The Arbitrum ecosystem has had many positive changes in the past short time, such as the ARB Airdrop being sent to each DAO as previously planned, and if projects simultaneously deploy incentives, will the Arbitrum ecosystem still exist? Whether it will explode more in the near future or not, everyone will find out with us in this article.

In this article, I and everyone will go through some of the main ideas as follows:

- Update on-chain index on Arbitrum.

- Information revolves around projects receiving airdrops and expected implementation plans.

- Update Arbitrum ecosystem.

- Projection of the Arbitrum ecosystem in the near future.

To understand more about this article, people can refer to some of the articles below:

- What is Arbitrum (ARB)? Arbitrum Cryptocurrency Overview

- Arbitrum Ecosystem: Launching ARB Token, Retroactive To Users & Many Other Updates

- GLP Wars: Development Focus on Arbitrum Ecosystem

- Arbitrum Ecosystem: Drama Arbitrum Foundation, Many New Elements Appear & Massive Projects Launch New Versions

Update On-chain Index On Arbitrum

Overview number of wallet addresses & transactions

The number of transactions on the Arbitrum network, as I shared in the most recent Arbitrum ecosystem update article, shows a general decrease after the launch of the ARB token. This is quite understandable because most users in the crypto market at the moment focus on doing retroactive. However, we can still hope that the amount of trans will be high again when the incentive is implemented.

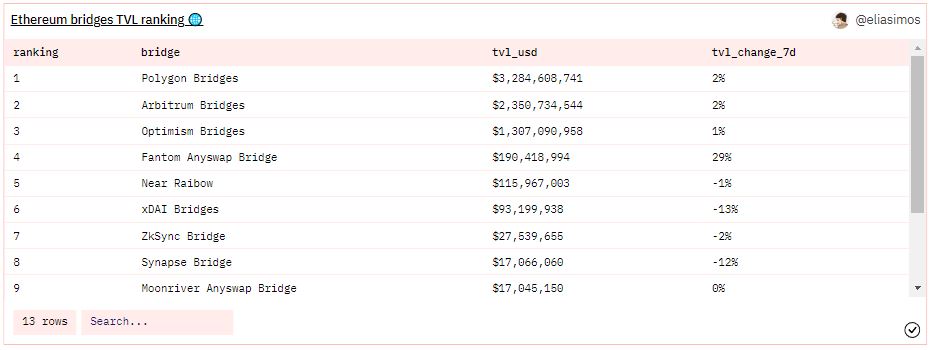

Arbitrum’s bridge is currently still the largest Ethereum bridge at the moment, second only to Polygon Bridge and nearly 2 times larger than Optimism Bridge.

Updated Information About Arbitrum Foundation

Arbitrum Foundation & First Proposals

After the AIP – 1 proposal failed due to too much information, the Arbitrum Foundation divided it into many different proposals such as AIP – 1.05, AIP – 1.1 and AIP – 1.2.

- AIP – 1.05: Return 700M ARB from Tresury to DAO. Acquisition of ARB from Wintermute and disclosure of terms between Arbitrum Foundation and Wintermute. However, the proposal was rejected with nearly 85% of votes against.

- AIP – 1.1: Regarding locking, unlocking and transparent reporting about 7.5% of total ARB supply will be used to cover Arbitrum Foundation’s operating expenses. Of which, 0.5% will be used immediately and the remaining 7% will be paid in installments over 4 years. And all activities related to this cost must be declared transparently. The proposal has now been approved.

- AIP – 1.2: Change some regulations in the implementation and operation of DAO, for example, to open a proposal instead of needing 5M ARB, now only 1M ARB is needed. The proposal has now been approved.

The fact that the AIP – 1.05 proposal was not passed shows that the DAO is not satisfied with the Arbitrum Foundation using its power to dominate members when they once shared that AIP – 1 was an announcement and not an announcement. Must be a suggestion. Currently, there are no new proposals on Snapshot.

