Blast – the Layer 2 platform built by Pacman is receiving a lot of attention from the Crypto community due to the Airdrop for early users. Recently, the community has been speaking out about Blast being a Ponzi platform, but Pacman has spoken out against this idea. So is Blast a Ponzi platform or not? Let’s find out in the article below.

Overview & Latest Updates About Blast

Overview of the Blast platform

Blast is a Layer 2 platform built and developed based on Optimistic Rollup technology, led by Pacman – Co Founder of Blur – NFT Marketplace platform. Some outstanding features include:

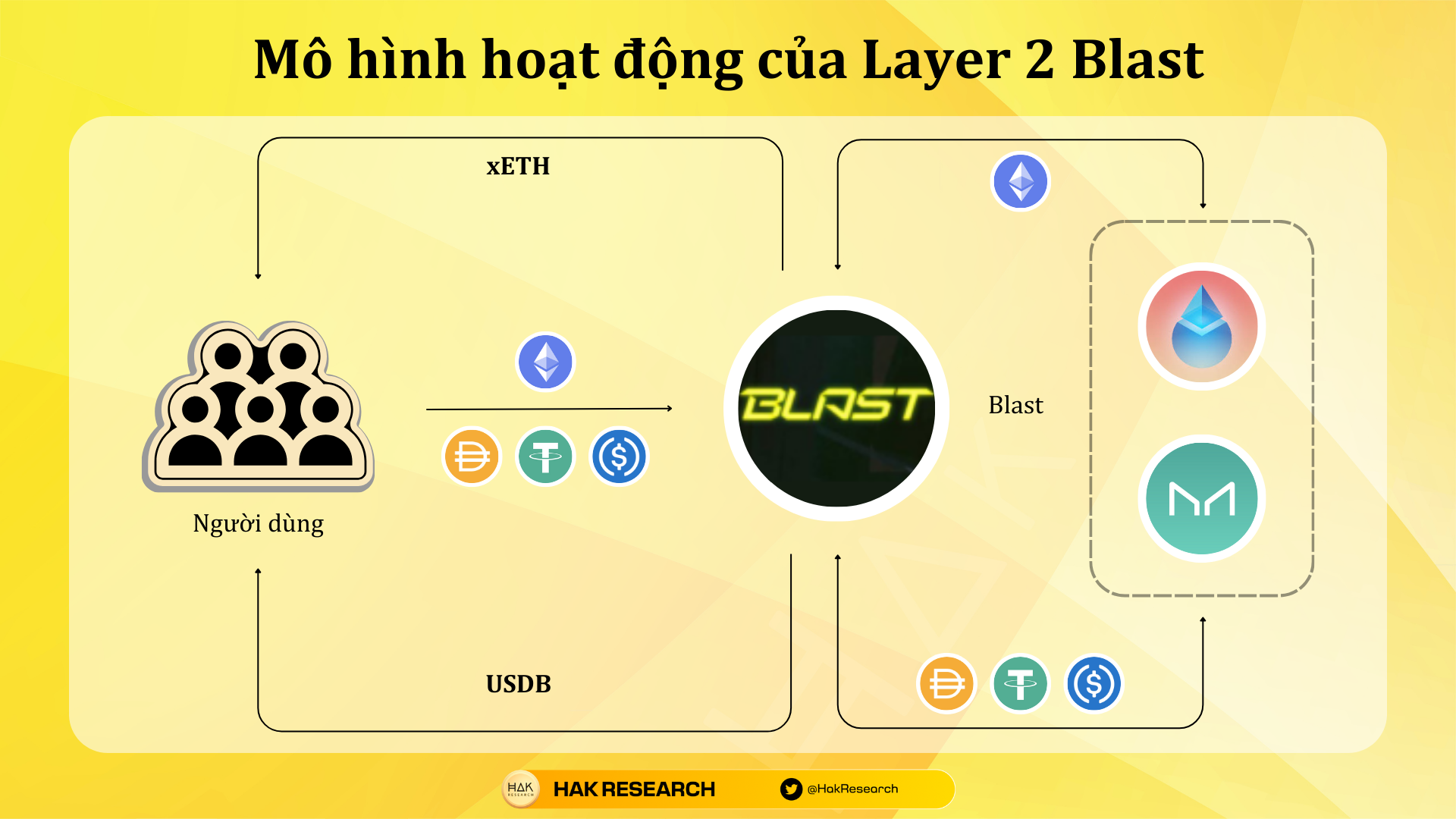

- Auto Rebasing: All ETH when users deposit into Blast will be staking on Lido Finance. Users on the Blast network will receive Staking rewards and Blast will return ETH to the user and this amount of ETH will increase over time.

