The Mantle Network ecosystem is undergoing many changes, especially in strategies to bootstrap the ecosystem quickly and sustainably. So what are those strategies and how do they affect the long-term future of the Mantle Network ecosystem? Let’s find out together in the article below.

What are you waiting for? Join me in the world of Mantle Network

Mantle Network & Decision Changes

It’s official. BIP-21 has passed!

Shoutout to the $BIT community for the overwhelming support on this proposal. We reached a historic high in number of participants at 4,708 voters

Watch our socials for follow-up news to this proposal!https://t.co/6eWqgbYhvF

— Mantle (@0xMantle) May 19, 2023

Through proposal BIP 21 on May 19, 2023, BitDAO – a decentralized autonomous organization backed by Bybit – announced a merger with Mantle Network – a high-performance Layer 2 platform. With this merger, there will be some notable points such as:

- BitDAO’s governance token, BIT, will be converted into Mantle Network’s governance token, MNT.

- Mantle Network inherited nearly $300M Stablecoin and 270,000 ETH from BitDAO to build, develop and expand Mantle Network.

Mantle Network Overview & On-chain Metrics

Overview of Mantle Network

Mantle Network is a Layer 2 platform using Optimistic Rollup technology, thereby inheriting the security and decentralization from Ethereum while still providing users with a transaction space and experience with low fees. Mantle Network’s difference is that it uses EigenLayer’s EigenDA service to store data, making the service fee very cheap.

In addition, Mantle Network also built a Liquid Staking Derivative product, allowing Mantle users or treasuries to Stake ETH on the Ethereum network through Mantle. People who stake ETH will receive mntETH to be used on the Mantle network and receive profits such as MEV, network fees,…

Notable On-chain indicators on the network

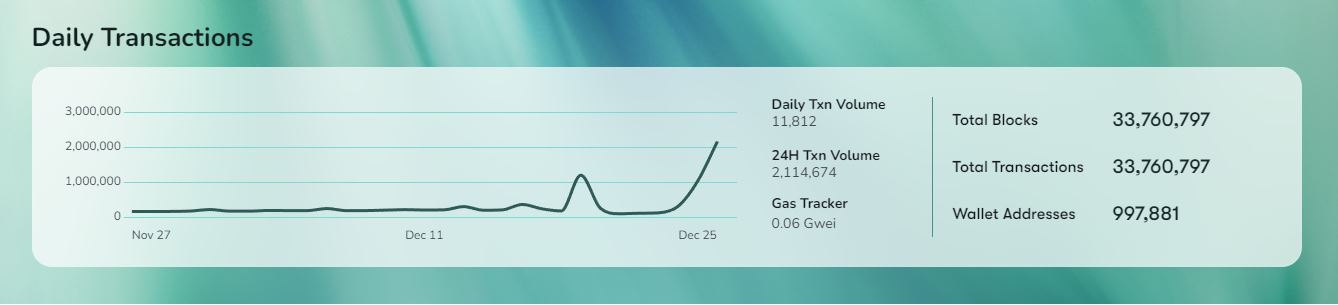

If in the period October – November, the number of transactions and the number of users on the Mantle network did not have too many highlights, only maintaining about less than 200K transactions per day, then in the last days of October this number quickly increased to more than 2M transactions per day, marking the network’s ATH milestone.

At the time of writing we have some notable data as follows:

- Total Blocks: 33,760,797

- Total Transactions: 33,760,797

- Wallet Addresses: 997.881

It can be seen that these are quite modest numbers when placing Mantle next to names like Arbitrum or Optimism. However, with a cheap Layer 2 platform that has only been launched for about 6 months, this is a really different number and the interesting thing is that these indicators are still continuing to grow.

However, is the growth index on Mantle Network just “the tip of the iceberg” according to the market, or are there hidden points underneath?

