In this article, we will look back at the money flow between ecosystems during the Bullrun 2020 – 2022 period with identifying characteristics, how money flows within an ecosystem and between DeFi pieces. This article is both for us to look back at the past and also for us to learn more lessons from the past so that we can have a differentiated perspective on the cash flow in the market at different periods.

Don’t wait any longer, let’s catch a bus together to return to the Crypto market in the period 2020 – 2022 to admire how crazy the cash flow has been.

Cash Flow Between Ecosystems During the Bullrun Period 2020 – 2022

Conditions for ecosystems to receive cash flow

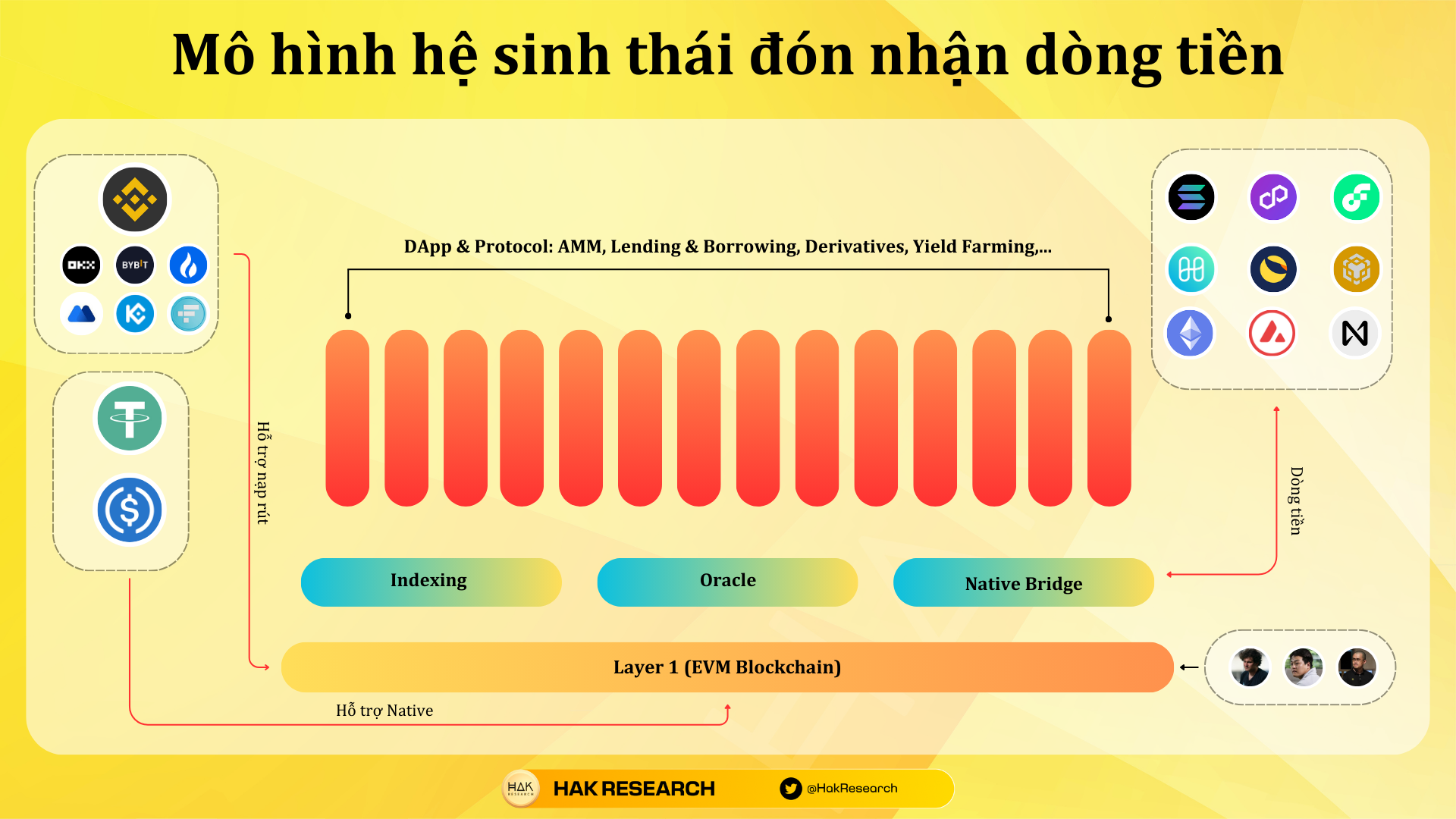

In the Crypto market period 2020 – 2022, in order for ecosystems to receive cash flow, which mainly comes from Ethereum, certain conditions must still be met. First, the ecosystem must have all the infrastructure pieces such as Oracle, API and especially a Bridge. In the market context of that period, when there were not too many Bridge platforms provided by third parties and there were many potential risks, Layer 1s themselves usually had to build a Bridge themselves. Typical examples include Avalanche Bridge and Rainbow Bridge of Near Protocol.

