Last week, the NFT market experienced a general decline with BlueChip NFTs such as: BAYC, Azuki and Degods all falling over 10% for the week. So what is the cause of this decline and is it related to Flooring Protocol? Let’s find out with Weakhand in this article.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- What is Flooring Protocol? Overview of cryptocurrency from Flooring Protocol

- What is Blue Chip NFT? Top Blue Chip NFT Collectibles on the Market

What is Flooring Protocol?

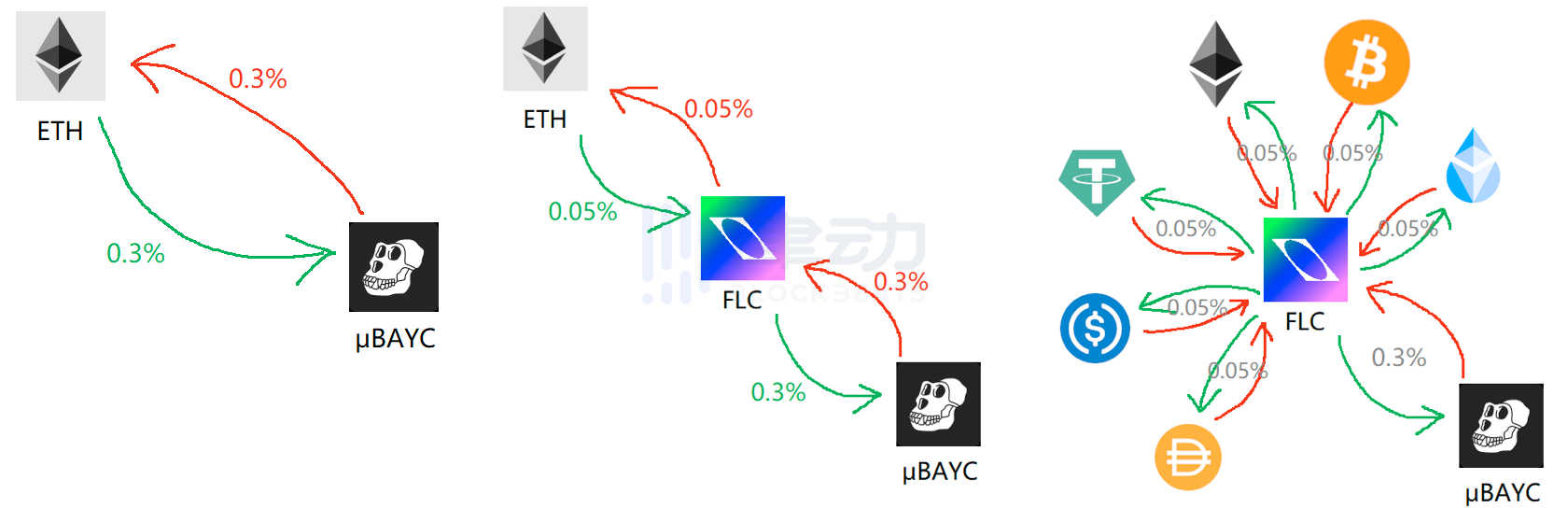

Flooring Protocol is a platform created with the purpose of solving a problem facing BlueChip NFTs at the present time, which is the problem of liquidity and user accessibility. BlueChip NFTs are currently priced too high, so to solve this problem, Flooring Protocol has divided NFTs into 1 million tokens called μTokens.

At present, Flooring Protocol has supported more than 10 different collections with many outstanding BlueChip NFTs such as: Pudgy Penguins, Azuki, BAYC,… This also means that users can buy and sell μAzuki , μBAYC, μPudgy, μY00t on Flooring Protocol itself with prices aligned to the floor price of NFT collections at the present time (price of 1 μToken = 1/1 million of the floor price of NFT collections). Additionally, Flooring Protocol also uses DeepNFTVault to provide users with an estimated value of their NFTs before dividing them into μTokens.

With rich ideas and models, Flooring Protocol has received a lot of response from the community when at one point Flooring Protocol’s daily transaction volume was even higher than Blur – the leading NFT Marketplace platform at the moment. in. In the future, Flooring Protocol aims to list μTokens representing featured NFT collections on leading Cex exchanges such as Binance,…

FLC Wants to Be the Ultimate Index in the NFT World

On December 31, 2023, Flooring Protocol published the first article on its Medium channel titled “NFT Trading Innovation: Introducing the µToken/FLC Trading Pair in the Floor Liquidity Pool”. The article also points out that in January 2024 the protocol will launch a groundbreaking new model that will link the price of the FLC governance token to the valuation of NFT collectibles through μToken.

FLC plays an important part in the Flooring Protocol

This is probably a product suitable for market demand. In the NFT market there is already a high investment threshold for these NFTs and it is also impossible to determine their future value increase. And if FLC is included in the investment strategy “Choose FLC = optimistic about the price increase of BlueChip NFTs” then this will certainly attract user interest in the NFT market.

