Lybra Finance has had crazy growth in an extremely short period of time, but this growth has clear and unsustainable signs. Let’s explore the depths with this Lybra Finance project.

To better understand Lybra Finance, people should refer to some of the articles below:

Explaining Lybra Finance’s Crazy Growth

Overview of Lybra Finance

Lybra Finance is a Lending & Borrowing platform developed towards CDP allowing users to mortgage stETH or mint stablecoin eUSD. From eUSD users can earn profits by providing liquidity or participating in DeFi activities on eUSD integrated protocols.

eUSD holders also receive a base interest rate of 8% due to the protocol holding stETH holding profits from staking. Not only that, the eUSD mint fee is 0.

General assessment: Lybra Finance’s operating model is really not too different from the crypto market, the difference here is that the market niche that Lybra Finance targets is

The birth of Lybra Finance V2

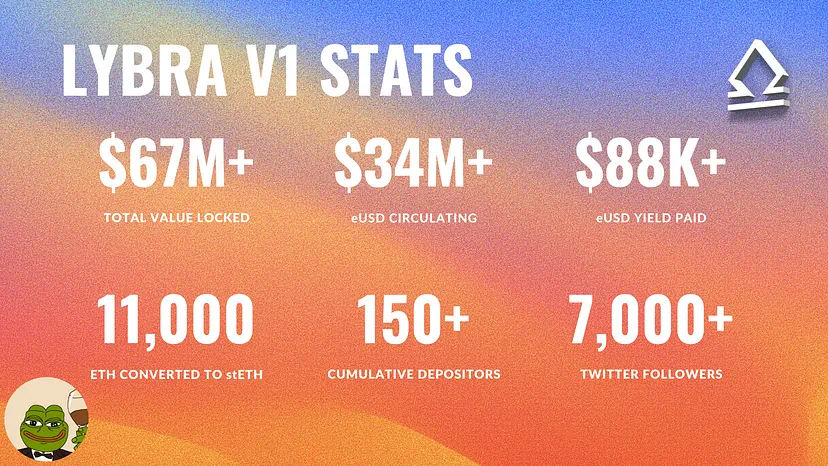

Since the launch of V1 Lybra Finance has achieved numbers that many other protocols have to admire such as TVL growing strongly, the supply of eUSD is also large, the number of ETH transferred into the protocol is also growing rapidly. ,…

But until Lybra Finance announced it was preparing to launch Lybra Finance V2 on May 24, 2023 with some changes such as:

- Accept many new types of LST such as wBETH, rETH of Rocket Pool, cbETHm osETH, swETH, tapETH,…

- Change LBR Tokenomics such as use case of LBR, deflation & burning mechanism of LBR, modification of LBR emission schedule.

- Launch of DAO and governance on Lybra Finance.

- Upgrade UI UX.

- Expanding partnerships with multiple DeFi protocols.

In fact, if we talk about Lybra Finance V2, according to the project’s promise, this is really a much better version than Lybra V1 with some of the following details:

- eUSD will be brought to Arbitrum through LayerZero technology, opening a new market with much cheaper prices and faster speeds than Ethereum. Lybra Finance also promises that more L2s are coming.

- Tokenomics clarity such as Core Team and Advisor being locked is good news for the project.

- Transfer from esLBR to LBR (rewards from Libra Finance programs) will increase from 30 days to 60 days. This reduces the inflation rate from 3.2% to 1.6% for this item alone.

- To receive the LBR reward, users are required to provide liquidity of at least 5% of the loan amount for the LBR – ETH pair. 10% of the LBR portion will be burned.

- Launching LBR lock option for 1.5 years increases rewards by 150%, 2 years increases rewards by 200%,…

With the above extremely attractive updates, LBR has grown from $1.4 to the most recent peak of $4.48. However, when LBR grew from about $0.2 to $1.4, there was no new information. It seemed like some parties already knew the V2 launch information, so there was fomo from before. Currently, the price of LBR is plummeting to $2.66.

