Convex Wars is very close with many clear signs such as the fact that Curve’s crvUSD and AAVE’s GHO are both present on the Goerli testnet network; Frax V3 is about to launch and Redacted Finance’s next product is Dinero which is also a stablecoin. The battle is very close and I hope everyone will not miss this trend.

In this article we will go through the following main ideas:

- Take a look at the events leading up to Convex Wars in the near future.

- Update how Convex Wars is going, comparing the most recent time that Weakhand has posted.

- Where are the investment opportunities if the projections gradually come true?

To understand more about this article, you can refer to some of the articles below:

- Curve Wars Is Coming Back. Which Projects Will Benefit & Grow?

- Convex Wars & Investment Opportunities This Summer

- What is Convex Finance (CVX)? Overview of Cryptocurrencies Convex Finance

- What is Curve Finance (CRV)? Curve Finance Overview of Cryptocurrencies

New Dynamics Create Convex Wars

These factors have emerged clearly

As I have shared in previous articles, there are a number of conditions that will form or will certainly form in the near future to lead to Convex Wars.

- Liquid Staking Derivatives

- Stablecoin Wars: crvUSD and GHO

- A number of platforms have been, are and will participate

How Liquid Staking Derivatives Lead to Convex Wars?

As everyone knows, LSD platforms are facing a huge expansion opportunity after the Shanghai update. Currently, only about 13% of ETH is staked on Beaconchain and many other LSD protocols, so after Shanghai there will be about 87% of the remaining ETH that will be staked, with a value of more than $150. B is 3x the entire DeFi industry.

That is the reason why LSD projects exploded so strongly. Next, each LSD protocol itself for Ethereum has its own synthetic roken such as:

- Lido Finance: stETH

- Coinbase: bETH

- Rocket Pool: rETH

- ANKR: ankrETH

- Stader Labs: ETHx

- Frax Finance: fxrETH

- Yearn Finance: yETH

- Stake Wise: sETH2

Thing obligatory With LSD platforms, they must pool liquidity for the xETH – ETH pair on Curve Finance so that users can get their ETH back at any time instead of having to wait for unstake which can lead to many risks because of the long time. .

Therefore, the logical thinking flow leading to Convex Wars will include the following thinking process:

- LSD projects are required to have an xETH – ETH liquidity pool on Curve Finance (because Curve Finance specializes in parity assets.

- Liquidity pool is one thing, the liquidity in the pool must be thick to avoid the situation where the platform’s xETH goes bankrupt, causing bad psychology for the platform’s users.

- If they want a thick liquidity pool, they must attract LPs to deposit ETH into their pool through incentives.

- Incentive can be a project token or an incentive coming directly from Curve Finance.

- To control incentives on Curve Finance, the platform must own veCRV to vote for its liquidity pool.

- However, Curve Wars is now over when Convex holds 50% of the total veCRV.

- Therefore, if you want to master Curve Finance, you must master Convex and CVX.

This is the reason why LSD can lead to Convex Wars that can happen after the Shanghai Upgrade event. The more protocols involved in building LSD products, the stronger Convex Wars becomes. Recently, Frax Finance and Yearn Finance have also officially shared about the LSD product for Ethereum.

Stablecoin Wars: crvUSD and GHO

crvUSD is Curve Finance’s stablecoin or GHO is AAVE’s stablecoin. The most important thing for a stablecoin is liquidity and in the beginning, these two platforms are required to have a liquidity pool on Curve Finance, there is also the possibility of listing major exchanges such as Binance, OKX, Bybit, … to have large liquidity but this possibility is very low.

Similar to the way we think with LSD, this time with Stablecoin Wars, it needs to be the trigger to lead to Convex Wars. Curve seems to have a home field advantage, but it’s not certain because the decision-making power lies with veCRV holders, not the protocol.

Up to now, these two stablecoins are also racing against each other as they are both present on Ethereum’s testnet network.

A number of platforms have been, are and will participate

JPEG’d a CDP-oriented NFTFi platform that allows users to mortgage NFTs to mint two types of assets, stablecoins pUSD and pETH. Currently, JPEG’d is accumulating CVX in 2 different ways:

- Sell native JPEG tokens to users at a discounted price in return for CVX.

