There are increasing signs that Layer 2 could be one of the first trends to drive the entire crypto market to growth in the coming cycle. So what are the reasons for us to believe in this? Let’s find out together in the article below.

To better understand this article, people can refer to some of the following documents:

- What is Layer 2? Complete Guide to Layer 2 Solutions

- What is Zk Rollup? Zk Rollup Solution Overview

- What is Optimistic Rollup? Overview of Optimistic Rollup

Some Achievements That Layer 2 Has Achieved

Layer 1s had problems during the Downtrend

Warren Buffett once had a saying like: “After all, you only discover naked swimmers when the tide has gone out” and it’s the same in the Crypto market. The low tide represents the downtrend of the market and who are the naked swimmers mentioned?

- It was not until the downtrend that people paid close attention to the information that BNB Chain only had about 21 validators or that Polygon only had about 100 validators. Yet they always think that they are very decentralized.

- Solana constantly had to shut down the network due to congestion. People ask questions about whether the Solana network is decentralized or not? They even discovered that Solana did not have a Testnet network.

- Blockchain projects began to no longer focus on development, leading to a situation where some people lost direction and others changed direction, which is the story of Polkadot, Fantom, Celo, Oasis Protocol,…

In the context of many problems with Layer 1 platforms, Layer 2 has appeared at the right time. In fact, Layer 2 platforms have also encountered many problems, but when Layer 1 began to become unstable, Layer 2 began to prove its effectiveness.

Layer 2 has completely solved the problems on Ethereum

Continuing the keyword this time is still “solve the expansion problem on Ethereum” but there are a few differences. Layer 2 becomes attractive due to several factors such as:

- Inheriting security and decentralization from Ethereum. Something that other Layer 1 platforms do not have and because of that they lose trust from users.

- Faster and cheaper is true. Transactions on Arbitrum or Optimism are not as expensive as Ethereum, only about $0.1 – $0.5.

Not only that, Ethereum is also very focused on both the technological aspect, as well as the Marketing aspect for Layer 2 platforms such as Vitalik continuously speaking up and supporting Layer 2. Hoang’s latest series of updates and upgrades Ethereum like EIP 4488 or EIP 4844 also solves the expansion problem on Ethereum.

The first signs come from Arbitrum & Optimism

The first signs of explosion came from Optimism when the platform combined elements such as Airdrop to the community + Deploying Incentive for projects + Strengthening Marketing activities made TVL on Optimism quickly increase from about $200M to $1.2B. The most important thing here is that after the Airdrop, Optimism still retains impressive indicators such as:

- TVL continues to maintain at a high level of around $900M without falling sharply even though the Airdrop has been long gone and Incentives are no longer as abundant as at the beginning.

- The number of transactions remains at 500K higher than in 2022 with only 50K per day.

The impression is not only shown in Optimism but also shown in Arbitrum when Arbitrum possesses a series of achievements such as:

- TVL races TOP, surpassing a series of big names in the market such as Avalanche or Polygon. Although the token has been launched, Arbitrum’s TVL still remains at more than $2B more than Polygon’s and the next target is the position of BNB Chain .

- Arbitrum has an ecosystem built on top of each other, so the protocols interact, connect and support each other’s development. This helps pcho Arbitrum stand out more than Optimism.

- Although projects have not launched Incentive too much, the number of transactions on Arbitrum still remains at 800K per day. Is a desirable number with a series of other platforms.

I firmly believe that this is just a sign of a brilliant future when the entire market supports it, then Layer 2 will truly become one of the important pieces in the entire Crypto market. We have seen that DeFi 2020 exploded, but it is still a sign of a brilliant Layer 1 combined DeFi in 2021.