Airdrop lands with DAOs on Arbitrum

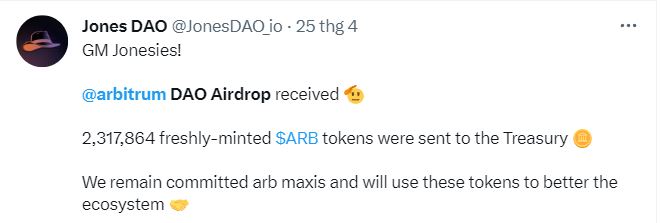

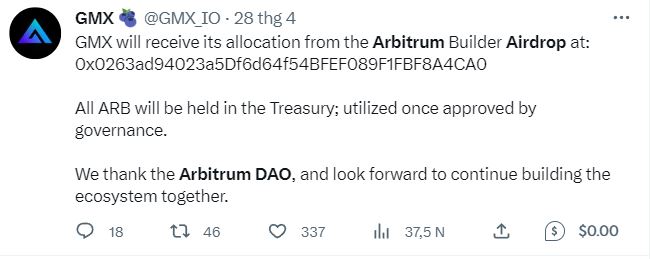

On the same day, April 28, many projects announced that they had received ARB airdrops from Arbitrum based on the projects’ positive contributions. However, there were a few ripples with this event when a project, Trident DAO, sold all of the 257,540 ARB it received on the Kraken exchange to earn USDC. This action was fiercely criticized by the community.

Trident DAO is one of the unique projects and I do not fully support the project’s actions, although they are right that they have full authority to decide on the amount of ARB they receive, but their actions invisible they look bad in the eyes of the community because the purpose of the airdrop for DAOs is to bootstrap liquidity for the project in particular and the entire ecosystem in general.

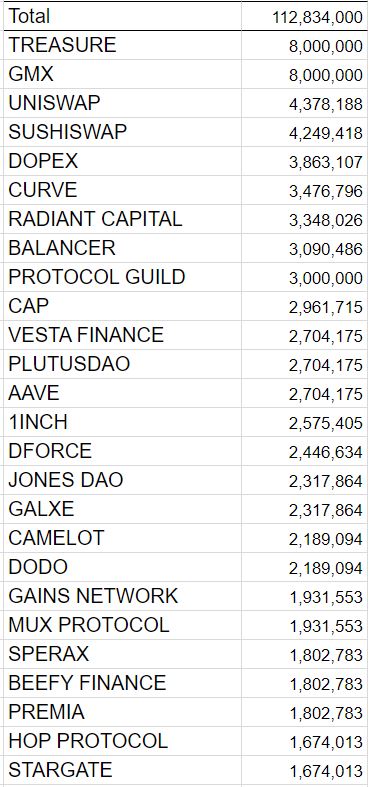

There have been more than 112M ARB distributed to projects that have DAO, and projects that do not have DAO because they have not yet launched tokens like Rage Trade have not had any further updated information. 112M ARB is equivalent to about $156M and if the projects jointly deploy Liquidity Mining at the same time, cash flows will certainly return to the Arbitrum ecosystem in the near future.

Some of the projects receiving the most ARB tokens are:

- Treasure DAO: Gaming, NFT & Metaverse platform on Arbitrum with the ambition to become a true Nintendo on the blockchain.

