Magpie is one of the active protocols in the DeFi market recently participating in Wombat Wars, Pendle Wars and there will be new wars coming soon. It can be said that Magpie is a perfect version of Convex Finance but is more “fighting and aggressive” than its predecessor.

To better understand this article, people can refer to some of the articles below:

- What is Magpie XYZ (MGP)? Magpie XYZ Cryptocurrency Overview

- What is Penpie (PNP)? Penpie Cryptocurrency Overview

- Penpie – Pendle Finance has the opportunity to become Convex Finance

- Penpie & Strategic Position in Pendle Wars

Magpie Creates Momentum for Success with Penpie on Arbitrum

Penpie’s success on Arbitrum

It can be said that the warrior blood of the development team has been clearly shown through projects such as Magpie, Penpie and the upcoming Radpie. Magpie participated in Wombat Wars from BNB Chain until Wombat Exchange decided to develop multichain to Arbitrum, Magpie was still the leading name.

When Shanghai Upgrade successfully opened up a huge potential for the LSDfi industry, Pendle emerged as potential LSDfi platforms with TVL growing continuously, then immediately after this project announced the launch of the tokenomics update was built veToken model, Penpie is present. And Penpie really made a difference when:

- Penpie has successfully IDO PNP on the Camelot platform – the most reputable Launchpad platform on Arbitrum today and the difference here is that PNP has grown 5 times compared to the purchase price on Camelot of $0.3. Recently, most IDO projects on Camelot often have negative prices after being listed, but with Penpie, this has changed.

- TVL and users had a strong increase to $32M. This helps Penpie on the Arbitrum network stand higher than big names like Plutus DAO, Vesta Finance or Silo Finance.

- Currently Penpie is holding nearly 7M PENDLE, equivalent to about 25% of vePENDLE on the market,

Not only that, Penpie has set up additional use cases for PNP when users can lock PNP to enjoy some of the following benefits:

- Get a portion of revenue from Penpie.

- Receive additional rewards from Penpie’s incentive which is PNP.

- Participating in Penpie’s governance helps drive protocol development.

Pendle Wars overview

The current Pendle Wars is between Penpie and Equilibria, however Penpie holds many advantages including:

- Penpie offers a somewhat more attractive profit margin than its competitor Equilibria.

- Regarding the liquidity war, if building a liquidity pool for mPENDLE, Penpie clearly has the advantage when Magpie Magpie has succeeded in building an mWOM/WOM pool with the best ratio at Wombat Exchange.

- Penpie has previous experience in Wombat Wars and Equilibria is a completely new project.