Layer 2 Is the Highlight of the Market

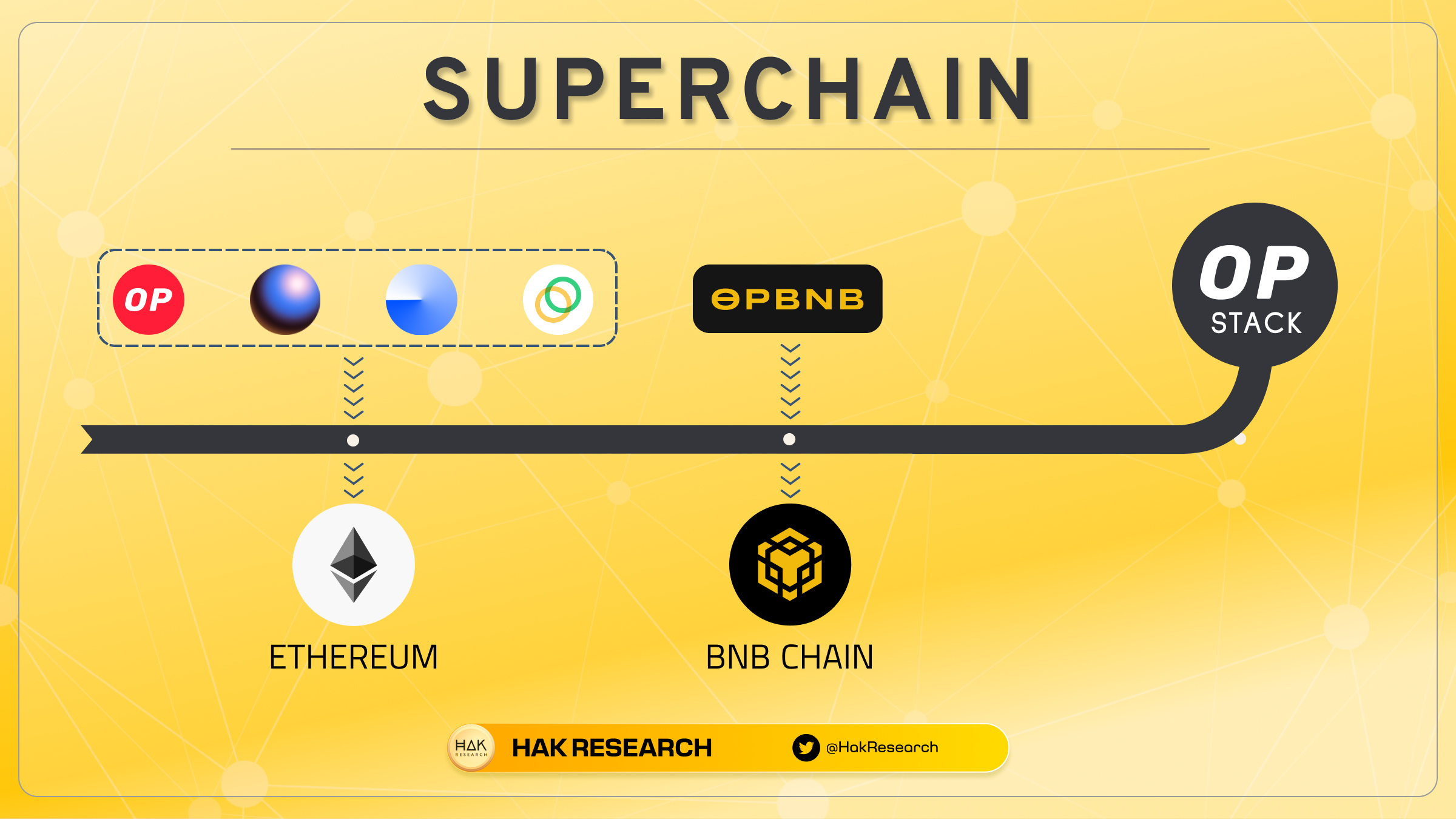

The highlight is Optimism’s Superchain

Many big companies have started building their own Layer 2 platforms and the most used toolkit is Optimism’s OP Stack because of its versatility, convenience and extreme customization ability. extremely high. With OP Stack, developers can customize almost all the pieces that make up a Layer 2 such as Consensus Layer, Execution Layer, Data Availability, Proof,…

Up to now, we have a number of large companies building on OP Stack such as

- Coinbase is building Base with the goal of diversifying revenue and diving deeper into Crypto products.

- Binance also built opBNB. opBNB will also be an Optimistic Rollup platform.

- A16Z also builds a Client to support the Superchain ecosystem.

- Celo from a Layer 1 platform also returned to Ethereum to become a Layer 2 built on the OP Stack platform.

At the moment, people are really FOMO that Optimism is the Layer 2 platform with the best technology, better than all the existing Layer 2s. And if you are thinking the same thing, you can refer to the article Why Did Binance and Coinbase Choose to Build on Optimism? for a more objective perspective.

Big guys focus on building Layer 2

Not only are the big guys returning to Layer 2 based on OP Stack technology, but we are seeing clear shifts towards Layer 2 such as:

- Polygon PoS has abandoned its Layer 1 orientation to become a zkEVM Validium platform. So all of Polygon Labs’ current solutions are aimed at Layer 2.

- Consensys also built a Layer 2 platform based on zkRollup technology.

