When famous DeFi developer Andre Cronje announced that he would launch a project called Solidly on Fantom, a real ‘war’ broke out for its airdrop. In just 2 months, Fantom has skyrocketed to 3rd place among all TVL blockchains. Then, shortly after Solidly went live, Andre announced that he was leaving DeFi – and TVL plummeted. Why is everyone talking about Solidly – and what does ‘ve(3,3)’ mean? Let’s find out with us in this article!

The Birth of Solidly

In September 2018, Andre Cronje has joined Fantom as a technical advisor (he is currently identified above Fantom homepage simply ‘DeFi Architect’). However, it was not until September 2020 that Cronje first hinted that he was building a project on Fantom. He tweeted that he was “establishing the Uniswap Protocol on another chain” and posted a curious logo: Uniswap’s unicorn with a SushiSwap chef’s hat on his head and a small Fantom logo in his eyes. However, there is no telling whether this idea eventually evolved into Solidly.

On January 1, Andre Cronje tweeted that he was preparing a “new test on Fantom”. And on January 5, a really big news broke out – that Cronje is developing the protocol together with Daniele Sestagalli, creator of Abracadabra.Money ($MIM) and Wonderland ($TIME). Sesta himself wrote about this collaboration on Twitter. Cronje even had a profile picture of the two of them for a while:

On January 15, the preliminary name of the new protocol was revealed a new page on GitHub : Solidly . Andre Cronje also Notification that its tokens will be distributed to major DeFi protocols on Fantom via an airdrop. Snapshot of the airdrop taken on January 23.

We’ll come back to this airdrop and the so-called ‘war’ it triggered, but for now let’s look at how Solidly works and where it borrows ideas from. There will be some in-depth technical issues!

Inspiration: Curve Finance and Vote-Margined Tokens (Ve)

Solidly certainly drew a lot of inspiration from another major DeFi protocol, viz Curve (CRV). It is an AMM where users can lock up CRV tokens in exchange veCRV (‘deposit slip’). The longer the lock period, the more veCRV you get.

If you don’t know how Curve Finance works, check out our article!

The draw tokens This cannot be transferred, but they provide several benefits to the owner:

- Sharing of transaction fees generated by AMM (50% of fees distributed among veCRV holders);

- Up to 150% increase on any CRV liquidity provider rewards;

- Can vote for CRV rewards.

The vote-escrow system solves an important problem in DeFi: the lack of value inherent in most governance tokens. Protocols like Compound ($COMP), Uniswap ($UNI), etc. distributed tokens that allowed their holders to vote on DAO proposals, but other than that there weren’t many other benefits. As a result, many people will simply sell their rewards.

How Solidly (SOLID) Works

SOLID And veSOLID

SOLID is the native token of Solidly. Users can vest it and receive a veSOLID (vote-escrowed SOLID), but the ratio is not 1:1 like in other protocols. Instead, it depends on the lock period :

- 6 months: receive 0.125 veSOLID for 1 SOLID;

- 2 years: receive 0.5 veSOLID for 1 SOLID;

- 4 years: receive 0.1 veSOLID for 1 SOLID.

There are also other vest timelines, but they have not been announced at the time of writing.

veSOLID owners will receive the following benefits:

- All fees are generated by the groups they vote on (see below);

- A large amount of SOLID emissions;

- The right to vote on which AMM pool will be incentivized (this is actually more important than you might think, so keep reading).

Note that Solidly is not a DAO : veSOLID owners will vote on certain issues, but they will not run the project. Control will remain in the hands of the founders. In our opinion this is a prudent move by Cronje considering the risks of taking over a rival DAO. such as what recently happened to Build Finance.

Adjust SOLID Emission

- Every week, There can be up to 20M SOLID distributed, however:

- …the actual emission rate varies depending on the rate of SOLID locked according to cThe following formula: (weekly SOLID emission) = 20,000,000*((total SOLID supply )-(locked SOLID supply)/(total SOLID supply)).

For example:

- Let’s say the total supply of SOLID is 300,000,000. If there are no locked tokens, the protocol will issue 20,000,000 SOLID: 20,000,000*(300,000,000 – 0)/300,000,000. Supply will increase to 320,000,000, or 6.25%.

- If 150,000,000 (50%) SOLID are locked, we will receive 20,000,000*(300,000,000 – 150,000,000)/300,000,000=10,000,000 SOLID emission for that week. Total supply will increase to 310,000,000, or 3.125%.

- If all 300 million tokens are awarded, we will receive 20,000,000*(300,000,000 – 300,000,000)/300,000,000=0 SOLID emission for that week. Supply will not change.

SOLID emission begins on February 24 and veSOLID holders will soon be able to receive the first rewards.

20 million a week is a big number, but as you can see, the more people who block SOLID, the slower the emission rate. Besides, Cronje mentioned that the emission process will slow down (‘decay’) as it approaches the ‘limit’. He doesn’t say what the maximum number of SOLIDs is or how quickly the emission rate will decrease, although a paper by Solidex (a productivity optimization tool for Solidly) stated that the emission rate will be 2% a week until Week 167.

