BendDAO is one of the leading NFT Lending platforms on the market today. However, recently, when witnessing a series of Blue Chip NFTs dropping in price heavily, BendDAO was also significantly affected when the TVL on the platform decreased by half in just a few days. So what is the current operating situation of BendDAO as well as whether the Bank Run risk will repeat with BendDAO? Let’s find out with Weakhand in this article.

What is BendDAO?

Overview of BendDAO

BendDAO is an NFT lending platform that applies the Lending Pool model, allowing users to deposit NFTs into the platform and borrow an amount of ETH immediately. BendDAO uses Oracles to calculate loans for borrowers as well as determine the level of liquidation for each loan on the platform.

BendDAO only allows NFT Blue Chip collateral to get the best liquidity as well as ensure safety for users to deposit ETH into the platform to earn passive income. In addition to Lending solutions, BendDAO also deploys many other features on the platform such as: Ape Staking or BNPL (Buy Now Pay Later) allowing buyers to pay a minimum of 60% to buy Blue Chip NFTs from NFT Marketplaces. Big as: OpenSea, X2Y2, LookRare,…

Operational situation on the platform

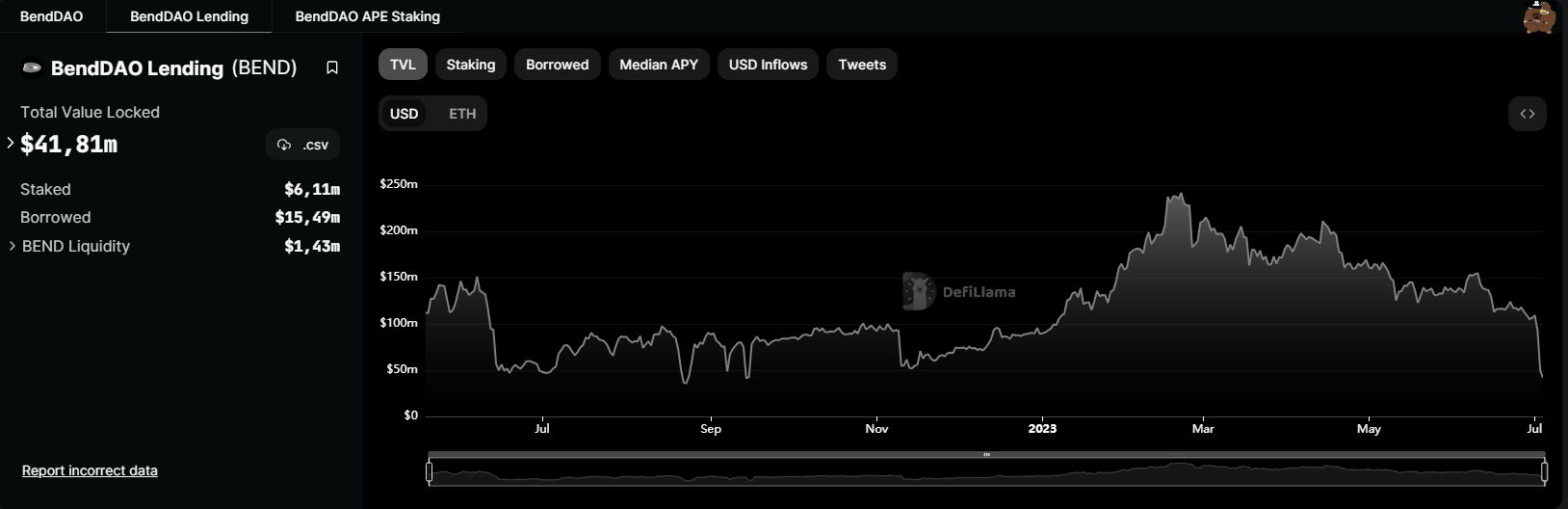

Regarding TVL on the BendDAO platform, it is witnessing a heavy decline, falling from 110M USD to only 41M in just 4 days from June 30 – July 3, 2023.

TVL on the BendDAO platform

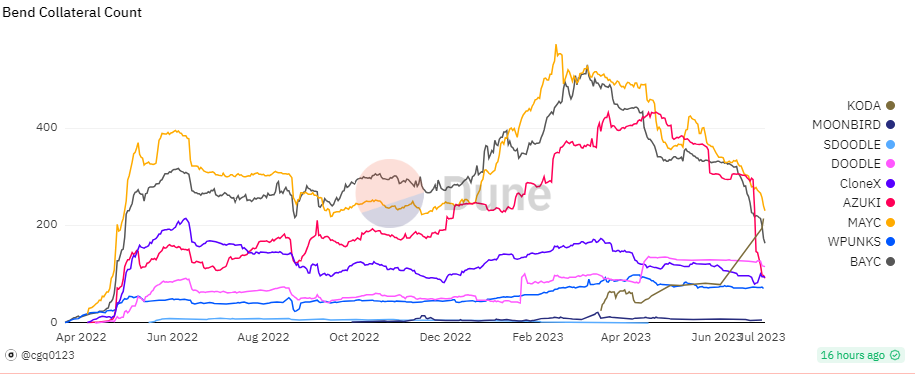

The number of collateral on the BendDAO platform has also seen a similar decrease. When we see the mortgage loans of Azuki, BAYC or MAYC are only 88, 159 and 219 respectively. This is very low compared to the peak in February 2023. This is understandable as the entire NFT market has witnessed a rapid and sharp decrease in just a short period of time, causing many loans to be liquidated.

