In recent times, with the recovery of the general market, the NFT market has also witnessed prosperity with a series of NFT collections growing impressively. There are blockchains that receive a lot of attention, but there are also blockchains that are losing their appeal and seem to be left behind. Let’s find out everything with Weakhand in this article.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- Sats skyrocketing, what is happening to the BRC 20 market

- What is Bitcoin Ordinals? Everything about Bitcoin Ordinals

- What is BRC 20? All you need to know about BRC 20

The NFT Market Is Seeing a Strong Recovery

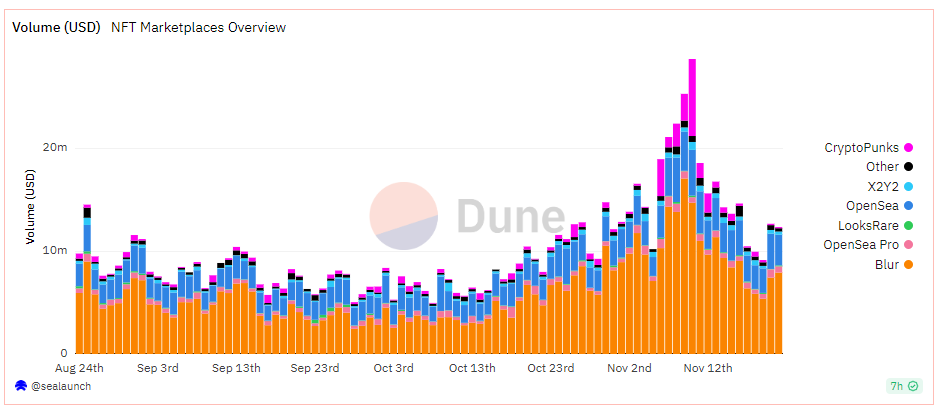

In line with the growth of the general market, the NFT market also witnessed a strong recovery. According to data provided by Dune, NFT trading volume on the market has grown strongly from about 5M USD on October 3, 2023 to a peak of 28M USD set on October 11 /2023, nearly 6 times growth in trading volume. At the present time, NFT trading volume has decreased (reaching about 12M USD) after previous consecutive increases.

NFT trading volume on the market

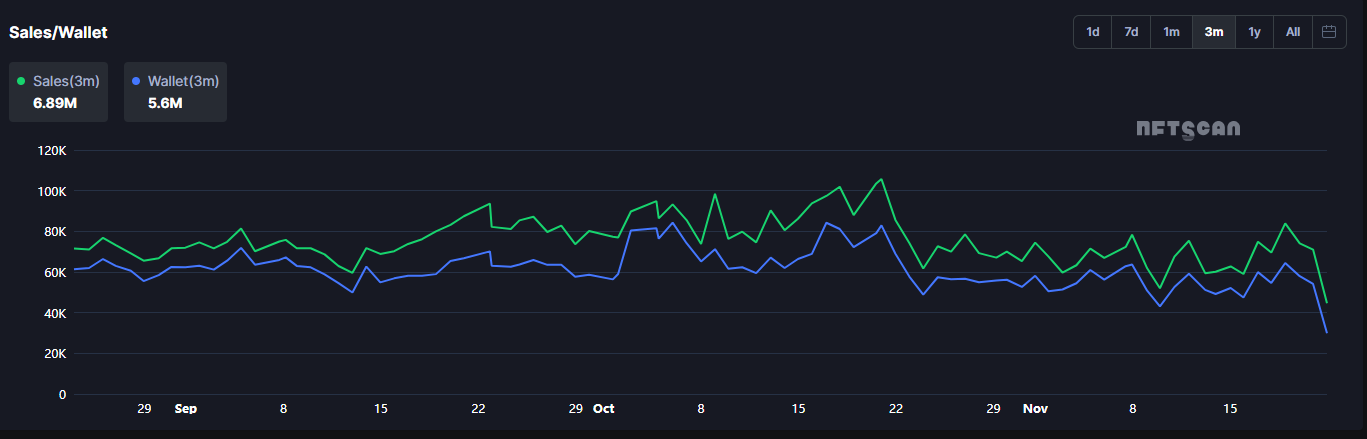

However, in contrast to the impressive growth in transaction volume, the number of users participating in buying, selling and trading NFTs only witnessed a slight, insignificant growth. This shows that the NFT market is still not really attractive to newcomers and even old people at the present time.