Distribute SOLID to holders

The idea is that holders of their locked SOLID tokens will not experience dilution. If SOLID’s total supply increases, so will their holdings – and at the same rate.

Going back to our example: if the supply is 30 million, of which 15 million are locked, then a weekly release of 1 million SOLID increases the supply by 3.125%, of which holders will receive gets 15,000,000*0.03125=468,750 SOLID, or almost half the emission. If you personally hold 1,000 veSOLID, you will receive 62.5 SOLID.

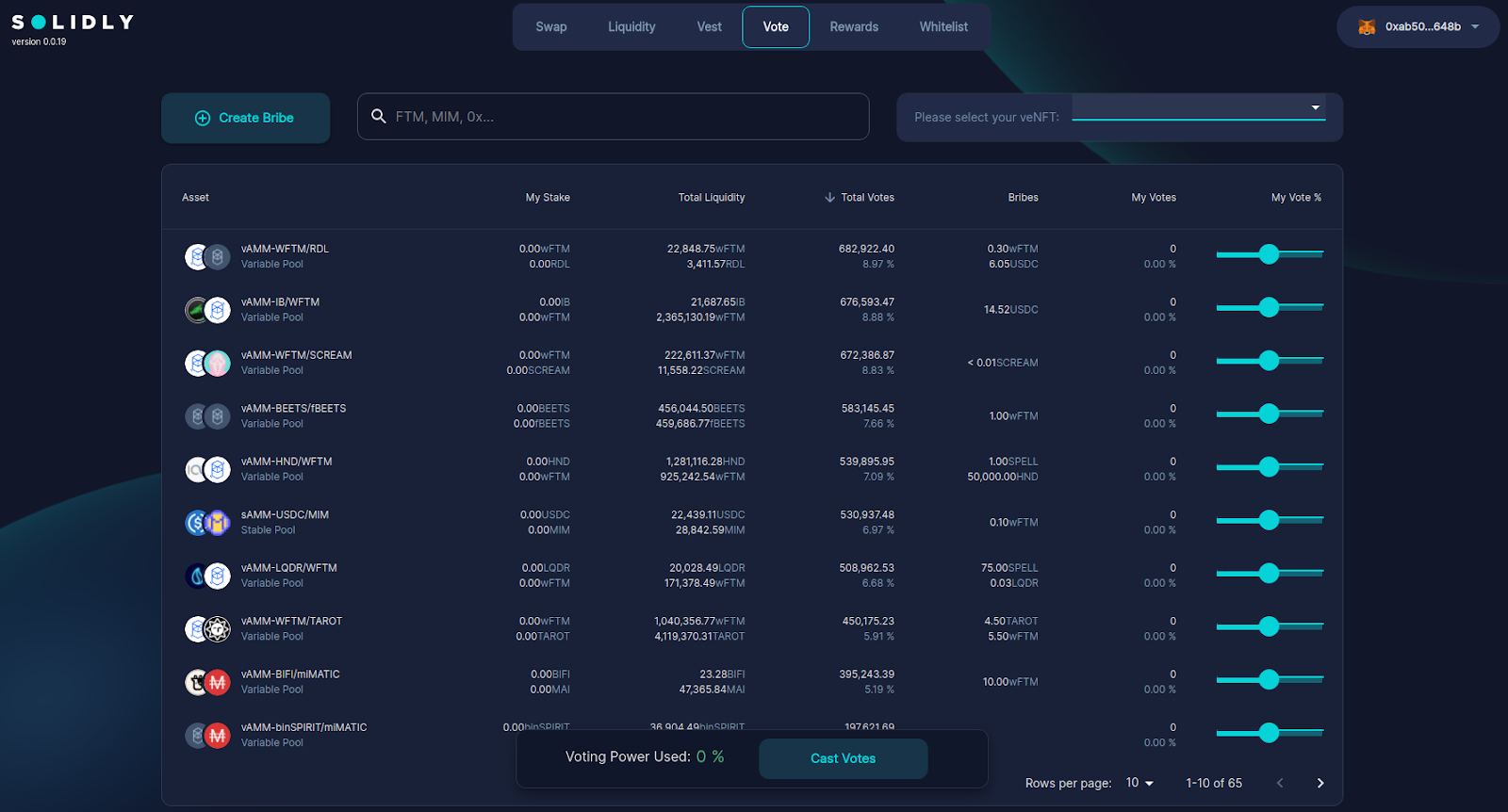

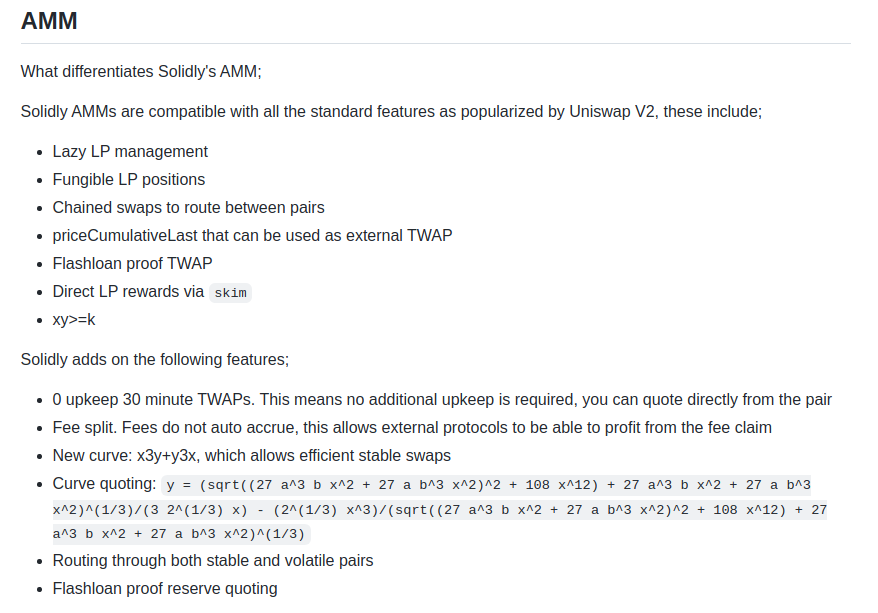

Solidly AMM

The main element of Solidly is AMM (automated market maker) – in other words, a decentralized exchange like Uniswap or SushiSwap. Liquidity providers can deposit tokens into the pool, while regular users exchange one token for another. However, there are some interesting features:

- All fees from a group will go to veSOLID keyers who voted for that group.

It’s actually a little more complicated than that: veSOLID lockers sex vote on liquidity measures attached to the group. In Curve Finance and Solidly, a gauge is a type of repository where liquidity providers can stake LP tokens. The number of LP tokens in the sex meter measures a pool’s usage.

Teams don’t have to have a measure, but any Solidly user can deploy a measure to any team. However, adding a gauge will cost 0.5% of circulating supply .

- AMM supports stablecoin swaps with virtually no slippage thanks to the new price curve formula (x3y+y3x=k instead of x*y=k );

- Liquidity providers are rewarded with SOLID – but don’t receive any transaction fees. However, if a pool does not have a meter, then all the fees it generates will go to its liquidity providers.

- Antagonistic voting : veSOLID holders can vote to reduce SOLID incentives for a group;

- Fees are paid on the group’s underlying assets;

- Projects New groups can be added without permission.

Immediately after launch, AMM counted 65 groups There are tokens like WFTM, MIM, TOMB, BEETS, SCREAM, TAROT, USDC, DAI, etc.

You will find more information about AMM above Solidly GitHub page by Andre Cronje, but I think you will have a headache, because the information there is quite a lot and… messy…

Lock NFTzation

Locked SOLID tokens can be wrapped in special NFTs, called veNFTs. This is important for two reasons:

first) NFTs allow holders to maintain liquidityeven though they cannot use the SOLID given to them. A veNFT can be sold on the secondary market – or even deposited into a future lending protocol as collateral. This makes locking tokens even more attractive, because holders will have a way to exit the locked position without losing funds.