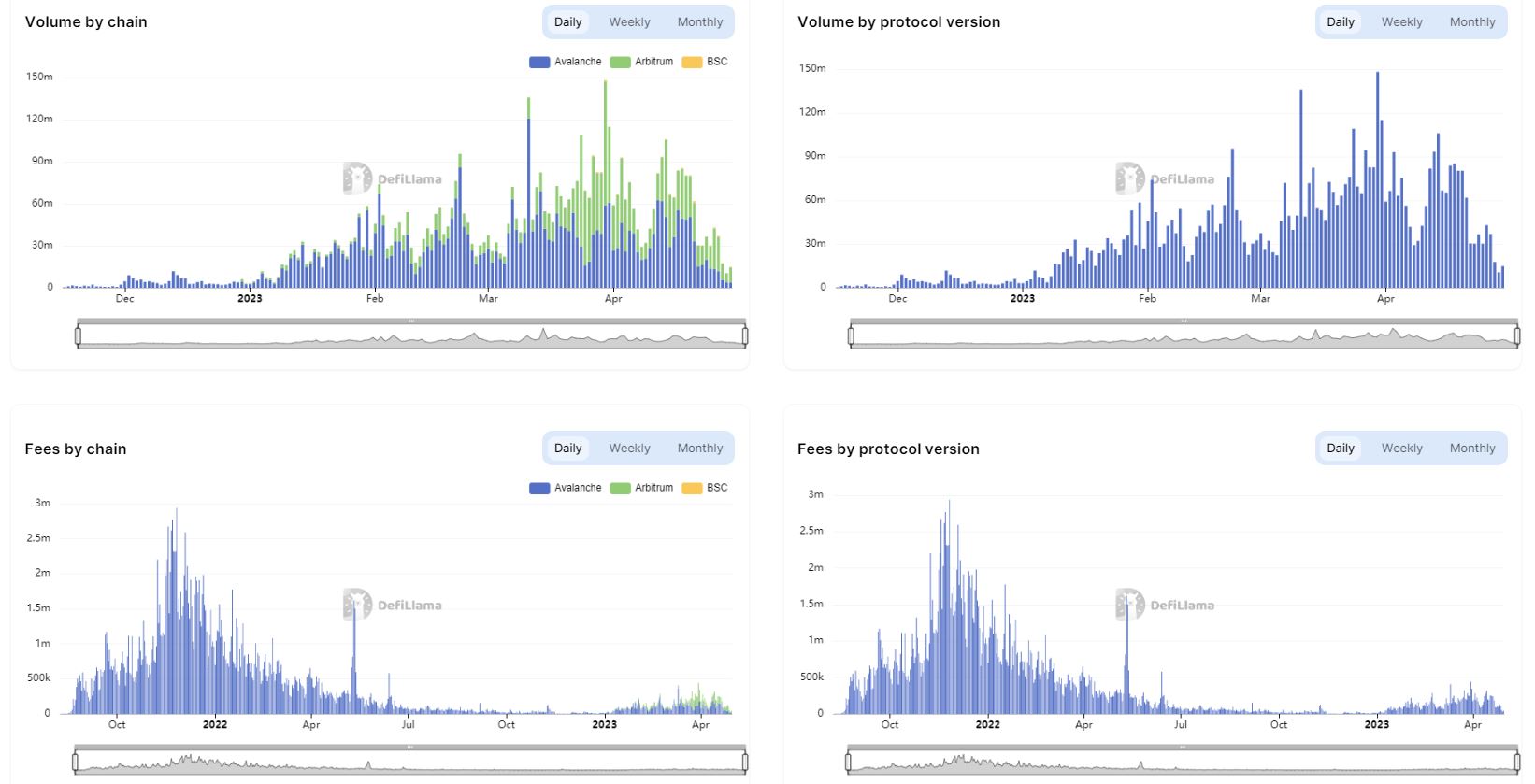

- GMX: Perpetual platform is popular today. There were times when the daily fees on GMX were higher than Uniswap.

- Uniswap, Sushiswap, Curve Finance: Multichain AMMs have been developing on the Arbitrum ecosystem for a long time.

- Dopex: The most popular Option platform on Arbitrum today/

- Radiant Capital: Lending & Borrowing platform uses LayerZero technology to attract liquidity from every chain to Arbitrum.

I will mention where the opportunities are for us at the end of the article. But identifying projects with the most ARB helps us build the most effective farming, trading, etc. strategy.

Arbitrum Ecosystem Update

It’s clear that the Arbitrum ecosystem has slowed down after the launch of the ARB token & the truly successful airdrop program for the community. However, for me, this is not a step back for the ecosystem but this is a careful preparation for the next explosion of the ecosystem with the keyword here being “Incentive – Liquidity Mining”.

Besides, the Arbitrum ecosystem continues to welcome newly launched projects and mainnets.