Continue Growing Strong with subDAO & Radpie

subDAO – Cradle of the next warriors

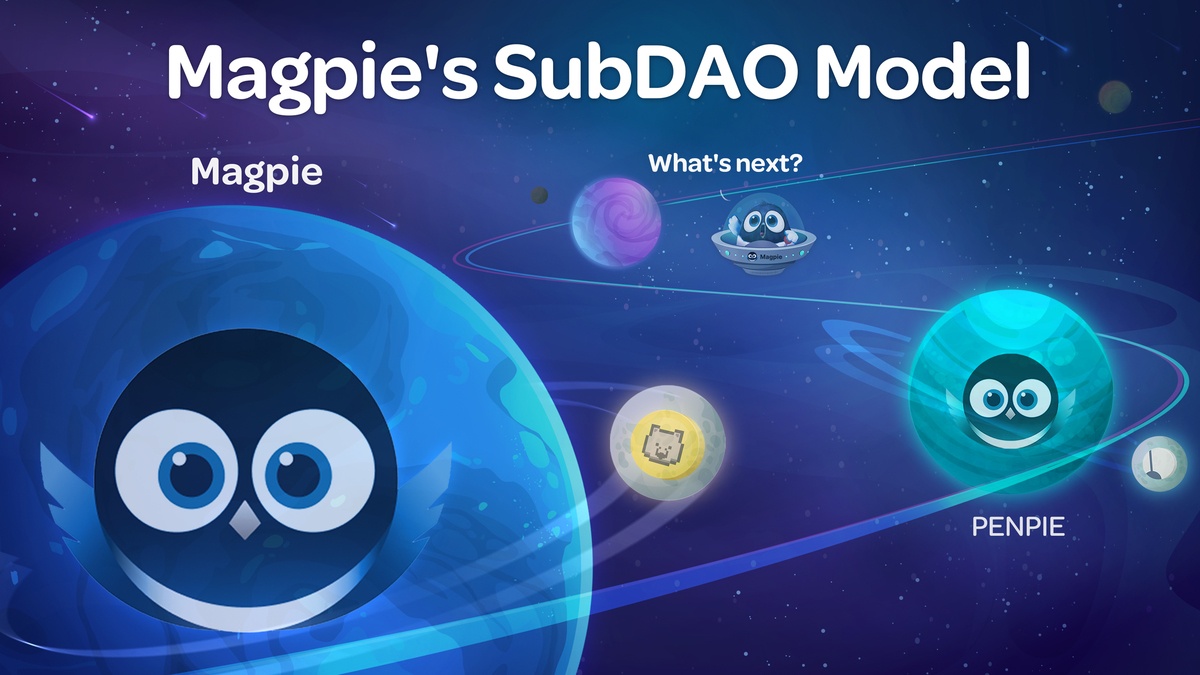

subDAO is an incubator to incubate, build and develop new Yield Farming projects to participate in the veToken wars or in other words help token holders to make more profits from the projects. Use veToken model. subDAO will be an ecosystem because the largest project is Magpie and its siblings.

It can be said that, besides the ecosystem, subDAO also includes users who hold vlMGP. vlMGP is the locked version of MGP, vlMGP represents long-term holders and partners with the project.

Some of the benefits of subDAO for vlMGP holders include:

- IDO Access: Users who hold vlMGP can participate in early purchasing of IDO of projects developed in the subDAO ecosystem at an affordable price.

- Revenue Sharing: Users who own vlMGP will also receive a portion of subDAO revenue. subDAO’s revenue comes from its own ecosystem.

- Voting Power: vlMGP holders have the right to vote on important proposals on the subDAO. The proposals determine the future development direction of subDAO.

Radpie and motivation were born

Not stopping at its success with Penpie and Pendle Wars, subDAO continues to move forward with its brainchild Radpie with its partner, a leading project on the Arbitrum ecosystem, Radiant Capital. Radiant Capital is a Lending & Borrowing platform with LayerZero integration making this protocol a Cross-chain Lending platform.

Radiant Capital has made a turning point in its tokenomics design by implementing the “Dynamic Liquidity” model, aiming for users to stay with the long-term with the sustainable development of the protocol.

This means that users must provide a minimum of 5% liquidity based on the amount they deposit into the protocol before the user can receive an incentive of RDNT from the project. A simple example is:

- Users deposit $10,000 USDC into the Radiant protocol, which must provide a minimum liquidity of 5% of $10,000 or $500 for the RDNT – ETH or RDNT – BNB pair to be eligible to receive the incentive.

- If you only deposit $10,000 USDC without providing liquidity, you will only receive the pool’s APR without any incentive.

Once liquidity is provided, users will receive dLP representing their assets in the pool. They can take away the dLP key to receive an incentive called RDNT. Besides the incentive, users also receive a portion of the transaction fees and governance rights on the protocol. The larger the dLP and the longer the lock, the more benefits users will receive. This is the motivation for Radpie to be born.

Radpie is the next strategic product of subDAO

Radpie will continue to participate in Radiant Wars with a focus on dLP. Users on Radiant are required to lock dLP for one to twelve months with Radpie, this story will be resolved by users sending dLP to Radpie and receiving mdLP. Some of the user benefits are as follows:

- Users can directly lock LP RDNT – ETH or RDNT – BNB to mdLP on Radpie’s platform and can convert back from mdLP at any time without being locked.

- Users still receive incetive RDNT rewards and a portion of protocol revenue.

- Receive incentives from Radpie itself.

Radpie will soon launch its token RDP, similar to Magpie with MGP or Penpie with PNP. Some of the benefits of users holding vlRDP (RDP key) include:

- Profit: Part of the RDNT incentive from Radiant Capital, protocol revenue. Protocol fees will be quite diverse with Stablecoin, wBTC, ETH, wstETH,…

- Platform governance: Users holding vlRDP have the right to participate in voting on proposals related to the development of the project.

Radpie’s dLP RUSH organized in conjunction with Radiant Capital will also be launched soon as those who are the first to put dLP into Radpie will share a reward of 2% of the total supply of RDP. A new war has really started from Radiant Capital and the first warrior is Radpie from the SubDAO ecosystem developed by Magpie.

Summary

An interesting battle is about to take place on the Arbitrum ecosystem, whether Radpie will be alone or have participation from other projects. What do you think about Radpie and Radiant Wars in the near future?