- T-Bill Yield: All USDC, USDT and DAI deposited to Blast will be deposited into Maker DAI’s Real World Asset product. Blast will return the user USDB representing the user’s Stablecoin on Blast.

Latest update about Blast

Right after its launch, Blast’s Twitter homepage shared that there would be rewards (Airdrop) for early supporters of the platform. Thanks to some of the following conditions, users have FOMO to join the platform and cover all possible risks including:

- Hint Airdrop: Directly sharing that there will be an Airdrop in the future for all early backers.

- Strong back: Blast is backed by Paradigm investment fund – an investment fund with many projects that have each had huge Airdrops for users. Besides, Blast was built by Pacman – Co Founder of Blur. In the past Blur has had many huge Airdrops for its users.

- Something special: It is turning its platform into a bank that makes Blast different from current Layer 2 platforms.

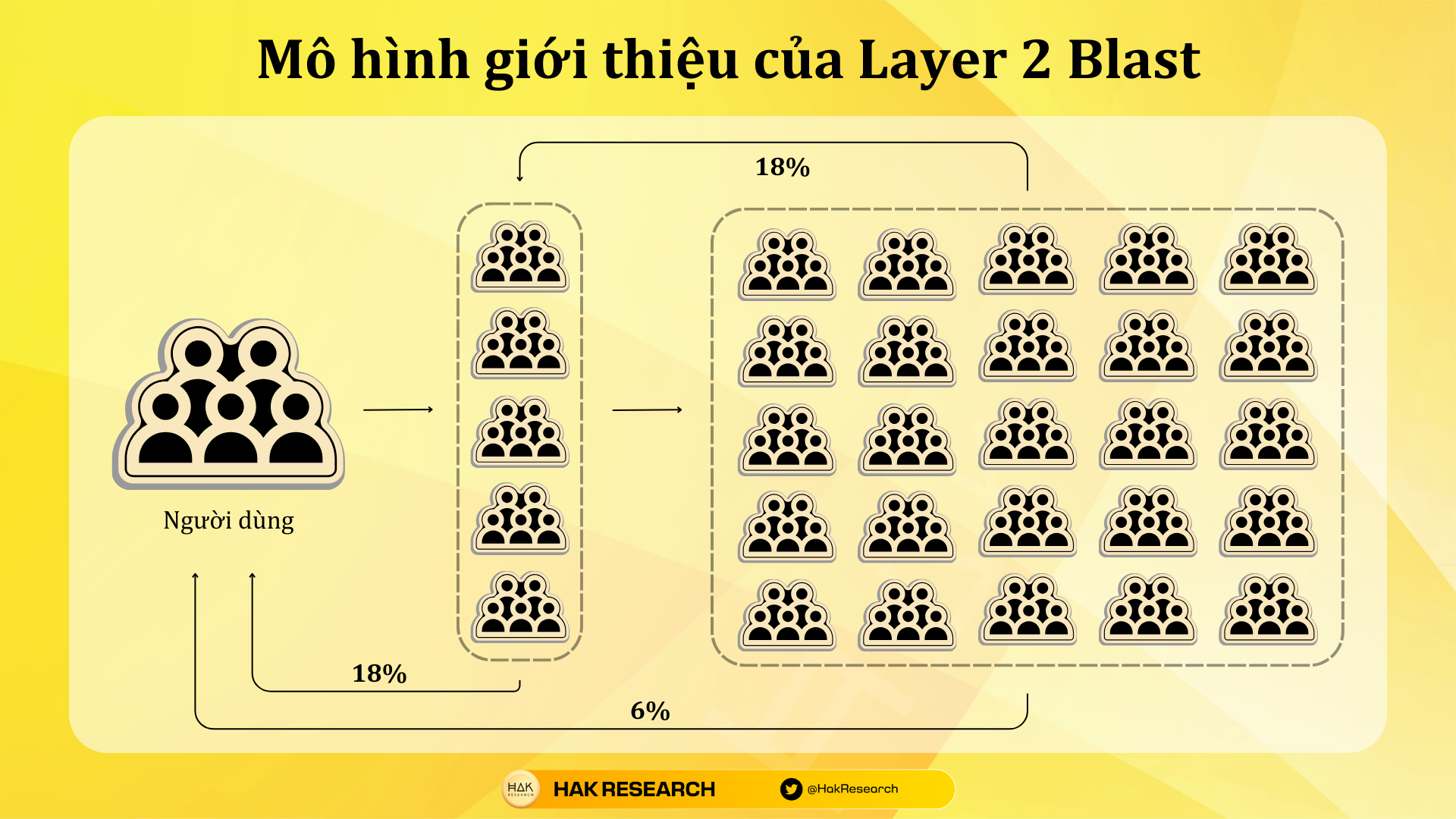

Besides, Blast introduces an extremely interesting program for one person to introduce another person such as:

- If users accumulate ETH, if they have enough 1 ETH, they will get 1 spin to receive Points. For example: Deposit 1 ETH into Blast to receive 1 spin every 1 week, deposit 0.5 ETH to Blast to receive 1 spin every 2 weeks or deposit 0.2 ETH to Blast to receive 1 spin every 5 weeks.

- Introductory model: If 5 people you introduce deposit more than 5 ETH into Blast, when you spin, the number of Points you receive will be x5 – x10 normally. If your deposit is less, you will receive 18% of the points of the 1st floor and 6% of the points of the 2nd floor.

The combination of all of the above has created a craze on the Blast network.

Blast has reached $443 Million in TVL within 4 days.

52,836 community members are now earning yield (~4% for ETH and 5% for stables) + Blast Points. pic.twitter.com/yiakjeKlss

— Blast (@Blast_L2) November 24, 2023

In less than 4 days, nearly $500M was deposited into the Blast network. Remember that Blast is currently not mainnet and users can simply deposit into a Multisig Wallet. At the time of writing (December 2, 2023), the amount of assets deposited into Blast has reached $650M. Everyone can check the Blast wallet address here.