Number of users trading NFTs on the market

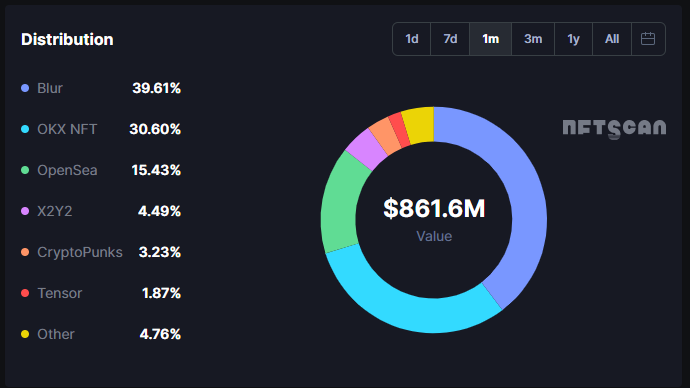

When considering the volume of NFT transactions on NFT Marketplaces in the past month, although Blur is still the leading name with 341M USD accounting for 39.61% of the market share, we see the strong rise of OKX NFT Marketplace. This platform ranked second with 264M USD, accounting for 30.6% of the market share. Knocked OpenSea down to third place with 132M USD and 15,433% market share. Overall, the impressive growth of OKX NFT Marketplace comes from the main reason being the hot return of BRC 20 and Bitcoin Ordinals. As for OpenSea, they are sliding downhill and gradually losing their position as the leader in the NFT market.

Top NFT Marketplaces

Which Blockchain Is Being Left Behind?

Besides the fierce competition on the NFT Marketplace, we also have another race for Blockchain NFTs. In this article, I only review the competition of the 4 most popular Blockchains in the NFT field including: Bitcoin, Ethereum, Solana and Polygon. Let’s find out now.

First, in terms of NFT transaction volume in the past 30 days on Blockchains, Bitcoin is the leading platform with 323M USD, surpassing Ethereum in second place with 307M USD. The reason for this largely comes from the hot comeback of Bitcoin Ordinals and especially BRC 20. We have seen the impressive growth of SATS Token and cannot help but mention the ORDI list Binance Token and then there is the impressive growth from 12 USD to nearly 28 USD.

NFT transaction volume statistics of leading Blockchains

Ranked 3rd and 4th on this list belong to Solana and Polygon with 49M USD and 28M USD respectively. A special point is that in this list, most Blockchains have a growth in transaction volume, only Polygon has a decrease in NFT transaction volume compared to the previous month (ie the period of September 2023). ). In addition, Solana also overtook Polygon to rise to the top 3 Blockchain position with the highest NFT transaction volume today. So what is causing Polygon to decline so much? First, let’s learn about the reasons for the recovery in transaction volume of each Blockchain in recent times.

Bitcoin – Pioneering new trends

Bitcoin has been gaining attention from more and more NFT players recently. Similar to the growth in the first phase that took place in April – May 2023, the strength of this growth phase still comes from BRC 20 with two typical names: Sats and ORDI.

First, when talking about Sats, being used as a gas fee for the leading Bitcoin Ordinals and BRC 20 trading platform Unisat has created a huge growth momentum for Token Sats. As for ORDI, this is the token with the largest community among the coins in the BRC 20 series. Being listed by a large exchange like Binance has created great fomo and continued to push the ORDI token price to a new high.

Besides the attention on BRC 20, everyone’s attention is also focused on Bitcoin Ordinals, especially NFT collections with a total supply of 10k receiving more priority in this growth period. NFT collections have a total supply of 10k with a number of characteristics such as: Large trading volume, low floor price, good liquidity, easily attracting cash flow from investors.

Impressive growth of Bitcoin Frogs

In terms of growth, Goosinals is even more remarkable. From the end of October until now, Goosinals has seen impressive growth from 0.002 BTC to the current level of 0.023 BTC (more than 10 times growth). Led by these two projects, 10k supply NFT collections also saw good growth. Take Bitcoin Bear Cubs and Bitcoin Whales, for example, both projects have increased over 200% in just a few days.

However, the NFT market on Bitcoin still does not have a clear trend and most of it comes from the speculative psychology and fomo of users. As a result, the majority of NFT 10k supply collections have seen a correction in recent days.

However, Bitcoin NFT still has limitless potential and a very bright development future in the near future. In addition to the fact that Bitcoin NFT is different from most other NFTs on Ethereum, Solana or Polygon in terms of plot, content and development direction.

