Defillama is an onchain tool provided for free to everyone with information that can be applied to the investment process, but this application is quite difficult to use for those new to the crypto market. In this article, Weakhand will guide you in detail on how to use Defillama for newcomers to the crypto market.

Related articles:

- Instructions for Using DeBank for Beginners

- Retroactive Defillama Hunting Guide

Overview of Defillama

Defillama is an application that provides information and onchain data of DeFi projects from all blockchains in the entire market such as Ethereum, BNB Chain, Solana,… The data that Deillama provides about blockchains is very complete information such as TVL, revenue, marketcap, daily transaction fees,…

In essence, all the information provided from Defillama can be searched from scanned pages or APIs, but the interface of these platforms is not friendly to most users. Therefore, Defillama was born to simplify onchain information to users in the simplest and easiest way to understand.

Instructions for Use Defillama

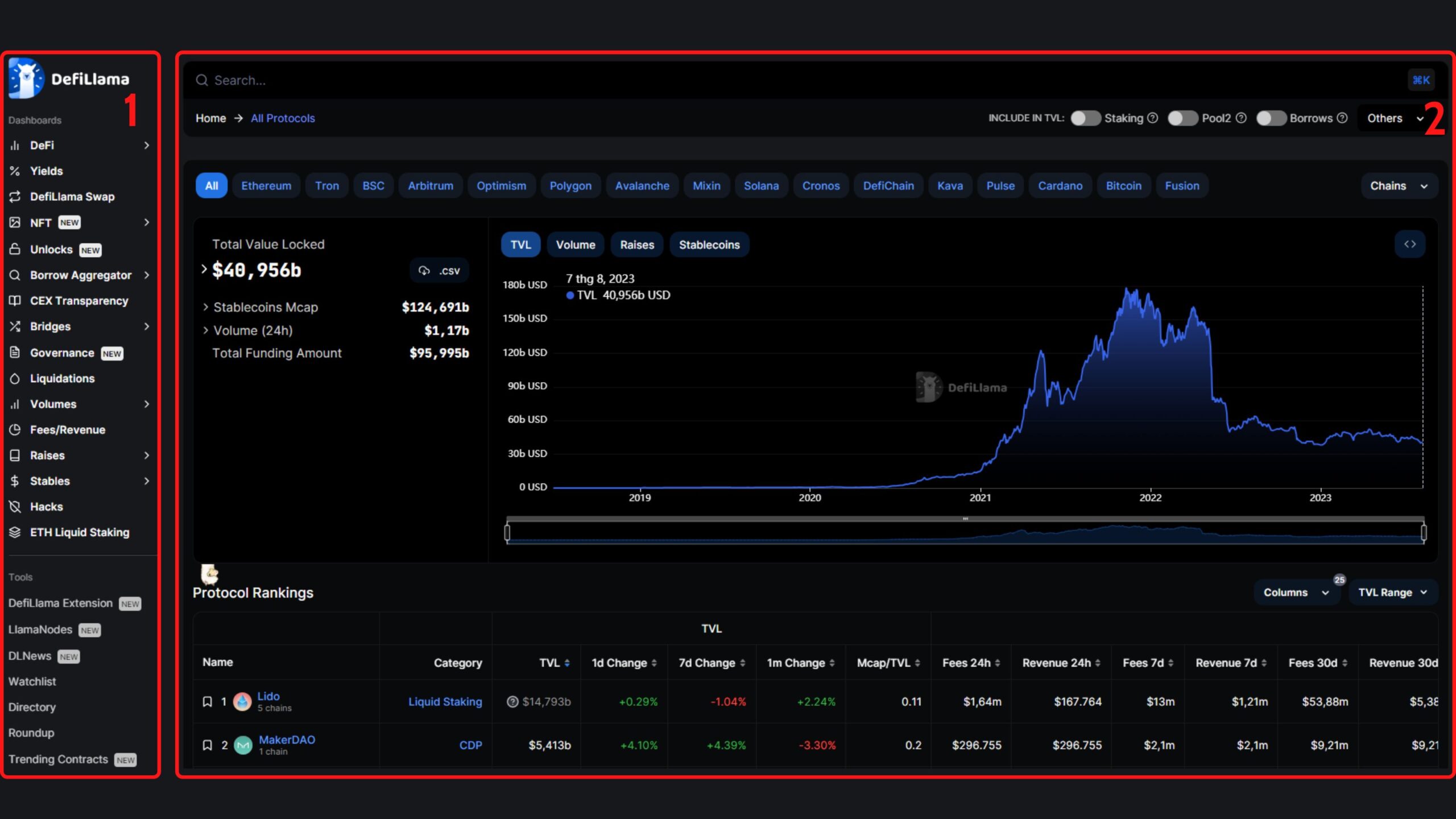

After accessing Defillama, people will see an interface consisting of 2 main parts as follows:

- Displays overview information about TVL, 24h trading volume,… of the entire DeFi market and leading protocols.

- Includes other topics that we will continue to learn about in the next part of the article.

DeFi topic

This will be a topic containing a lot of different information in the DeFi market.

Overview

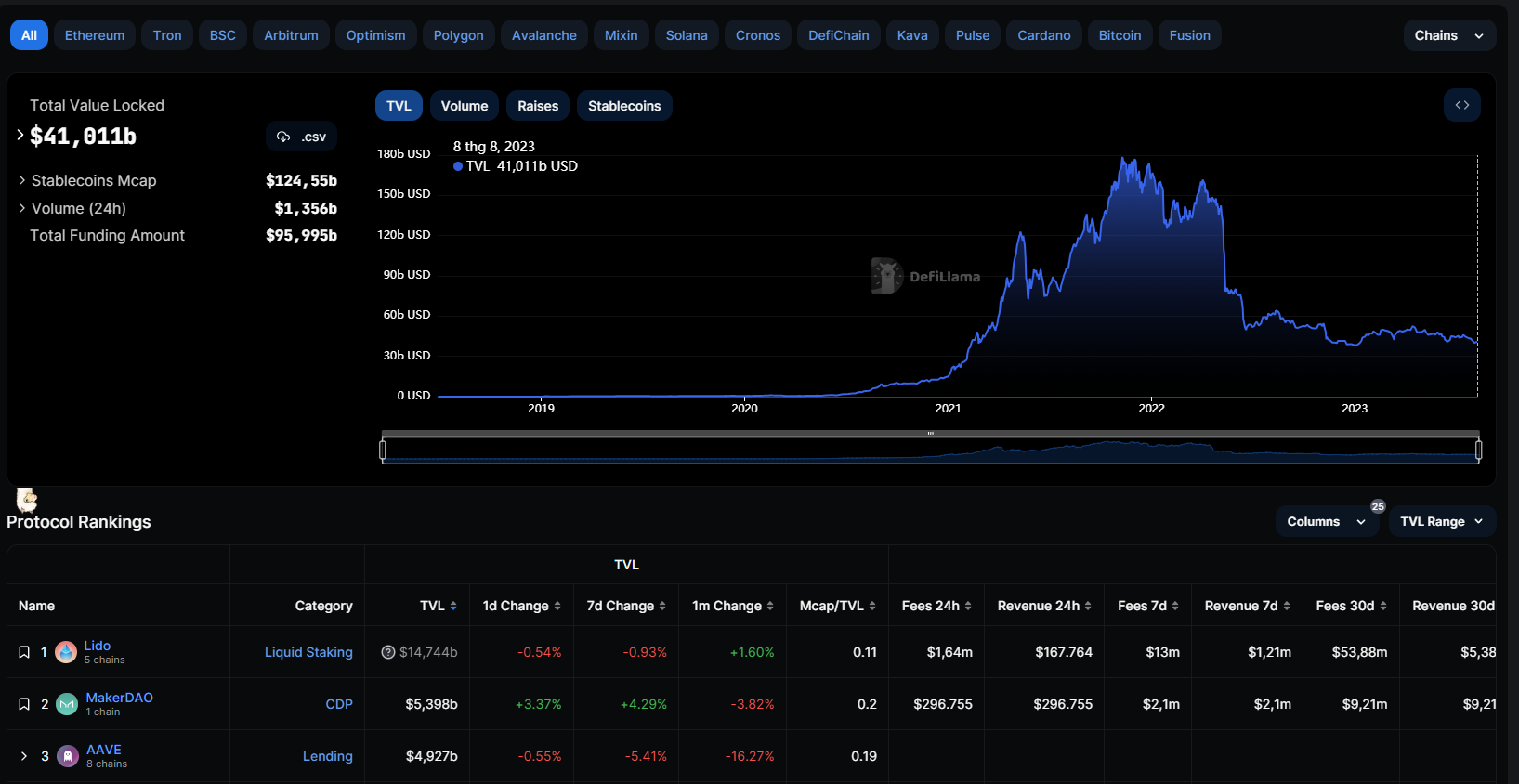

This feature provides all the overview information about the DeFi market with the following main contents:

- Total Value Locked (TVL): Total value of assets locked in the DeFi market.

- Change: Amount of change in locked exchange assets within 24 hours.

- Dominance: Demonstrates the dominance of the protocol with the most TVLs in the market.

- TVL Rankings: Ranking protocols across the entire market based on TVL, people can also filter by specific chains.

