The Arbitrum ecosystem continues to develop with many new upgrades in recent times, but there are many potential risks. Recently, the number of official Public Sales projects has been increasing, but the quality of these projects takes a lot of time to test.

In this article, everyone and I will review some highlights of the Arbitrum ecosystem recently!

Arbitrum Ecosystem On-chain Parameters

Overview number of wallet addresses & transactions

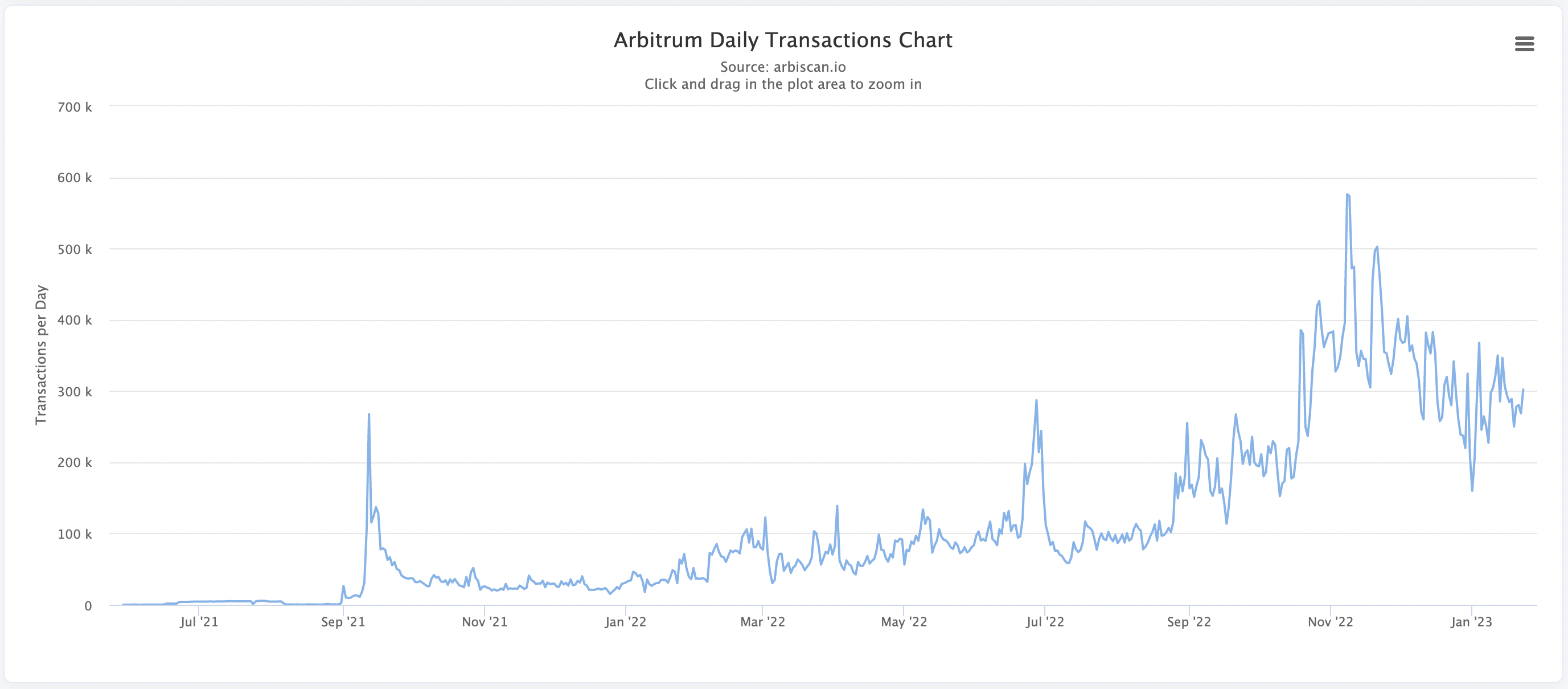

Number of daily transactions on the Arbitrum ecosystem

The number of transactions on the Arbitrum ecosystem is remaining at a relatively high level, but has decreased by about 30% compared to the peak at the end of 2022. Up to now, the number of Arbitrum transactions is maintaining at level is about 200K – 350K.

This shows that after the airdrop/retroactive fever, the number of users who continue to stick with the project based on the services available on the ecosystem is growing well.

