The risks of the Credit Protocol segment are no longer on paper and theoretical but have become reality when some Maple Finance customers became involved with FTX and Alameda Research, leading to no longer being able to repay loans to them. users on the Maple platform.

In this article, let’s review the influence of FTX and Alameda on Maple Finance – the platform considered the most successful Credit Protocol ever.

Potential Risks With Maple Finance

Overview of Maple Finance

Maple Finance is a Lending & Borrowing protocol aimed at individuals and organizations outside of TradFi. Lenders will provide collateral which is real-world assets such as real estate, bonds, stocks,… to borrow loans in DeFi through Maple Finance.

Up to now, Maple Finance’s main customers are usually units and companies in the crypto market such as Maven 11, Icebreaker Finance, Orthogonal Trading, Alameda Research,… The main customers are selected companies. in the crypto market helps Maple Finance save time in KYC of borrowers and collateral assets can include crypto.

The biggest risk with Credit Protocol platforms

The biggest risk with Credit Protocol platforms is that their customers are borrowers who are unable to repay their debts. There are many reasons for this risk, such as:

And Weakhand has a very detailed article about the Credit Protocol segment that everyone can read to understand more about this segment: What is Credit Protocol? Long-Term DeFi Trends.

Maple Finance Hits Bad Debt Due to Collapse of FTX & Alameda

In fact, Maple Finance is not directly involved with FTX or Alameda Research, although they once provided many loans to Alameda Research, but these loans were all repaid 100% before FTX collapsed. But there is no indirect involvement with Alameda Research.