According to my subjective perspective, there was intervention in the price line possibly by MM or whales aiming to push up the price before Lybra Finance announced the launch of V2 and then continued to push it further thanks to the support of the community. or KOLs.

Foreign KOLs continuously “shill” Lybra Finance

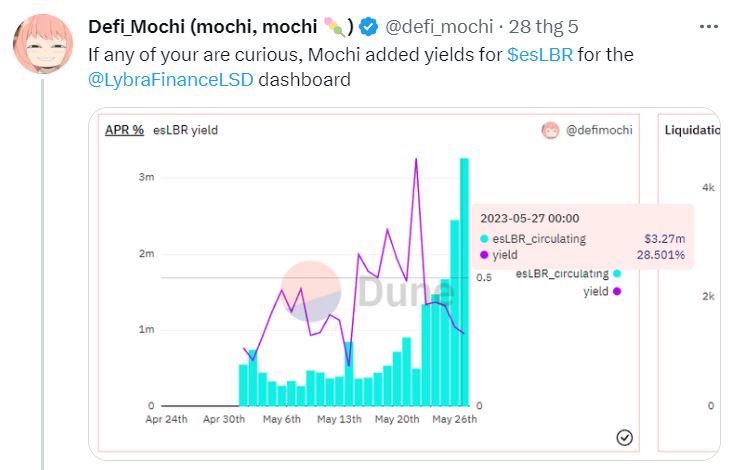

DeFi Mochi is one of the famous KOLs in sharing projects’ Analytics by writing code on Dune Analytics, and also started tweeting + retweeting about the Lybra Finance project from mid-May. and whether intentionally or unintentionally, this was the time of LBR’s most powerful explosion.

Twitter account @defi_mochi has had many actions related to the Lybra Finance project such as:

- Build tools to check TVL, Volume, number of stETH on Lybra,… on Dune Analytics.

- Build tools to check projects in the LSDfi segment.

- Interact with Lybra Finance.

- Interact with KOLs who mention Lybra Finance.

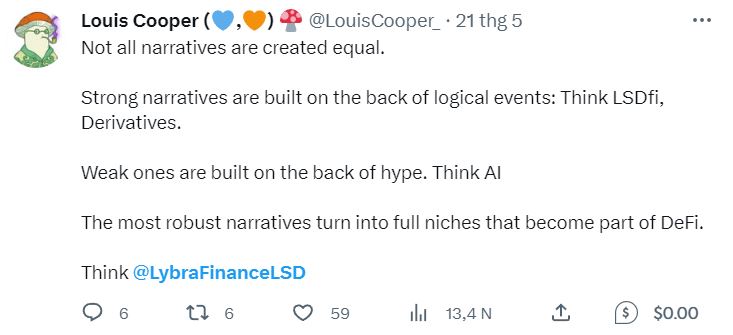

Besides DeFi Mochi, many Twitter accounts also mention Lybra Finance as a hidden gem in the crypto market such as hkm.eth, @0xFlips, Louis Cooper, Dami DeFi…. According to my observations, both @0xFlips and Louis Cooper worked together to build Fungi Alpha.

Note: All of the above information is obtained from observation. I don’t know the main reason why the above twitter accounts mention Lybra Finance? Maybe because of potential projects? Is there Alpha Leak information? Or marketing services.