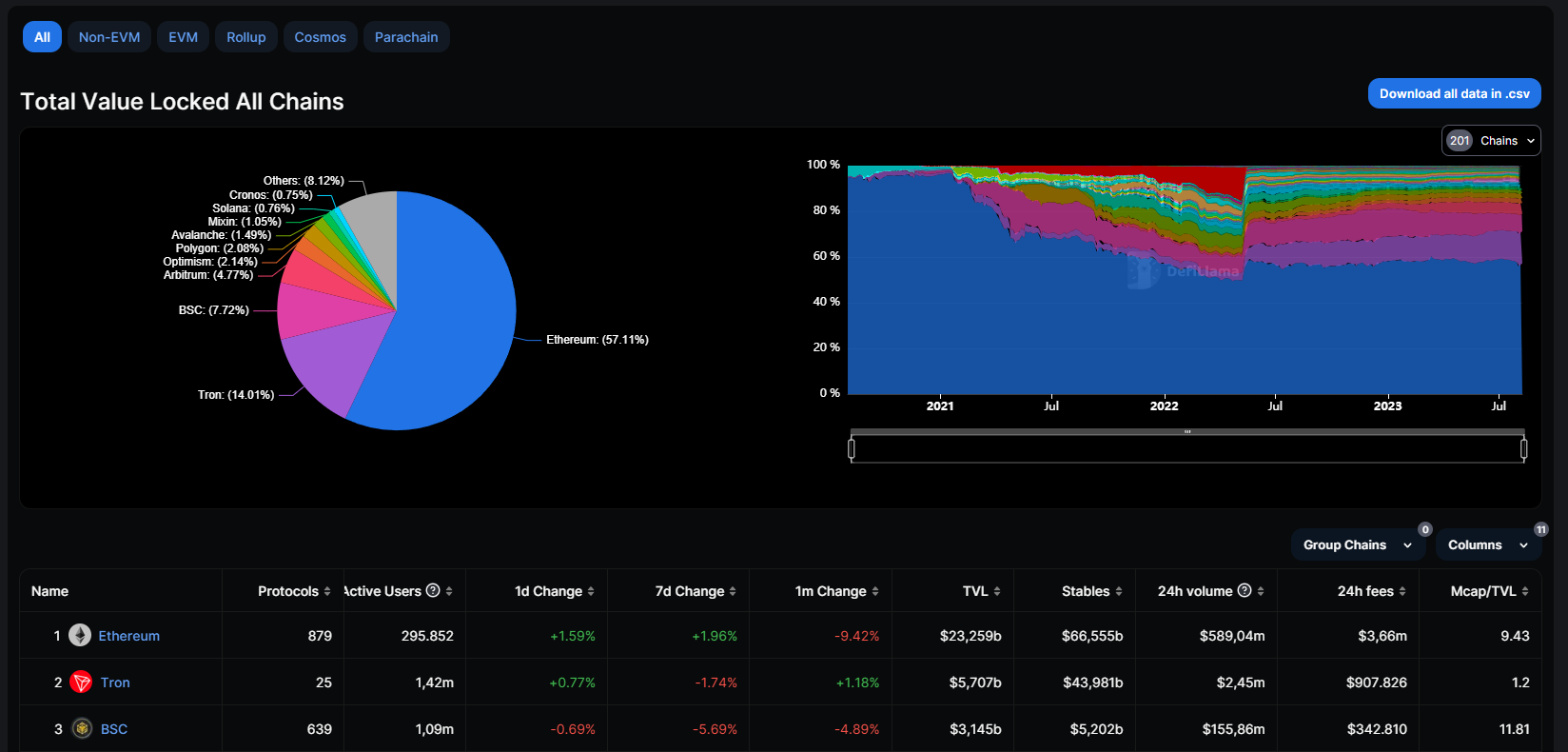

Chains

- The pie chart will display the TVL ratio between chains at the current time.

- The line chart will display the TVL ratio of all chains from past to present.

- The parameters below will display detailed information of each individual chain such as number of protocols, number of active wallet addresses, TVL change in %, amount of stablecoins on chains, 24h transaction volume, etc. .

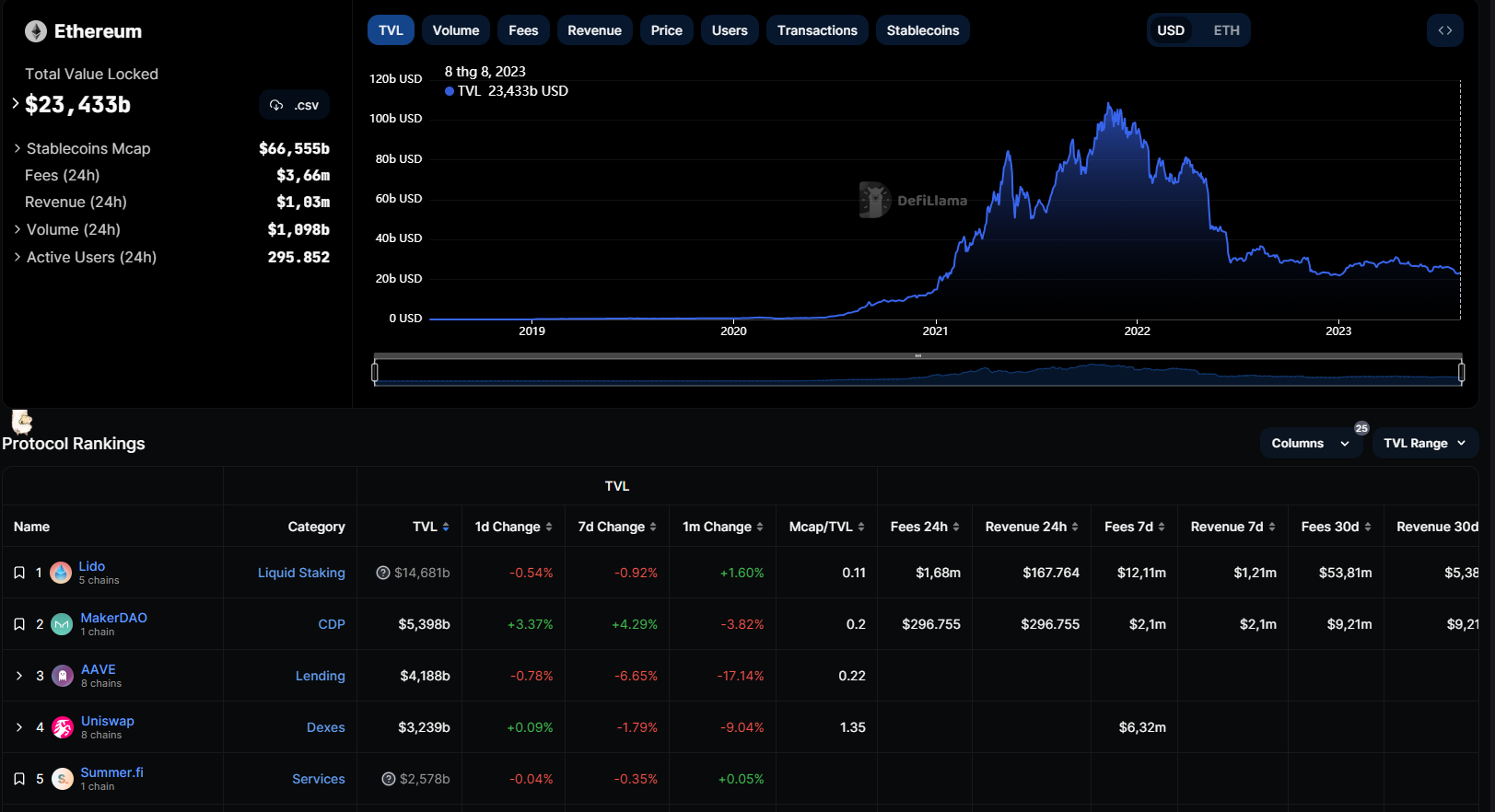

When selecting a blockchain, such as Ethereum, more detailed information about that chain will appear such as:

- Stablecoin Mcap: Capitalization of stablecoins in that blockchain.

- Fees: Transaction fees used by users on the blockchain within 24 hours.

- Volume: Transaction volume in blockchain protocols in 24 hours.

- Active Users: Number of users of that blockchain in 24 hours.

- Protocol Ranking: Ranking of DeFi protocols in that ecosystem based on TVL.