For example, Taproot Wizards – a collection of NFTs on Bitcoin recently successfully raised 7.5M USD led by Standard Crypto. Unlike most other NFT collections, they will not sell NFTs on the market and users can earn them through performing project tasks.

Solana – NFTs grow simultaneously after Break Point

Break Point is an annual event organized by the Solana community at the end of the year highlighting what Solana has accomplished this year and what it plans to do in the future. With the positive information in this event, the SOL token has witnessed impressive growth. Besides, NFTs on Solana are also growing and the two NFT collections receiving the most attention are Mad Labs and Tensorians.

First, when talking about NFTs on Solana, most people probably know about Mad Labs – the famous NFT collection of the Backpack wallet that created a fever right at the time of its launch. After a period of development, Mad Labs still affirms its appeal and position as one of the top collections on Solana, worthy of filling the void left by Degods since leaving Solana.

Mad Labs has seen impressive growth recently

Besides Mad Labs, it is impossible not to mention Tensorians – a PFP collection of 10,000 NFTs officially launched by Tensor on Solana. If everyone doesn’t know, Tensor is the leading NFT Marketplace platform on Solana at the moment. With good effects in recent times, Tensorians also witnessed impressive growth from 7.75 SOL to 30 SOL. As the Tensor NFT Marketplace grows, the collection of Tensorians will certainly become more valuable over time.

Ethereum – Gaming rekindling and impressive growth of Animoca Brands NFTs

With the recovery of the market, Blue Chip NFTs such as: Bored Ape Yacht (BAYC), Azuki, CryptoPunks,… also have good growth with a ROI of about 30%. On Ethereum recently, the focus of attention must be on Gaming NFTs and NFTs related to Animoca Brands.

First to mention are NFT Gaming, with the appearance of Big Time creating a new wave and seemingly revitalizing the Gamefi market. Immediately after that, a series of NFT Gaming especially on the Ethereum network had impressive growth such as: Skyborn – Nexian Gems and Skyborn – Genesis Immortals of the game Skyborn Legacy, Sugartown Oras of Sugartown, Mittaria Genesis,… . or the most recent Shrapnel Operator Collection of Shrapnel all have impressive growth.

But to choose the most impressive name, it is Parallel Avatars – Parallel’s NFT collection has grown more than 10 times in just a short time. Additionally, the PRIME token also showed good performance reaching its ATH at nearly 8 USD.

Impressive growth of PRIME token

In addition, in the meantime, we cannot help but mention the NFT collections of the Animoca Brands family with two typical names: Mocaverse NFT and The Grapes. First, Mocaverse has witnessed impressive growth from 1 ETH to an ATH of nearly 3 ETH. The reason for this crazy growth comes from rumors that Mocaverse is about to launch tokens and airdrop activities for NFT holders. Next is The Grapes with an even more impressive performance with about 5 times growth from only about 0.5 ETH to 2.5 ETH. The fomo comes from the fact that The Grapes will launch the token and NFT holders will certainly receive airdrops in time.

A notable event of the NFT community on Ethereum recently is that Memeland launched the Meme token and deployed it on Binance Launchpool, all owners of You the Real MVP, The Captainz and The Potatoz NFTs all received huge Airdrops, Meme tokens immediately after also witnessed 2 times better growth.

The resurgence of NFT collectibles on Ethereum that preceded the recent rise of Bitcoin NFTs may be the reason why Ethereum NFTs are being left behind and cede the stage to Bitcoin NFTs for now. . But in general, with its stability that has been confirmed for a long time, Ethereum is still one of the top choices for NFTs in the near future.

Polygon – Not having many outstanding activities, seems to have been left behind

Polygon appears to have been left behind in this recovery of the entire NFT market. Polygon’s flagship Pluto Misfits also only saw a 50% increase while other NFT collections on Polygon have not seen any updates recently.

Polygon was once considered one of the leading Blockchains for NFTs but its recent decline is a worrying sign. There are many reasons for this decline such as large NFT collections like y00ts deciding to leave Polygon and moving to Ethereum or the top game Pixel deciding to leave Polygon and moving to Ronin,… Overall , Polygon needs a lot of work to do to help their NFT segment regain the traction of the community as they want to be the leading Blockchain for NFTs.

summary

The NFT market has become vibrant in recent times and each blockchain has shown that it has its own appeal to attract users to its platform. Above is all the information that I want to introduce in this article, hope everyone has received useful knowledge.