LayerZero is an infrastructure project about transmitting messages between blockchains. Projects using LayerZero technology mean being in the LayerZero ecosystem. Last May there were a lot of innovations in LayerZero and the platform’s ecosystem that I will share immediately below.

In this article about updating the LayerZero ecosystem, we will go through some of the main steps as follows:

- Overview of LayerZero including project activity & ongoing on-chain metrics.

- LayerZero ecosystem overview: Key integrations and integrations from last May.

To understand more about this article, people can refer to some of the articles below:

- What is LayerZero? LayerZero Cryptocurrency Overview

- LayerZero’s Working Mechanism

- LayerZero Ecosystem: The Number of Projects Is Constantly Growing. Will It Open Up New Trends?

- Potential Projects on the LayerZero Ecosystem

LayerZero Overview

On-chain index of LayerZero and ecosystem

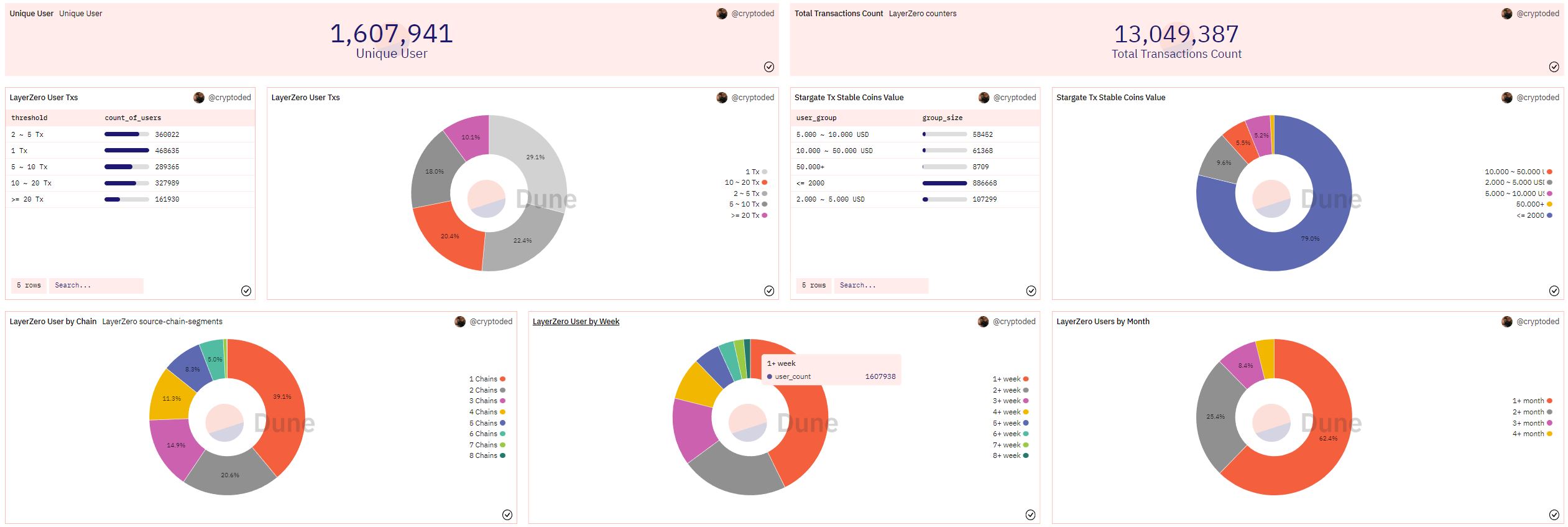

Looking through the image above, we have some outstanding parameters as follows:

- Total number of users: 1,607,941

- Total number of transactions: 13,049,387

It can be seen that on average each new user only has about 8 transactions. For a protocol that has been born and the mainnet is now more than 1 year old, this is a relatively low number, possibly the hindrance comes from relatively high transaction fees on Stargate and only recently has the number of users increased. and the number of new integration projects skyrocketed.