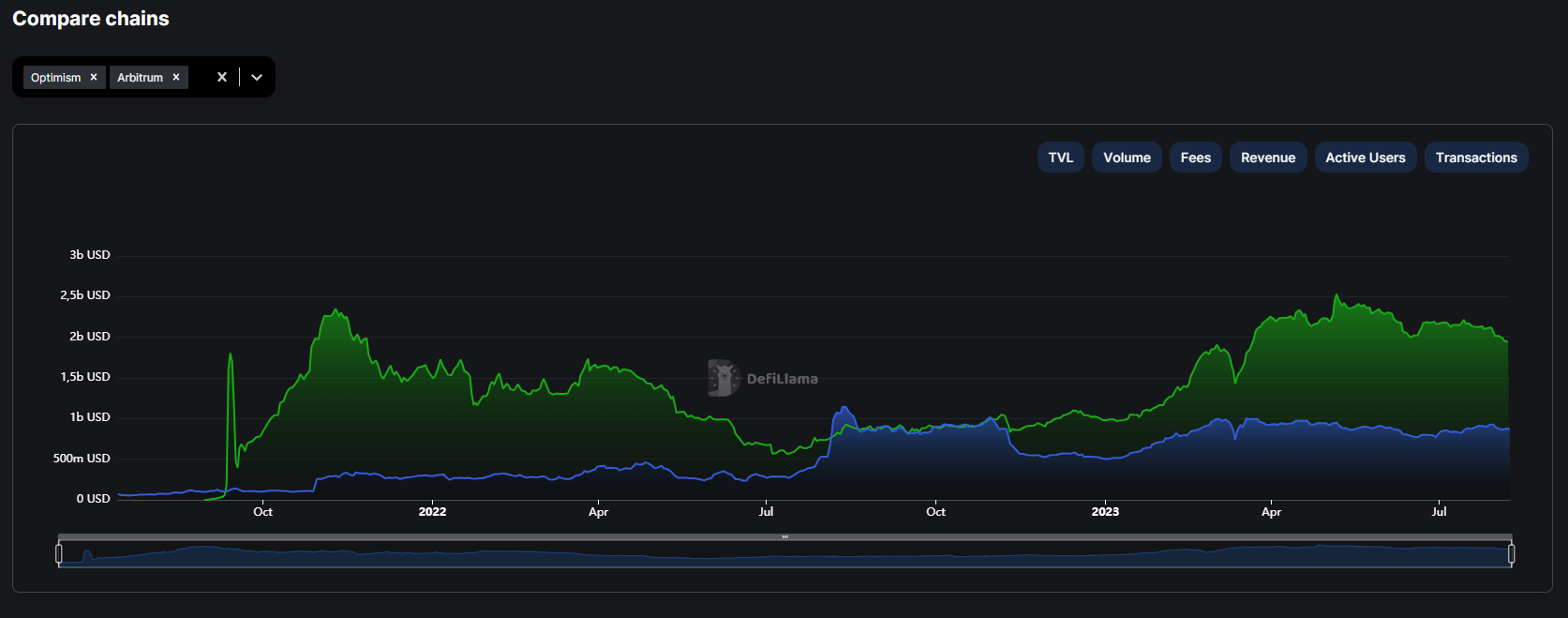

Compare Chains

This feature will allow users to compare TVL between 2 or more chains from the past to the present in the most intuitive way. People can use this feature to effectively compare different blockchain development processes to choose the more potential chain to have skin in the game.

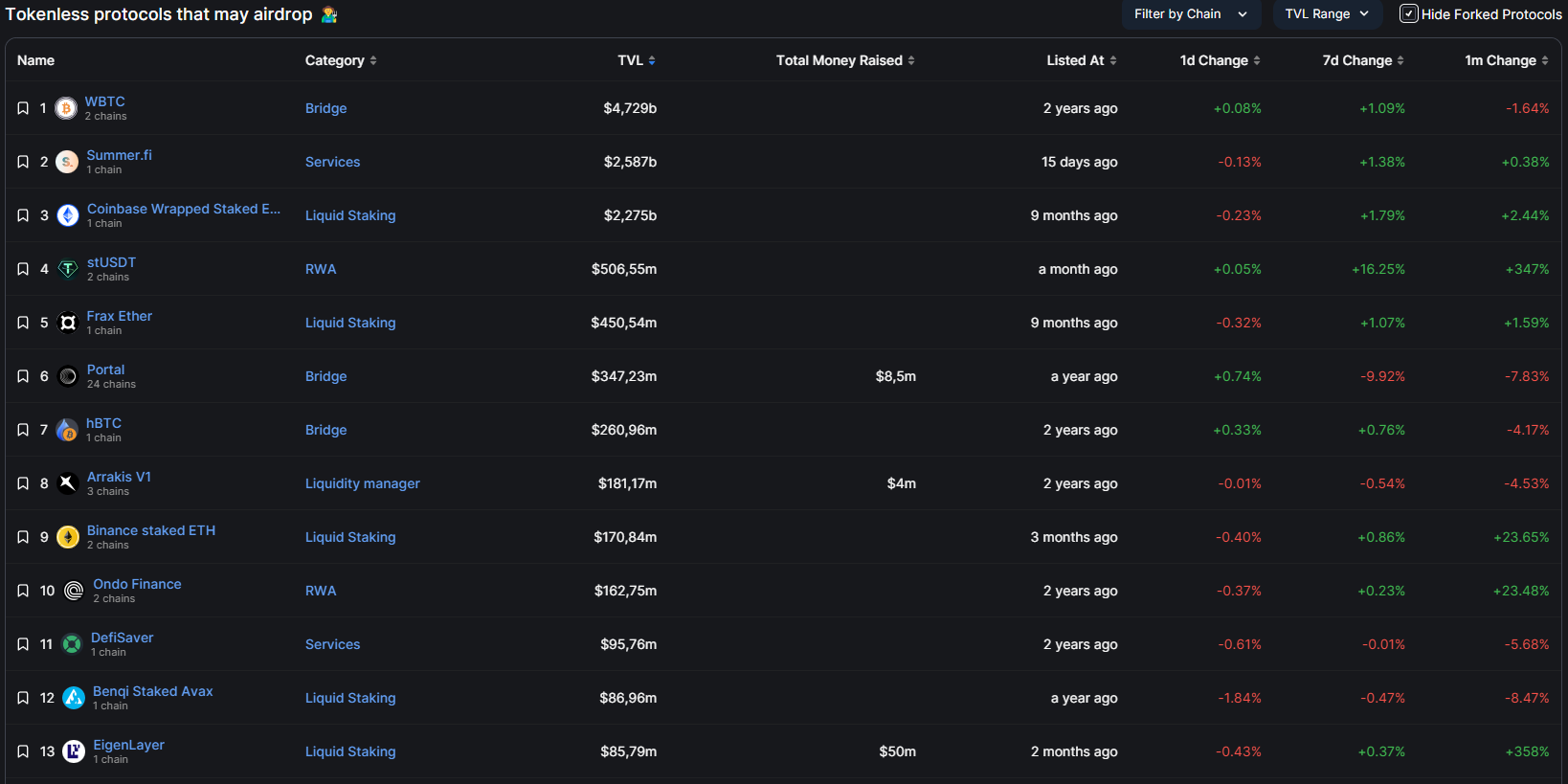

Airdrops

Airdrop is an act of rewarding tokens to users through using products or participating in campaigns from projects with the purpose of decentralization and decentralization. Defillama’s Airdrops feature will continuously update new projects that do not have tokens so everyone can rely on it to experience and find airdrop opportunities in the future.

However, in reality, the projects listed by Defillama only do not have tokens, and selection will take more time and effort, so people need to carefully review the project before experiencing it.

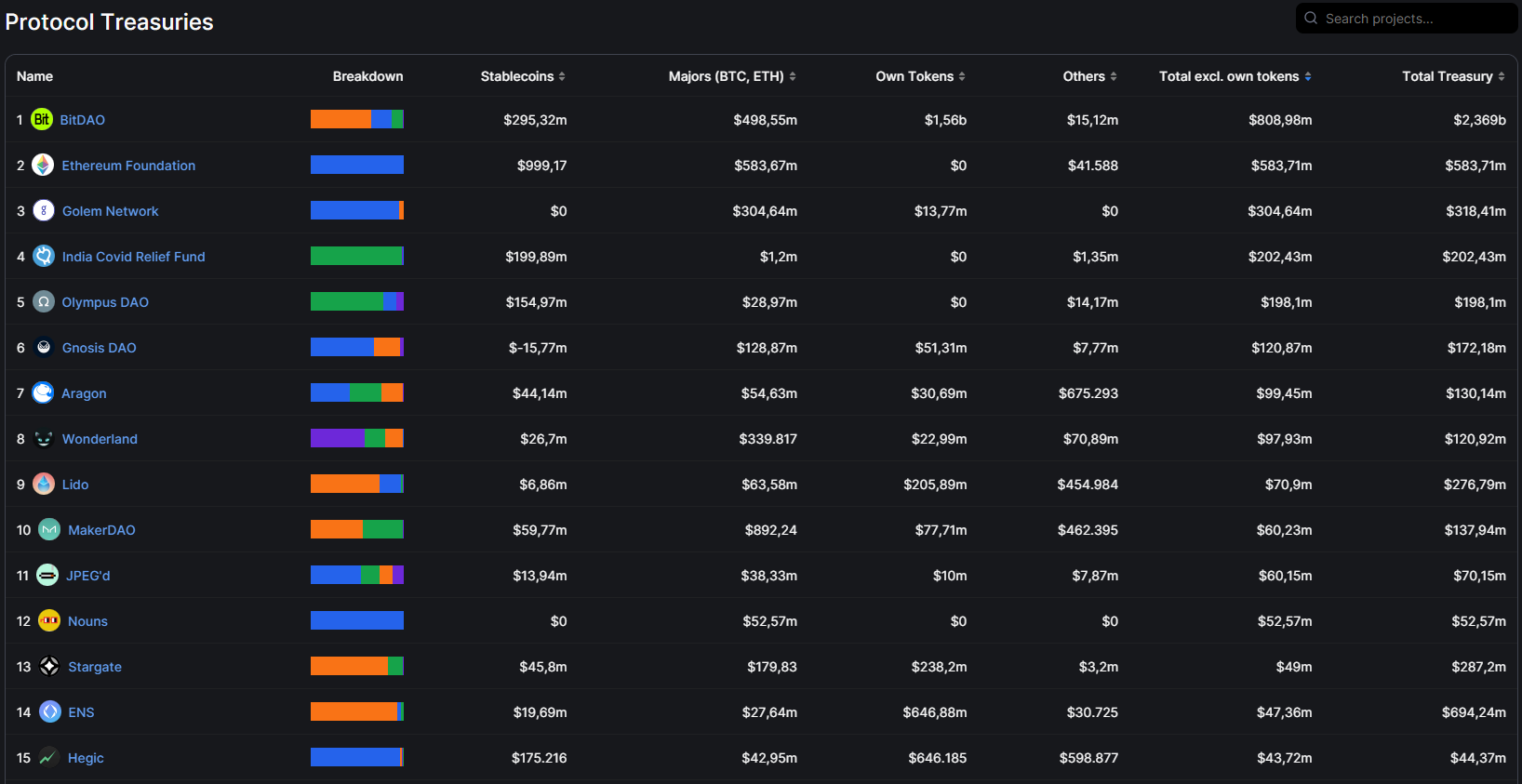

Treasures

This feature provides detailed Treasury information of DeFi protocols sorted from high to low with the following parameters:

- Stablecoins: Amount of stablecoins held in the Treasury.