GMX – The first platforms for version V2

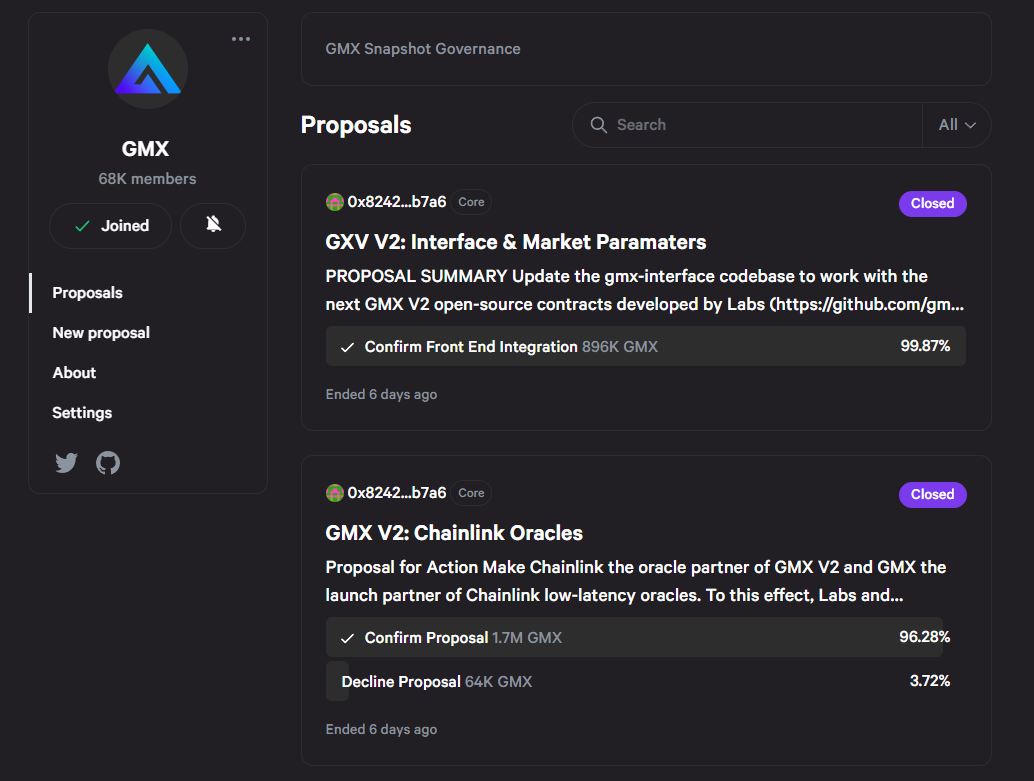

On the same day, April 25, 2023, GMX completed 2 proposals related to GMX V2 including:

- GMX V2: Proposal to use Chainlink for version V2 in addition to using 1.2% protocol fee to pay for Chainlink service and Chainlink network costs.

- GXV V2: Proposal to establish a new fee market in addition to building a Risk Committee – to support all GMX markets.

However, it is quite strange that the GMX V2: Sustainable Development proposal is about moving towards a sustainable development protocol when Deduct 10% of total protocol fees into Tresury It has not yet been posted to the snapshot for official voting, but according to my observation of community discussion, the community is very supportive of this proposal.

However, there is one point to note: GMX is a bit slow in accepting ARB as an asset that allows providing liquidity and Long – Short on its platform while other projects such as Radiant Capita or Vesta Finance accepted ARB as collateral or Dopex launched ARB SSOV. If GMX does not quickly lose market share to other Perpetual platforms.

GMX’s direct competitors on Arbitrum such as Cap or Mux Protocol have allowed users to Long – Short ARB with leverage up to 100x.

Dopex – Launching ARB SSOV products

Very quickly, Dopex launched the first Option product related to Arbitrum’s ARB native token. With this product, Dopex allows investors to open positions with ARB until the end of May 2023. With this, if people predict that if Arbitrum deploys incentives to cause the price of ARB to grow, they can buy ARB call options at the end of the month to make a profit.

Not long after its launch, the ARB Monthly – Calls pool on Dopex attracted 631.5K participants to deposit money into the vault. There is a small note here that Dopex is currently also implementing an incentive with 15,000 ARB per month for those participating in ARB SSOV.