Looking deeper at the index sourced from @cryptodead account on Dune Analytics we see that only 10% or about 160K users have a trans level of 20 or more. However, there are a few positive numbers as follows:

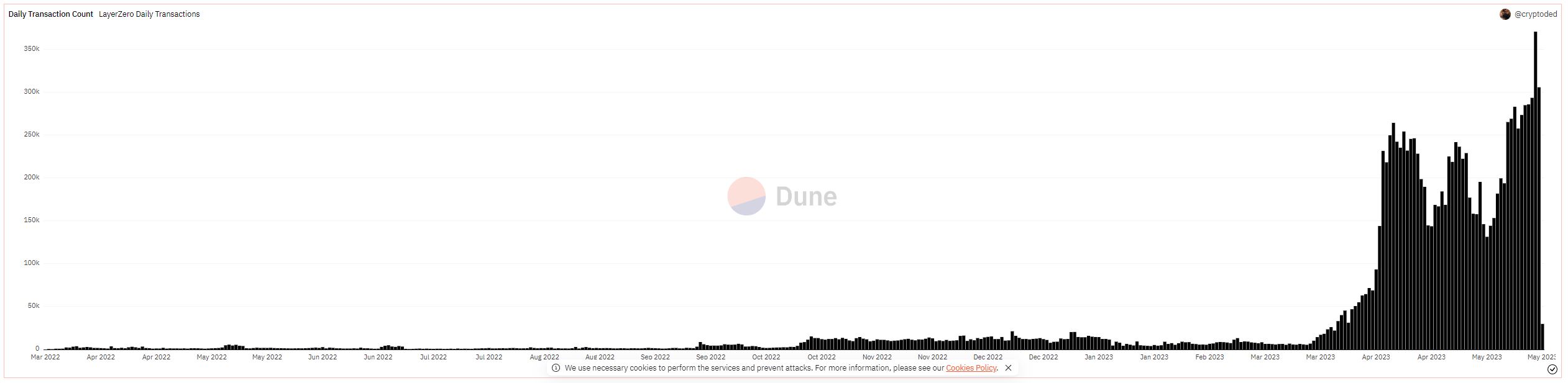

The number of new users and transactions has only skyrocketed recently from an average of 6,000 trans per day to an ATH peak on May 20, 2023 with the number of trans reaching more than 370,000 trans. This growth starts from March 15, 2023 for some of the following reasons:

- After the airdrop/retroactive events of Aptos, Arbitrum, Optimism or Sui Blockchain, people rushed to work on Stargate, leading to times when LayerZero’s network was overloaded. However, in terms of hype, LayerZero is still not as good as names like zkSync or StarkNet.

- The concept of omni – chain is starting to be talked about more and more.

- After successfully raising a large amount of up to $120M with a valuation of up to $3B, many users are curious and want to use the protocol. This news also somewhat makes Stargate more reputable in the eyes of DeFi users.

- The number of Protocols & Dapps during this period began to explode from large protocols such as Trader Joe, zkSync, Radiant Capital, Lil Pudgy,… to smaller projects that also began integrating LayerZero. However, this is just the first step for a big picture ahead.

It can be seen that after a year of development, LayerZero’s ecosystem is now starting to develop and has some of the first results. However, the indicators are still mixed as many people believe that the project will launch tokens and airdrops to users. We only really have reliable indicators in the long term or after the project releases the token.

With my personal experience with Stargate, Lil Pudgy, Trader Joe and Radiant Capital, I found the experience to be very smooth, although the only problem is that the transaction fees are relatively high, averaging about $1 per trans. I believe that LayerZero needs to have more solutions to reduce transaction fees to less than $0.3.

LayerZero operations

April 27, 2023: LayerZero introduces a new project called Essence that allows the separation of security and operations processes on LayerZero, allowing anyone to easily become a Validator on LayerZero’s network. Easy setup in less than 1 hour. With Essence, LayerZero is definitely moving towards decentralization of the network.