- Majors: Amount of BTC and ETH held in the Treasury.

- Own Tokens: The amount of the protocol’s own governance tokens held in the Treasury.

- Others: Other altcoins held in the Treasury.

- Total excl. own tokens: Total assets excluding Own Tokens held in Treasury.

- Total Treasury: Total assets held in the Treasury.

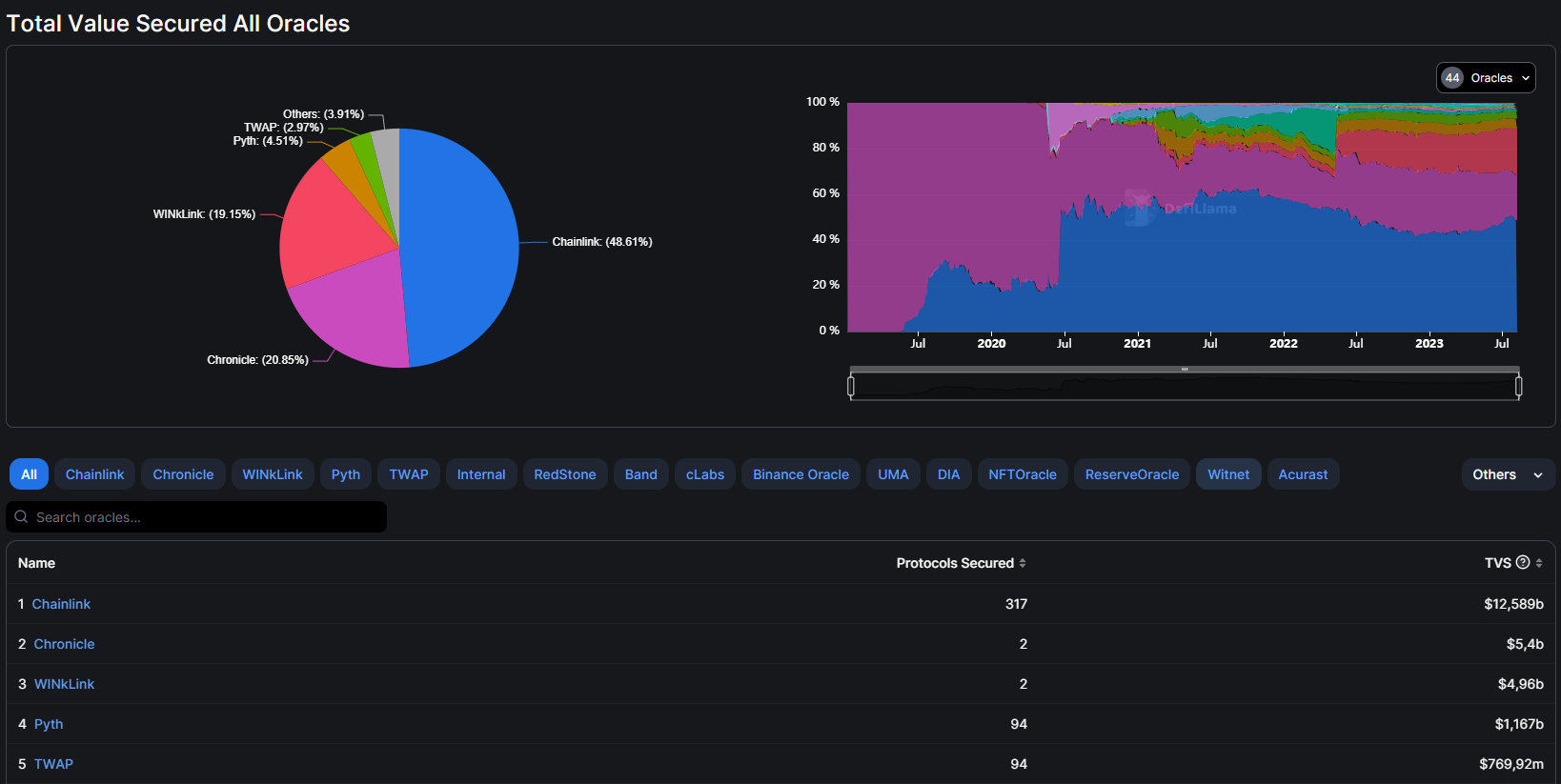

Oracles

This is a dashboard showing the asset value provided by Oracles with details as follows:

- The pie chart shows the proportion of assets provided by Oracles projects at the present time.

- The line chart will show the proportion of assets provided by Oracles projects from the past to the present.

- The ranking table below will show the order of Oracles protocols ranked by TVS and Protocols used.

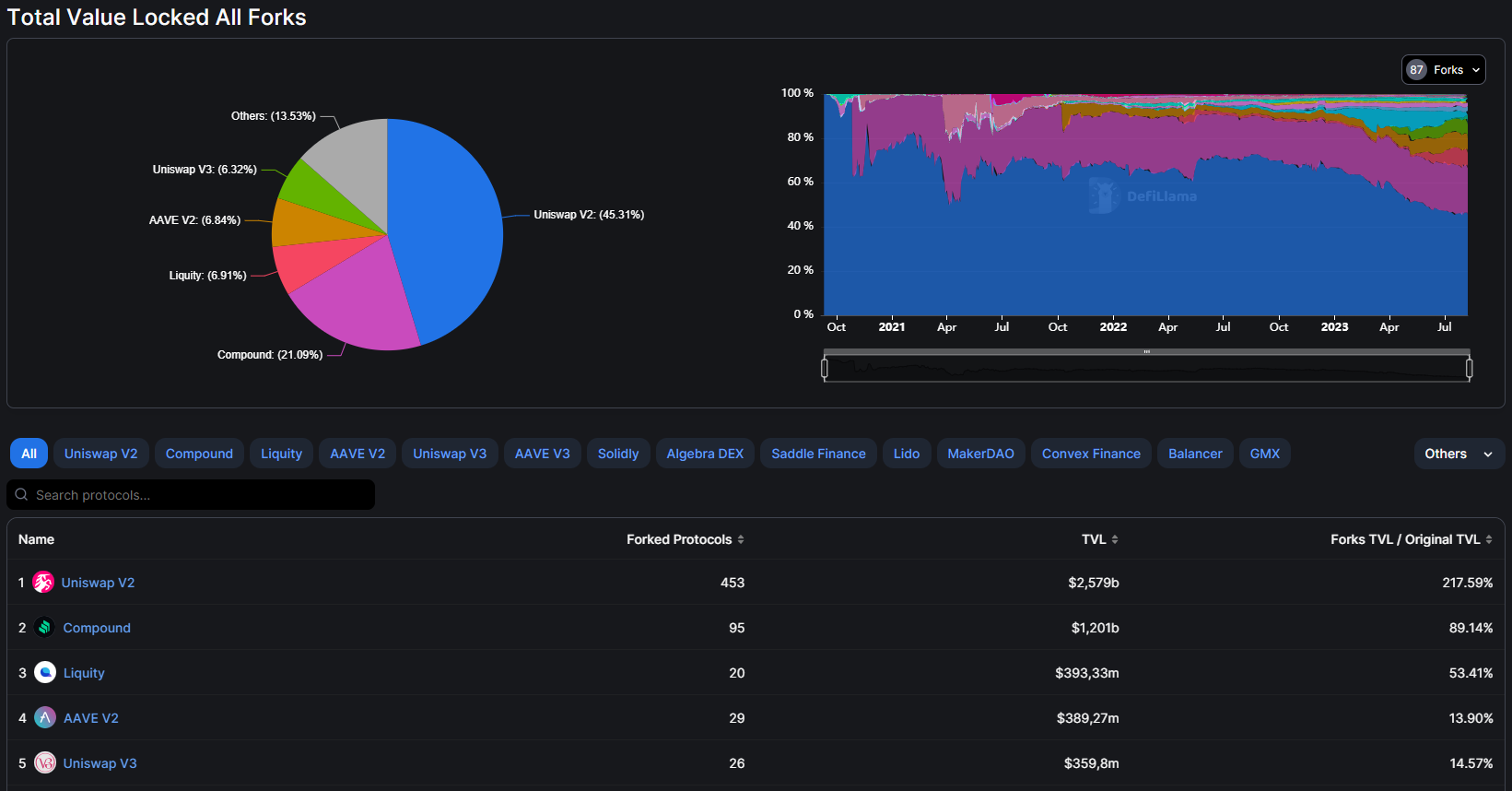

Forks

This is a feature that demonstrates the value of fork projects from a parent project as detailed as follows:

- The pie chart will show the proportion of assets in protocols forked from a parent project such as Uniswap v2, Compound, AAVE,… at the present time.

- The line chart will show the proportion of assets in forked protocols from the past to the present.

- The rankings below will display the top most forked protocols by TVL and number of forked projects.

Top Protocols

An overview of projects leading different segments arranged in order from large to small blockchains.

