Hackathon MVB VI organized by Binance Labs for development projects on BNB Chain has officially ended and had results. The Most Valuable Building Accelerator Program is a support program jointly led by Binance Labs and BNB Chain to provide direction and funding to emerging projects built on top of BNB Chain.

At MVB, there have been many projects that were incubated and later became an indispensable part of the BNB Chain ecosystem such as PancakeSwap, Space ID, Bakery, Paraswap, Ondo Finance,… Surely in MVB VI there will be A few hidden gems worth noting. What are you waiting for? Everyone, let’s get into the main content of today’s article.

Most Valuable Building Season 6 Winning Projects

Projects in the DeFi puzzle

Kinza Finance – Lending inspired by Solidly

Kinza Finance is a Lending & Borrowing platform that takes security as the focus of product development. Besides, Kinza Finance also designed its tokenomics model based on the tick (3,3) mechanism that was once very famous with Andre Cronje’s Solidly.

Some of Kinza Finance’s unique products and features include:

- veTokenomics: The veToken model of the new protocol aims to adjust the appropriate token inflation strategy to help the protocol develop in a reasonable manner.

- Real Yields: The protocol uses a dynamic interest rate mechanism in lending similar to AAVE or Compound to generate real profits.

- Asset Tiers: Kinza Finance has a hierarchy of asset types according to risk level to optimize borrowers’ ability to use capital.

- Liquidation Improvements: Kenza Finance introduces a new model that is more beneficial for those participating in asset liquidation.

- Stablility Pool: There will be specialized liquidity pools to handle liquidated assets to avoid causing bad debt to the protocol when liquidating assets on some other AMM platforms.

- Protected Collateral

The project will soon launch products in the near future. Everyone can join the discussion in the project’s discord to get the latest information.

Casmere Exchange – DEX Aggregator platform integrating LayerZero technology

Casmere Exchange is a DEX Aggregator and Stable Swap Cross-chain platform that uses LayerZero’s message passing technology allowing trading of any asset between different blockchains such as Avalanche, Polygon, BNB Chain, Ethereum & Fantom.

The operating mechanism of Casmere Exchange is relatively simple, for example: Alice wants to swap ETH on the Avalanche network to USDT on the Polygon network.

- Step 1: All of Alice’s ETH was transferred to 1inch on Avalanche by Cashmere Exchange to be swapped into USDT.

- Step 2: Cashmere Exchange proceeds to transfer all USDT to the USDT Avalanche Pool and notifies the relayer that the process is complete.

- Step 3: The Relayer notifies Cashmere Exchange on the polygon network to transfer USDT to Alice corresponding to the amount on the Avalanche network.

- Step 4: Polygon USDT Pool transfers the corresponding amount of USDT back to Alice.

An interesting point is that Stableswap uses liquidity directly on the Cashmere Exchange platform itself. Users can provide one-sided liquidity (single-sided liquidity) for Stablecoins so LPs will not need to worry about Impermanent Loss.

Hinkal Protocol – Protocol invested by Binance Labs

Hinkal Protocol is a protocol that takes zero-knowledge technology as the focus of development and application of zk technology to put privacy in the hands of users. With Hinkal Protocol, users can transfer money (stablecoins, crypto assets), trade, stake and participate more deeply in DeFi activities such as lending, borrowing, farming, long – short, …. completely private.

Hinkal Protocol targets its customer base not only at retail investors in the crypto market but also at organizations, businesses and partners who want to use the B2B method. Besides, other protocols can integrate Hinkal Protocol to protect user privacy.

Although it hasn’t launched a product yet, Hinkal Protocol already owns an extremely reputable backer system with many names such as Binance Labs, ODOS, John Jarve, Stanford Blockchain, Galxe,…

But in the context that privacy protection protocols for users are being abused as a money laundering tool, the future of Hinkal Protocol for me is still extremely challenging in the near future.

KiloEx – New generation Perpetual platform

KiloEx is a next-generation decentralized Perpetual platform that offers many improvements over existing models such as dYdX, Perpetual or GMX. KiloEx uses the Peer to Pool model, but there is no detailed information about KiloEx’s operating model.

Some outstanding features of KiloEx:

- Decentralized Copy Trading: Users can copy the strategies of famous investors on the platform with fake results using blockchain technology.

- Decentralized Referral: Users can refer users to receive additional rewards from the referred person’s trading fees when they trade.

- Hedging Tools: With KiloEx users can use the Delta Neutral strategy.

- Lower Risk Of Liquidation: Trading prices on KiloEx are taken from many different reputable sources, so Traders on the platform will be less affected by price differences.

- Highest Leverage Available: KiloEx provides great leverage for Traders to be able to earn more profits.

- Wide Trading Pairs: Traders have many options and are not constrained in cryptocurrency transactions.

From a preliminary reading, KiloEx doesn’t really have many differences, so I think I will need to observe this project more in the future.

Projects in the Infrastructure & Application Layer puzzle

Alt Layer – Platform providing Rollup service for underlying blockchains

As we see that in the operating model of Layer 1 is Ethereum and Layer 2 such as Optimism, Arbitrum, zkSync, StarkNet, Boba Network,… then Ethereum is the place for consensus and data storage besides Layer 2. is where transactions execute.