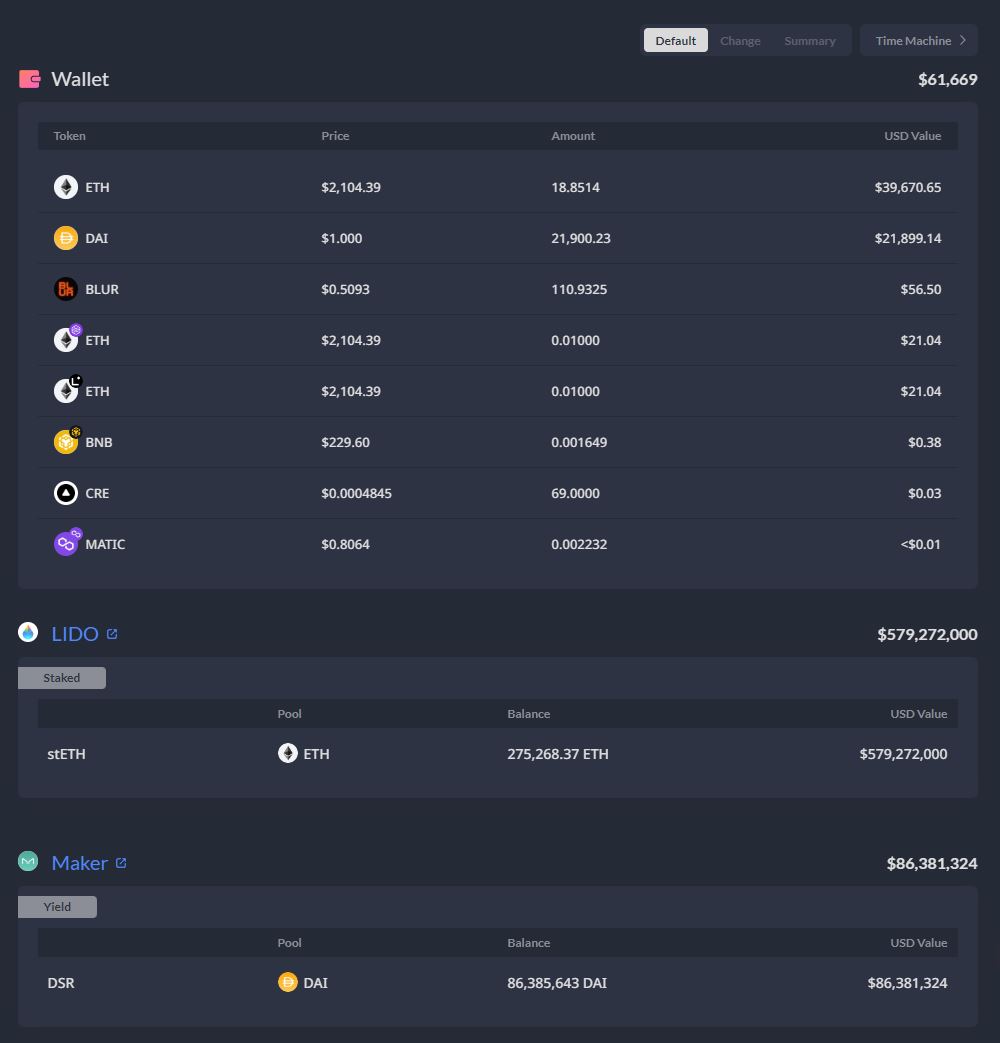

Currently, there is approximately $579M ETH staked on Lido Finance’s platform and $86M DAI deposited in Maker DAO’s DSR.

If we look back at some of the new ecosystems, Sui Network’s current TVL is about $150M or Aptos is only about $60M, and if we look at ecosystems with all the pieces, Solana and Avalanche only have about $60M. $650M, everyone can see how money flows into Blast FOMO, they ignore all possible risks such as:

- The network promises mainnet in April 2024, but the promise in the Crypto market is extremely expensive.

- The place users deposit is just a Multisig Wallet which is quite risky.

Is Blast a Ponzi Platform?

Pacman speaks out about whether Blast is a Ponzi platform?

Based on the above factors the communities believe that Blast is a Ponzi platform. Pacman’s message to the community includes 3 main ideas:

- The profits that Blast brings to users.

- The surrounding information comes to Paradigm.

- Information about the Refferal program.

I’ve seen a number of misunderstandings about Blast spreading around. While many of these are humorous memes, it’s important to set the record straight on a few points:

— Pacman | Blur + Blast (@PacmanBlur) November 24, 2023

But I shared above and Pacman also shared that Blast’s profits come from Lido Finance’s Staking and Maker DAO’s Real World Asset. All of these profits are Real Yield and come from beneficial activities.

Next on the story the community claims that Paradigm is the investment fund behind the entire launch of Blast. However, Pacman denies this, saying that Paradigm is only behind in terms of sharing, giving advice,… and all operations and eyes are decided by the development team.

Finally, Blast’s introduction model is no longer strange in the market. It has been used effectively by many different parties.

Personal opinion about Blast