Comparison

This is a feature quite similar to Compare Chains that allows people to compare TVL between 2 or more different protocols from the past to the present.

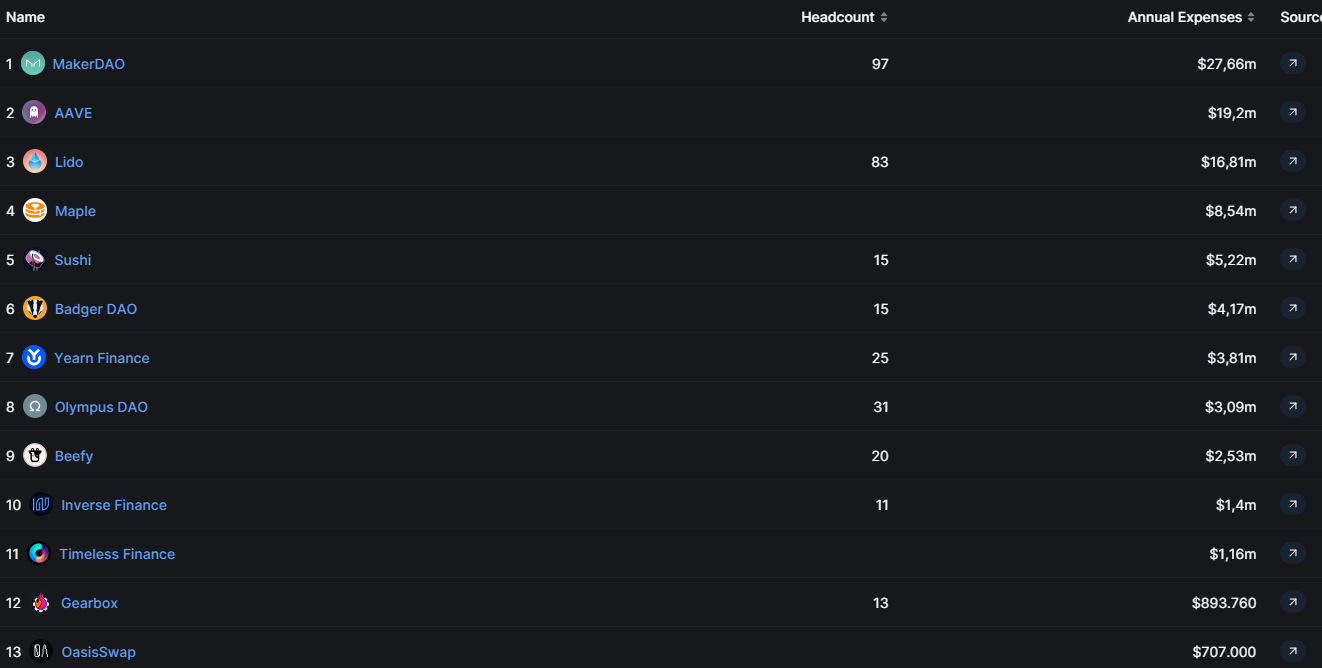

Protocol Expenses

This is a feature that helps people see how much a DeFi protocol costs to operate annually.

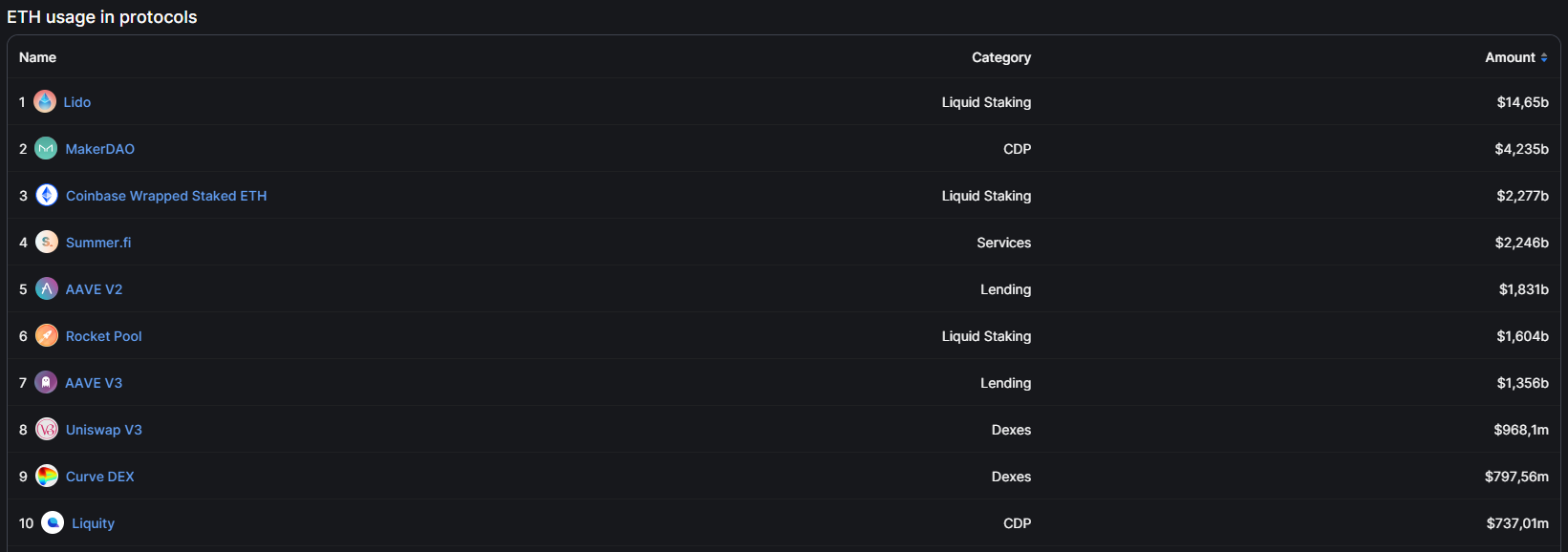

Token Usage

This is a feature that helps users select and see which protocols a certain token is used in, for example, ETH is used in Lido, MarkerDAO, cbETH,…

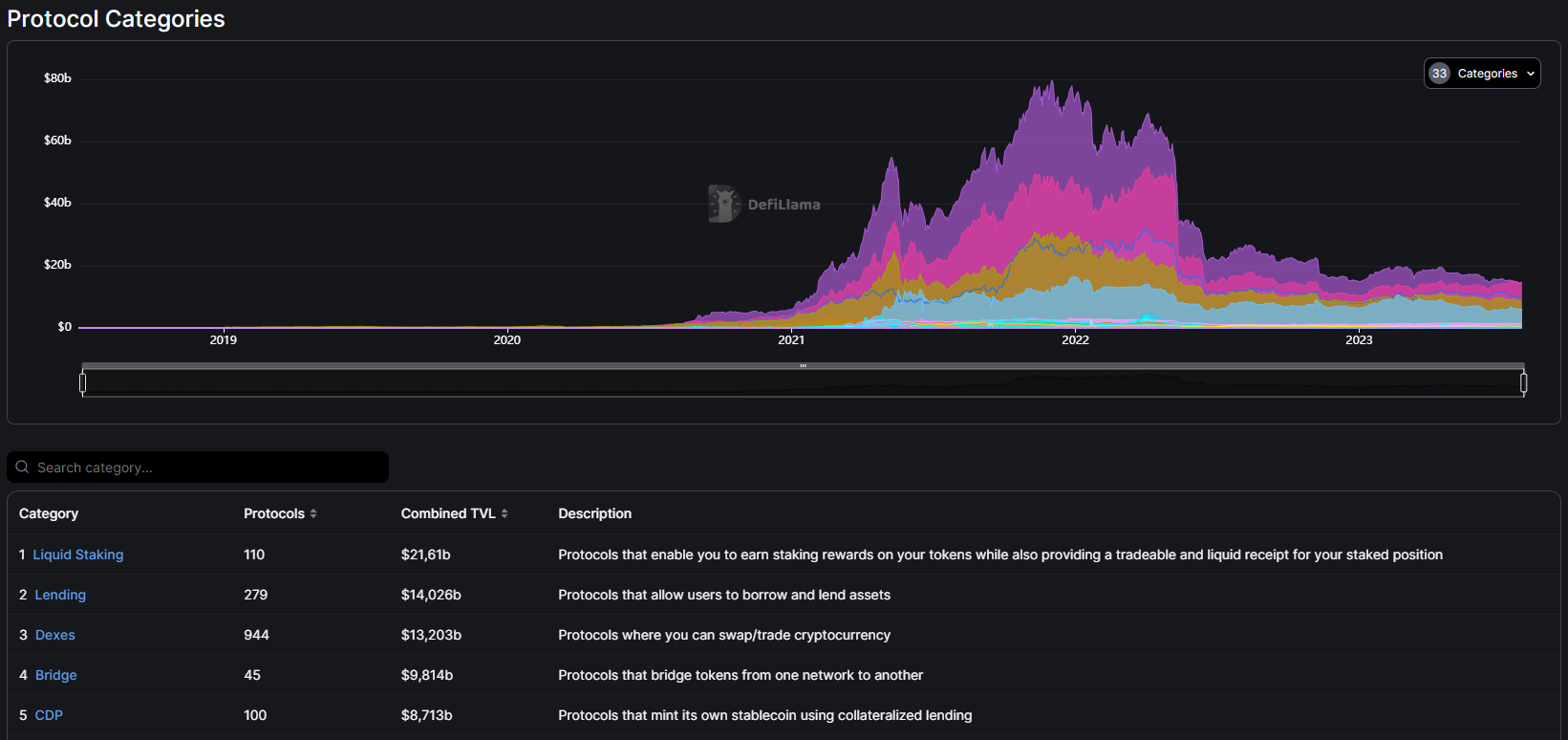

Catrgories

Categories is a feature that provides users with information about TVL as well as the number of projects of different pieces in the DeFi market.