- A series of new zkEVM platforms were born such as Kakarot, Scroll, Taiko,… and most of these zkEVM platforms have successfully called for tens of millions of dollars from many famous investment funds.

From the above two ideas, we see that most of the big players in the market are flocking to Layer 2 and I am sure they are trying to figure out something so they are acting together like that. So what do you think the big guys are achieving?

With the series of events above, it is evident that Layer 2 is the highlight of the entire Crypto industry.

Why Layer 2 Becomes a Future Trend

For an element or puzzle piece to become a trend in the Crypto market, in my opinion, it needs to have a number of key factors as follows:

- Easy to understand. Trends must be extremely simple and easy to understand in the eyes of users even though deep down they are extremely complex.

- Easy to attract cash flow. Cash flow is easy by attracting through a number of conditions such as the support of major exchanges, fast and simple money transfer times, especially there must be a channel that creates large profits for the companies. investors like IDO did with DeFi.

- Good story. Trends need a story that is attractive enough to users so that they feel this is a potential piece of the puzzle and can explode even more in the future.

In my opinion, Layer 2 has fully converged the above factors, only needing a few catalysts to explode. In essence, Layer 2 has already exploded on an ecosystem scale like Optimism or Arbitrum, but with a better market, we can see that the entire Layer 2 industry can explode even more strongly in the future.

Layer 2 has become an easy-to-understand concept

Currently, Layer 2 concepts have become popular and are much easier to understand than in the beginning. Knowledge and terminology about Layer 2 today are popular on all media channels such as Twitter, Youtube, Website, Facebook,… so users’ access to Layer 2-related content is constantly changing. The custom is increasingly popular.

Today, when mentioning Layer 2, users immediately remember the following points:

- Built on Ethereum, it inherits the security and decentralization from Ethereum itself.

- Much faster & cheaper than Ethereum.

- There are also similarities with a similar Layer 1 Blockchain platform

No need to know too much about the technology, behind-the-scenes operations, or proof of transactions, users just need to understand that Layer 2 inherits the essence of Ethereum and solves the same expansion problem as Layer 1 platforms. before. That is enough!

Layer 2 platforms are increasingly easier to accept cash flow

In essence, Layer 2s often encounter difficulties when withdrawing money from Layer 2 to Layer 1. However, today, two solutions have been created to solve the above problem:

- Bridge solutions from third parties such as Orbiter Finance, Lifi, Stargate,… allow switching from Layer 2 to Layer 1 in an extremely short period of time.

- The fact that large exchanges such as Binance, OKX or some smaller exchanges such as Bybit, Bitget, MEXC,… support deposits and withdrawals directly from the product also solves most user needs.

With the above two solutions the Layer 2 problems are finally solved and the cash flow from CEX can flow directly to Layer 2 platforms is one of the prerequisites in helping the entire Layer 2 industry explode. explode. Let’s remember when Binance supported stablecoin deposits and withdrawals with Solana, Avalanche, Fantom, Near Protocol,… what happened?