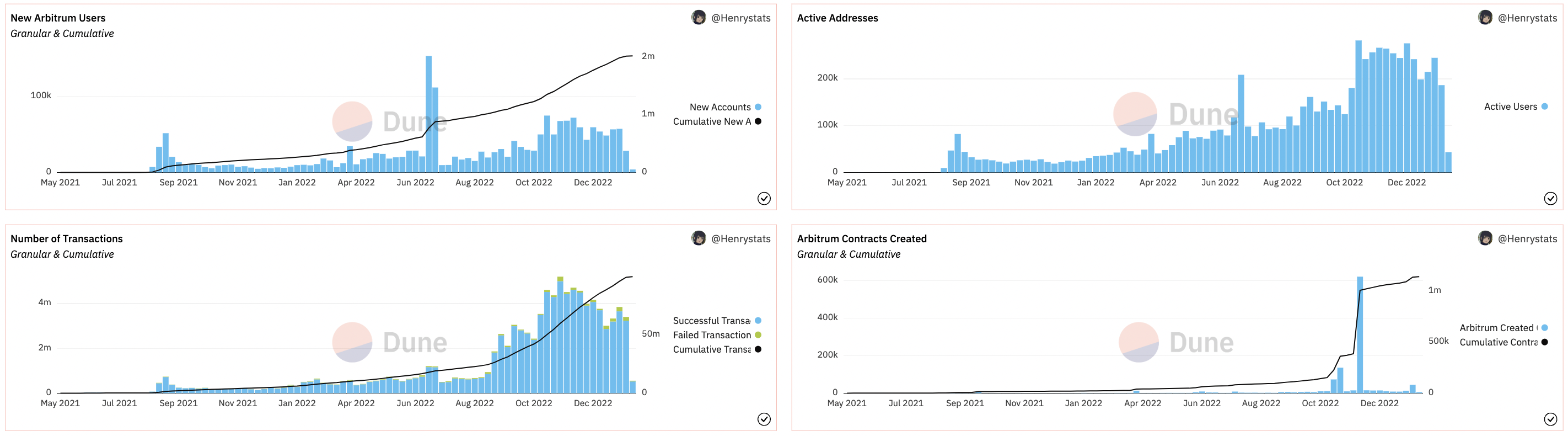

Some information about the on-chain index of the Arbitrum ecosystem

Some other numbers of the Arbitrum ecosystem such as the number of new weekly wallet addresses, the number of regularly active weekly addresses, the number of weekly transactions,… although no longer growing strongly, are still maintained at impressive milestones.

About Total Value Locked (TVL)

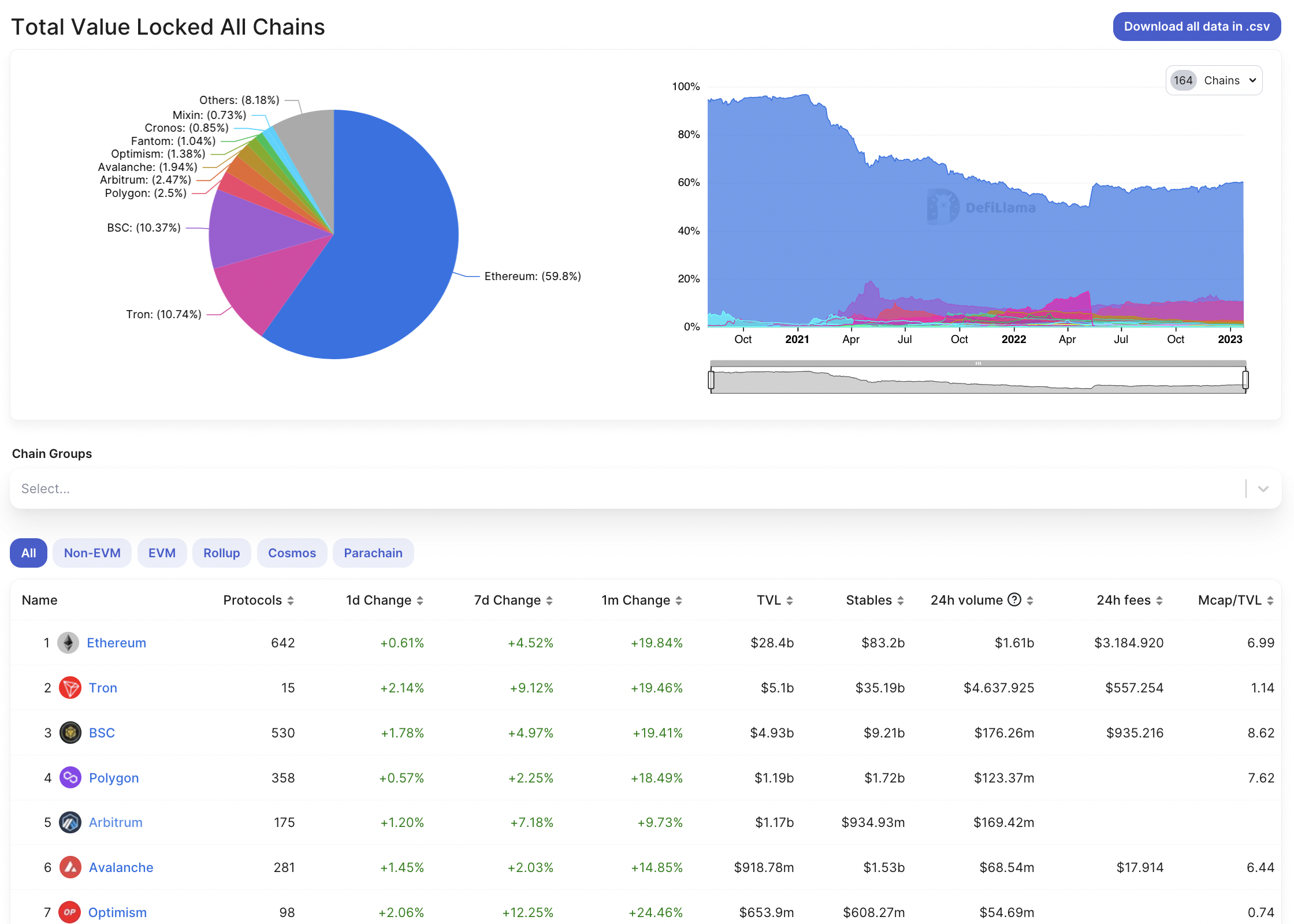

TVL of major players in the market

Ethereum bridges TVL is an indicator of funds locked on two-way bridges from Ethereum to Arbitrum.