I completely agree with Pacman’s opinion. In which the profits that Blast brings to its users are Real Yield activities, depositing user assets into Lido Finance and Maker DAO itself is relatively safe. Take a closer look at the operating model:

- Users send ETH to the Blast network, this ETH will be staked for Lido Finance. Lido will return Blast stETH representing the deposited ETH. So if Blast uses this stETH or another form of xETH at a 1 to 1 ratio, there is essentially no difference and there is not too much leverage here.

- Users who deposit Stablecoin USDC, USDT or DAI into the Blast network will be deposited into the RWA array of Maker DAO. Maker DAO will share profits with Blast. A bit of ponzi here is that Maker DAO takes advantage of this profit to redistribute it to users in the form of Stablecoin USDB.

The ponzi only exists in the USDB model, but it does not carry too much meaning because in essence, instead of distributing profits in the form of DAI, it is instead USDB. Blast is very smart to take advantage of this to build its own Stablecoin. In the current market context, I believe that each ecosystem needs a Native Stablecoin to centralize liquidity.

As for the referral mechanism, it is completely normal to have only 2 layers. Many other DeFi protocols in the market also use 4, 5 or even 6 different layers to share benefits, everyone can refer to it. Referral model of Marginfi – Lending & Borrowing platform on Solana.

However, in fact, one thing I don’t like is the way Pacman and the project make the community FOMO but do not talk about the risks that users may suffer in the future. Excessive FOMO like this also makes people have a bad view of the Crypto market.

Summary

Pacman and his team had one of the different strategies. Calling for hundreds of millions of dollars in the context of not having any products yet. This reminds me of ICOs in previous years. Hopefully through this article, everyone will have more perspective on whether Blast is a Ponzi platform or not?