Then the Alt Layer is similar to Ethereum which is the consensus layer and the layers built on the Alt Layer are the execution layers and these layers have to pay fees to the Alt Layer because the Alt Layer provides the execution layers with decentralization and network security.

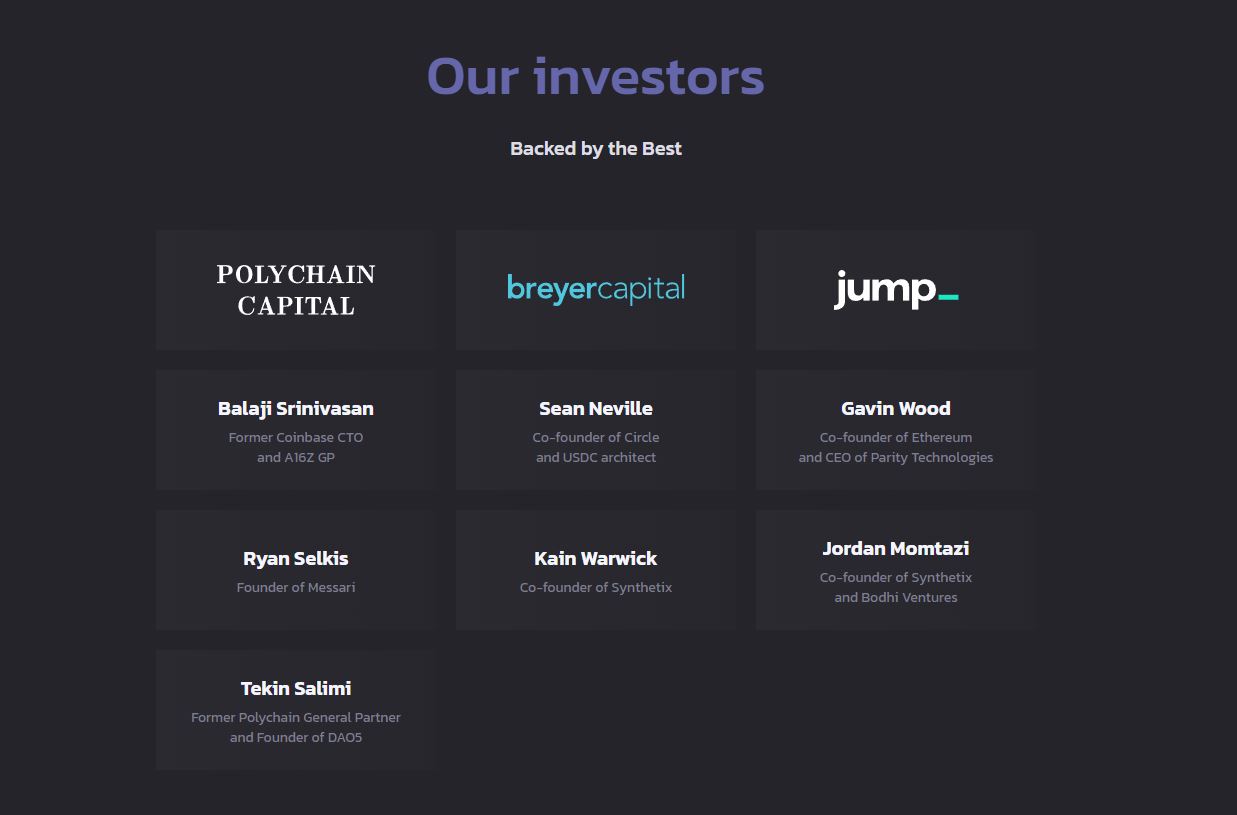

Up to now, Alt Layer has successfully raised an amount of up to $7.2M led by Polychain Capital, Jump Capital and Breyer Capital in addition to many prominent individuals in the community such as Garvin Wood – Co Founder of Ethereum and CEO of Parity Technology, Warwick – Co Founder of Synthetix,…

In addition, we have a number of projects that won this hackathon including:

- ZkCross: It is the zkRollup technology platform on BNB Chain, but instead of developing zkEVM, zkCross chose to develop zkWASM – which means the supporting programming language will be different.

- xBank Crypto: The platform allows for buying, selling, trading and many enhancements with NFT collectibles. Future could become one of the leading NFTFi projects on BNB Chain.

- Slise: The platform uses on-chain data to make ads more effective without violating user privacy.

- Masa: By using Soulbound Token and analyzing users’ on-chain activity Masa scores the credit of each wallet address in a fair and decentralized manner.

- HIM: Is a Gaming project.

- Sparkle.xyz: Is an astrology-oriented lifestyle application with a bit of spirituality and within each person.

- EthosX: Decentralized Perpetual platform with many innovations on BNB Chain.

Summary

Above are all the projects that won the 6th Most Valuable Building Accelerator Program organized by Binance Labs. Have you chosen which hidden gems to monitor in the near future or do you know if Binance is focusing on a clear trend? You can comment below the article.