According to this index, Arbitrum is currently the largest bridge after Polygon Bridges, but it is 40% higher than Optimism Bridge and 5 times higher than Rainbow Bridge, the bridge connecting Near Protocol & Ethereum.

After surpassing Polygon to become the TOP 4 ecosystems with the highest TVL in the market, Arbitrum recently returned this position to Polygon to return to its TOP 5, however this difference is only about $200M. But if people look at the number of protocols, Polygon has 358 protocols compared to Arbitrum which only has about 175 protocols.

Arbitrum’s TVL is also much larger than its industry rival Optimism.

Arbitrum W3/2022 Ecosystem Update

About Arbitrum

The project has not had any notable updates recently, but the project continuously supports projects through AMA events on the Twitter Space platform.

This can be considered a strong move in supporting the project in community building. Besides, this is also an activity aimed at informing about projects officially supported by Arbitrum.

About the DeFi segment

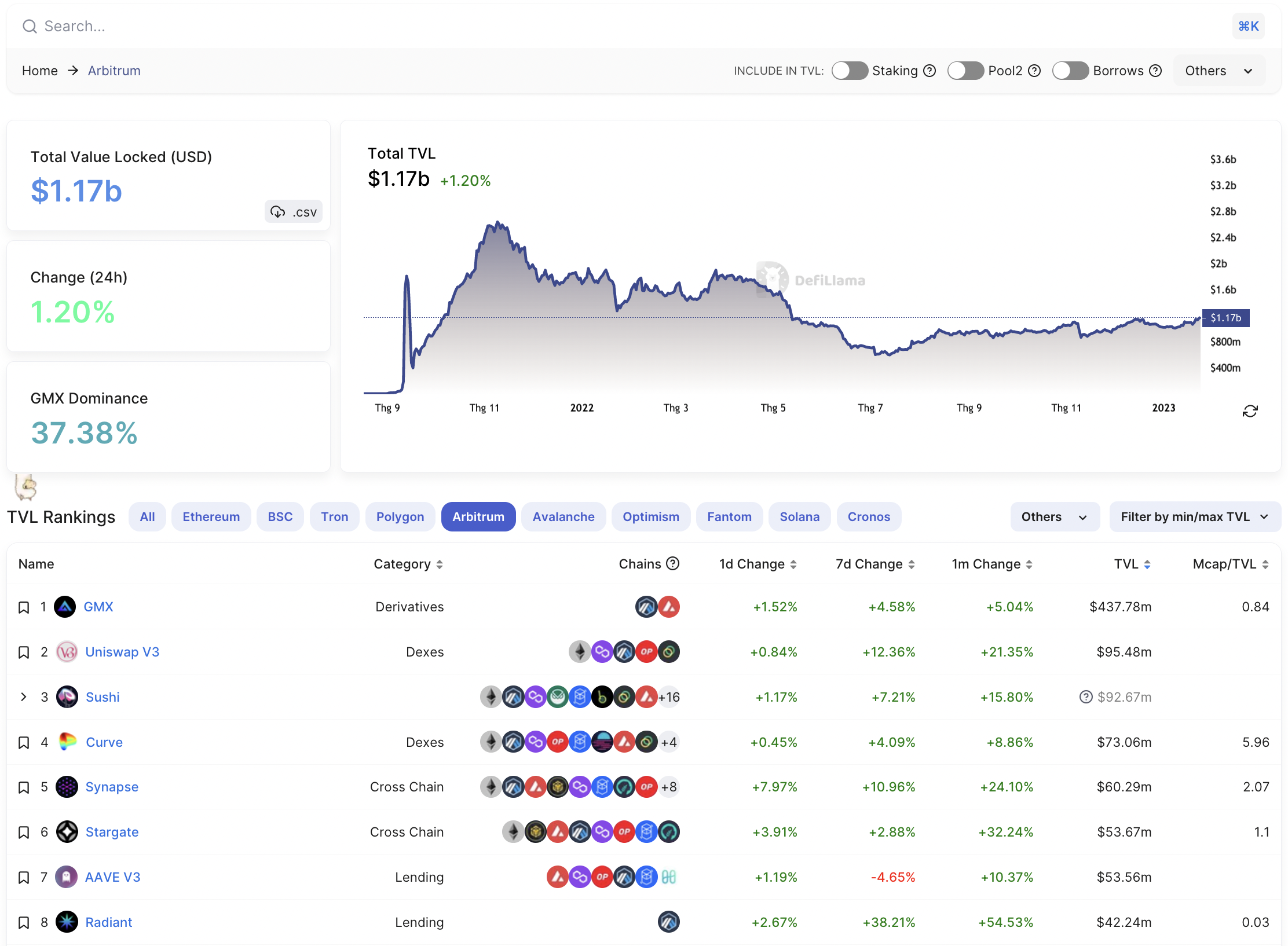

TVL of projects on the Arbitrum ecosystem

GMX continues to dominate the entire Arbitrum ecosystem

GMX continues to lead the entire DeFi ecosystem on Arbitrum with a total TVL of about $450M, 4 times higher than the protocol in second place, the Uniswap platform with a TVL of only about $95M. Certainly, GMX will continue to lead the development of the Arbitrum ecosystem for a long time to come.