2) Locked batches of tokens can be converted into separate veNFTs: One user (or rather, address) can own multiple NFTized locks, meaning if you want to sell part of your tokens, you can do so. At the same time, the balance of all veNFTs held by sex users are counted together to receive rewards.

Incentives for Pools and Bribes (Bribes)

We discussed how SOLID lockers will receive a significant portion of the weekly token issuance. The remainder will go to the AMM liquidity pool – and it is veSOLID holders who will decide which pool.

The mechanism will take place as follows:

- veSOLID holders receive fees generated by the pools they vote on;

- Therefore, they will be interested in voting for pools that generate more fees – that is, have higher transaction volumes and add value to the protocol;

- To incentivize veSOLID holders to vote for them, pool creators can use so-called bribe (Bribes) – a concept introduced by Curve Finance. There is nothing evil about bribes in DeFi: they are simply rewards tied to a pool. The bribe is distributed to all liquidity locks in that group.

The offering of bribes led to the so-called ‘War of curves’ as projects compete to provide the highest incentives. The winner so far is Convex Finance company first offered a bribe in the form of an airdrop (1% of CVX tokens) to liquidity providers. Convex is a profit optimizer for Curve, providing maximum gains for all groups. We may see a similar type of bribery war on Solidly, so keep an eye out for this one.

What Future for Solidly?

As we mentioned before, Solidly AMM website is still operating, although a warning appears when you visit stating that the service will be shut down on April 3. Solidex (profit optimizer for Solidly) is also active and you can lock LP tokens for pools like WFTM/TOMB and USDC/OXD.

Soon after Cronje left, Solidex’s anonymous team hinted that they will take on the project from now on.

In fact, some people even do suppose, I think none other than Andre himself is behind Solidex, because of the domain name was registered even before Cronje published the first description of Solidly (then called ve(3,3)).

Could Andre Cronje still be pulling the strings in the DeFi world – just anonymously? Maybe he’s just tired of the publicity and wants to focus on building? Only time will tell. Currently, the level of uncertainty remains high and users should consider all risks before putting money into Solidly and/or Solidex.