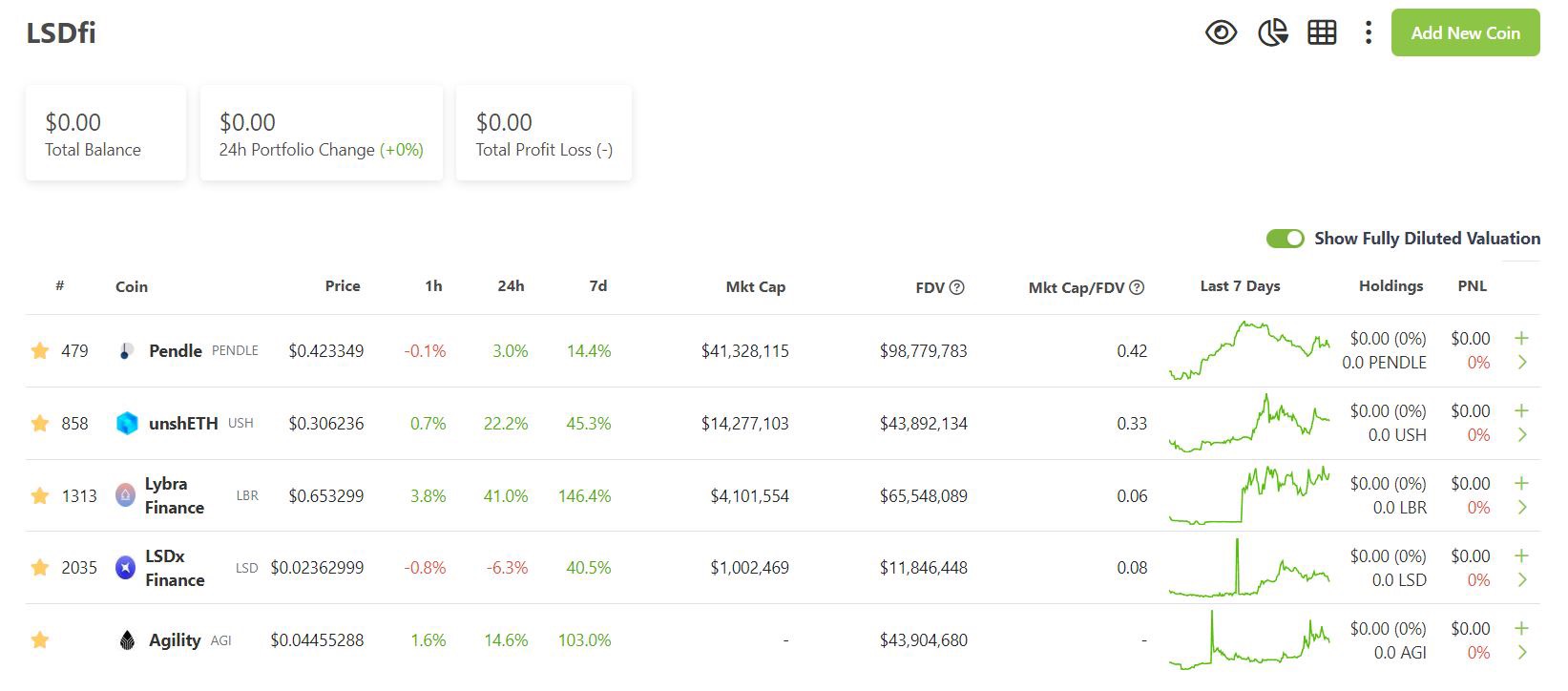

Lybra Finance – One horse alone

It can be seen that among LSDfi projects such as Pendle Finance, Agility, unshETH, LSDx Finance,… Lybra is almost the only one that has strong growth later. I still remember at the time when LBR was priced at $0.6, all LSDfi projects increased sharply while the entire market stood still.

As of May 18, 2023, when I saw a lot of foreign KOLs (or English-speaking Vietnamese) talking about LSDfi, most projects had growth. However, after this period, only Lybra Finance continues to grow, while Pendle Finance, unshETH, LSDx Finance have a slight decrease and Agility has divided into 2, so there is something unclear here.

Because if it is a flight industry, all projects must have growth or no difference to the point where one project has x8 times while other projects remain stagnant. This reminds me of Pendle Finance in the previous period.

Pendle Finance’s growth is somewhat similar to Lybra Finance in that:

- Mentioned a lot by KOLs while the operating model has remained the same for a period of time before.

- At the same time, launching the veToken model to create wars.

- Also tied to the LSDfi trend.

Summary

Obviously, with the combination of MM, the project itself also launched news, a potential development roadmap and the community responded, LBR has had strong growth in a short time. However, the rapid price increase also makes LBR more sensitive when encountering a bad market.