Rocket Pool is one of the long-standing DeFi and LSD protocols in the Crypto market. Recently, the project released the Houston update, which is considered an update that helps Rocket Pool change the definition of how to operate a DAO and has a few more changes in its node operations. In this article, everyone will learn about Rocket Pool’s overview and review of Houston Upgrade.

To better understand Houston Upgrade, people can refer to some of the documents below:

- What Are Liquid Staking Derivatives (LSD)? Top 5 LSD Projects with Great Growth Potential

- What is LSDfi? The First Puzzle Pieces & Potential In The LSDfi Array

- What is Rocket Pool (RPL)? Overview of Rocket Pool Electronic Lathe

- Overview and Liquidity Flow in LSDfi

Overview and Review of Houston Upgrade

Looking back at the old journey

Houston Upgrade was officially introduced on the day Rocket Pool officially celebrated its 2-year mainnet event. In 2 years, Rocket Pool has achieved a number of outstanding achievements such as:

- Rocket Pool continues to be one of the rare LSD protocols that brings decentralization to the Ethereum network, unlike the headaches that Lido Finance is creating.

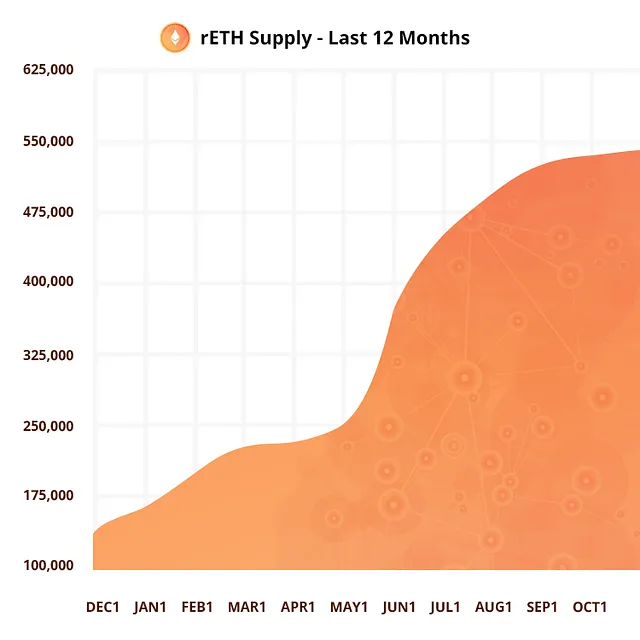

- The number of ETH deposited in Rocket Pool has grown 4 times compared to 2022, which is largely due to the Atlas upgrade.

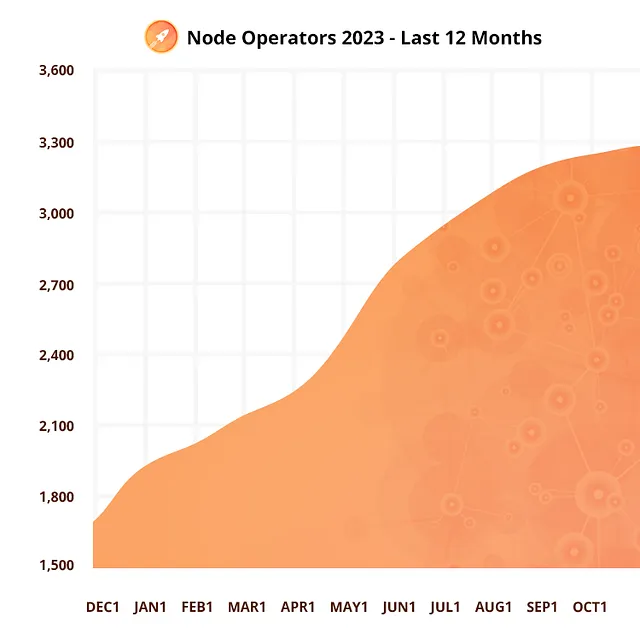

- Rocket Pool has a network of about 3,300 Node Operators on the Ethereum network, accounting for 30% of the total number of Ethereum nodes and spanning over 134 different time zones.

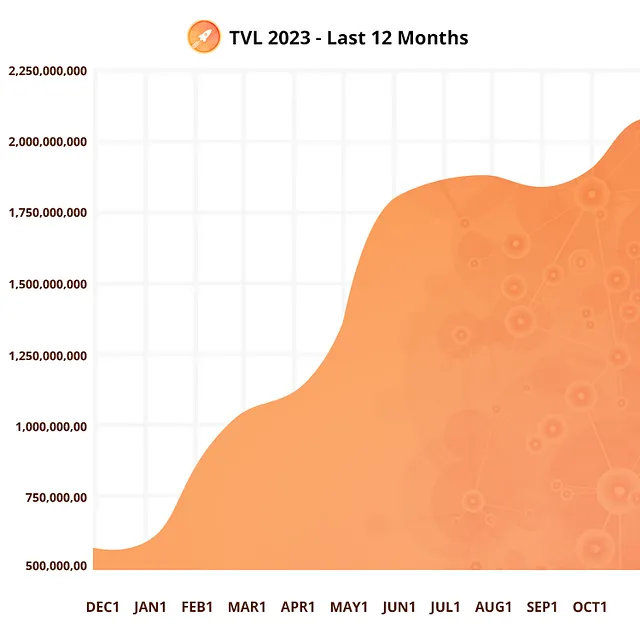

- Rocket Pool’s TVL has increased nearly 300% compared to November 2022.