However, the fact that an ecosystem is overly dependent on one protocol when GMX’s TVL accounts for nearly 40% of the entire system’s TVL makes the health of GMX also the health of the entire ecosystem. So if GMX has any problems, the Arbitrum ecosystem will also be seriously affected. However, we can expect that since its inception, GMX has not encountered any major problems.

Dopex – DPXUSD is Dopex’s biggest hope in Q1/2023

Dopex is expected to launch the next native stalecoin on the Arbitrum ecosystem as it is expected to deploy this stablecoin in Q1 2023. With the launch of stablecoins, it is rDPX, not DPX, that is the token that benefits the most as most of the collateral for DPXUSD is rDPX.

Everyone can learn more about DPXUSD in the article The Mystery Behind rDPX’s 305% Growth. Will rDPX continue to grow?.

Currently, Dopex does not have any new information about this stablecoin, but by building a native stablecoin on the Arbitrum ecosystem in the context of current native stablecoins not working effectively, the Arbitrum community is very hopeful about it. DPXUSD.

The proof is easy to see at the time I wrote the article The Mystery Behind rDPX’s 305% Growth. Will rDPX continue to grow? The price of rDPX was at $35 then rDPX posted an increase to $46 and is currently trading at $37 (at the time of writing).

In the context of Dopex’s Option products not working really effectively, I also have high expectations for the next product to be much more popular and popular than Option.

Umami Finance – Preparing to launch GLP Vaults

GLP Vault product launch roadmap

The product applying Umami Finance’s Delta Neutral strategy for liquidity providers on GMX or GLP holders is expected to be launched on March 9, 2023.

Everyone can learn more about how GLP Vault works in the article What is Delta Neutral? When The Game Is Built Around GMX.

So Umami Finance will be the first project on Arbitrum’s ecosystem to launch the Delta Neutral strategy specifically for GLP before Rage Trade or Jones DAO. Will the early launch of GLP Vault be a strong driving force for $UMAMI growth in the near future?

Jones DAO – Preparing to announce the Gamma Neutral strategy

Jones DAO first announced Smoothpaper, which is the Gamma Neutral strategy that Jones DAO shared in 2022. With this strategy, Jones DAO commits to eliminating 100% of the risks for liquidity providers on GMX and others. GLP holder.

This is expected to be a new growth driver for Jones DAO in particular and GMX in general.

Some important updates on the Arbitrum ecosystem

December 20, 2022: GammaSwap launches the first testnet to the community.

January 4, 2023: NFTPerp launches the Private Beta Trading Competition program, attracting community interest as this is an investment project that allows Long – Short popular NFT collections.

January 18, 2023: Rage Trade successfully integrates the Stargate protocol to help integrate cross-chain assets into Rage Trade pools such as USDC, USDT, ETH, STG, MAI, FRAX.

January 19, 2023: Radiant Capital is preparing to launch version V2 with many upgrades around increasing the number of collateral and improving tokenomics. Recently, this project was also shilled by Adam Cochran in the 2023 portfolio and the $RDNT token price has increased sharply recently.

January 19, 2023: Plutus DAO announces tokenomics upgrade to V2. From there, those who hold and stake the $PLS token will receive 3 times more profit from the protocol than usual.

Recently, there have been many projects on the Arbitrum ecosystem that have been forked from Solidly’s model or some other popular models that are Public Sale on the platform, although some projects have received support from the community such as: The price is not as good as expected. Some projects like 3xcalibur, Neutral Finance, Camelot, Factor DAO, STFX.io, Ikki Protocol, OreoSwap.

From my personal perspective, people investing in Public Sale of these projects need to pay attention to the following details:

- Details about Public Sale with parameters such as maximum total supply, initial total supply, purchase price, purchase marketcap, maximum purchase amount, token payment method,…

- Is the project’s community large, active and vibrant, interested in public sale,…

Some new projects such as: Yamma Finance, Firebird Finance, Ikki Protocol, Delta Prime, Neutral Finance, Tender.fi, Perpy Finance, Maddy Protocol, Arion Finance, Solitude DAO, Atlantis Finance, Olive, Beamer Bridge, Aboard Exchange, Cask Protocol,…

About NFT & Gaming segment

Regarding the NFT & Gaming puzzle piece on the Arbitrum ecosystem, the most prominent is only the Tresure DAO project with the only token $MAGIC. Let’s take a look at some outstanding on-chain parameters of this project.