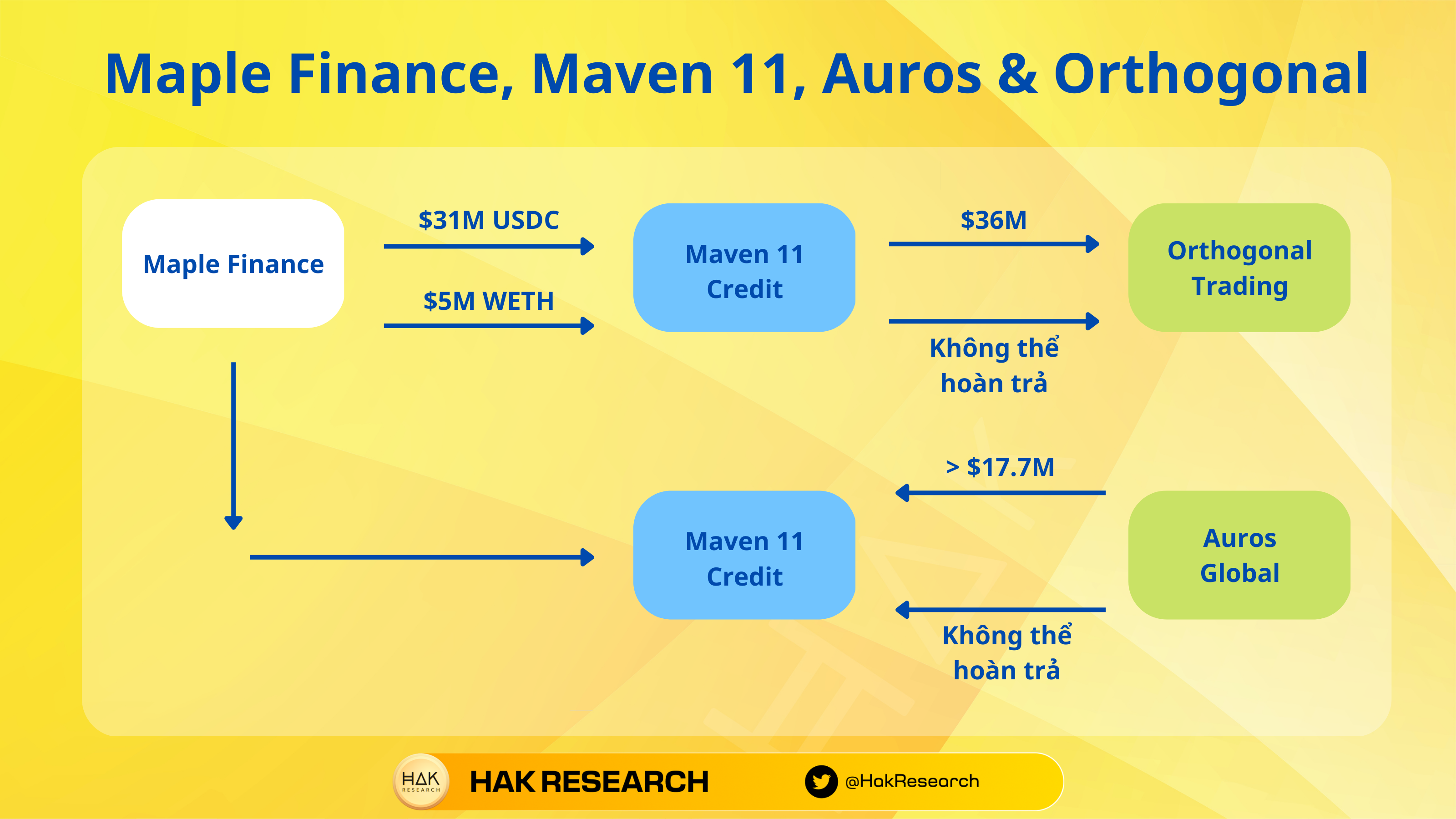

Through Maven 11, Orthogonal Trading and Auros Global borrowed tens of millions of dollars, but the simplest way to get involved with FTX was to store assets on the FTX exchange, but when FTX went bankrupt and could not withdraw money, it led to Orthogonal Trading and Auros Global is unable to repay Maven 11.

In Orthogonal Trading’s case, it used Maven 11’s loan to continue lending to Alameda Research and when Alameda Research could not continue to pay the loan, Orthogonal Trading could not repay Maven 11. The main reason was This led to Orthogonal Trading’s loan appraisal process having many flaws.

As for the case of Auros Global, because this is a Market Maker in the market, leaving assets on the exchange is understandable. And when FTX announces bankruptcy, all this money will be frozen and must wait to be recovered. There is information that Auros Global filed for bankruptcy because it was too greatly affected by the FTX event.

However, Orthogonal Trading and Auros Global can completely use this reason to not have to pay the above debts. With this event, the market raised concerns about the risk assessment of borrowers of Maven 11 Credit and Maple Finance.

Up to now, Maple Finance is offering 2 solutions, but according to my personal assessment, this solution is similar to “losing a cow to build a barn” which is introducing Maple 2.0. And below are some highlights on Maple 2.0:

Some Urgent Solutions For Maple Finance

Update news quickly to users

This is probably what Maple Finance and Maven 11 are doing best when continuously updating information about loans and borrowers to investors. Although providing official and quick information cannot get back the money that is being lost, it also shows the platform’s responsibility to its users and investments.

Adequate compensation for users

Currently, the above issues have not come to an end in terms of how users on Maple Finance will be compensated and whether the asset liquidation amount plus a small amount of money from Maple Finance will be enough or not? However, in order to continue to develop long-term with the market and continue to gain trust from users, it is understandable to adequately compensate all users.

Maple Finance may use its own funds to compensate users. However, according to Token Terminal, Maple Finance’s revenue (Revenue) is unstable and relatively low.

Besides, Maple Finance still has another solution which is to call for capital from investment funds. The advantage is that Maple Finance has only called for capital once, compared to its competitors in the same industry, which have called for Series A round, so Maple can create a new round of calling for capital. However, calling for capital in a bad market like this is relatively difficult or possible, but the valuation and the amount called for are not necessarily as high as the development team’s expectations.

Comprehensive protocol upgrade

Part of the reason why Maple is deeply involved in the bad debt story this time is that the project very quickly reached $2B in loans, making the development team and Pool Delegated team negligent and lacking vigilance regarding the loans. borrow from me. It was that subjectivity that led to Maple’s outcome this time.

Upgrading to Maple 2.0 is absolutely necessary for the project, although it comes a bit late and it is not until something big happens that the protocol takes steps to change.

Summary

The biggest risks of a Credit Protocol platform have finally arrived and the project it chose is Maple Finance. Due to the platform’s subjectivity, it has caused a huge amount of bad debt with no clear way to fix it, so Credit Protocol platforms will still have a lot of work to do in the future.

Investors themselves have clearly seen the risks of Credit Protocol platforms, so they should make the right investment decisions in accordance with their own risk appetite.