Recent

Projects recently listed on Defillama will be displayed in this Recently Listed Protocols section.

Languages

This parameter represents the dominance of programming languages in DeFi such as TVL, TVL Dominance and the ratio between the number of projects with open or closed source code on Solana.

Title Yeilds

The Yeilds section will focus on providing information for real DeGen in the DeFi market.

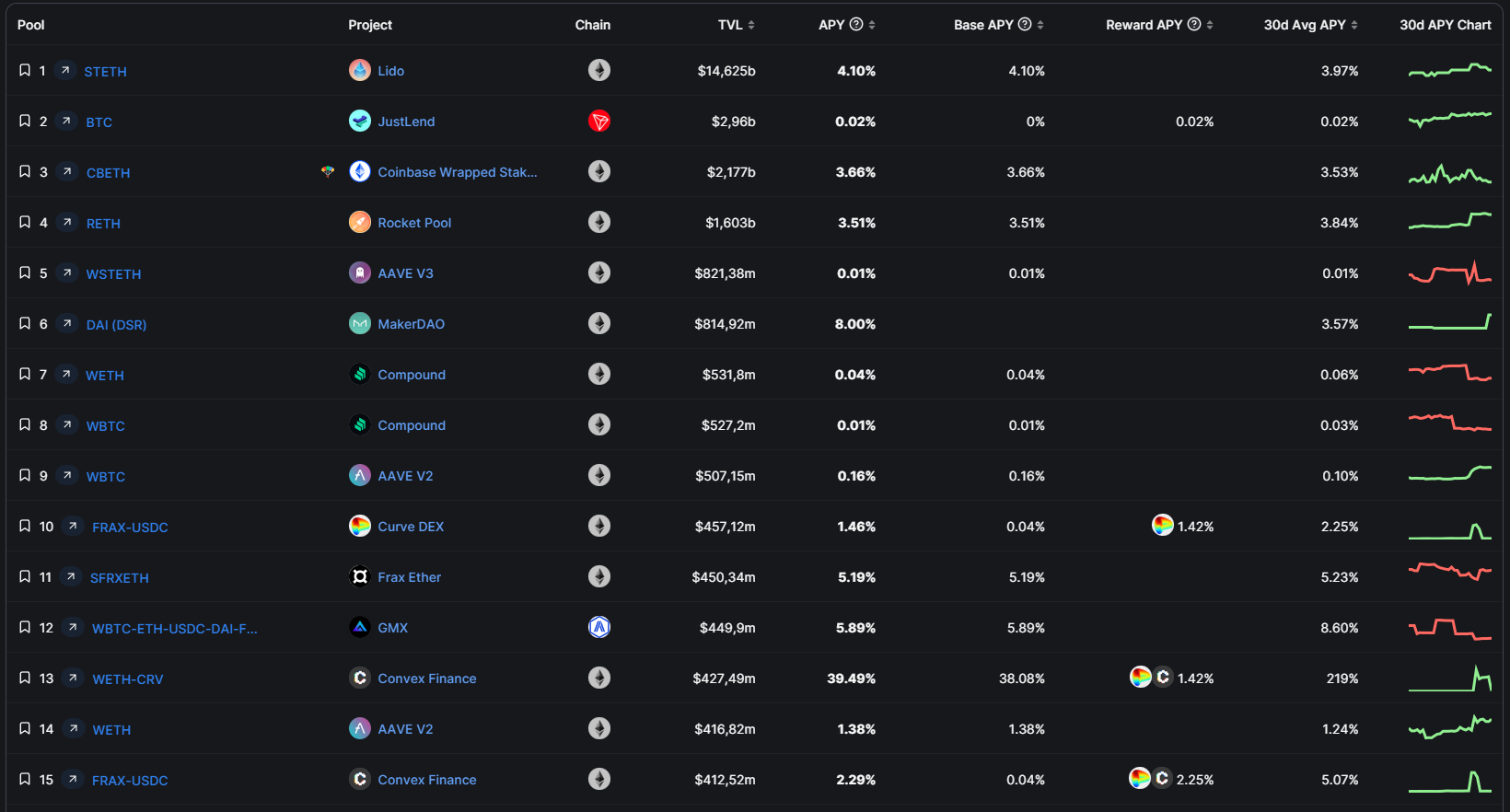

Pools

Pools, also known as Liquidity Pools, are smart contracts into which users deposit assets. This feature will help people find detailed information from the largest pools on the market such as APY, TVL, APY. medium,…

Leveraged Lending

Providing leveraged lending platforms to help users earn many times more profits with just an initial amount of capital.

Borrow

Displays the total TVL of active projects in the Borrow segment and a few other parameters such as LTV, Supplied, Borrowed,…

Overview

An overview of the APY of protocols in the DeFi market as well as daily gains and losses in a few tables.

Stablecoin Pools

Ranking of the largest stablecoin liquidity pools in the market and some information such as TVL, APY, Base APY, Reward APY,…

Projects

Statistics of Yield Farming platforms with TVL.

NFTs heading

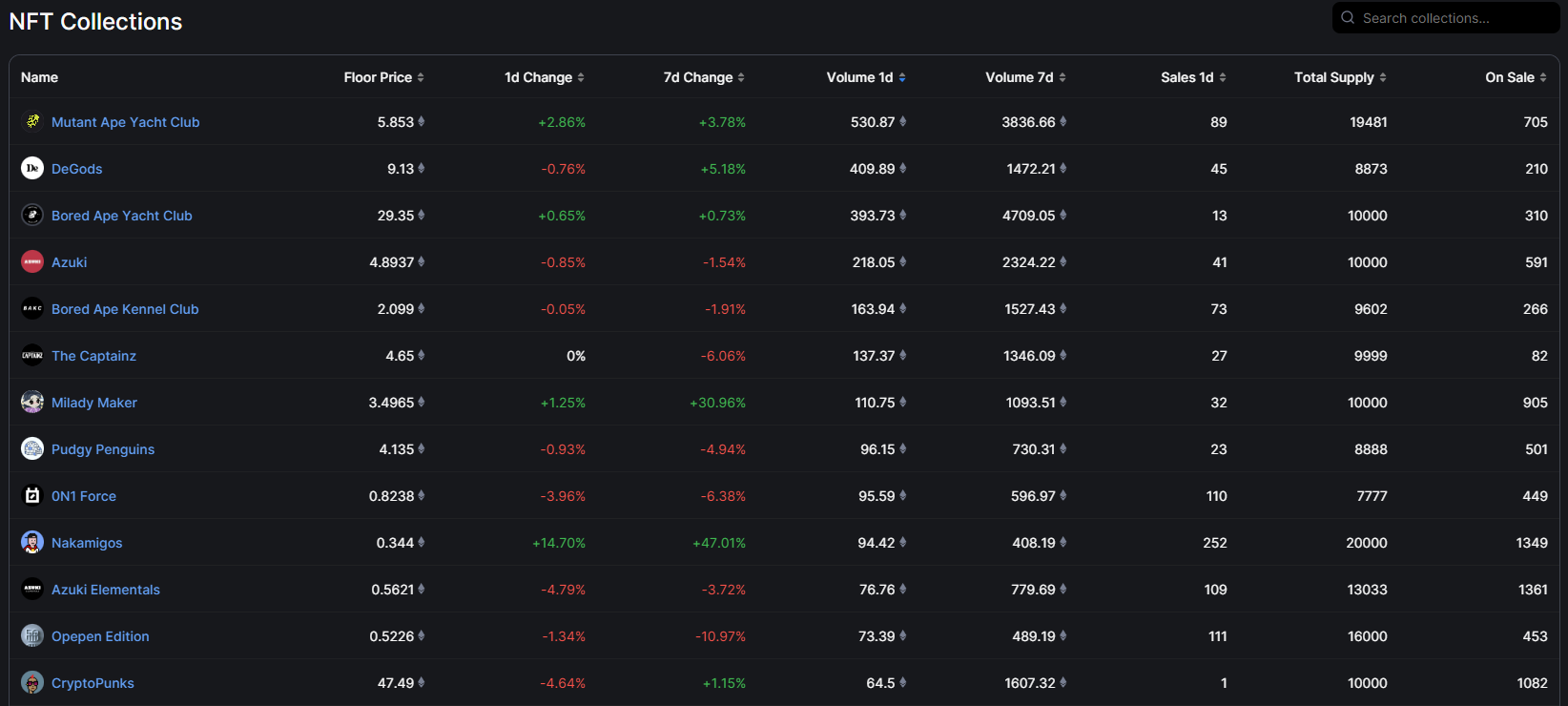

This topic will be most suitable for NFT traders as Defillama provides a lot of different onchain information.

Collections

Ranking all NFT collectibles across the market along with a few facts like:

- Floor Price: The average price of an NFT collection at the moment.

- Volume: Total trading volume of the collection in a certain period of time.

- Total Supply: Total supply of NFT collection.

- Om Sale: Number of NFTs being offered for sale on exchanges.

Marketplaces

Shows many different parameters about NFT exchanges such as:

- Volume: Total trading volume of NFT exchanges across the market.

- Trades: Number of users of NFT exchanges.

- Market Share: Domination rate of NFT exchanges.

