On November 16, 2023, Gondi – a P2P NFT Lending platform with a novel refinancing model announced the launch of its Gondi V2 version with some exciting updates. Let’s learn about Gondi V2 with Weakhand in this article.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- What is Gondi? Overview of Gondi cryptocurrency

- NFT Lending: Models, Efficiencies & Opportunities

- What is Blend? Perpetual Lending Protocol for NFTs

Gondi Overview

Gondi is an NFT Lending platform on Ethereum that applies the P2P Lending model with a novel refinancing mechanism that provides borrowers with the best loans, and borrowers can receive passive interest during the lending process. get a loan.

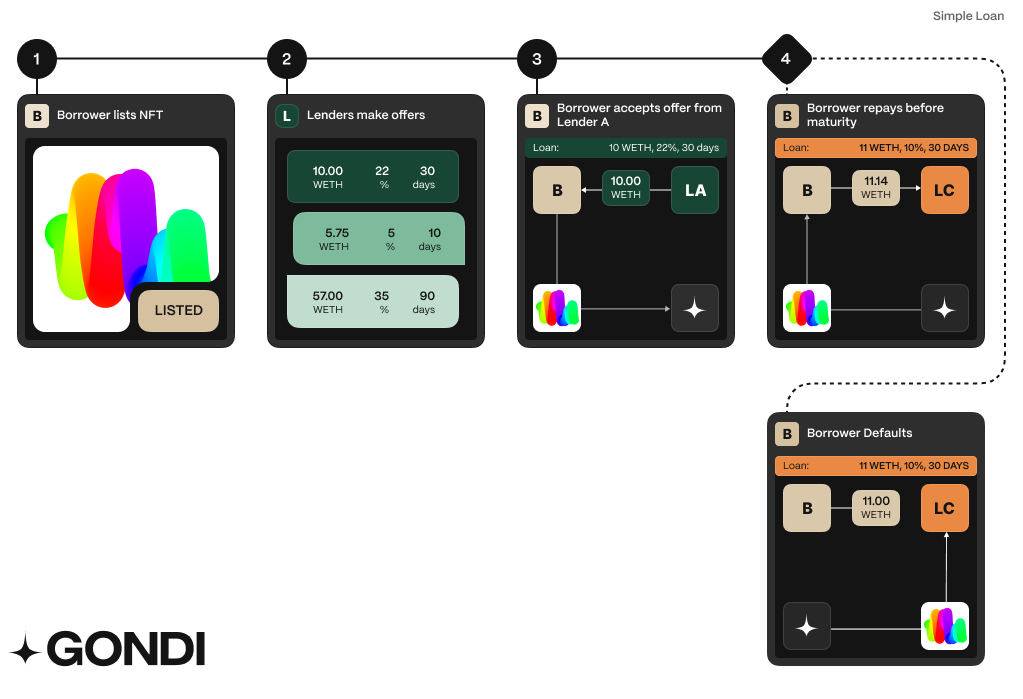

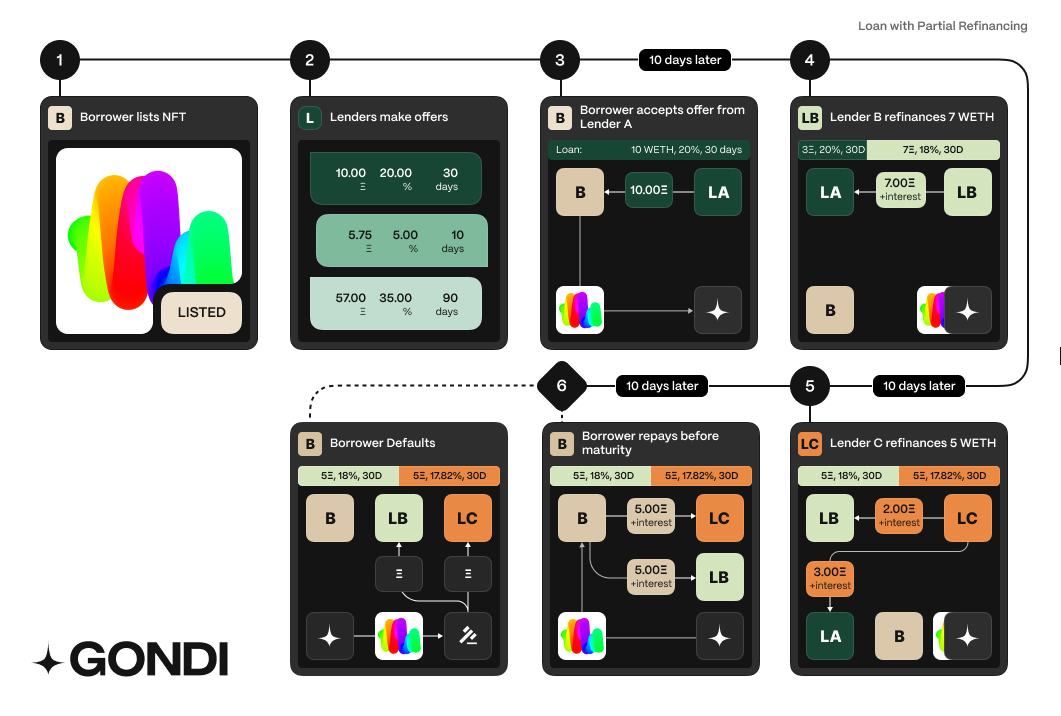

Currently, Gondi is implementing 2 refinancing models on its platform including: Instant refinancing and partial refinancing.