- Deduct part of your Tresurt to buy CVX.

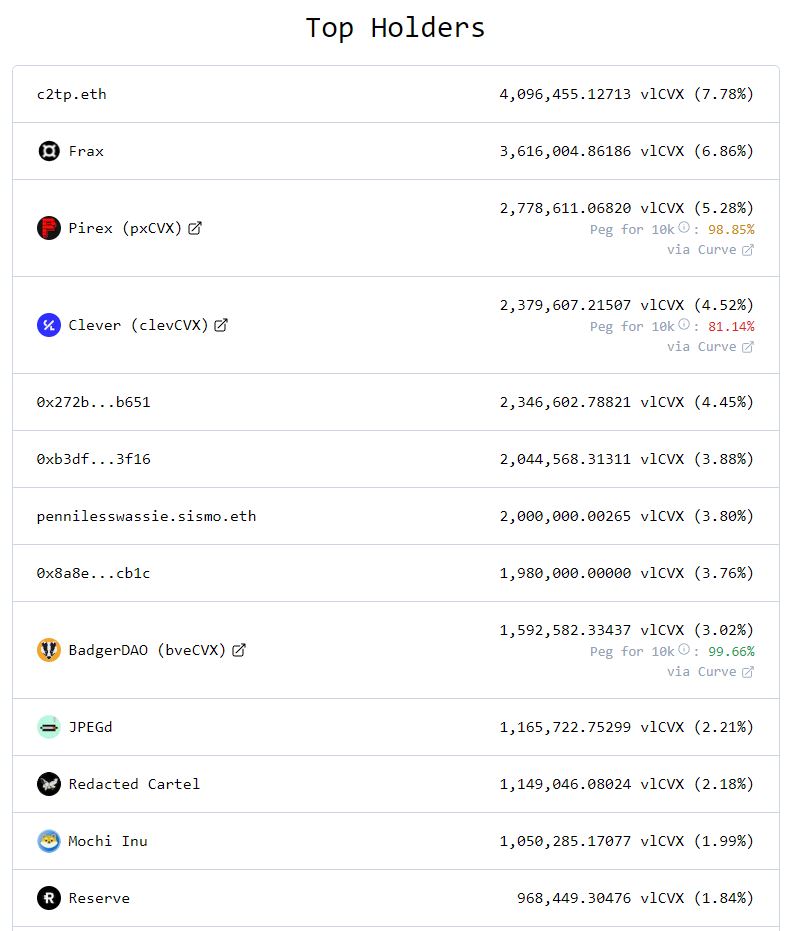

Besides, there are many platforms that already own CVX including: Frax Finance, Redacted Cartel, Mochi Inu, KP3R, Alchemix, Silo Finance, Tokemak, Paladin.

Note: As for why these platforms own CVX, everyone can research further. Weakhand will learn and provide information to everyone in the near future.

These factors appeared recently

Firstly, recently Redacted Finance launched its next product, Dinero – this is a stablecoin. Previously, Redacted Finance had two products: Pirex and Hidden Hand. What is worth noting here is that Pirex is a Liquid Staking project for Convex. That means:

- On the one hand, Redacted Finance participates in Curve Wars through Pirex.

- On the other hand, Redacted Finance also created its own stablecoin with the Dinero product.

Monday, Dopex, a platform also originating from Olympus DAO, also has a deep relationship with Convex and is also preparing to launch DPXETH peg 1 – 1 with ETH. Of course, if this platform wants to bootstrap liquidity for the DPXETH – ETH pair, it will also have to participate in the Convex Wars. Motivation is there but not too high.

TuesdayTapioca DAO – a Cross-chain Lending & Borrowing platform using LayerZero technology will also soon launch stablecoin USDO in the near future.

