Crypto Spotlight is an article updating the Crypto market situation with notable and outstanding information in the past week. The 35th week of the Crypto market witnessed many unexpected events surrounding the issues between the SEC and Bitcoin ETF applications of many different units such as Grayscale, VanEck, BlackRock,… Everyone, join me in Crypto Spotlight W35 Please.

To better understand Crypto Spotlight W35, people can refer to some of the articles below:

- What Happens If Bitcoin ETF Is Approved By SEC In The US

Featured Market News

GrayScale wins SEC lawsuit: Important step for Crypto & Bitcoin ETF market

The District of Columbia Court of Appeals has ruled in favor of Grayscale in the company’s lawsuit against the Securities and Exchange Commission (SEC) over the listing of a Bitcoin investment fund (ETF) based on the Grayscale Bitcoin Trust (GBTC). ).

The court ruled 2-1, with Justice Karen LeCraft Henderson writing an opinion critical of the SEC. Henderson argued that the SEC applied the rule unfairly, allowing ETFs based on other asset classes, such as gold, but not Bitcoin-based ETFs. The court’s ruling is a major victory for Grayscale and the cryptocurrency industry as a whole. This opens the door for the listing of Bitcoin-based ETFs in the US, which could help attract new capital into the Crypto market.

This is a strong and direct blow to the private calculations of SEC chairman Gary Gensler. On the sidelines of this event, we have some outstanding events related to Bitcoin ETF and Gary Gensler including:

- The SEC continues to delay decisions on Bitcoin ETFs of a series of giants such as BlackRock, VanEck, Fidelity, Ark, WisdomTree, Invesco & Galaxy,… Latest delay time for some Bitcoin ETFs in March /2024 almost coincides with the Bitcoin Halving event about a month later.

- In September, SEC Chairman Gary Gensler will testify before the Senate Banking Committee on September 12 and before the House Financial Services Committee on September 27.

The unemployment index is increasing. Will the FED stop raising interest rates?

On September 1, the US Bureau of Labor Statistics (BLS) announced that the US unemployment index increased to 3.8%, higher than the forecast of 3.5%. Although this is not a quite high number, being higher than expected will more or less create pressure on the FED to increase interest rates in the near future. Recently, the FED continued to increase interest rates from 5.25% to 5.5% after only a short month of rest.

The current interest rate of 5.5% is higher than the peak interest rate in 2006 and on par with the period in the 2000s.

Focus on Layer 2 Platforms

Base is like a “dengue fever”

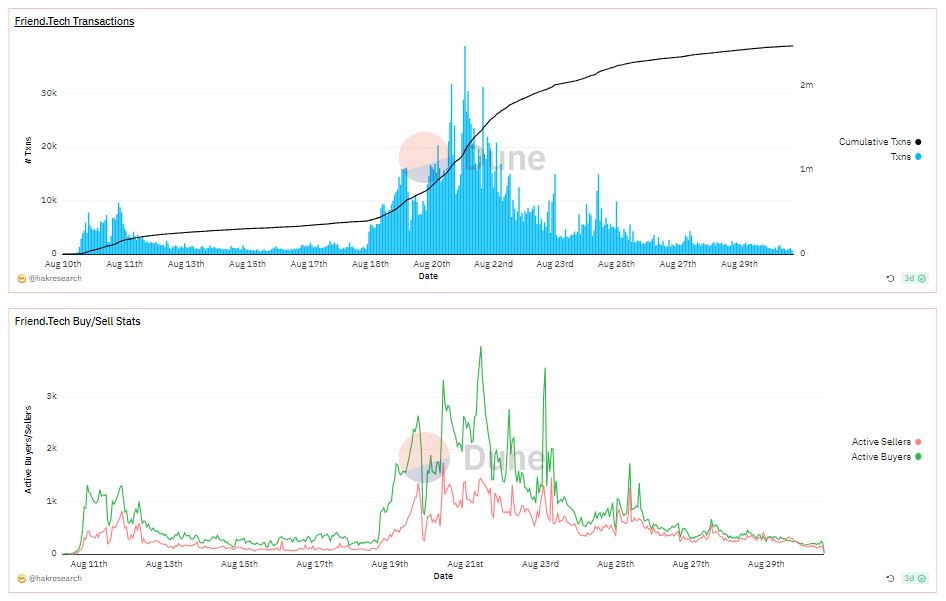

The Friend.tech fever has shown signs of cooling down as the number of Transactions, Friend.tech Buy – Sell or ETH Buy – Sell Volume has shown signs of decreasing sharply in the past week even though the project has had a lot of good information. There are many reasons behind this event because the project stated that any user participating in using Friend.tech’s competitors will not receive Airdrops from the platform but then the project “turned around”. “Sorry to the community for the hasty statements. Part of it comes from the fact that Friend.techd’s scoring has decreased a lot compared to the initial time.

For whatever reason, Friend.tech no longer retains the same hype as when it first launched.

If Friend.tech is the Base ecosystem that has cooled down, the Aerodrome platform – the AMM project with the (3,3) model developed by Velodrome’s own team, has immediately made the Base ecosystem hot. returned when there was a TVL growth of several million dollars to nearly $200M in less than 24 hours.

Arbitrum introduces Arbitrum Stylus Testnet

Offchain Labs has officially launched the next upgraded version of Nitro, Stylus, with a few main changes such as:

- Continue to improve network scalability like Nitro did with One.

- Introducing RUST. Developers can now build Protocols or DApps using the Rust programming language, and projects on Sui or Solana can be easily migrated to Arbitrum. Arbitrum is the only Layer 2 platform that supports Rust.

Everyone can refer to the article Everything About the Arbitrum Stylus Update for an accurate and detailed perspective on the Stylus update – Arbitrum’s most important upgrade in 2023.

Some other outstanding information in Layer 1 or Layer 2 platforms include:

- Farcaster – a SocialFi project built by a team who worked at Coinbase and successfully raised $30M, has officially switched to Optimism.

- Optimism gives Base 2.75% of the total OP supply within 6 years and in return Base will contribute revenue to Optimism Collective.

- Maker DAO – the largest CDP platform on the market, is expected to build its own Layer 1 platform based on Solana’s open source code.

Some Notable Investment Deals

Last week there were only a few investment deals with:

- Strom is an LSD platform on the Bitcoin Lightning Network with $3.5M in Seed round with participation from Lemniscap, No Limit Holdings, Cogitent Ventures,…

- DeForm is a Web3 Marketing platform with $4.6M in funding with the participation of Elad Gil, Scalar Capital, Next Web Capital, a_capital,…

- FirstMate is a platform that connects developers and NFT holders with $3.75M led by Dragonfly Capital alongside Coinbase Ventures and NextView Ventures.

By the end of August, the entire Crypto market had successfully called for about $280M from many projects and many different segments. However, there were also many projects that were calling successfully but did not announce the specific amount.

Summary

Hopefully through Crypto Spotlight W35, everyone can grasp the notable information of the Crypto market in week 35. End of Crypto Spotlight W35 and see everyone at Crypto Spotlight W36.