Welcome to the Dopex Essentials series that helps everyone get acquainted with the basics of options trading. Everyone should start with the first part of the series to grasp the knowledge throughout.

Here is the complete list of parts of this Series:

In this section, we will learn in depth Covered Call

In addition to this series, people can also refer to the following articles to better understand Option Trading and Dopex!

- Huge Growth Potential of Options in DeFi

- Exchange Between Weakhand & Dopex – Leading Options Platform on DeFi (Vietnamese)

- What is Dopex (DPX)? Overview of Dopex Cryptocurrency

- Series 9: Real Builder | Dopex – Growing Amid Difficult Insects

What is Covered Call?

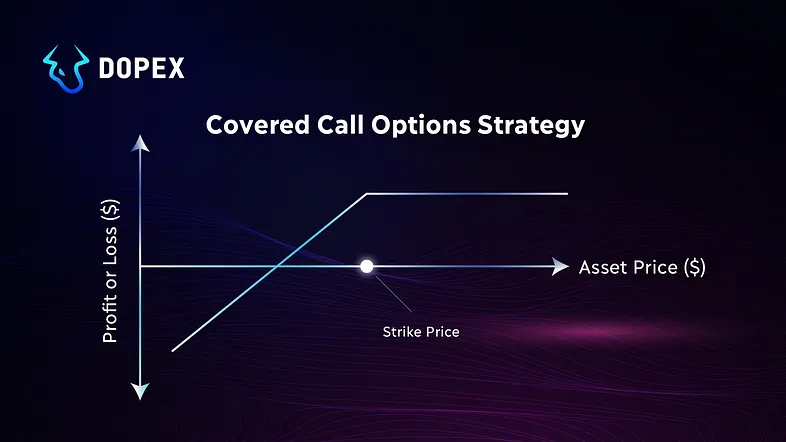

Covered Call is a financial transaction in which an investor both sells a call option and owns an equivalent amount of the underlying asset. In other words, an investor takes a Long position on an asset and then writes (sells) call options on that same asset to generate income.

The investor’s long position in this asset is “covered”, whereby the seller can surrender the stock if the call option buyer decides to exercise the option. If an investor simultaneously buys an asset and sells call options on that asset position, it is called a “buy-write” trade.

How does the Option Covered Call strategy work?

Implement strategy Covered Call

- Buy the underlying asset.

- Sell a call option on the underlying asset you bought.

Strategy Covered Call is a popular strategy and it is generally considered low risk compared to other strategies. This is because when using the options strategy Covered Callthe losses you may experience will be limited compared to other strategies with unlimited risk of loss.

With Covered Call, the worst case scenario is:

- You must sell all “stock” you own.

- The “shares” you own will lose all of their value, except for the premiums you earned.

In both cases, the level of risk is finite.

With the Covered Call strategy, you not only reduce the risk of losing money but There is also a limit to how much money you can make from increasing the price of the underlying asset. In return, you receive income in the form of premiums paid by the option buyer.

Example of Option Covered Call strategy

Holy Pepperoni buy 100 ETH at $50 per ETH, for a total value of $5,000. He expects ETH to rise and sells an options contract with a strike price of $55 for Push. Push pays a premium of $20 for this call option.

Scenario 1

If ETH price does not rise above $55, Push is unlikely to exercise the option; and then it will expire. When that happens, Holy Pepperoni will keep his ETH and pocket the $20 dollar premium Push paid him. His total profit or loss would be $20, plus (or minus) any change in ETH price since he bought ETH at $50.

Scenario 2: Ideal scenario

ETH increased in value to exactly $55 at expiration, but Push did not exercise his option. If this happens, Holy Pepperoni will keep the $20 he received from Push and his original 100 ETH, currently worth a total of $5,500. Combined with the $20 premium, Holy Pepperoni’s total earnings are $520.

Scenario 3: Worst case

If ETH drops to $0, Holy Pepperoni will lose its initial investment of $5,000. However, he will get to keep the additional $20 Push payment. That would make Holy Pepperoni’s total loss $4,980 ($5,000 – $20)

Scenario 4:

If ETH rises to $60, Push can exercise the option. He will pay Holy Pepperoni $55 per ETH. Holy Pepperoni will then keep the $20 premium and receive $5,500 dollars from Push for the 100 ETH he sold. That would make his total profit $520. However, he would lose out on potential profits if he only sold his ETH for $60 USD. He could have made $1,000 in profit instead of just $520. But the call option he sold to Push forced him to pay just $55 per ETH, plus a $20 premium.

Another example of Option Covered Call

Bruce owns some rDPX and has expectations for its long-term future and current price but feels that in the short term rDPX is unlikely to see much volatility, perhaps only a few dollars compared to the current price of $25.

If Bruce sells a call option on rDPX with a strike price of $27, he will earn a premium from selling the option, but over the life of the option, limiting his upside potential to $27 .

Suppose the premium he receives for writing a one-month call option is $0.75 ($75 per contract).

Scenario 1

rDPX trades below the $27 strike price. The option will expire with no intrinsic value and Bruce will profit the entire premium from the option. In this case, by using the “buy-write” strategy, Bruce had superior gains compared to just holding the underlying asset. He still owns the invested rDPX but has an extra $75 in his pocket minus other fees.

Scenario 2:

rDPX trades above $27. The option is exercised and rDPX’s gain is limited to $27. If the price exceeds $27.75 (strike price plus premium), then Bruce’s position will be more profitable than if he held only rDPX. Even so, if he planned to sell at $27, selling the call option would give him an additional $0.75 dollars per rDPX.

Conclude

If you are a long-term investor and want to generate more income from your assets then Covered Call is a good strategy for you. As long as you choose the right asset to sell the option and have a good strike price.

Covered Call offers the most attractive profits as long as the price of the underlying asset remains below the strike price of the contract. Covered Call also limits your potential for loss because you cannot lose the premium you receive from selling options. The main risk of this strategy is that you will miss out on profits if the value of your investment in the underlying asset increases too quickly.

If you are ready to experience the options trading market, Covered Call could be a good way to start. In some cases, selling a Covered Call can be more profitable than owning the underlying asset.

Summarize main ideas

- To execute a Covered Call, an investor takes a Long position in an asset then sells call options on that same asset.

- Covered Call is a popular options strategy used to generate income in the form of options premium.

- Covered Call is low risk because you own the “stock” being used in that option.

- This strategy is ideal for investors who believe that the underlying price will not fluctuate much in the near future.

- In the worst case, you will lose the potential profit from the underlying asset if it exceeds the strike price of the call contract.

Introducing Dopex

Dopex is a decentralized options protocol that aims to maximize liquidity, minimize losses for option writers, and maximize profits for passive option buyers.

This article is done based on the combination of Dopex & Weakhand