Convex Wars Situation Update

Situation of Liquid Staking platforms for Convex Finance

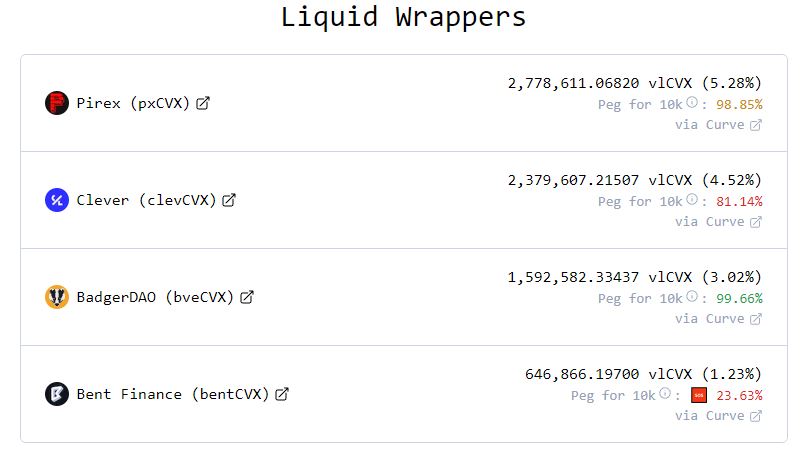

Currently, Convex Wars is still a battle between 4 platforms including Pirex, Clever, BadgerDAO and Bent Finance and the race is extremely tense between the 2 leading platforms. And to see the growth rate, we will look back at the parameters of these platforms at the time I last wrote the article about Convex Wars on February 22, 2023:

- Pirex belongs to the Radacted Cartel ecosystem: 4%

- Clever belongs to the Aladdin DAO ecosystem: 4%

- Badger DAO: 3%

- Bent Finance: 1%

However, up to now we have seen that:

- Pirex belongs to the Radacted Cartel ecosystem: 5.28%

- Clever belongs to the Aladdin DAO ecosystem: 4.52%

- Badger DAO: 3.02%

- Bent Finance: 1.23%

It can be seen that only Pirex and Clever had outstanding growth, especially the top separation of the Pirex platform when growing from 4 to more than 5% in just a relatively short period of time. However, the gap between these platforms is still very short, so only one platform with a reasonable and different strategy can win the Convex Wars. There may even be new riders joining the race.

It cannot be confirmed that Pirex is the winning platform because there is still a long way to go and it is also impossible to confirm that Bent Finance or Badger DAO will lose because perhaps the parties are still quite cautious and hiding their cards.

However, up to now, with its small incentive source compared to Clever or Badger DAO, Pirex is doing better than it can. I have also analyzed in great detail the strengths and weaknesses of these platforms in the article Convex Wars & Investment Opportunities This Summer, which everyone can refer to.

Situation of platforms holding Convex

Regarding the number of platforms holding CVX, there are not too many large fluctuations in the number of CVX as well as the list. However, people can actively learn more about protocols such as Mochi Inu, Tokemak, Frax Finance, KP3R, Olympus,… with some questions such as:

- Why do these protocols own CVX? What are they planning with the amount of CVX they hold?

- Where does this amount of protocol CVX come from?

- Are they increasing their CVX holdings?

I firmly believe that people will have more insights and perspectives when learning more details about the protocols that own CVX and why they own so much CVX.

What Are The Investment Opportunities When Convex Wars Occur

Behind every insight we find in the crypto market, it all boils down to the story of how we can make money from those insights. So, with the forecast of the driving forces that can lead to Convex Wars and that Convex Wars can happen, from our perspective we will have a number of opportunities as follows:

- The safest but low profit is to invest directly in Convex Finance with native token CVX. Obviously, in Curve Wars, CRV will benefit the most, similarly in Convex Wars, CVX will benefit the most.

- A little more risk means higher profits, which is to bet on one of the platforms participating in Convex Wars such as Pirex, Clever, Badger DAO or Bent Finance. However, this requires in-depth research on the operating model of each project.

- A short look at upcoming LSD and Stablecoin projects to see who has the advantage in this Convex war to be able to create a deep liquidity pool and then bet on it. However, besides the liquidity factor of LSD and Stablecoin platforms, it is necessary to take into account the number of use cases of those assets. Liquidity is not the only and most important thing.

Summary

I believe that Convex Wars may take place in the near future and there are preparations for it. Are you prepared yet in terms of knowledge, skin in the game,… and if not then I believe you need that equipment because sooner or later Convex Wars will come.

Maybe in the near future the market will not support it, but in the future when the factors are formed again, Convex Wars will likely return.