While looking back on the old journey, Rocket Pool also continued to hint at the Saturn upgrade that will be released after the Houston Upgrade with the goal of expanding the scale of the protocol. It can be said that in a context where LSD platforms such as Lido Finance, Frax Finance, StakeWise,… are causing a decentralized fever for the Ethereum network, Rocket Pool is an effective solution. Therefore, people who really “love technology, love decentralization” or Whales on Ethereum will often deduct a portion of ETH to deposit into Rocket Pool to join hands to solve the above problem.

Rocket Pool itself has also proven its capabilities when rETH (Rocket Pool’s LST) has also gradually been accepted on many major DeFi protocols such as Maker DAO, AAVE, Compound,… This is one of the steps The first basic foundation is a foundation for Rocket Pool to compete fairly with Lido Finance in the near future.

Houston update overview

FirstlyRocket Pool introduces The Rocket Pool Protocol DAO model, abbreviated as pDAO. The problem with the current DAO governance models is that it is maintained and implemented based on token weighted voting. Essentially, the more tokens a user holds for a protocol/project, the greater their voting power. Users also do not need to actively participate in the protocol, simply holding tokens is enough. Rocket Pool wants to change this.

With Rocket Pool, users want to help shape and shape the future of Rocket Pool, they need to actively participate and not just store tokens in a cold wallet. It can be happily said that “Gatling handle, all beings are equal”, everyone from retail investors, developers or investment funds need to actively participate in developing Rocket Pool can participate in the direction and development of the project.

The most important thing is that The Rocket Pool Protocol DAO is deployed 100% on-chain.

Some basic rights of pDAO include:

- Protocol Parameters: pDAO can adjust some protocol settings such as the min/max amount a user can deposit into the protocol.

- Treasury Funds: RPL has an inflation rate of 5% and pDAO has the right to decide how to spend this budget for different purposes.

- Security Council: An elected pDAO board can respond quickly to any potential problems that arise. pDAO has the right to add, remove members and even completely disband the security council if they need to.

Any node with non-zero voting power can make a proposal, however they need RPL as collateral for the proposal. During the process of making a proposal, other nodes can provide false proofs of the proposal node. If this proof is correct, the other node can receive a reward of the RPL of the proposal node.

Regarding voting, there will also be 4 options including abstain, agree, oppose and higher than veto if voters think this proposal is toxic to the protocol.

Next, Rocket Pool introduced the concept of Staking ETH on Behalf of a Node, roughly translated as Staking ETH on behalf of a Node. So what does Stake ETH on Behalf of a Node mean? Staking ETH on Behalf of a Node is in the RPIP -32 proposal, proposal allows an independent address to fund a registered node with ETH. The node can then use this ETH to deposit funds without having direct access to the ETH.

Staking ETH on Behalf of a Node creates a number of positive changes such as:

- Increased security for Node Operators means they can stake directly from their Hardware Wallet, thereby eliminating the need to transfer funds to the node first.

- Launching Staking as a Service service.

- Integrate protocols securely as funds are managed using the protocol’s own smart contracts.

- DAOs and institutions can participate once the assets are in the treasury.

The main goal of this upgrade is that in the easiest way anyone can participate in staking on Rocket Pool including single users, protocols or DAOs.

Houston Upgrade Review

In fact, if you see an update that has a strong impact on Rocket Pool’s Native Token, RPL, you will be quite disappointed because this update mainly changes the way DAO operates and the user experience on the product. . However, if we look at the long term we see that:

- If Rocket Pool’s DAO still operates effectively, thereby creating demand to participate in DAO on Rocket Pool, the number of RPL participating in staking will increase, thereby reducing the source of RPL on the market and ultimately stimulating RPL growth.

- If the ETH on Behalf of a Node Stake model works effectively, the Rocket Pool protocol will have strong growth in users and TVL, thereby creating a positive, optimistic sentiment about RPL.

However, if both of these things happen at the same time, it will not have a direct impact on RPL.

Besides, I feel quite excited about the slight upgrade of Stake ETH on Behalf of a Node, this makes it much more convenient and convenient for single users to deposit money into the Rocket Pool protocol. compared to before. In fact, Lido Finance has done this before and Rocket Pool has also learned a little.

Finally, I’m also intrigued by Rocket Pool’s upcoming Saturn update, in which Megapool will be introduced. And I believe that Rocket Pool will continue to grow stronger with 2 factors considered the focus of Saturn’s development:

- Reduce the amount of ETH needed to operate a node from 8 to just 4 ETH or introduce a wip model – allowing the amount of ETH to be flexible even with a minimum of 1 ETH for a validator in Rocket Pool.

- Currently, the current Validators in Rocket Pool are called minipools, the limitation of this model is the cost of creating a minipool. Megapools will allow users to control multiple Validators from a single smart contract. This will significantly reduce setup costs for Node Operators in Rocket Pool.

Summary

I believe that Saturn Upgrade will be one of the steps to help Rocket Pool’s ambition to surpass Lido Finance be completely well-founded. Hopefully through this article, everyone can understand more about the overview and evaluation of Houston Upgrade.