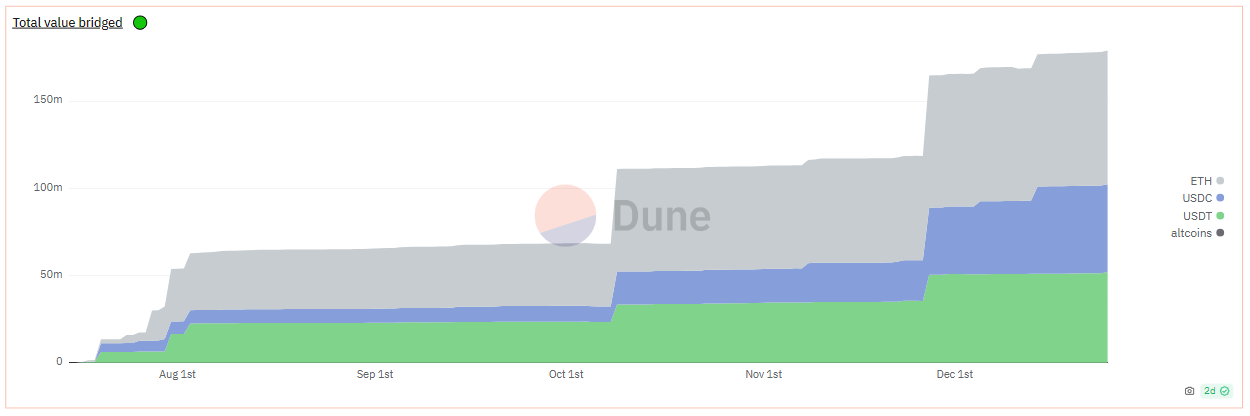

Along with the rapid increase in the number of Total Transactions, the amount of assets such as ETH, USDT, USDC and other Altcoins are also being continuously moved by users. The total value locked on Mantle Network’s Native Bridge has nearly reached $200M.

This index shows that since its inception, Mantle has always acted as a magnet to attract cash flow from other ecosystems, especially Ethereum, when the amount of ETH locked accounts for nearly 50% of Native Bridge’s total TVL. .

Along with that, the TVL of the Mantle Network ecosystem has also begun to grow again from the October price to mid-December with an increase from $34M to $130M.

Mantle Network Ecosystem Update & Things to Note

Investment proposal to establish the Mantle Network ecosystem fund

Proposal MIP 24 aims to build a Mantle Network ecosystem fund named Mantle EcoFund with a total fund value of up to $200m with the goal of building and developing the Mantle ecosystem. Some basic information about Mantle EcoFund includes:

- Mantle EcoFund will inherit $100M USDC from Mantle Treasury and the remaining $100M will come from various investment funds such as Alumni Ventures Blockchain Fund, Animoca Ventures, Bankless Ventures, Cadenza Ventures, Dragonfly Capital, Figment Capital, Folius Ventures, Ghaf Capital Partners, Hashed, Hashkey Capital, Leadblock Partners,…

- Build a Mantle EcoFund Investment Committee (Mantle EcoFund Investment Committee).

- Mantle Treasury investment call is $10M.

Some notable points with Mantle EcoFund include:

- The life cycle of Mantle EcoFund is 3 years and the extension period is 2 years. The total time can be up to 5 years.

- Focus on investing in Pre Seed, Seed & Series A rounds of the project. Projects that receive support are required to deploy products on the Mantle Network ecosystem.

- Money from Mantle Treasury according to schedule is 10%, 30%, 30%, 30% and investment funds also pour corresponding money at the same rate.

- Mantle EcoFund will collect a management fee of 2% each year from Mantle Treasury and investment funds. In return, 20% of the profits generated by Mantle EcoFund will be shared with strategic investment funds.

Mantle EcoFund’s goals include:

- Support the development team and partners to build Protocols on the Mantle Network ecosystem.

- Drive developers and DApps to Mantle Network.

- Encourage investment funds to invest in the Mantle Network ecosystem.

- In terms of numbers, the goal is to build more than 40 projects within 3 years with a profit of 1.5 times.

Mantle EcoFund Investment Committee (Mantle EcoFund Investment Committee) plays the role of effectively operating Mantle EcoFund with extremely clear requirements, rights and responsibilities. People can refer to Mantle EcoFund in the MIP 24 proposal here.

From proposal to action of Mantle EcoFund

Immediately after the proposal to establish Mantle EcoFund was approved, Mantle EcoFund took actions to build a Mantle Network ecosystem including:

- Build subsidies for projects participating in the Mantle Network ecosystem.

- Providing liquidity to projects on the ecosystem In fact, the project has supported users to stake ETH through Mantle Network, subscribe more than $30M to the Ondo Finance protocol and build USDY liquidity on AMMs such as Fusion X or Agni Finance.

- Rebalancing between assets such as BTC, ETH, USDC, USDT and MNT.

In addition, Mantle Network is also working with the Ethena project with the goal of bringing USDe – Stablecoin based on the Delta Neutral strategy, to the Mantle platform and allowing Mantle’s mETH to become collateral on Ethena.

Introducing Merchant Moe, a franchise of @TraderJoe_xyz

Crafted to be the liquidity cornerstone of @0xMantleMoe is building a trader’s oasis among the bustling DeFi markets on Mantle Network.

Read about our upcoming journey below

pic.twitter.com/8xfGqlFNoo

— Merchant Moe (@MerchantMoe_xyz) December 11, 2023

Besides, Mantle Network has also successfully negotiated to buy copyright from Trader Joe. With this event, Trader Joe’s development team will build a similar version called Merchant Moe on Mantle with improvements to fit the Mantle Network ecosystem. Merchant Moe aspires to become the largest Native AMM on Mantle Network.

With the acquisition of the copyright of Trader Joe – one of the leading innovative AMMs in the Crypto market, the Mantle development team’s great ambition in building a strong and sustainable ecosystem has been demonstrated.

Mantle Journey is the difference

Mantle Network has released the Citizens of Mantle collection in collaboration with famous NFT artist Chen Man. Chen man has a huge profile as he has taken cover photos for global fashion magazines such as Vogue, Harper’s Bazaar and Elle, and worked with many luxury fashion brands including BULGARI, Tom Ford, Gucci, Dior, Louis Vuitton and Chanel.

Chen Man is the only Chinese photographer trusted by many international directors, artists and celebrities such as Rihanna, David Beckham, Anne Hathaway, Michelle Yeoh, Tom Holland, Stan Lee, George RR Martin and LeBron James. Most recently, she collaborated with Canadian electronic music star, Grimes, on her limited edition NFT collection, Silent Noise, marking Chen Man’s foray into the world of NFTs.

Citizens of Mantle benefits include:

- Acts as a user avatar on the ecosystem.

- While experiencing the Mantle ecosystem, NFTs are upgradeable so users can unlock more benefits in the future.

Mantle Network has also built Mantle Journey to help users do tasks on the ecosystem in exchange for rewards. In the near future, Mantle will continue to expand its missions so that users can have diverse experiences on the ecosystem.

Some updates on the Mantle Network ecosystem

- Agni Finance: Launched the Ambassador program and organized many contests to stimulate users to participate in its community.

- FusionX: After being successful with the AMM product, this platform decided to expand its products with Perp DEX. In parallel, FusionX also introduced the TradeFest program to attract users and liquidity providers to the product. its new product.

- Butter Exchange: A new project in the AMM segment has also successfully called for $4.6M from Mantle Network.

- Lendle: A project in the Lending & Borrowing segment has also successfully deployed LEND issuance and announced a short-term roadmap with the main goal of integrating different DeFi protocols such as DEX, Lending & Borrowing, Cross-chain,. ..

Comments on the Mantle Network Ecosystem

Clearly, the new Mantle Network is in the early stages of its ecosystem before dawn. Projects on the platform do not have much difference from the general market and have not created a significant trend to attract cash flow from other ecosystems. With the acquisition of Trader Joe’s copyright to build Merchant Moe, it also shows Mantle Network’s ambition.

Besides, the establishment of Mantle EcoFund also shows that Mantle Network is extremely serious with its ambition to build its ecosystem. And with the participation of many investment funds, including some big names such as Pantera Capital, Dragonfly Capital, Hashed, Haskey Capital or Animoca Brands, it also shows that investment funds also have high hopes for Mantle’s success. Network.

Mantle Journey is an innovative solution for attracting and retaining users. However, this is only considered one of the short- to medium-term solutions. If Mantle Journey can be expanded towards the benefits that users receive from the platform, it may attract more users to participate in the Mantle Journey ecosystem.

One point that perhaps Mantle Network needs to consider is that Mantle chooses to approach users through LSD and RWAs, details are:

- Users can stake ETH directly on Mantle Network and Mantle will return to users mETH representing their liquidity and assets.

- Mantle focuses on the Ondo Finance protocol with products on US government bonds.

From my personal perspective, these are two approaches that will not be really effective because very few users will bring ETH to Mantle to participate in staking and the number of people buying tokenized US government bonds is also small. not so much.

Therefore, Mantle should continue to improve and diversify its ecosystem, so it has products that are more suitable for the public, and Merchant Moe is a bright spot.

Summary

Mantle Network ecosystem is in the first stages of building and developing its ecosystem. There are still many opportunities ahead for investors with early interest in Mantle Network.