With instant refinancing model: Any lender can become a new lender by repaying the principal + interest to the previous lender but with a reduced APR of the loan. It is also possible to combine some other conditions such as increasing the loan term and increasing the loan amount.

Loans on Gondi use an instant refinancing model

For example: Alice’s loan request is accepted by Bob (the borrower) with the following terms on April 1 as follows:

- Loan amount: 10 WETH

- APR: 20%

- Loan expiration date: April 30 (30 day period)

On April 10, Charly refinanced the loan by reducing the APR with the terms of the new loan as follows:

- Loan amount: 10 WETH

- APR: 14%

- Loan expiration date: April 30 (duration 20 days)

Charly must transfer the principal and accumulated interest to Alice (10 WETH + 0.0548 WETH) to perform the refinancing and become the new lender for this loan.

On April 20, Bob decides to repay the loan. Bob’s loan accrues at 20% APR for 10 days and at 14% for the next 10 days. Bob repays 10 WETH in principal and 0.0931 WETH in interest (0.0548 + 0.0383 for each 10-day period), which goes to Charly.

With partial refinancing model: With this model, the lender only needs to refinance part of the loan with the condition that the refinancing amount must account for at least 5% of the total principal amount of the loan. A loan will have a maximum of 10 refinancing rounds and of course there is a condition that the following refinancing rounds must have a reduced APR compared to the previous refinancing rounds (note that the APR can only be reduced, not the date changed). maturity or principal amount).

The loan on Gondi applies a partial refinancing model

For example: Alice’s loan request is accepted by Bob (the borrower) with the following terms on April 1:

- Loan amount: 10 WETH

- APR: 20%

- Expiry date: April 30 (duration 30 days)

Charly is a lender that recently partially refinanced a loan with 5 WETH and an APR of 12%. So, Alice will receive back her 5 WETH principal and continue to accumulate 5 WETH at a 20% APR.

Overall, Gondi has come up with a pretty good invisible Lending for NFTs that helps more lenders participate in loans, thereby increasing liquidity and better loan order matching. However, this model still has a few disadvantages such as: not fixing the loan time, causing many lenders to jump in and out of the loan, thereby causing chaos and making it difficult for Gondi to compile statistics on loan parameters and amounts. Loans are fixed for borrowers, causing difficulties in the repayment process, etc. Therefore, Gondi V2 was born to solve these problems. Let’s learn about Gondi V2 right here.

What’s special about Gondi V2?

- All loans on Gondi V2 will save users an average of 50% on gas fees.

- Introducing the Buy Now Pay Later feature that allows users to buy NFTs using Gondi loans on 150 different NFT Marketplaces such as: Cryptopunks, Opensea…

- Sell & Repay: Allows borrowers to sell their NFTs on other NFT Marketplaces or Gondi to repay the loan and keep the profit difference on the NFT sale.

- Refinance Lock: Lenders now need to loan for a fixed amount of time (at least 5% of the loan’s life) before exiting the loan. The refinance lock will apply to both instant and partial loans.

- Allows the borrower to choose a portion of the principal amount of the loan offer.

- Loan Extension: Allows lenders to seamlessly extend loans without making any changes to other loan terms.

- Vaults: Allows borrowers to pool multiple ERC-721, ERC-20, and even ETH into one Vault, then borrow against that Vault.

- Delegate.cash: Allows users to authorize hot wallets. This also allows borrowers to prove ownership and claim the airdrop.

- Make Flash Loans.

Gondi V2 Contract will be deployed on November 12, 2023 where outstanding Gondi V1 loans will not be affected with this update. From this point onwards, all loan and loan offers will be launched under Gondi V2 version.

Gondi V2 Review

Overall, Gondi V2 brings many updates and solves the problems encountered in version V1 such as: Fixing the lender’s minimum loan period and allowing borrowers to be flexible in choosing initial principal amount in loan offers. In addition, Gondi V2 also supports Buy Now Pay Later (a feature similar to buying in installments, allowing users to pre-own NFT Bluechips without having to spend an amount of capital up front) or the Vault feature to increase flexibility. for the loan and the borrower. This is also a feature outlined by Gondi since July 2023 and has now been released in this V2 version. This also shows the development team’s commitment to continuously improving the product and sticking to the road map outlined previously.

Those are the highlights of the V2 version, but when looking more broadly, can Gondi V2 have a place in today’s competitive NFT Lending segment?

Firstly, in terms of market share, Blur’s Blend is still the leader and has maintained a stable level in recent times. Arcade recently launched version V3 and Airdrop to more than 5,000 wallet addresses. In addition, Arcade also has a new direction when hitting the RWA segment with many loans of real-world assets encoded as NFTs. Loans worth several hundred thousand dollars to several million dollars also create user hype for this platform. This is what Gondi lacks – widespread user awareness. Therefore, besides product development, Gondi needs to come up with its own marketing strategies and unique points that only Gondi has. For example, Blend with high APR loans, Arcade famous for NFT RWA or JPEG’d the leading CDP platform for NFTs today, but for Gondi I have not seen this.

summary

Overall, the launch of Gondi V2 has resolved the weaknesses that the V1 version encountered, but it is still not enough to create a breakthrough in the market. Above is all the information that I want to introduce in this article, hope everyone has received useful knowledge.