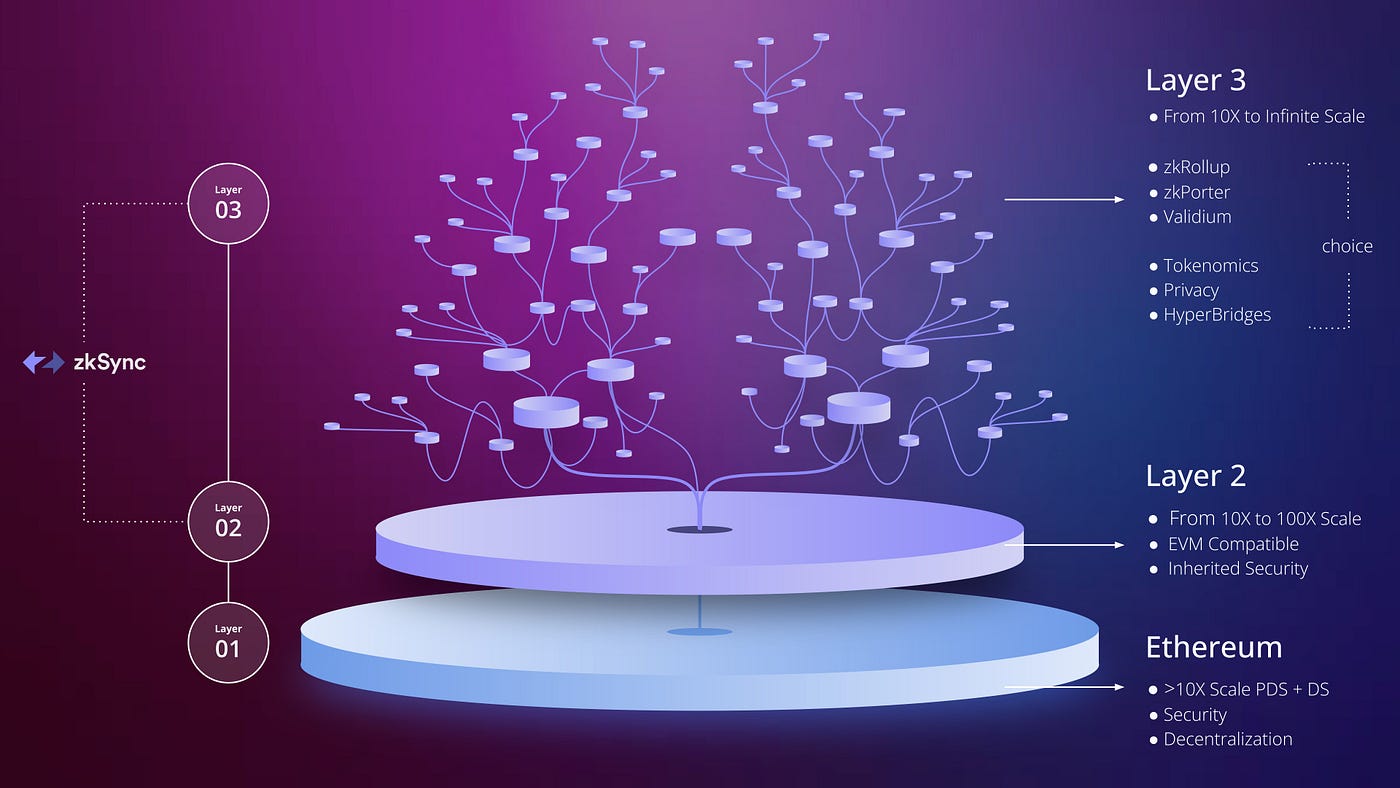

The simultaneous birth of Layer 3

For Layer 2 to become a trend, it needs a groundbreaking story and technologies that help change the entire Crypto industry the way Metaverse, NFT or DeFi have done, then that is Layer 3. If users If they understand Layer 2, they will certainly understand Layer 3 in the following ways:

- Layer 3 will also inherit a level of security and decentralization from Ethereum.

- Layer 3 can also be an underlying Blockchain.

- Layer 3 will be hundreds, thousands of times faster than Layer 2. Users and investors are always obsessed with scalability parameters.

Besides the simple elements above, a number of stories can be told with Layer 3 to attract users and investors such as:

- Layer 3 will be the Endgame in solving the scalability problem on Ethereum with the promise of unlimited expansion with almost zero transaction fees.

- Layer 3 will be where Blockchains and DApps are oriented towards a certain industry with the concept given as Application – Specific Blockchains. These Blockchains will only focus on a single segment such as Trading, Gaming, NFT or DeSocial.

I believe that the keyword will still lie in the ability to expand infinitely when deploying Layer 3 platforms on zkSync, Arbitrum or Optimism. Some Layer 3 platforms that people can learn more about are Arbitrum Orbit or ZK Credo.

Personal Feelings About Layer 2 Trends

Based on the above opinions and perspectives, I see that Layer 2 completely meets all the conditions to become a big trend in the Crypto market in the form of having products with clear text, not just based on Arbitrum paper, Optimism already has clear ecosystems, Starknet, Linea, Polyogn zkEVM or zkSync have started the mainnet alpha process.

So our opportunities lie in the following:

- Retroactive is always an opportunity for newcomers and those who do not want to delve into the technicalities of the crypto market.

- Native Tokens of Layer 2 currently have relatively few use cases, but I firmly believe that with the appearance of Layer 3, this problem will somewhere be completely solved.

- Layer 2 itself is also a foundational Blockchain, so look for Hidden Gems in Layer 2 ecosystems. Puzzle pieces about DeFi, Gaming, DeSocial or NFT.

- Projects that decide to become Application – Specific Blockchains will also be noteworthy.

Another opportunity I talked about a lot in previous articles is that Layer 2 uses Native Token to make Incentive, which is also an opportunity for us to experience projects on the ecosystem to receive more rewards. compared to usual.

Summary

I personally believe and expect Layer 2 to be one of the particularly big and strong trends in the upcoming growth cycle of the market.