FLC Became the Agent That Caused the NFT Market to Collapse

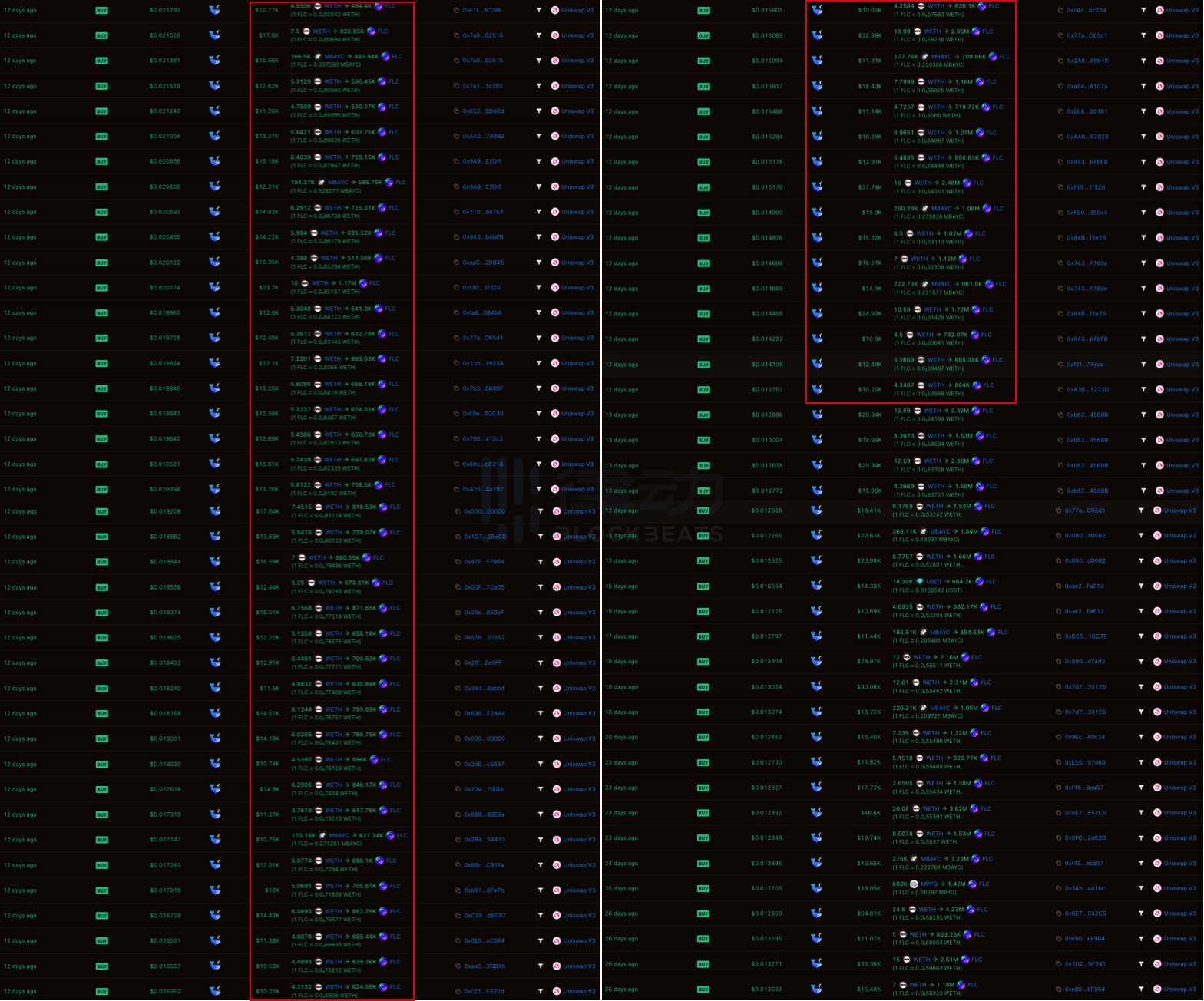

FLC Empowerment offers a good option for traders. Since January 2, there has been a sharp increase in purchases of FLC tokens. On January 3, 2024 alone, the number of buy orders worth more than 10,000 USD in one transaction increased from 7 orders on January 2 to 50 orders. Previously, FLC tokens had very few large purchase orders when the total number of purchase orders over 10,000 USD last week was only about 10 orders.

From January 2, 2024: FLC token witnessed many large buy orders

The large number of buy orders also caused the FLC token price to skyrocket from 0.012 to 0.035 in just 2 days. After the price spike, investors and pre-existing holders of FLC tokens began selling their FLC in exchange for μTokens, then exchanging μTokens for BlueChip NFTs and selling the NFTs on Blur.

Some wallet addresses have sold FLC after seeing the price skyrocket

Some liquidity providers such as addresses starting with 0x27 and 0xF6 have been using their FLC holdings to redeem BlueChip NFTs such as BAYC, Azuki and DeGods since January 5, 2023 and sell them on NFT Marketplace platforms like Blur and Opensea.