Second, the platforms themselves must have basic pieces in DeFi such as AMM, Lending & Borrowing, Yield Farming, Derivatives, Stablecoin,… so that when the money flows to the ecosystem, Services will be available to serve users. In particular, the Blockchains that attract the most cash flow will have some of the following characteristics:

- Own a truly quality Launchpad platform. With IDO bets with ROI up to 100, 200, even 300 times, it will be very easy to attract users. Representative ecosystems such as Solana, Avalanche.

- An ecosystem with a huge yield source from Farming is also easy to attract individual investors & whales to participate. Although it will be less than other ecosystems. Representative ecosystem like Fantom.

- An ecosystem with new pump dump projects with ROI up to hundreds of times. These projects can be called Memecoin, can be called Shitcoin and also attract many investors like BNB Chain at that time, Binance Smart Chain.

Third, the common feature of the ecosystems in the period 2020 – 2022 is EVM Blockchain, so moving DApp, Protocol or building a new project here is extremely easy. Some extremely successful EVM Blockchains during this period include BNB Chain, Polygon, Avalanche C Chain, Fantom, etc.

Fourth, Layer 1 platforms must receive support from major exchanges, especially Binance. In the context of Ethereum becoming too expensive, it is only suitable for big guys and Whales, but for small investors, there needs to be a faster, simpler and especially cheaper solution. Therefore, the fact that the exchange supports direct deposits and withdrawals for a platform Blockchain is one of the vital criteria.

The fifth and final factor for a Blockchain to attract cash flow is that Circle and Tether jointly announced that they will deploy USDC and UST on that Blockchain network.

And there is another special point in the Crypto market in the period 2020 – 2022: a successful Blockchain platform is often associated with a certain organization or KOLs. May be mentioned as:

- Sam, FTX and Alameda Research are the individuals and organizations behind Solana’s crazy growth.

- CZ and Binance are also behind many trends taking place on BNB Chain.

- Do Kwon and 3AC were also the people behind the success of Terra – UST until the platform collapsed.

- Even if Fantom is successful, it is impossible to deny the attraction of Andre Cronje.

However, there are a few ecosystems that have been truly successful without a large organization or influential individual but thanks to their effective strategies such as Avalanche or Polygon.