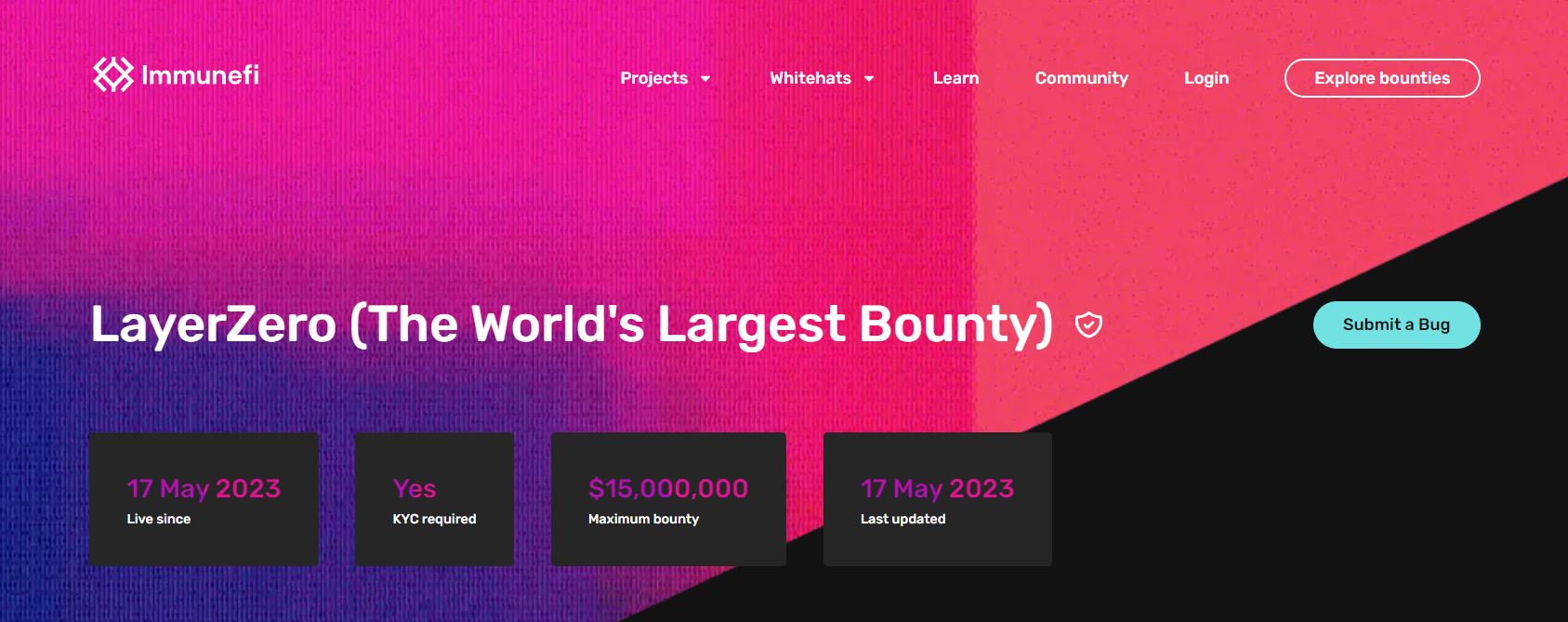

May 17, 2023: LayerZero launched the Bug Bounty program, considered the largest Bug Bounty program ever in the crypto market with a total prize value of up to $15M. It can be seen that this may be the final rehearsal before LayerZero develops its ecosystem more strongly.

Besides the two important updates above, LayerZero also participates in a number of other activities including:

- Sponsor the annual Avalanche Summit event.

- Present at the Consensus event.

- Sponsor the Fres Party II event hosted by Trader Joe.

- Present at the Cornell Blockchain Conference event in New York.

- Participate in Token 249 event in Singapore.

Overview of the LayerZero Ecosystem

Featured events on the LayerZero ecosystem

LayerZero’s development team also quickly caught on to the zkEVM trend when:

- April 25, 2023: LayerZero is officially available on Polygon zkEVM.

- April 27, 2023: LayerZero officially deployed on zkSync’s network.

However, recently I have seen two outstanding news that I think will have a certain impact on the future of protocols on Ethereum such as:

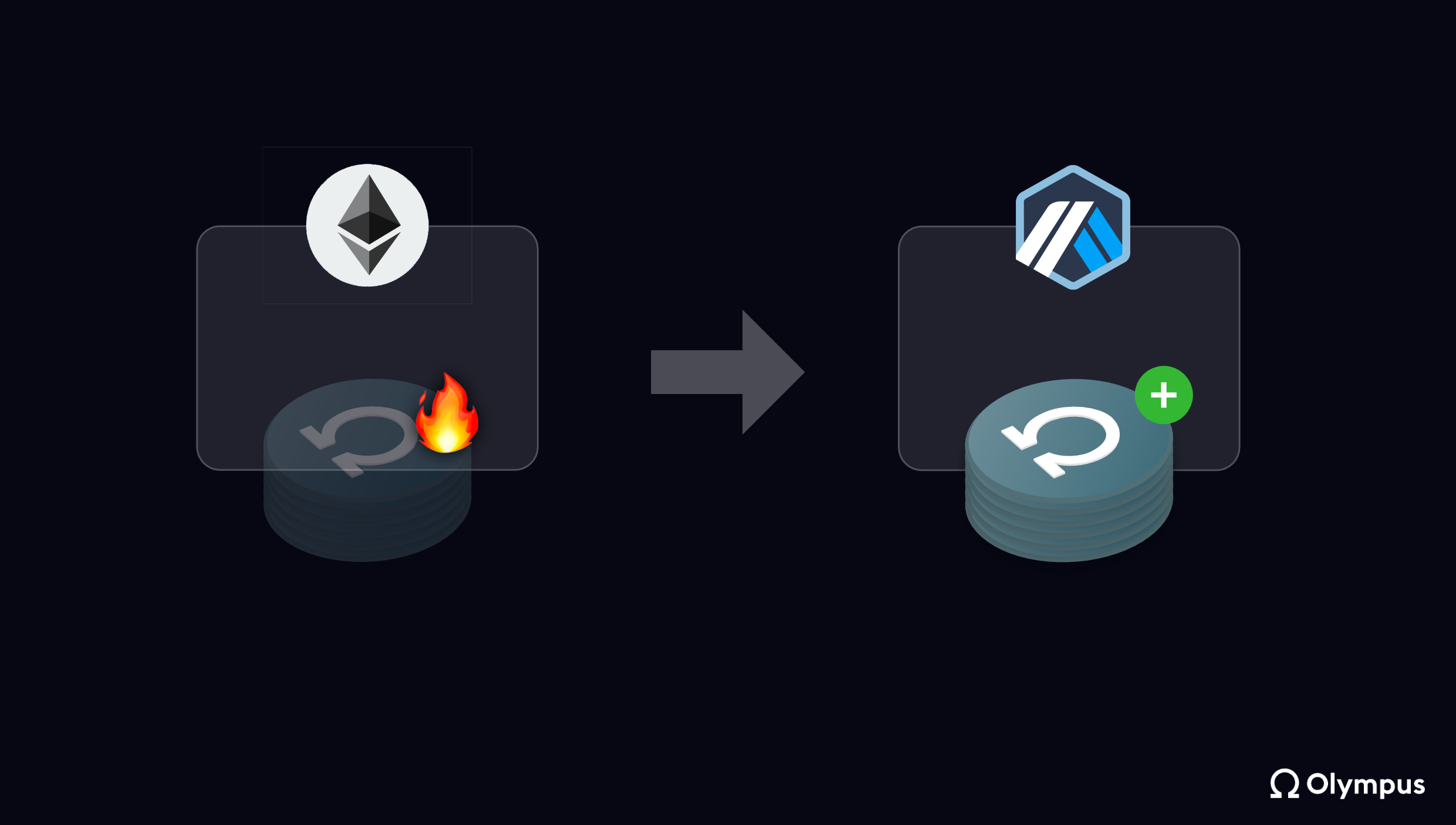

- May 5, 2023: With LayerZero technology, native OHM is available on Arbitrum’s network.

- May 17, 2023: Use veBAL to participate in voting on Layer 2 platforms.

With the story of Olympus DAO plus LayerZero’s message passing technology, OHM moves from one blockchain to another without slippage. As far as I understand, Olympus DAO acts as a “bank” between the decision to burn assets on this blockchain and mint assets on the original blockchain.

In the future, if projects use a model similar to the Olympus DAO, Impermanent Loss with Cross-chain platforms using the Liquidity Pool model will no longer exist and projects using the Liquidity Pool model will likely lost market share. However, the implementation of Olympus DAO also has many potential smart contract risks.

In fact, Olympus DAO is not the first project to do this, but before that, major protocols such as Trader Joe’s and Radiant Capital all allowed the transfer of JOE or RDNT from Avalanche C Chain to Arbitrum, BNB Chain or vice versa. Impermanent Loss. This is quite similar to applying omni-chain technology to NFT collections.

I firmly believe that in the future there will be many protocols using LayerZero to be able to bring assets from one blockchain to another without Impermanent Loss. With this case we can go deeper into the case of Trader Joe. Trader Joe allows staking JOE on Arbitrum and receiving sJOE thereby receiving a portion of the protocol’s revenue on the Arbitrum network itself.

However, I think it is completely possible to put staking/locking tokens on an L2 network or an AltLayer but still receive the protocol’s transaction fees on all blockchains, which would be more reasonable instead of staking/locking. Which token chain receives that chain? If so, it will open up a period of strong growth for Real Yield protocols being developed on Ethereum such as Curve, Balancer, Covex,…

Similar to JOE, Balancer also allows moving BAL to Arbitrum and other Layer 2, then users can also lock BAL and take advantage of the power veBAL brings to them.

Some other events

In addition to the important events I mentioned above, over a short period of time, the number of projects integrating and using LayerZero technology is increasing, we have some examples as follows:

- Star Protocol successfully integrates LayerZero allowing the transfer of .zk domains to different blockchains such as Ethereum, Polygon and zkSync.

- AIT Protocol also integrates LayerZero allowing users to receive rewards on different blockchains.

Summary

It can be seen that LayerZero is still showing a fast pace of movement even in a crypto winter, besides the number of projects participating in LayerZero integration is increasing. However, keep an eye out for projects going in the direction of Trader Joe’s or Balancer.