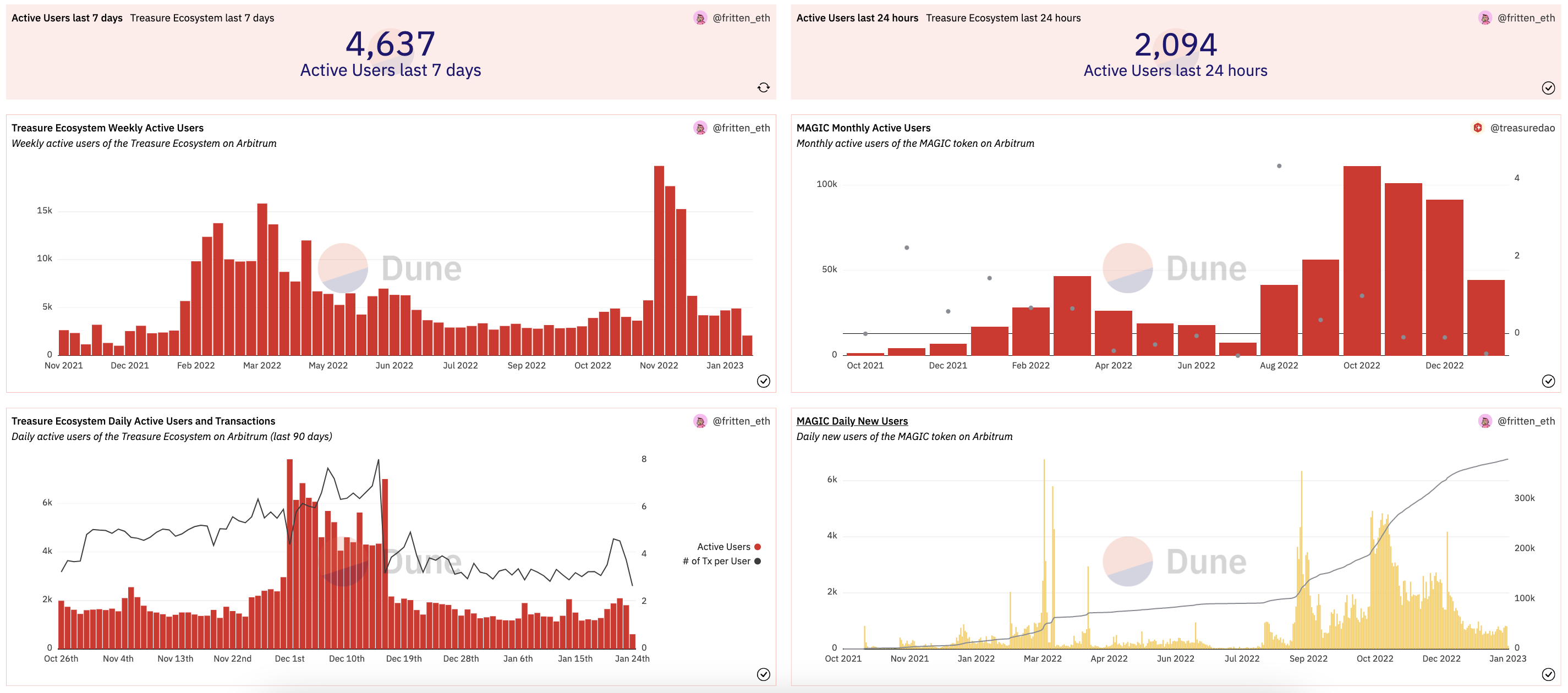

Treasure DAO’s on-chain overview

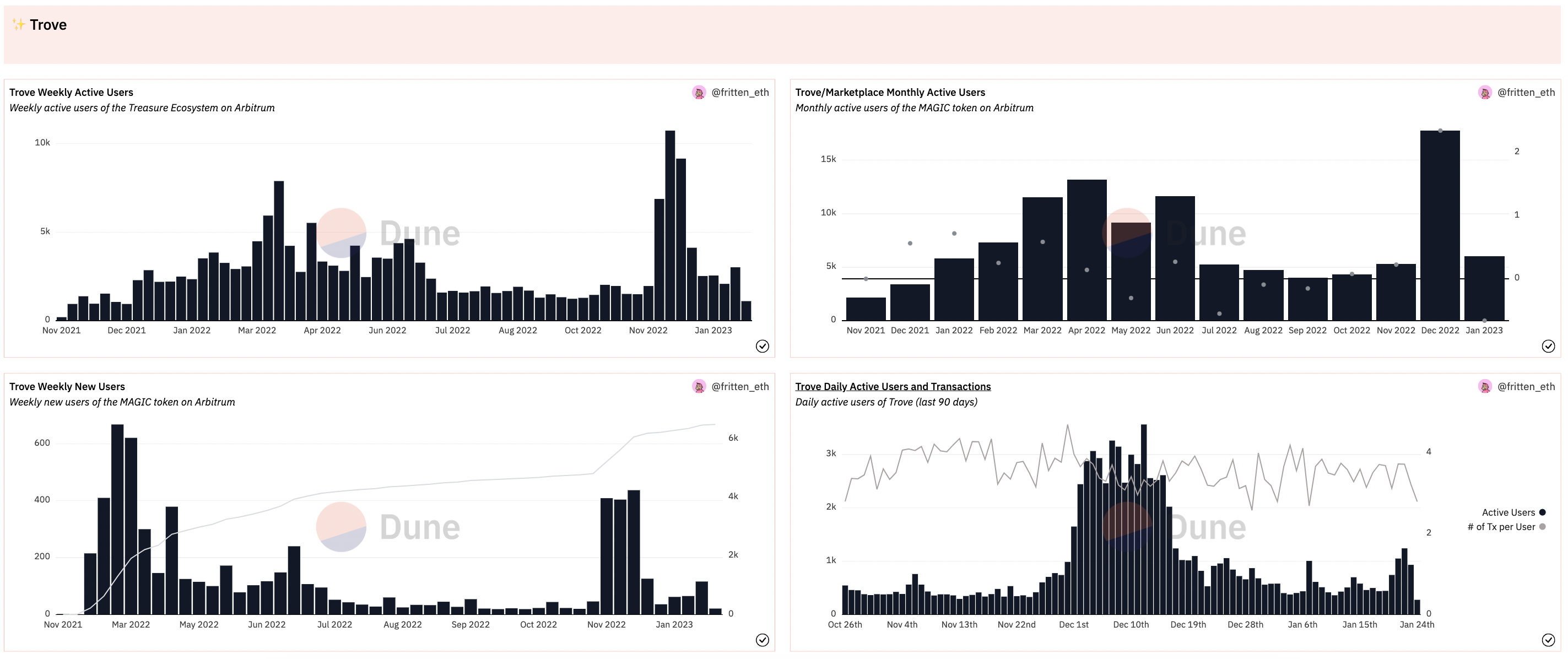

The on-chain parameter of Treasure DAO’s NFT Marketplace exchange is Trove

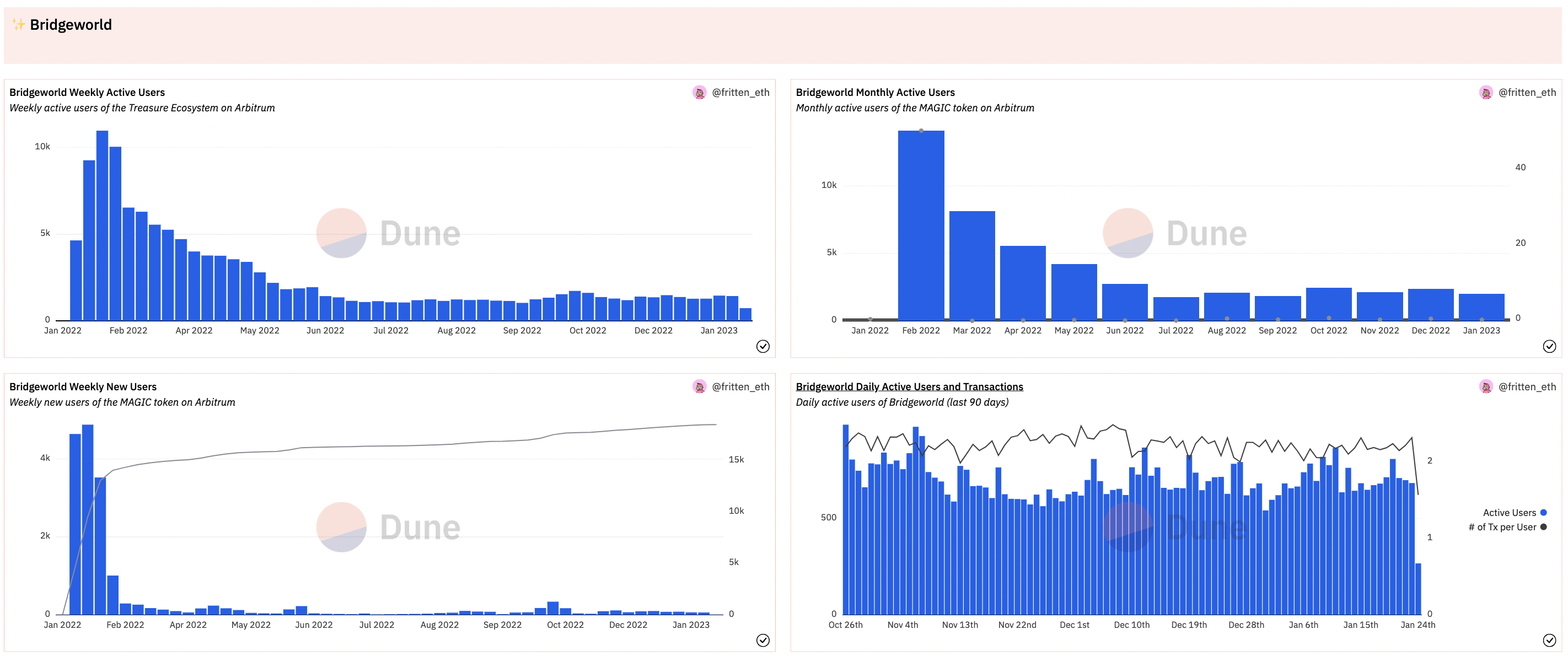

On-chain parameters of the game Bridgeworld

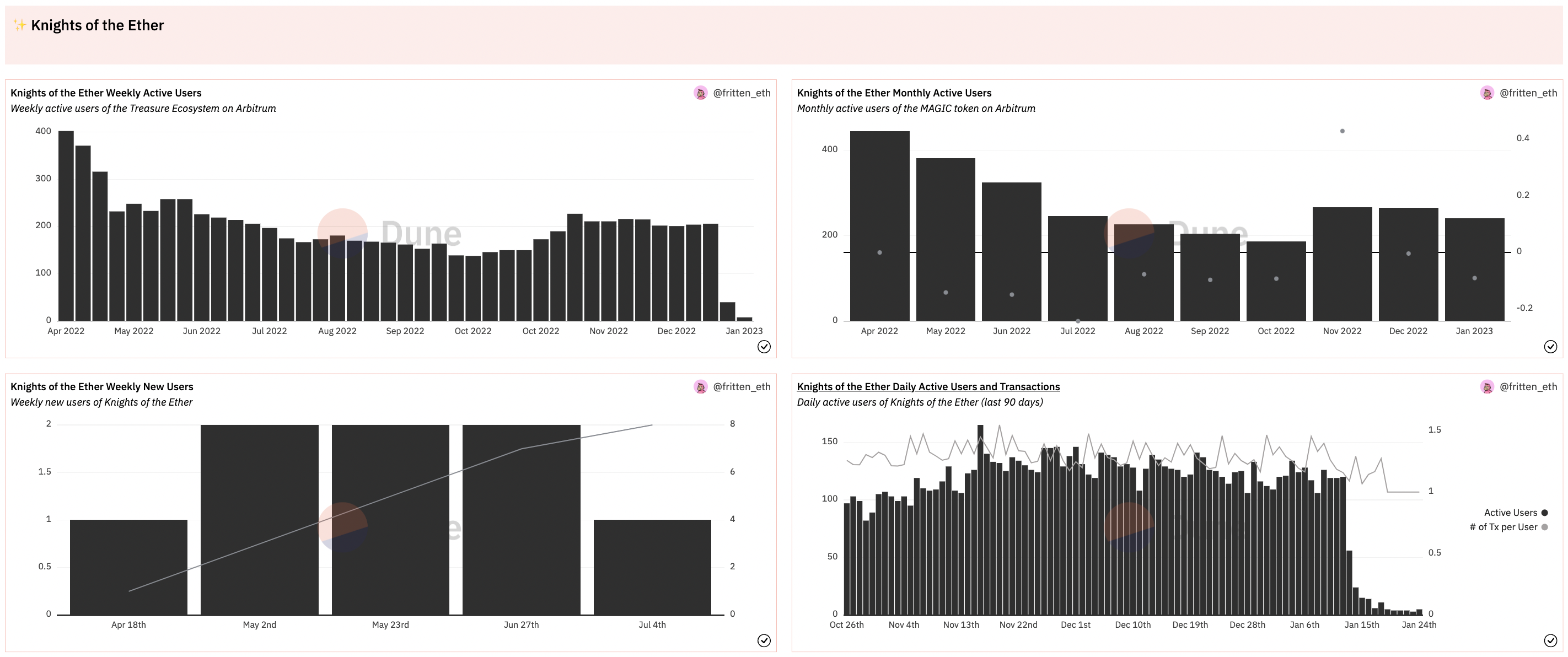