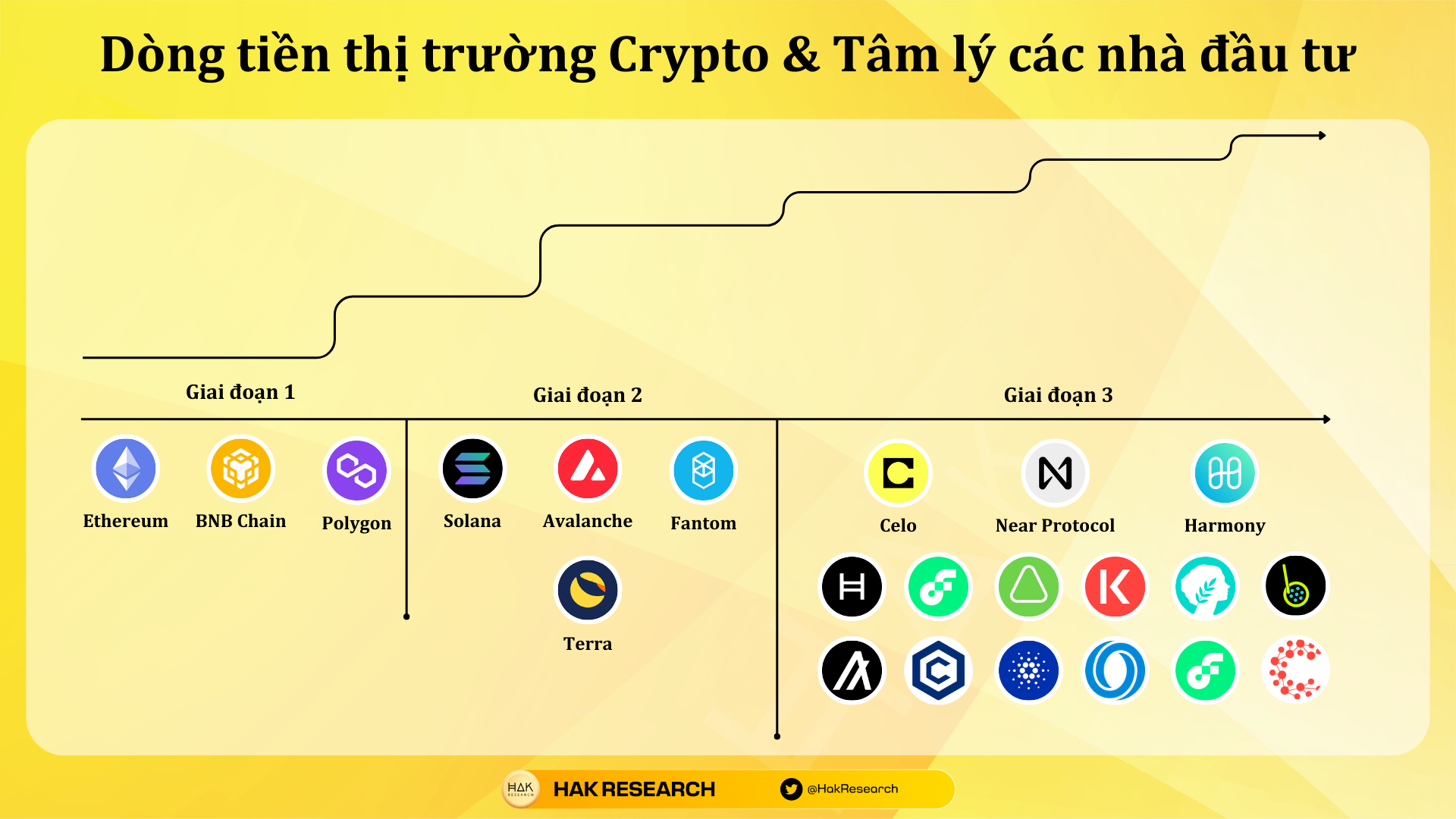

Cash flow and psychological stages

In the early stages When investors’ psychology is still quite cautious and cautious, ecosystems often have to be at a good level or higher to attract them, because then investors will focus on risks rather than profits. profit I can earn. Therefore, the underlying Blockchain must have a large and strong enough ecosystem to attract investors.

This period was the time of some of the early booming platforms with the emergence of Ethereum, BNB Chain and Polygon.

Next step is when the psychological barriers of investors begin to be forgotten when IDO bets of hundreds of times continuously appear and memecoin and shitcoin projects begin to appear en masse. At this time, investors began to be aggressive in their profit-making decisions. And also the stage of power transfer between the first Layer 1 layer to the next Layer 1 layers. In this next phase, the Layer 1 ecosystem is still relatively full of puzzle pieces, but the way it attracts the main cash flow lies in the Launchpad platforms and new projects constantly launching with APR for Farming up to thousands of percent.

If everyone remembers:

- Solana with the first IDO bets on Raydium and later Solanium with projects with huge ROI such as Star Atlas, Genopet, DeFiland,… and a series of DeFi pieces with huge Farming opportunities. At that time, Solana was one of the non-EVMs but with different strategies became one of the most attractive Layer 1.

- Similar to Solana, Avalanche at this stage with the Launchpad platform Avalaunch is equally attractive to users. Along with that, Incentive packages are used effectively, which is why money flows to Avalanche.

- Finally, Fantom gives its users a huge source of Yield from Farming. And Fantom itself also plays a role in transitioning the Layer 1 market to the final stage.

Besides names like Solana, Avalanche or Fantom, there is still a Terra that is not comprehensively strong, but with the attraction of 20% APR from UST, Terra also receives the attention of the community.

After this period The market officially entered a new phase when investors’ FOMO emotions reached their peak. At this time, the ecosystem does not need to be full of puzzle pieces to attract cash flow because at this time investors will have the mindset to find new ecosystems and bet on its growth. Some typical names for this period include Near Protocol, Celo, Casper, Polkadto, Cardano,…

Some notable signs of platforms at this stage include:

- Most platforms do not have a complete infrastructure, but the decisive factor is a Bridge that helps move assets back and forth between Blockchains.

- DeFi pieces only have a basic and simple way like a few AMM projects, Lending & Borrowing, Yield Farming and there are almost no advanced pieces like Derivatives, Stablecoins,… It can be said that the intrinsic of these projects is still at a low level and the reason it receives cash flow is the hope of investors.

- The appeal of communities and KOLs. At this stage, communities and KOLs play an important role in orienting late investors on how to catch up with market profits. When lands like Solana, Avalance, BNB Chain,… are finished, they are forced to look for new lands.

The realities of the Crypto market in the period 2020 – 2022

In fact, it is not that the money flow will flow in the direction from A to B to C to D to E and to F, but the market cash flow at this stage moves smoothly and the ecosystems have more and more converging factors. will receive more cash flow while other young ecosystems will receive less. For example, at almost the same time the cash flow from exchanges, Ethereum poured into Solana and Avalanche C Chain (the time difference is not too much).

A short time after the story about Farming emerged on Fantom, the cash flow from Ethereum, Solana, Avalanche transferred to Fantom, of course not all, but only those who love Farming, when the Yield dries up. they return to where they came from.

The money flow at this time is still flowing according to the general trend of the entire Crypto market. In the first phase, we witnessed DeFi and Layer 1 followed by the emergence of GameFi, Metaverse, NFT, Move to Earn all overshadowing. blur the growth of DeFi and Layer 1.

That’s why in a new cycle, we always have to assess where there will be places that can receive cash flow and explode strongly. Some signs can include:

- Where are stablecoins like USDC, USDT,… going? The market recently also witnessed a few new Stablecoins such as Paypal USD or Binance’s FUSD being researched.

- What trends are likely to happen in the near future and what are the signs? Signs can come from supporting exchanges, investment funds focusing on investing in,…

Summary

It can be said that some of the signs of cash flow reception in the old cycle can still operate again in the next cycle and certainly not all. Looking back at the past helps us predict and prepare for a better future.

Hopefully through this article, everyone can understand more about the cash flow between ecosystems during the Bullrun 2020 – 2022 period.