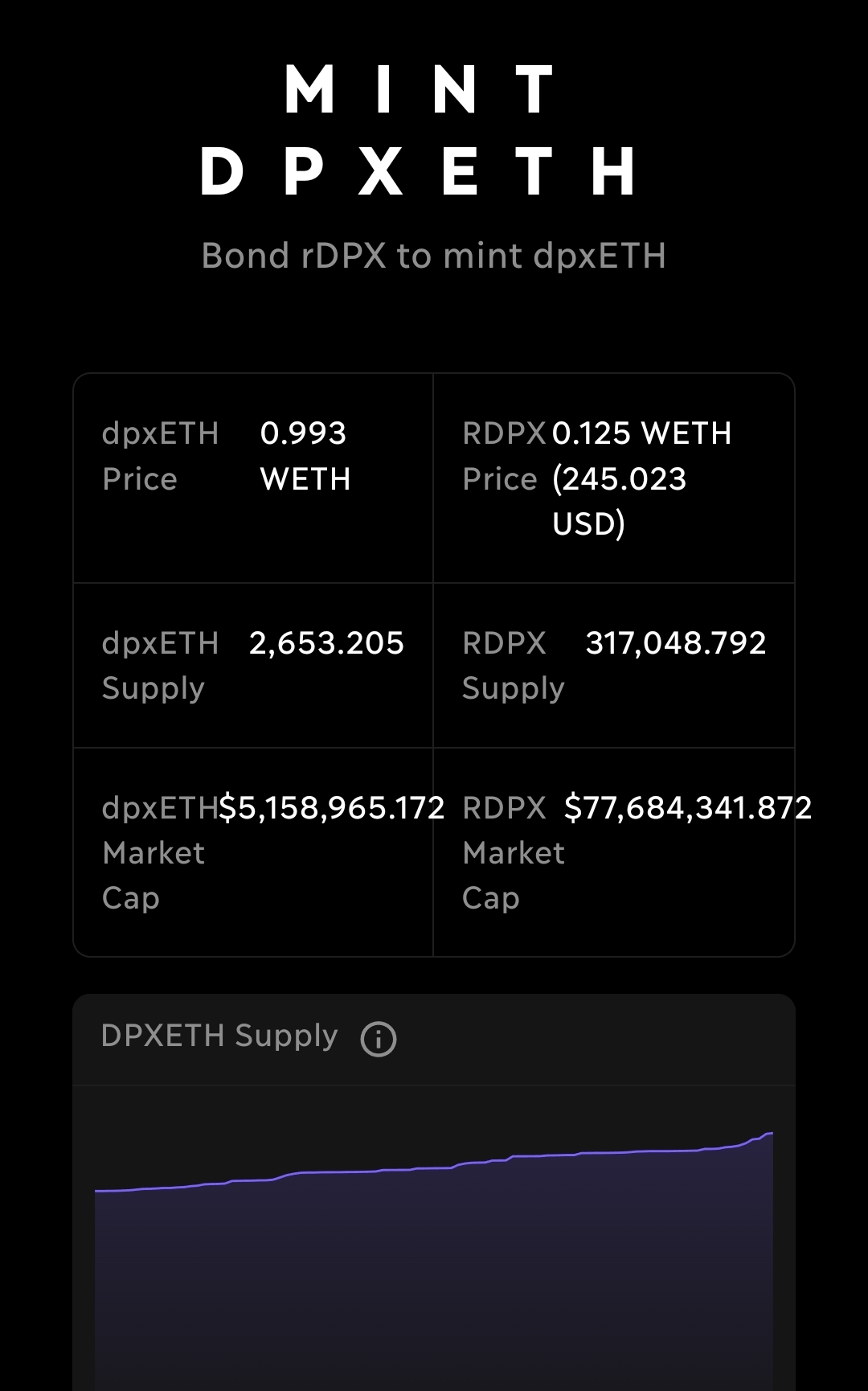

The latest information coming from TzTok-Chad is that rDPX V2 is being deployed extremely actively on the V2 network. However, I am also quite wondering why Dopex’s team wants to build dpxETH in the form of bond issuance (Bond) from rDPX, why not mortgage? Maybe if we use the mortgage mechanism, it will be quite complicated with the liquidation story?

However, if rDPX bonds are sold, the source of rDPX in the market will decrease, causing positive impacts on the price of rDPX in the future, and after rDPX, the project can completely sell DPX bonds to cause legal action. Similar positive pricing for DPX. However, to be successful, the dpxETH team must have a rich source of liquidity and many use cases.