On-chain parameters of the game The Knife of the Ether

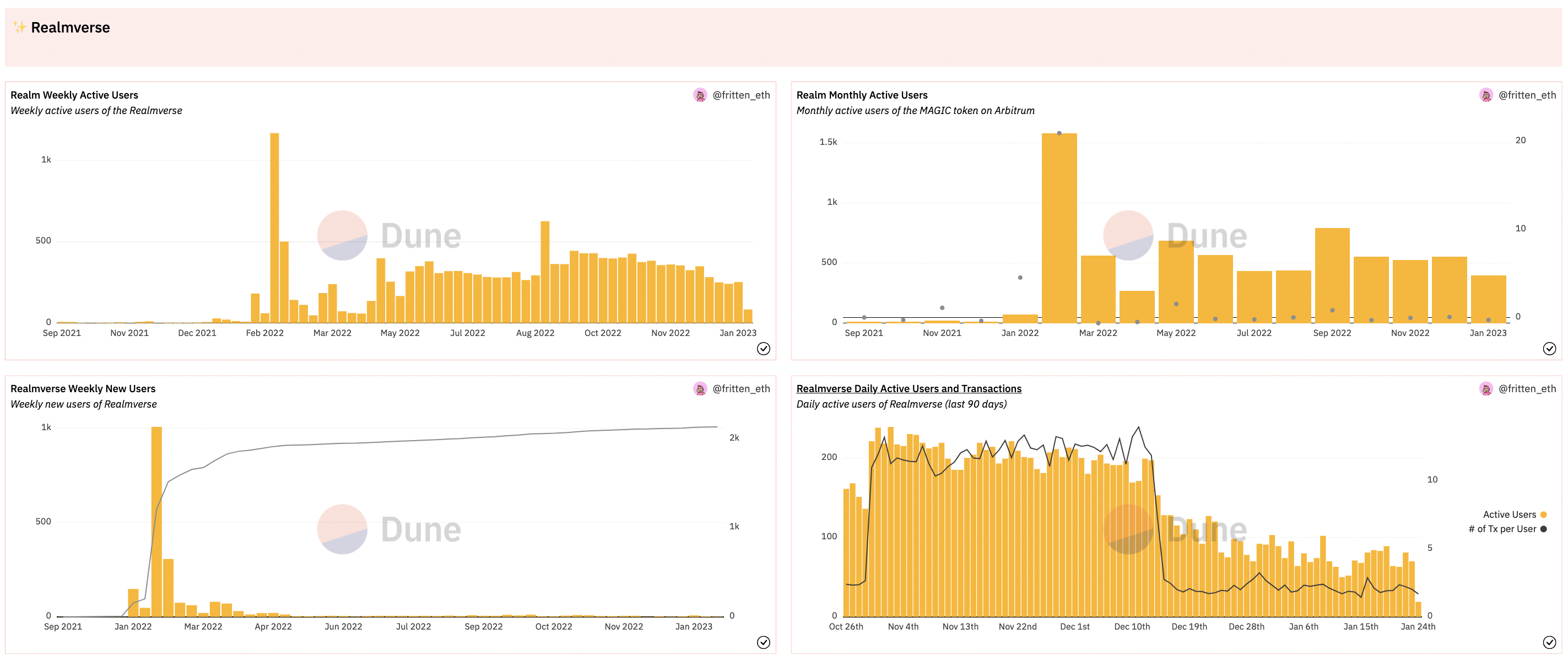

Realmverse game on-chain parameters

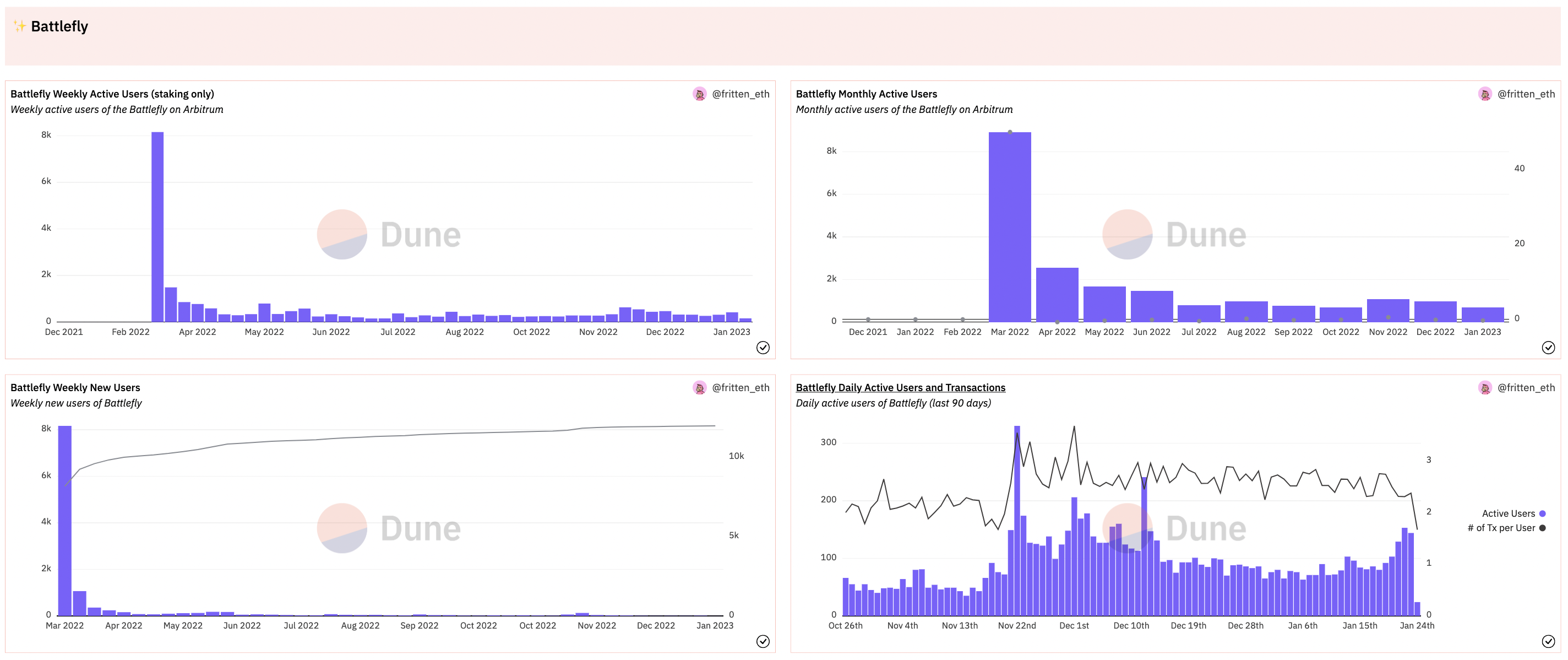

On-chain parameters of the game Battlefly

Treasure DAO aims to be a Nintendo Switch platform on the Arbitrum ecosystem. At the present time, there are many games with quite unique and interesting gameplay, however, the number of players of the project only grows strongly at first but gradually decreases in the long term.

However, according to my observation, the game Knife of the Ether still has its attractions to keep users on its platform.

In the near future, many new game projects will be deployed on the Treasure DAO ecosystem and promise a bright future with the $MAGIC token.

Some new NFT & Gaming projects: Forgotten Runes Wizard’s Cult, Rocket Monsters,…

Summary

Ecosystem Arbitrum continues to be strong in many different aspects. The only thing that the community is hoping for is that Arbitrum will deploy the token in Q1/2023.