Amount of collateral on the BendDAO platform

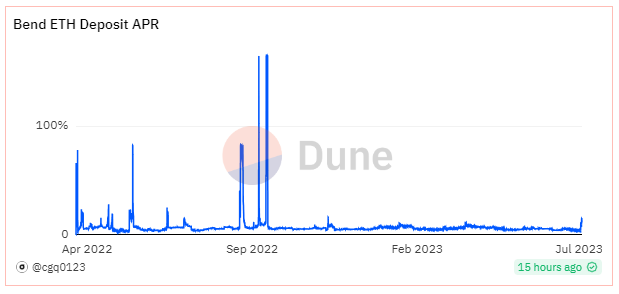

Regarding lenders’ interest rates, we are seeing a jump in recent days from 4% up to 14%. This shows that the demand for sending money to the platform is not high and users are even withdrawing ETH on the platform to their personal wallets.

BendDAO ETH Deposit APR

Horrifying Bank Run Past

August 22, 2022 can be considered a bad day for BendDAO. Due to concerns about bad debt for liquidated BAYC, MAYC,…, people who deposited money into BendDAO to earn automatic interest withdrew their funds en masse, causing bendDAO’s reserves to decrease from ~ 18,000 ETH to less than 15 ETH at that time. The reason is said to be because the liquidation bid must be higher than the outstanding debt on the NFT and at least equal to 95% of the current floor price of that NFT. As the floor prices of many collectibles have dropped recently, the liabilities for many NFTs on the BendDAO platform have exceeded the floor prices of these NFTs. This becomes increasingly less attractive to liquidators, thus leading to the appearance of many bad debts.

BendDAO is gradually falling into bankruptcy, forcing them to take urgent action. On August 23, 2022, BendDAO approved updates to gradually reduce the liquidation threshold from 95% to 70% effective September 20, 2022. The DAO also agreed to reduce the bidding lock time from 48 hours to 4 hours.

Ultimately, the results of this adjustment made BendDAO’s liquidation auction more attractive to bidders and thus restored some trust and deposits back into the platform. .

BendDAO’s Problems At The Present Time

Issues with price data sources on the platform

Azuki’s strong price drop recently caused Oracle to not update it in time and said that Azuki’s floor price was still 14.46 ETH while the floor price at that time was 9.7 ETH. This leads to many problems for lenders and creates opportunities for many whales to take advantage of to make a profit.

Communication Liquid NFTs had the same problem as BendDAO helped a whale buy 50 Azukis for free. People can learn more about this story in the tweet down here.

Bad debts appear

Currently, there are more than 20 Azuki NFTs being auctioned, but Price Oracle still thinks that the floor price of Azuki is 9.9 ETH while the floor price on Blur is 8.67 ETH. This caused not many people to want to participate in the auction and turned into bad debt on the platform with a current debt of 17.04 ETH.

BendDAO’s Workaround

Solve Oracle problem

Currently, BendDAO is using Oracle TWAP, which causes price data to update slower than the market. Therefore, the team is considering using Oracle Chainlink to help price data update faster on the BendDAO platform.

Solve bad debt problem

In response to the Fuds related to bad debt and causing the project to default again. BendDAO already has one tweets on twitter that they have enough money in Treasury including 300,000 USD to pay this debt.

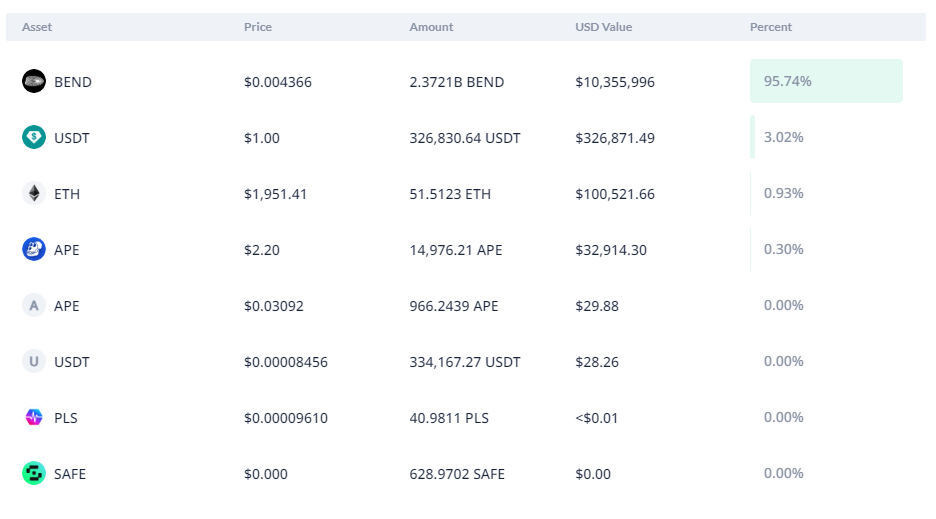

A day later, BendDAO made a proposal to use Treasury to participate in the auction to resolve bad debts and received more than 95% approval from the community. But let’s take a look at the assets in BendDAO’s Treasury, will it solve the problem if the market situation becomes more serious?

BendDAO Treasury assets

In the Treasury, more than 95% are illiquid BEND tokens and if the bad debt exceeds 300,000 USD, how will BendDAO deal with it?

Overall, this incident is not too serious for BendDAO, but they need to improve many features on the platform, most notably Oracle data sources to help the platform operate more stably in the immediate future. even when the market situation falls into bad circumstances.

summary

Surely the recent incident has taught BendDAO a big lesson about mistakes on the platform. Hopefully BendDAO will soon fix this error and return to normal operations on the platform.