NFTs are considered digital assets with high risk and volatility. Indeed, over the past year we have seen massive price drops of 70% – 90% on the majority of NFT collections on the market. In this article, Weakhand will show you some viable strategies that can be implemented especially in downtrend markets. Using these strategies, users can protect their portfolio and still make profits from it. Let’s find out with Weakhand!

What is NFT Lending?

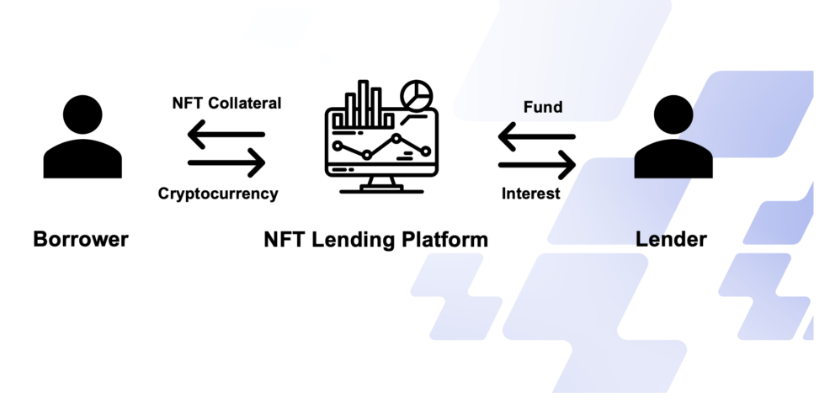

NFT Lending are Lending & Borrowing projects but instead of collateral being tokens or coins, with NFT Lending projects, the collateral is NFT collections that can be BAYC, MAYC, Doodles, Azuki, Moonbirds, Clone X,…

Regarding the operating mechanism, NFT Lending is not too different from Lending platforms in DeFi: users deposit their NFT collateral to be able to borrow assets (ETH, SOL,..) according to pre-existing rates. LTV levels between platforms may vary depending on the applicable mechanism of each platform.

What is NFT Lending?

Currently, there are 3 types of lending models for NFT collateral on the market including:

- CDP: This is a model where users use collateral as NFT to mint tokens (usually Stablecoins) with the corresponding LTV ratio ranging from 50% – 70%. This is a familiar model in the Defi market with the most prominent project being MakerDAO. In the NFT market, there are also a number of projects working on this CDP segment such as: JPEG’d, paprMEME,…

- Lending Pool: This is a model where users use NFTs as collateral to borrow a corresponding amount of tokens from existing pools on the platform. In the Defi market, there are two most prominent projects: Aave and Compound, and in the NFT market, we also see many projects working on this field such as: BendDAO, Unlockd Finance, Zharta Finance,…

- Lending P2P: This is a peer-to-peer lending model in which users use NFTs as collateral to borrow money from another person at a LTV and APR level decided and agreed upon by both parties. In the Defi market, I do not see this model being popular, but in the NFT market, this model is popular with many projects such as: Blend – NFT lending platform integrated on Blur, NFTfi, Arcade xyz,. ..

In addition to the three basic lending models, there are also many new lending models on the market that combine Lending P2P and Lending P2Pool such as: OpenSky, Sodium Finance or a modified P2P Lending model that allows many people to lend. Borrow and participate in a loan such as: MetaStreet, … In general, NFT Lending is one of the most developed segments in the NFT market at the present time with a full range of puzzle pieces and diversity with many other projects. together.

NFT Lending Strategies During a Downtrend Market

Currently, NFT Lending on Ethereum is still the most prominent market when attracting many construction and development projects. However, the disadvantage of most projects on Ethereum is that they only allow Blue Chip NFT collateral, whose current price is a few ETH or more. This causes difficulties for most users in the market, especially users with low capital.

So in this article, I will provide strategies for lending NFTs on Solana – a Blockchain that also attracts many construction projects. NFT Lending projects on Solana support collateral that is NFTs with a much lower value than on Ethereum. So it will be more suitable for users who want to participate at the present time, let’s go into NFT lending strategies.

NFT Lending Strategy in Downtrend Market

First strategy: Use an NFT loan as a hedge

In the current downtrend market, the amount of liquidity in the market is extremely low when few people want to participate in buying, selling and trading NFTs. If you want to protect your investment portfolio from a possible collapse (like in the case of Azuki just now), a good idea is to be able to use NFTs as collateral to borrow a certain amount of Sol determined. The process will take place as follows:

- You will use your NFT as collateral to borrow a certain amount of SOL on NFT Lending platforms such as: Sharkyfi, Frakt, Citrus, Rainfi,…

- Prioritize loans with low APR and long loan terms. That way, you’ll stay on the loan longer, and if you decide to repay it, you won’t have to pay high interest rates.

- If the floor price falls below the amount you borrowed, you have the option of not paying back the loan and keeping the money with you.

Risks: If the floor price does not fall below the loan amount, you will have to pay back the loan + interest. If you do not repay, your NFT will be liquidated or transferred to the lender.

Second strategy: Short SOL with your NFTs

This is a strategy that requires you to have a lot of experience and know what you are doing, so the risks will be higher. If you think the price of SOL has a high chance of falling, you can implement this strategy with NFTs as your collateral. Be careful because if the strategy goes against your plan, your NFT will be at risk. The following is the implementation process:

- Borrow Sol with your NFTs on NFT Lending platforms such as: Sharky, Frakt, Citrus or Rainfi.

- Swap Sol to get USDC on Raydium.

- Buy Sol again when the price drops.

- Repay the borrowed amount and keep the profit.

Risks: If you sell Sol and its price increases, you will need more USDC to buy back the amount you borrowed. If you cannot repay the loan, your NFT will be liquidated.

Third strategy: Short 1 Token with your NFT

This is the most advanced strategy but also the riskiest. In this strategy, I will use the Midas Protocol.

Through Midas Protocol, you will use your NFTs as collateral to mint the MDS Stablecoin with a maximum LTV of 35% of your NFT floor price. The biggest advantage of Midas Protocol is that the protocol does not charge interest and has no loan time limit. The process goes as follows:

- Use your NFT as collateral to mint an amount of MDS tokens with a maximum LVT of 35%.

- Swap MDS Token to USDC Token.

- Provide this amount of USDC Tokens on Lending & Borrowing protocols such as: Marginfi or Solend to borrow an amount of Tokens (SOL, ETH, BTC,…)

- Sell the newly borrowed assets into USDC.

- Buy them back when the price drops.

- You can then pay back the borrowed money and keep the profits.

If you are right and the price of the borrowed assets like: BTC, ETH, SOL,.. drops, you can buy them back at a cheaper price and that way you can pay back what you borrowed in the transaction loan format and you will keep the difference between the amount you sold and the amount you bought back, which will be your profit.

Risks: This strategy has liquidation risk, you can be liquidated on Midas Protocol if the NFT price drops too much and you also experience liquidation on Lending & Borrowing protocols such as: Marginfi or Solend if the price of the assets Borrowed assets increased too high. To avoid liquidation, you must provide additional USDC to the protocol.

summary

Remember that these strategies are for times when the market is in a downtrend. If you are a beginner then focus on simple strategies. As you gain more experience, explore more advanced strategies but be aware of the risks involved. Above is all the information I want to introduce in the article on NFT lending strategies in a downtrend market. I hope everyone has received useful knowledge in this article.