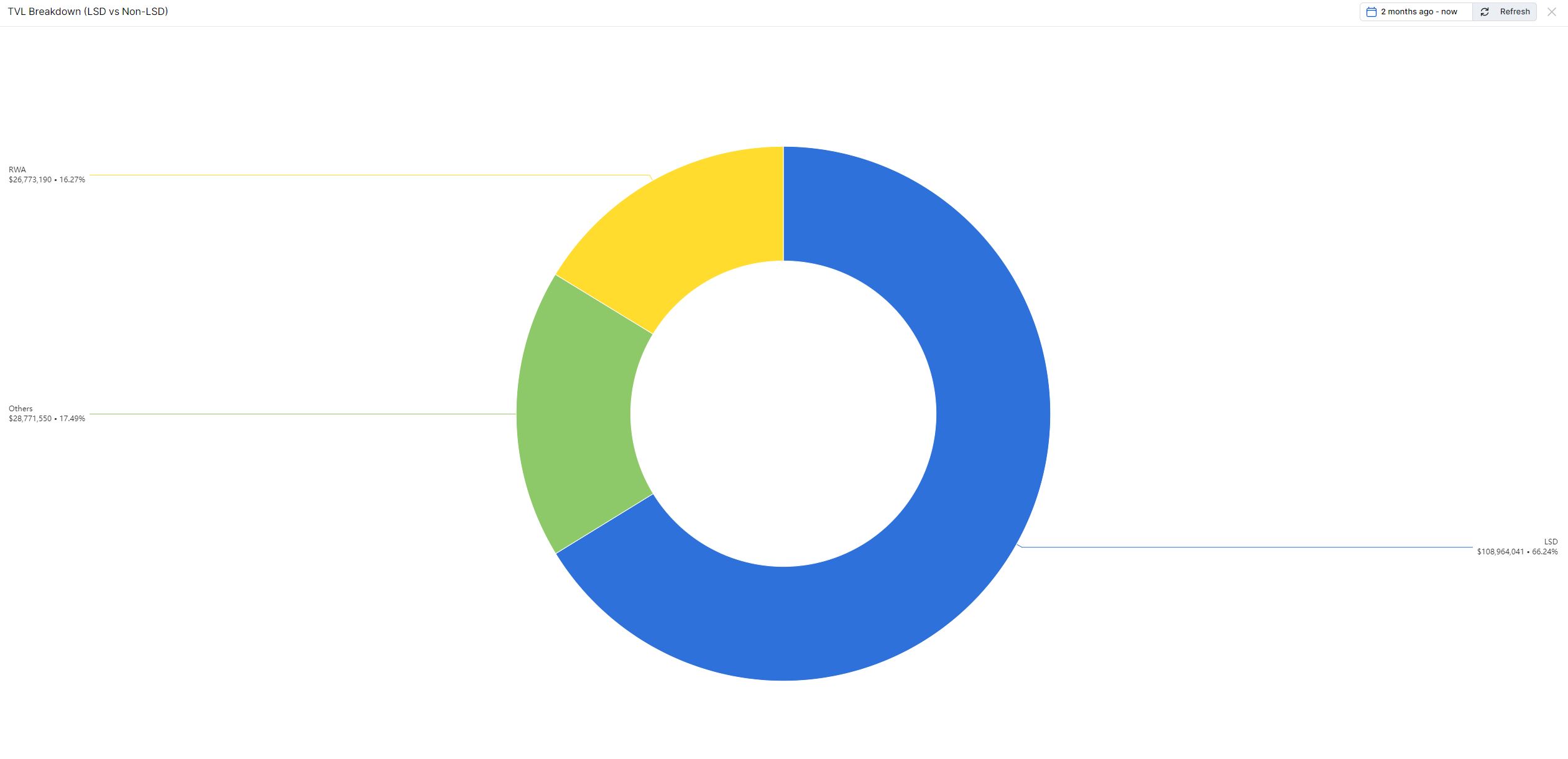

Immediately after launching, the RWA segment quickly accounted for more than 16% of Pendle Finance’s total TVL and this drove Pendle’s TVL to grow rapidly from $117M to $161M at the time of writing. Clearly, RWA has had a positive influence on protocol development.

Pendle Earn has been integrated into OKX Wallet and Bitget Wallet, giving users easy access to receive fixed interest on their assets held on-chain. This factor also creates sustainable growth for Pendle Finance now and in the future.

Personal Review of Pendle RWA Product Launch

In the current context, we see that LSD is showing signs of going down although the amount of ETH staked is still growing, but this amount of ETH is mainly staked directly on the Beacon Chain and not staked through Liquid Staking Derivatives platforms. We can see that this is the general situation of the entire LSD and LSDfi industry when indicators such as TVL, Revenue, Volume, User Active,… are all showing signs of a slight decrease.

However, a quiet LSD does not mean that the entire Crypto market is quiet. In a market context that needs a breakthrough or difference, Real World Assets emerges as an extremely potential segment and RWA is completely consistent with Pendle Finance’s development goals such as:

- RWA projects have a variety of tokens that hold profits, and these profits come from the profits of assets pegged in the real world.

- The RWA segment is also attracting a lot of interest from users, investors and VCs because what it can do is access trillions of dollars in the real world and put it on On-chain.

Integrating RWA and Fixed Yield is completely reasonable for Pendle Finance. However, it also has some disadvantages such as:

- Interest rates from US government bonds (a form of RWA tied to Stablecoins) may only be attractive to users in the context of a depressed and declining market. When the market grows strongly again, it is likely that the model will be quite difficult to operate effectively.

- Bringing assets from the real world to On-chain will likely still encounter technical obstacles and especially legal issues.

From these two factors, I believe that RWA will also be just one of the products in Pendle Finance’s development roadmap. In the future, Pendle Finance certainly needs to have new products that are both trendy and suitable for users.

Summary

Pendle’s launch of the RWA product has created a boost that will help the protocol continue to grow even stronger in the near future. The final destination that Pendle Finance is aiming for. With the ability to support all types of yield-bearing assets, we can expect more integrations in the future of Pendle Finance to establish a strong foothold in the ecosystem. DeFi state.

People can follow Pendle Finance at some popular channels such as:

- Website: https://www.pendle.finance/

- Twitter: https://twitter.com/pendle_fi

- Telegram Pendle Finance in Vietnam: