With AAVE and Curve Finance both revealing that they will soon release stablecoins, Curve Wars is on the rise again.

So what is special about the stablecoins of AAVE and Curve Finance and when Curve Wars happens, which parties will benefit or in more detail which tokens will increase in price in the near future, everyone will find out in the next article. hey.

AAVE & Curve Finance Jointly Announce Stablecoin

The fact that Maker DAO is successful with DAI in both the Crypto market and outside of TradFi, besides that DAI has no competitors in the same industry, makes Maker DAO reach the finish line alone and monopolize a very large piece of the pie. And of course, it is quite understandable that both AAVE and Curve Finance launched their own stablecoins as both platforms have great advantages when deploying stablecoins.

AAVE with Stablecoin GHO

Overview of GHO

AAVE first shared with its community the roadmap to build a stablecoin called GHO in July 2022. At that time, AAVE Companies created a proposal for the development of the GHO stablecoin pegged to USD and managed by the AAVE DAO.

GHO has the same operating mechanism and characteristics as Maker DAO’s DAI such as:

- Decentralization.

- GHO is an Over-collateralized Stablecoin meaning you have to collateralize about 120 – 200% more than the loan they need. For example: If you want to mint 100 GHO, you need to deposit $150 ETH.

- Users can use many types of collateral to mint Stablecoin GHO.

- Managed by the AAVE DAO community.

After 3 months, the AAVE development team has more detailed information about this GHO stablecoin.

Operating mechanism and applications of Stablecoin GHO

In this update, AAVE shared more information about the GHO stablecoin such as borrowing mechanism, mortgage mechanism and liquidation of collateral assets, interest accumulation model, peg holding mechanism at $1, the Use oracles to update mortgage asset prices and many other information.

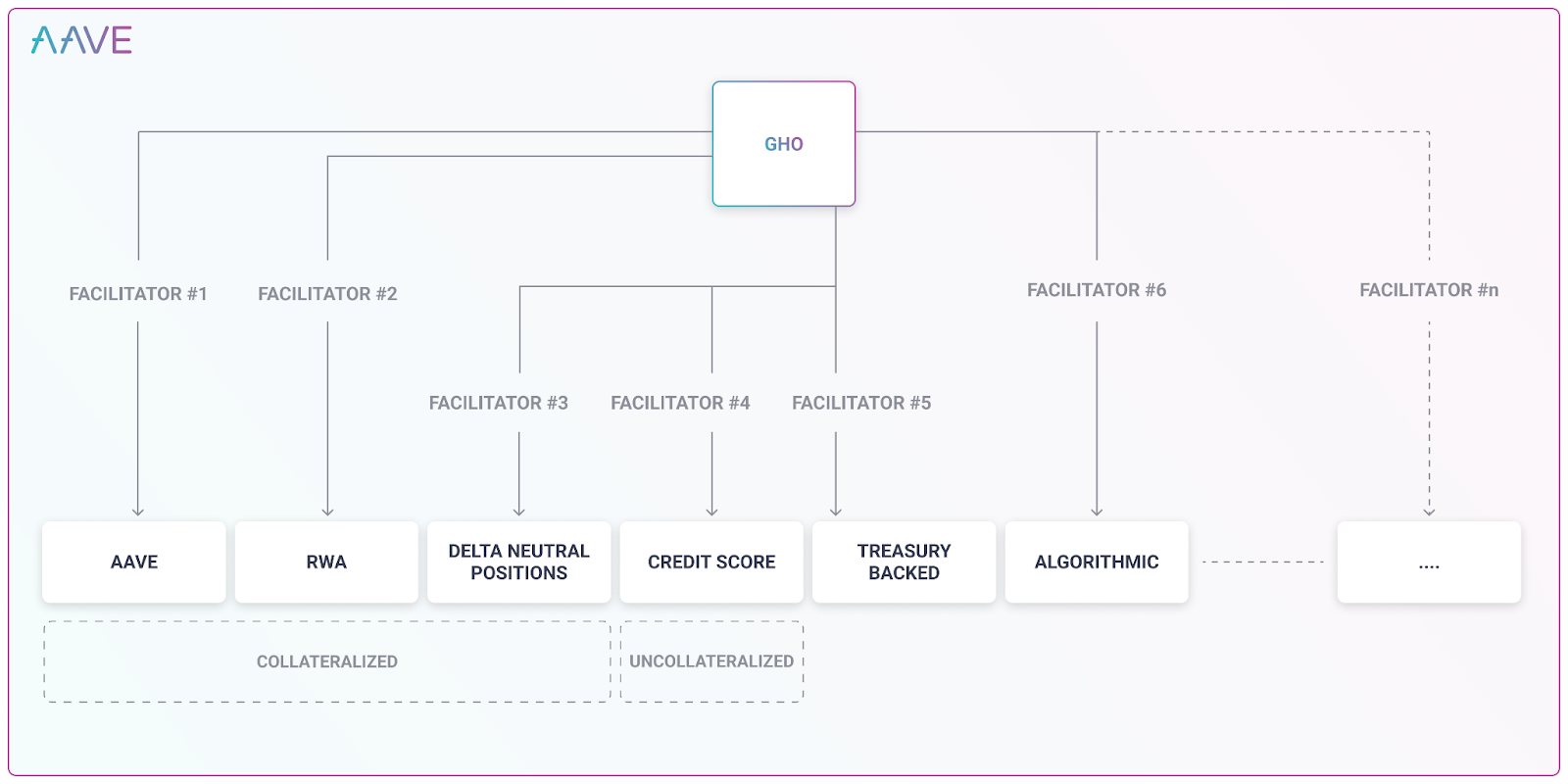

In the operation mechanism of stablecoin GHO, there will be many Facilitators who are individuals nominated by AAVE DAO with the function of building and disseminating GHO for a variety of uses such as RWA (Real-world Assets). , Delta Neutral Positions, Credit Score, Treasury Backed, Algorithmic,…

AAVE’s strengths in developing GHO

AAVE is currently the largest Lending Pool platform in the crypto market with a multichain development orientation. With an abundant amount of collateral, just with a reasonable strategy and an appropriate amount of incentive, it is possible to convert a large amount of idle collateral in the pool into collateral to mint GHO.

AAVE is also a big brand and has many loyal users on many different blockchains. Because of multichain development, GHO can easily be transferred from one blockchain to another. The rapid increase in use cases and liquidity keeps GHO firmly at the $1 price level.

Curve Finance with Stablecoin crvUSD

At the end of November 2022, Curve Finance introduced to the community the whitepaper of Stablecoin crvUSD along with the LLAMMA operating mechanism.

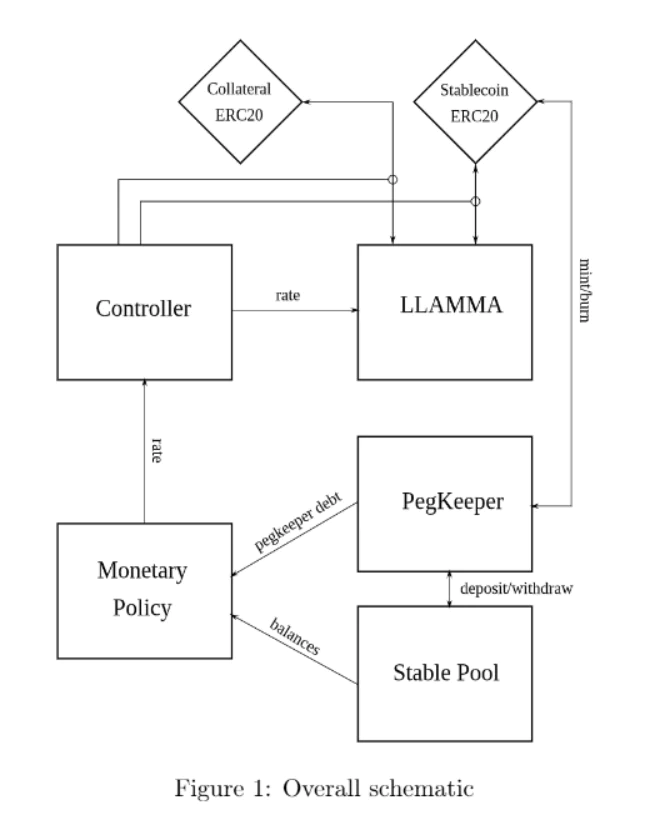

The operating mechanism of crvUSD is similar to Maker DAO’s DAI in that users can mortgage assets to mint stablecoin crvUSD. And Curve Finance introduced the mechanism Lending-Liquidating AMM Algorithm Abbreviated as LLAMMA.

Operational mechanism of stablecoin crvUSD

With LLAMMA, this mechanism helps users limit the risks of liquidating collateral and incurring a large loss, and it also helps the protocol avoid bad debts that are difficult to recover from. Calculate early.

LLAMMA is a loan that operates under a continuous portfolio rebalancing mechanism based on the user’s collateral. Simply put, when collateral decreases, the LLAMMA mechanism will operate so that collateral assets are automatically exchanged into borrowed assets.

For example: Users use BTC as collateral to mint crvUSD. When BTC drops, the LLAMMA mechanism will automatically convert a portion of BTC to crvUSD to make the portfolio safer. When BTC increases, the LLAMMA operating mechanism will automatically convert a part of crvUSD into a part of BTC.

With transactions like the above, users may suffer a little loss, but if you look at the crypto market as an extremely volatile market, this mechanism helps investors avoid the market when it drops sharply and there is no change. ability to recover to the old price level in the short – medium term.

Curve Finance’s strength in developing crvUSD

The most important thing for a stablecoin to be able to keep its peg is liquidity and Curve Finance has that. So just starting a war with then attracting liquidity for crvUSD will be a relatively easy thing. It’s just unclear whether Curve Finance will directly confront Maker DAO like Terra did?

Curve Wars Will Officially Return

When both GHO and crvUSD officially return, the battle to attract liquidity will become increasingly fierce. I think the liquidity war will take place on Curve Finance and Uniswap V3, however the liquidity war on Uniswap V3 will not have as many opportunities and uniqueness as on Curve Finance.

Number of veCRV locked and participating in voting

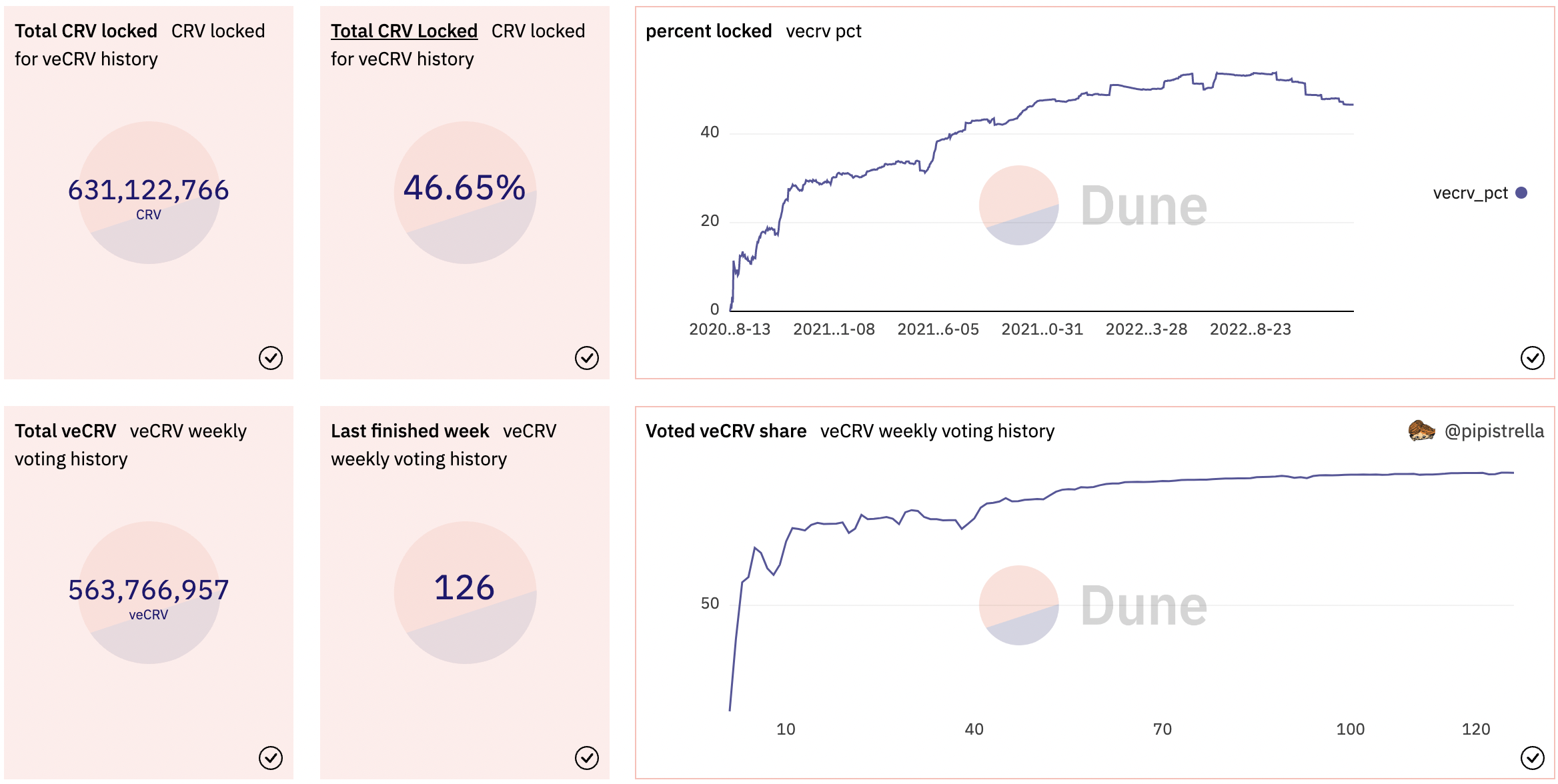

Up to now, according to the Coingecko platform, there is a total of more than 650M CRV tokens in circulation with a total supply of nearly 1.9B, there are more than 630M CRV tokens being locked to receive veCRV in an average time of 126 weeks is equivalent to 2.4 years.

Therefore, accessing and incentivizing only about 20M remaining CRV tokens and the amount of CRV to be paid in installments in the future is not a reasonable strategy. And the most sensible strategy is to gain access to veCRV. The right to use veCRV here is not necessarily the right to own veCRV.

Parties involved in the war over veCRV

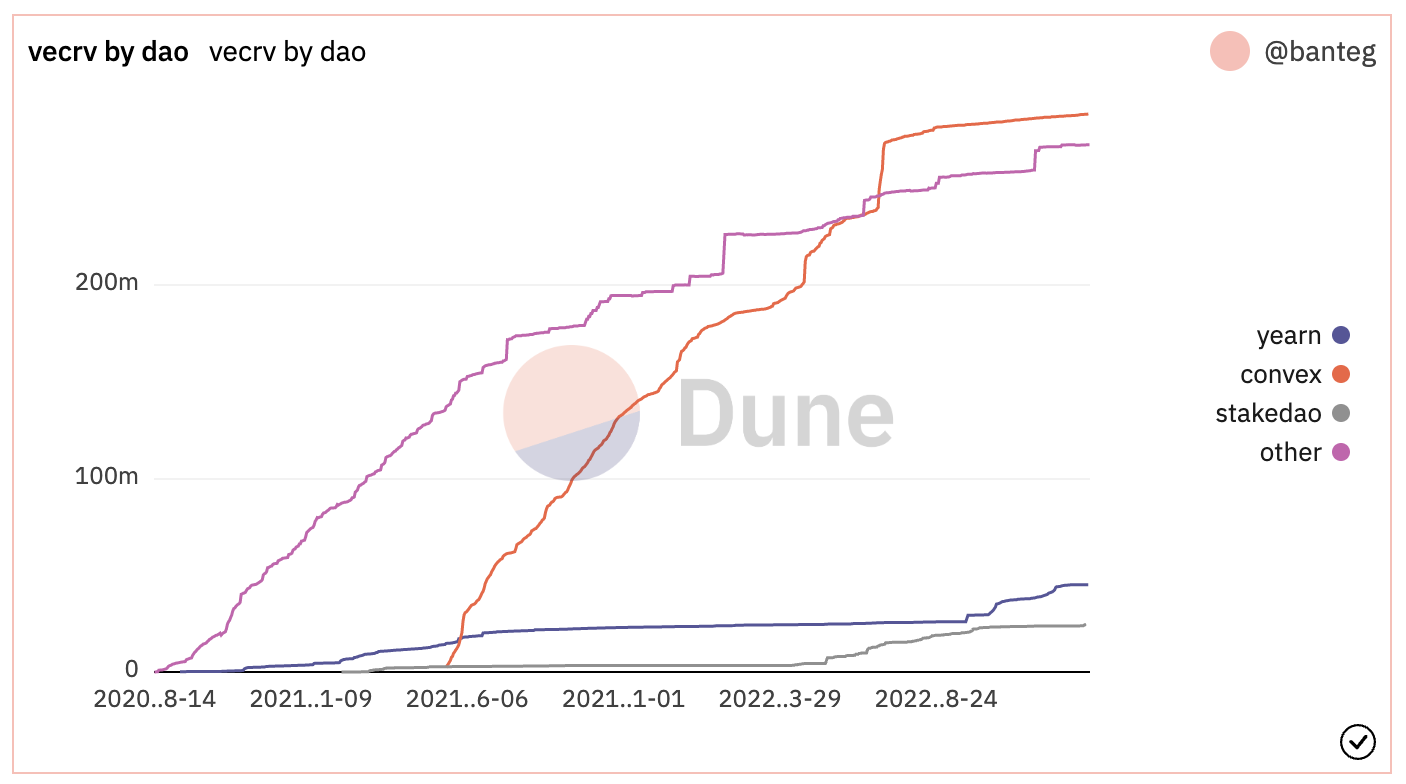

Up to now, there have been many protocols created to compete for veCRV, but we only recognize the 3 largest platforms that have direct influence with proposals on Curve Finance.

|

Protocol |

Number of veCRVs |

% holding |

|---|---|---|

|

Convex |

288.673.788 |

44% |

|

Yearn Finance |

45,118,488 |

7% |

|

Stake DAO |

24,575,837 |

3.6% |

|

Other |

272,723,756 |

45.4% |

It can be said that Convex holds a large part of the voting power on the Curve Finance platform. Besides, there are users and Whales participating in direct locking on the platform, so here we will have 2 clear strategies for AAVE and Curve Finance.

- 1 is that AAVE and Curve Finance need to have a very thorough proposal to convince individuals or whales who directly hold veCRV so they can vote for their proposal.

- 2 is the Convex Wars, how can 2 platforms hold many CVX or vlCVX.

We will review some of the parameters of the Convex platform at the present time.

Some parameters of Convex

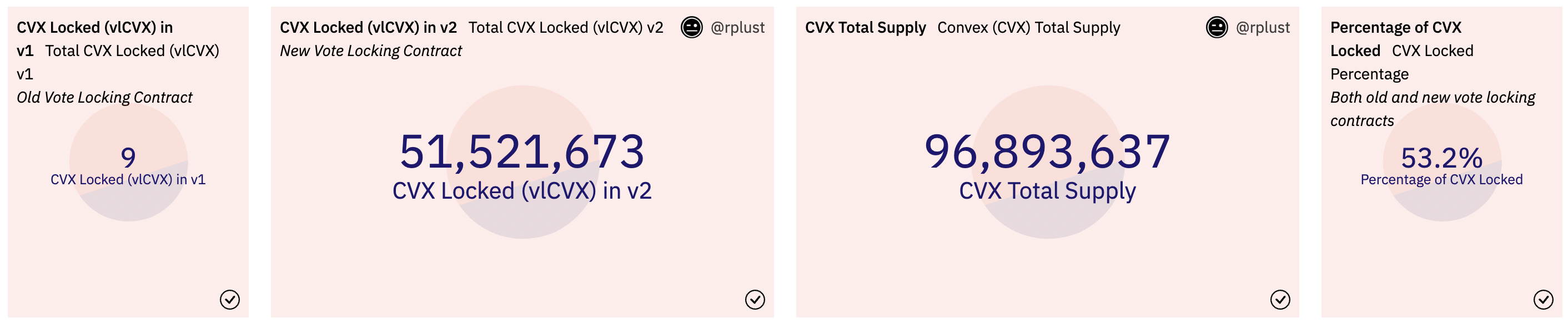

Up to now, there are about 75M CVX tokens in the crypto market, of which nearly 52M are locked in Convex V2. Temporarily, there are about 22M CVX tokens still out of circulation without being locked and can still be traded normally.

Number of locked Convex

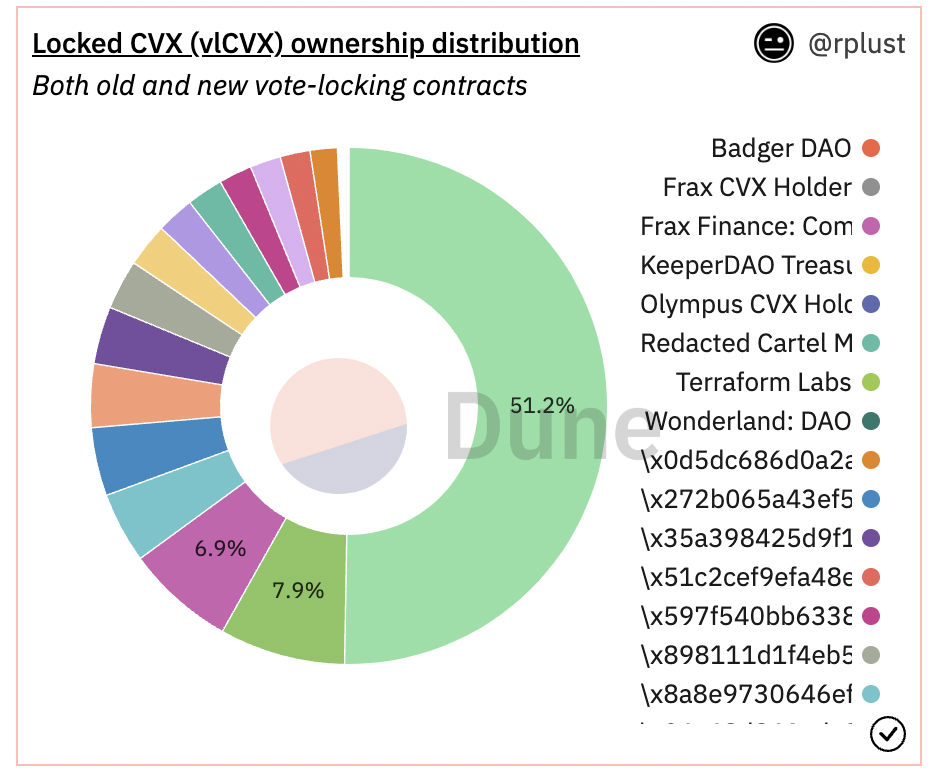

Besides, many platforms have also participated in Convex War to hold CVX tokens. However, the amount of vlCVX held by platforms other than FRAX is about 7%, the amount held by other platforms is insignificant.

So from our perspective, we can temporarily make some projections as follows if Curve Wars will return to the battle between GHO, crvUSD and DAI.

- CRV has the motivation to increase prices because the number of CRVs on the market is very small. If Curve and AAVE simultaneously collect these few remaining CRVs, it could cause CRV prices to increase. Besides, the amount of CRV emitted will not be sold because it will be locked on Curve or Convex itself. However, with such a small amount of CRV and buying so much that the price increases the more you buy, it will not really help platforms own CRV at a reasonable price.

- CVX has a clearer price increase motivation because the number of CVX outside the market is still very large (about 50% of total supply is outside the market). Besides, Convex is also holding up to 44% of the total amount of veCRV, so if you understand Convex, you can understand this war.

- Besides CVX, FRAX is also very interesting as this platform owns 7% of vlCVX. Besides, there are also Olympus DAO, KP3R,…

- Besides, smaller platforms like Yearn and Stake DAO can also have a positive influence because maybe AAVE Companies or Curve DAO will collect both Yearn and Stake DAO tokens with small-to-big thinking.

From my personal perspective, the opportunity will not only lie in the price increase of tokens of Curve-affected protocols, but the information in the proposal to create pools, direct incentives,… on the topics Curve and AAVE output are also important.

Conclude

Above are some of my perspectives on Curve Wars that may reoccur when the ghosts of GHo and crvUSD get closer and closer. In the past, we had a perfect Curve Wars, a half-way Convex Wars, I think this stage Convex Wars will be as saturated as the current Curve War and we will have at least 1 more War. below the Convex platform where Frax resides.