Earning

Represents the amount of money that projects that have created NFT collections receive through Mint activities, Royalty fees,…

Unlocks heading

Displaying the token payment schedules of different projects with detailed time down to the second, users can also search for the token payment schedules of these projects before making investment decisions.

Heading Borrow Aggregator

This category allows people to filter which projects are supporting Lending and Borrowing a certain token.

Heading CEX Transparency

This section represents the assets held by centralized exchanges and the money flows in and out of people over a certain period of time.

Bridges heading

Overview

Shows the trading volume and number of txs of cross-bridges in the DeFi market over a certain period of time.

Chains

Shows the volume of assets transferred into and out of blockchains through cross-chain bridges using indicators such as Deposits, Withdrawals, Net Flow.

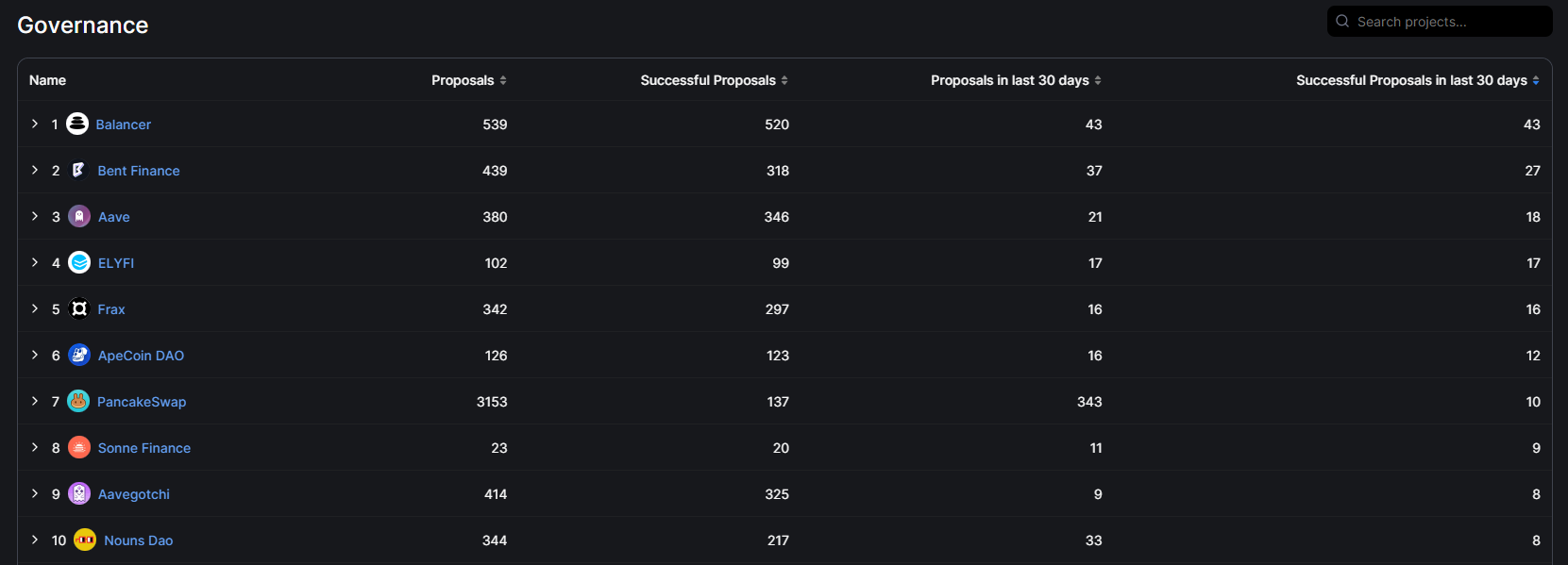

Governance heading

This category ranks all the largest DAOs in the Crypto market with number of Proposals, number of Proposals passed, number of Proposals in 30 days,…

Liquidation heading

This heading represents the total number of assets liquidated across the DeFi market across some of the market’s largest Lending & Borrowing platforms.

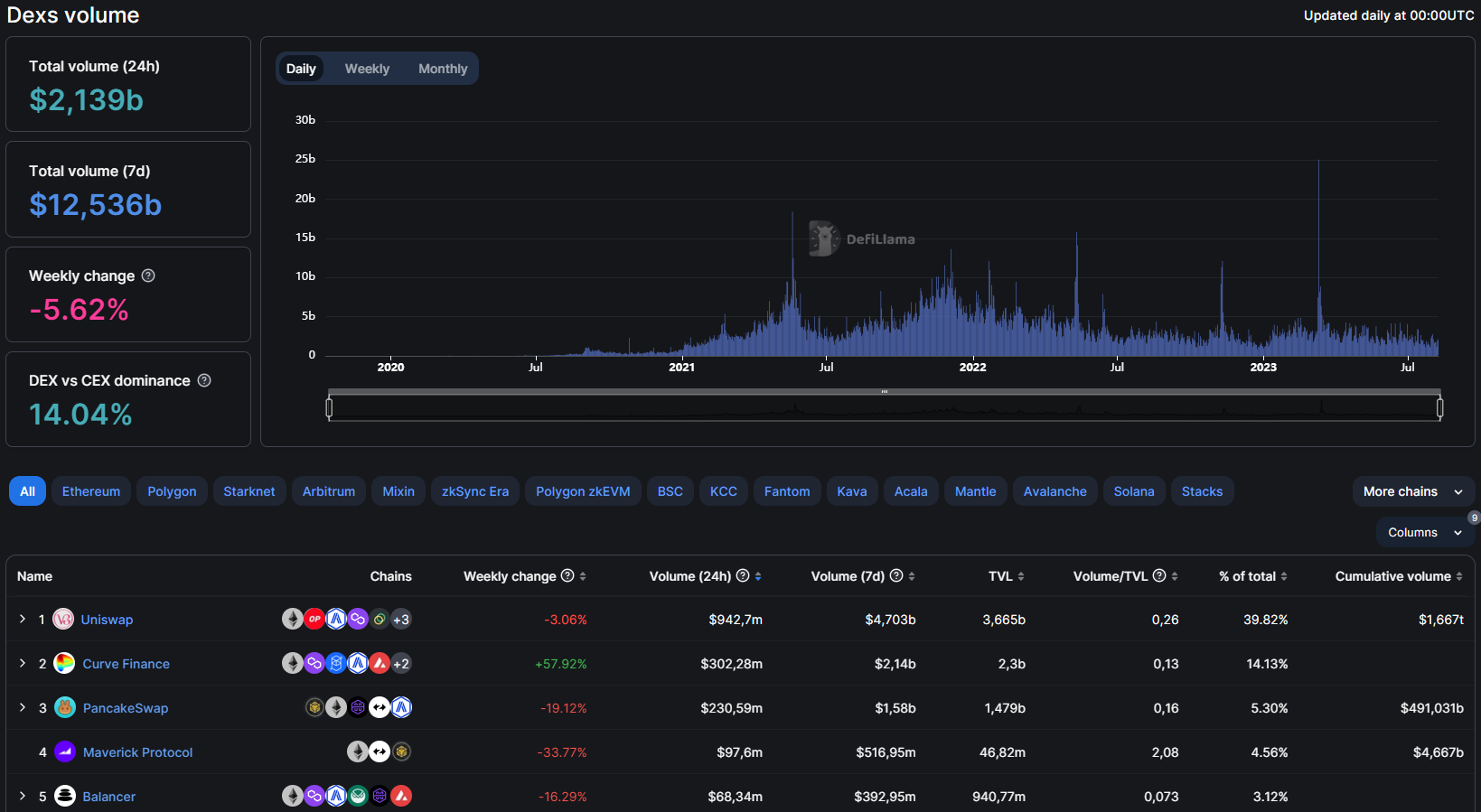

Heading Volumes

Overview

Overview of the Volumes heading shows the following parameters:

- Total volume 24h: Total trading volume of DEX within 24 hours.

- Total volume 7d: Total trading volume of DEXs within 7 days.

- DEX vs CEX dominance: DEX trading volume compared to the total volume of both DEX and CEX.

Chains

This is a ranking based on DEX trading volume of all blockchains in the DeFi market.

Derivatives

This is a table summarizing the trading volume of Derivatives protocols in the DeFi market as well as the dominance rate breakdown of these protocols.

Options

This is a table summarizing the trading volume of Options protocols in the DeFi market as well as the dominance rate breakdown of these protocols.