However, behind Dopex there is still a Tetranode holding a lot of CVX, FXS & CRV that can support Dopex in building liquidity on Curve Finance. Besides, no one knows if Dopex will sell the rDPX earned to buy CVX or FXS similar to the way JPEG’d has deployed in the past. The only way for us to know is to wait.

Wombat Exchange and ecosystem explode

Through Liquidity Mining programs, the Wombat Exchange ecosystem has had a boom in TVL since the time of deployment on Arbitrum:

- Wombat Exchange’s TVL skyrocketed from $47M to nearly $100M.

- Wombex Finance’s TVL skyrocketed from $25M to nearly $70M.

- Magpie’s TVL skyrocketed from $6M to nearly $20M.

- Quoll Finance’s TVL Soars to Nearly $31M.

However, the growth in TVL has not been accompanied by a steady increase in trading volume on Arbitrum. According to information from DefiLlama, the daily trading volume on Wombat Exchange on Arbitrum is showing signs of decreasing. It is true that Liquidity Mining attracts many LPs to provide liquidity, but real users still seem to be with Curve Finance. Maybe Wombat needs more strategy.

The above suspicion is correct that when trading volume on Curve Finance, the Arbitrum system is only second after Ethereum and higher than many other blockchains.

Not only that, TVL on Wombex, Magpie or Quoll Finance also showed signs of slowing down after an initial period of overheating.

Trader Joe and his honeymoon on Arbitrum

Clearly, the trading volume on Trader Joe V2 (using Liquidity Book technology) has helped Trader Joe have the advantage of centralized liquidity on Arbitrum compared to Camelot, which is now just about to be deployed thanks to the open source launch of Uniswap V3. Trader Joe has the support of many OGs on Arbitrum such as GMX, Dopex,…

Up to now, the trading volume on Trader Joe V2 on Arbitrum network is many times higher than that of Avalanche C Chain. However, if calculated in terms of all products, Avalanche C Chain is still the leader.

Some updates of smaller projects

- Jones DAO – A new vault launch platform for AURA with jAURA. Users can deposit AURA into the protocol to earn profits.

- Plutus KNIFE: Continue to update and share the vision of an LSD Hub project on the Arbitrum ecosystem.

- Camelot: Continue to burn 2,400 GRAIL with a total value of more than $5M

- Radiant Capital: ARB and wstETH officially become collateral assets on this Lending & Borrowing platform.

Projection of Arbitrum Ecosystem in the near future

Growth forecast

If the market continues to support it, there is a high possibility that the Liquidity Minig program of the projects will take place with relatively similar duration. Therefore, if you want the ARB incentive to become attractive, it is entirely possible for ARB to increase its price due to MM’s coordination. ARB price increases have several benefits as follows:

- ARB’s price increase also makes the incentive more attractive in the eyes of LPs.

- ARB increased its price as a marketing method to attract investors’ attention to the Arbitrum ecosystem.

This is something that has happened with Optimism, but I’m not sure it will happen with Arbitrum, but there is reason to believe it will happen again.

How to invest when forecasting accurately

The Arbitrum ecosystem booming again with the story of incentives and Liquidity Mining will have 2 clear investment opportunities:

- Invest directly in ARB and potential native projects on Arbitrum such as GMX, DPX, GRAIL, JONES, VSTA, RDNT, PLUTUS,…

- Go provide liquidity to get incentive.

Hak is not a place to call bets on investing, so the above is only providing information and should not be considered investment advice. Regarding providing liquidity for incentives, we identify the largest DAOs holding the most airdrops as Treasure DAO, GMX, Uniswap, Curve Finance, radiant Capital,… mainly AMMs and Lending Protocols.

From my perspective, projects can be implemented as follows:

- Provide liquidity to farm ARB. Like AMM, it provides liquidity for the most booted pairs and Lending & Borrowing participates in both processes.

- Long – Short has ARB rewards.

- Playing games on the Treasure DAO ecosystem is rewarded with ARB.

Therefore, please prepare BTC, ETH, Stablecoin to prepare to go farming, everyone.

Summary

Above are some important updates about Arbitrum and its ecosystem in the past 2 weeks. Besides, there are some ecological projections.