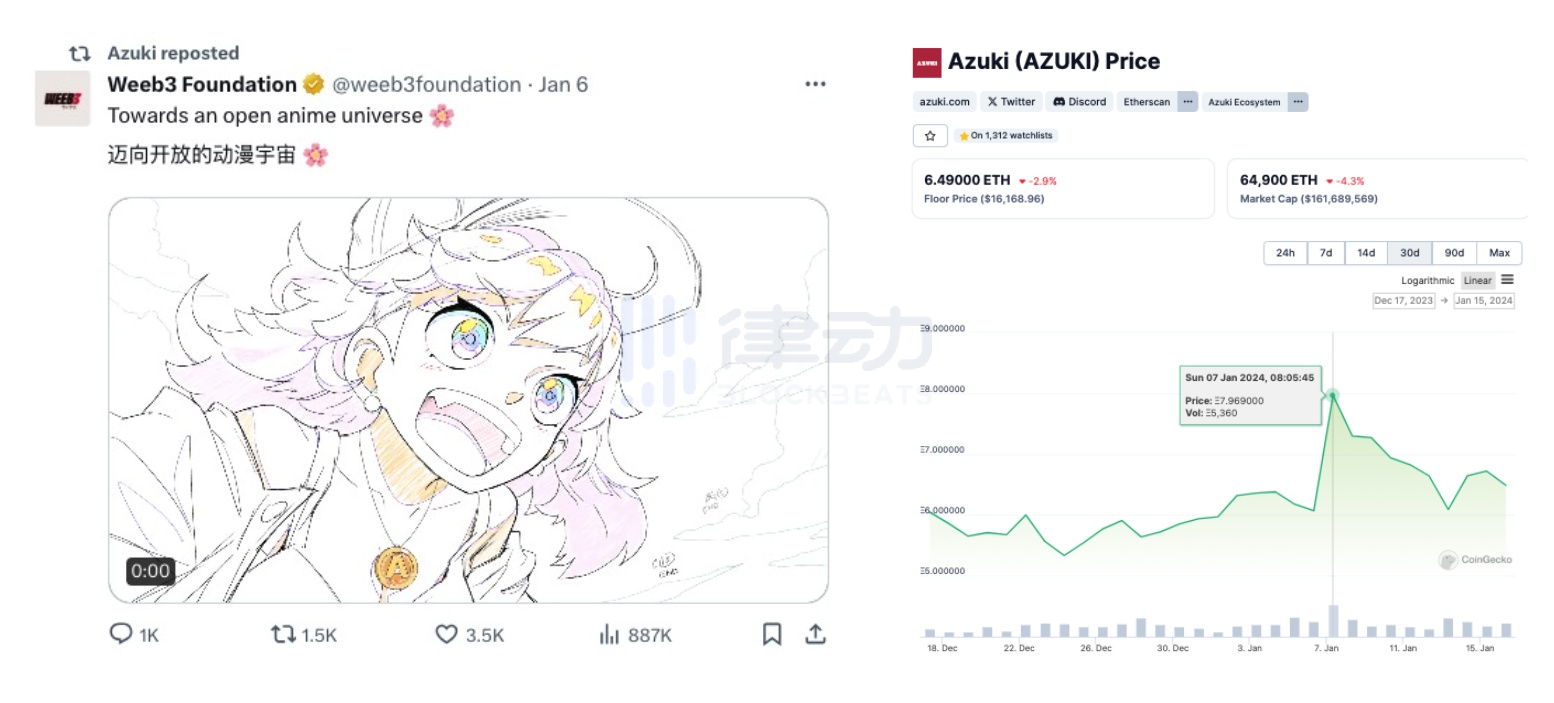

The impact of Flooring Protocol transactions has greatly affected the NFT market especially BlueChip NFT collectibles. BAYC’s floor price was also reduced a week later from January 6, 2024 and as of January 13, 2024 its floor price had decreased by 15%, the Degods collection also saw a decrease of 27% in just 1 week.

Speculation about Azuki launching ANIME token

The decline of BlueChip NFTs has affected the entire NFT market. According to data from Blur as of January 12, 2024, many NFT lines have seen a decline of 10% to 25% within 7 days and the NFT market appears to be experiencing a general downturn.

The NFT market has mostly seen a decline

Is NFTFi “Playing With Fire”?

This is not the first time NFTFi projects have made a big impact on the NFT market. When the market crashed in 2022, the falling BAYC price triggered a liquidation auction mechanism on the NFT Lending platform BendDAO resulting in a large amount of user deposits being rapidly drained and causing BendDAO to fall into Bank status. Run.

For Flooring Protocol, the NFT fragmented trading model has clear advantages that help lower investors’ NFT purchase threshold and increase liquidity in the NFT market. However, this has also caused the value of NFTs, which was originally based on community culture, to give way to speculative trading activities for different NFT tokens.

summary

The Flooring Protocol does bring many benefits to the NFT market in terms of increasing liquidity and reducing barriers to entry for users, but it also brings many major fluctuations that disrupt the NFT market. Above is all the information that I want to introduce in this article, hope everyone has received useful knowledge.