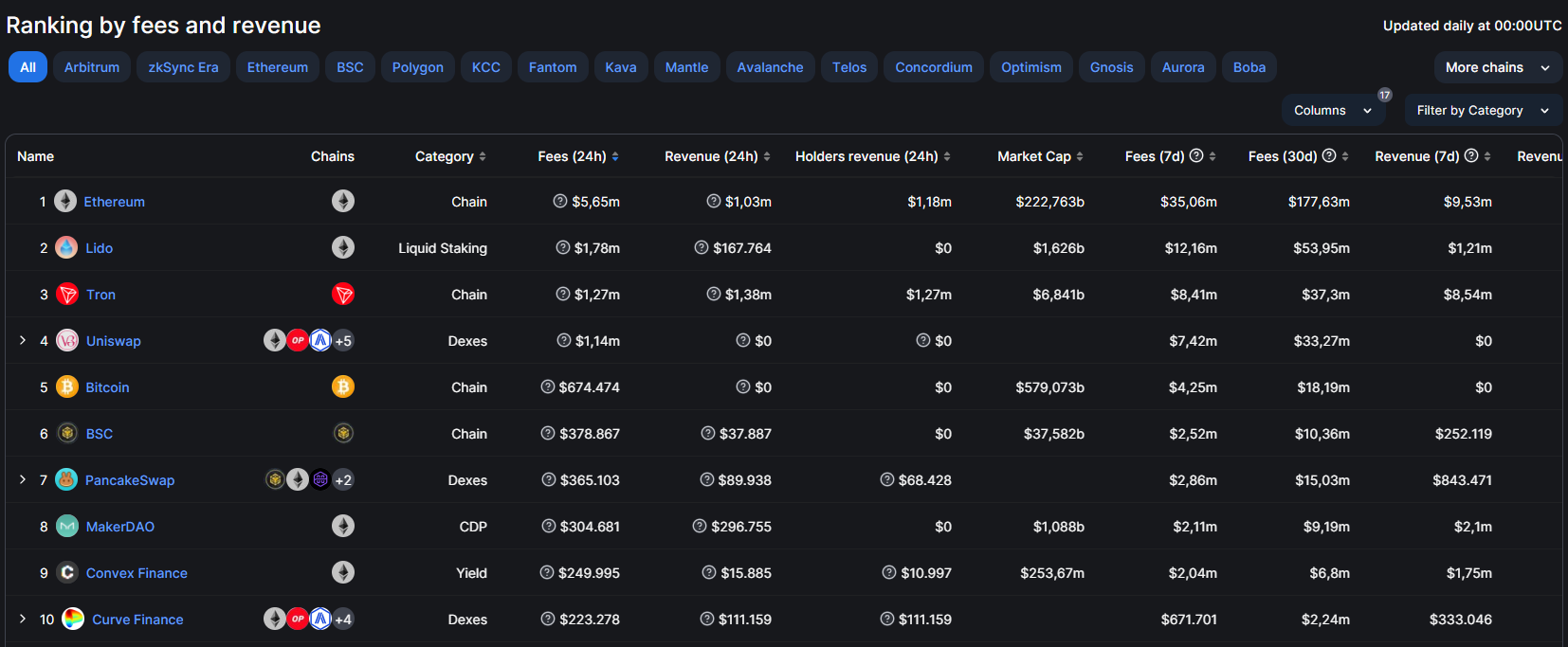

Heading Fees/Revenue

This is a ranking of all DeFi protocols as well as blockchains divided based on transaction fees paid by users and protocol revenue.

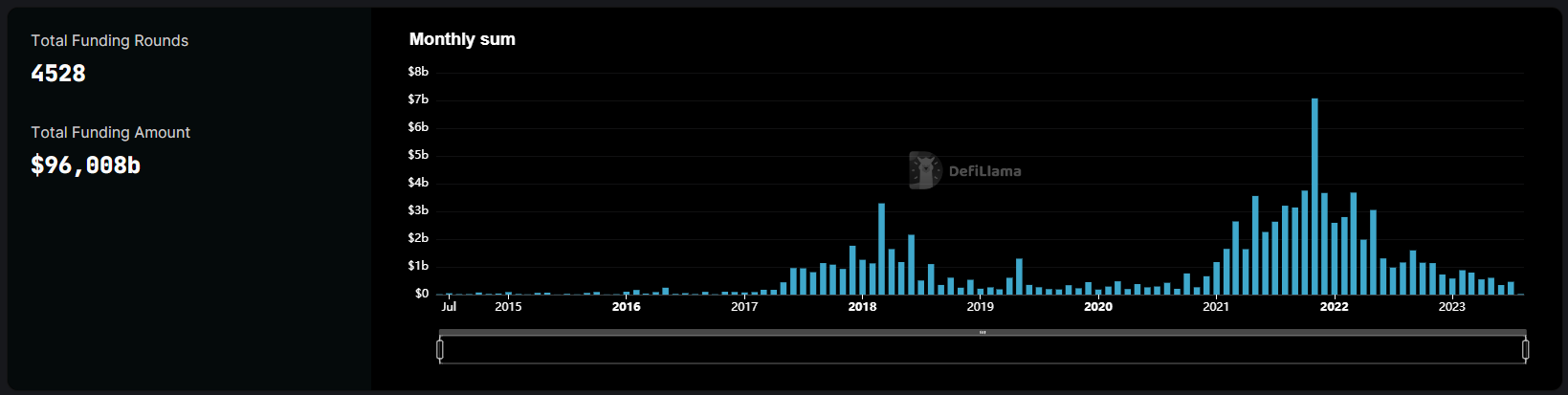

Heading Raises

Overview

The Overview feature of the Raises section shows parameters such as:

- Total Funding Rounds: Total number of capital calls of the entire market.

- Total Funding Amount: Total amount of money that investment funds have allocated to the project.

Active Investors

Statistics on investment funds and their activities within 30 days.

Heading Stables

Overview

Overview of the Stables heading shows the following information:

- Total Stablecoins Market Cap: Total capitalization of stablecoins.

- USDT Dominance: Shows USDT’s dominance over the entire stablecoins market.

- Chains: Blockchains that support certain stablecoins.

- % Off Peg: Difference from peg $1.

Chains

Rank blockchains based on the number of stablecoins on them using a pie chart.

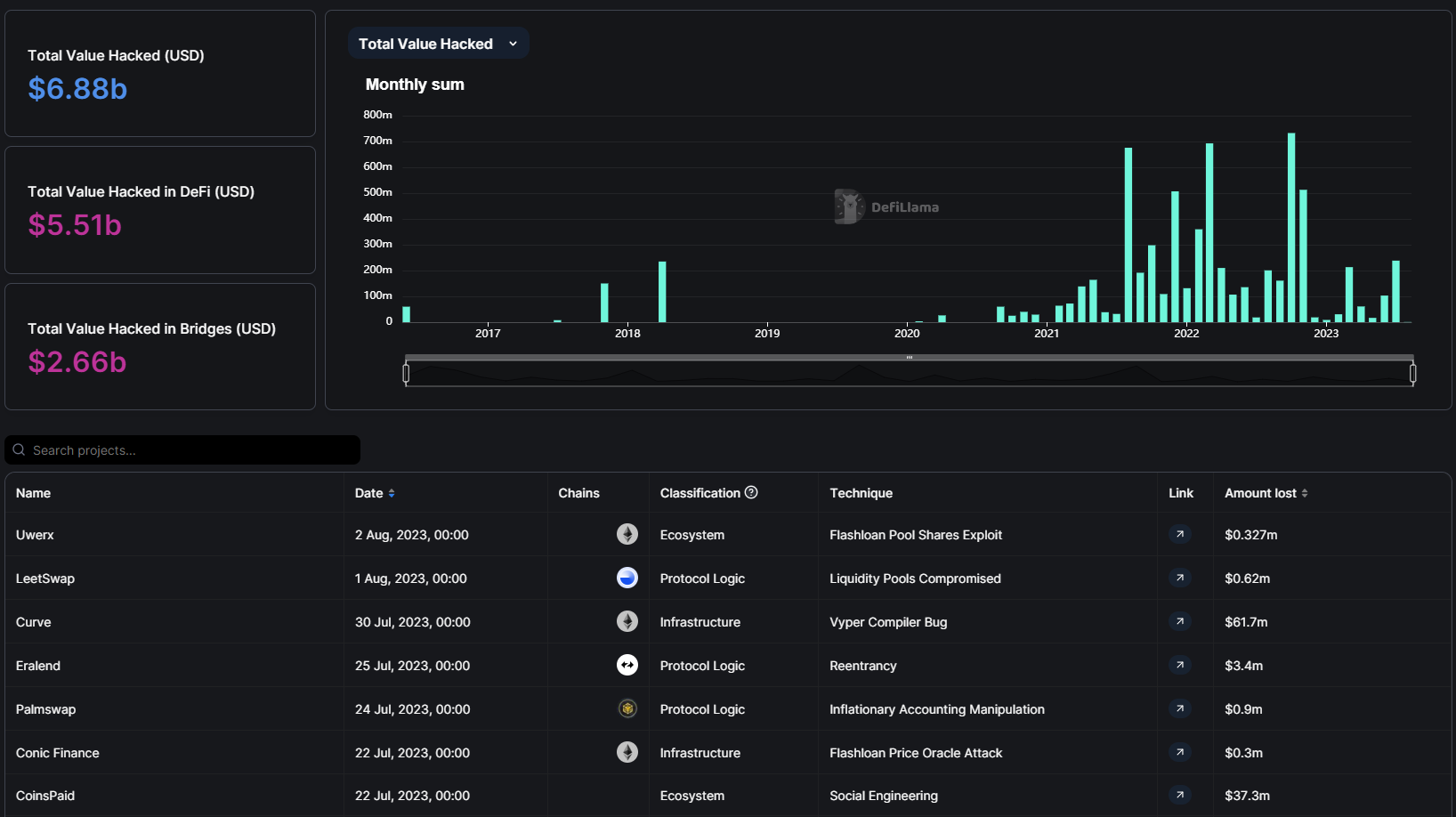

Hacks topic

Displays information about recent hacks and some of the following information:

- Total Value Hacked: Total amount of assets hacked.

- Total Value Hacked in DeFi: Total number of assets hacked in DeFi.

- Total Value Hacked in Bridges: Total value hacked from bridges.

Heading ETH Liquid Staking

This section shows an overview of the ETH Liquid Staking market with the following parameters:

- Staked ETH: Amount of ETH locked in protocols.

- TVL: Total value of ETH locked in LSD protocols.

- Market Share: % occupancy of LSD protocols.

Summary

Above is a detailed instruction for using Defillama from Weakhand. Hopefully through this article, everyone will be able to find good investment opportunities from this onchain tool.