After Curve Wars, we still don’t have real wars in the crypto market. Joe Wars was beautifully arranged, but it was born while the market was experiencing many events, so it didn’t show much. However, recently there is a war that is quietly going on: Balancer Wars.

Will this war open up a new round of growth for the BAL token? Let’s find out in this article!

Balancer Wars Is Being Formed

Overview of veBAL

What is veBAL?

The veBAL model was developed based on the veCRV model that was extremely popular in the past, however, veBAL also has a number of different adjustments to better suit the protocol.

When a user provides liquidity to the 80/20 BAL – WETH pool, the user will receive an LP Token, BPT. This is considered the first difference compared to veCRV’s model, which is simply locking CRV tokens from 1 week to 4 years. At Balancer, it will be a liquidity lock to help the protocol have more liquidity for the BAL pair – WETH.

Next, users will lock their BPT from 1 week to 1 year. The longer the lock time, the more veBAL you will receive. For example, if you lock 1 BPT for 1 year, you will receive 1 veBAL. This is the second difference, while Curve Finance requires a lock of up to 4 years, while Balancer only requires 1 year.

What is the purpose of holding veBAL?

- VeBAL owners share 75% of the entire platform’s revenue.

- veBAL holders have the right to vote on the use of the Liquidity Mining program on Balancer.

The Conditions That Create a War

Protocol revenue

Although Balancer is not 100% similar to Curve Finance, we can rely on Curve Finance’s business activities to make that measure for Balancer.

One of the two biggest motivations for users to be willing to lock their liquidity to receive veBAL is the project revenue sharing story. If a project has no users and no revenue, of course the liquidity provider will not accept its liquidity key to share zero revenue with the project. But with a project that already has products, revenue and users obviously of course LPs will have an incentive to lock up more of their liquidity.

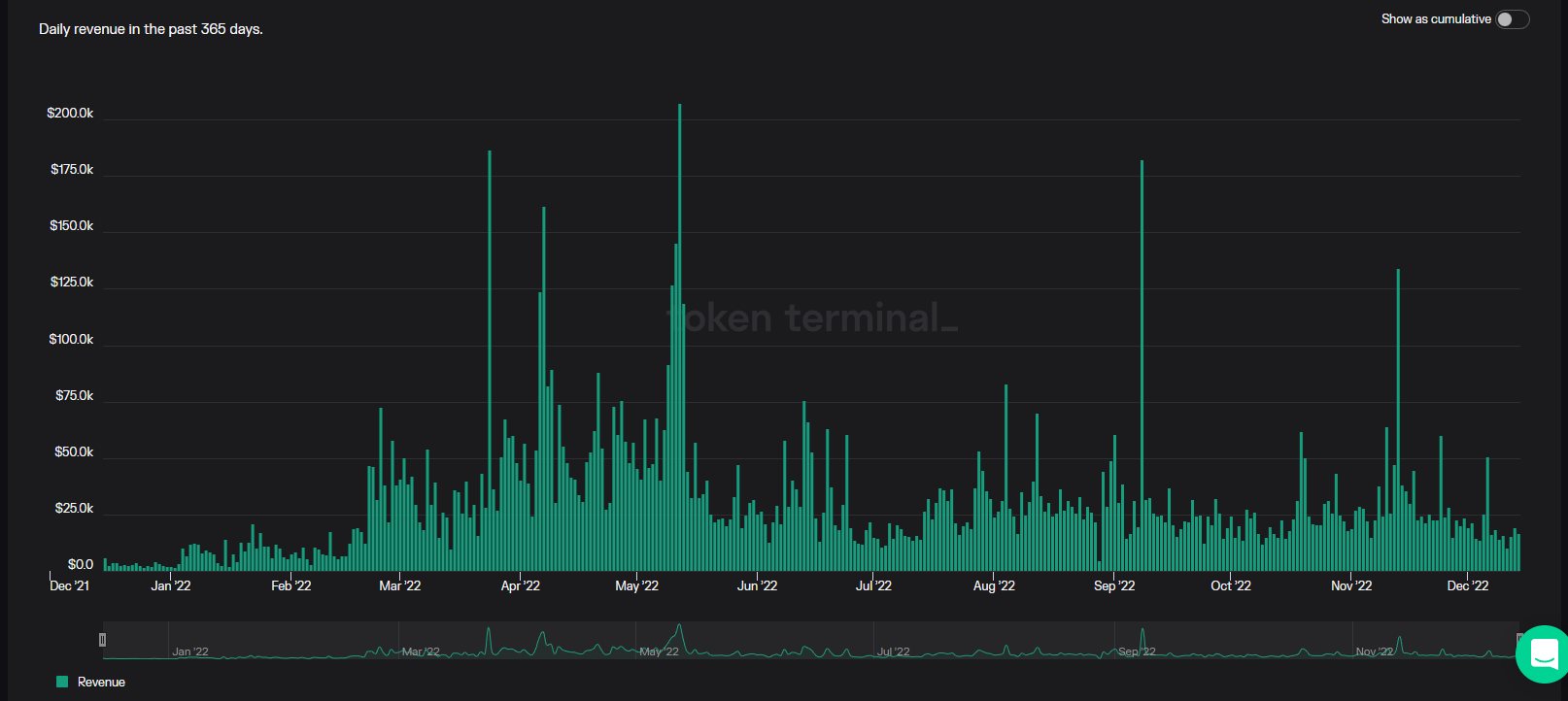

Even though the exciting DeFi summer is over, Balancer is still regularly generating organic revenue streams. Balancer’s revenue ranges from $10,000 – $30,000 per day, while other famous projects such as:

- SushiSwap: Sushi revenue ranges from $4,000 – $12,000 per day.

- PancakeSwap: Pancake revenue ranges from $100,000 – $300,000 per day.

- AAVE: The revenue of the largest Lending Protocol platform in the market is about $15,000 per day.

- Lido Finance: The revenue of Lido Finance – the largest Liquid Staking platform in the market is about $80,000 – $150,000 per day.

- Information about the revenue of the Uniswap and Curve Finance projects is unclear.

It can be said that Balancer’s revenue is not the top in the Crypto market, but this is still a relatively attractive number for investors.

At the present time, there are a number of trading pairs such as wstETH – WETH, rETH – WETH,… being pushed by incentives, through which it can be seen that the project is also quite interested in bootstrapping liquidity on Balancer and if any incentives from projects like Lido Finance or Rocket Pool, the more motivated LPs are to lock in the liquidity received in veBAL.

Warring parties

Aura Finance – Leading project

Aura Finance allows LPs, after successfully providing liquidity on Balancer and receiving BPT, to lock it on Aura Finance instead of on Balancer.

LP will receive higher rewards than directly locking BPT. This comes from the fact that any party holding more than 20% of the total supply of veBAL will receive more rewards. This is also a motivation to help players. LP chooses to lock his BPT on Aura Finance. In addition, when locking BPT on Aura, LPs also receive a reward of the project’s own native $AURA token, which increases LP’s profits.

Aura Finance’s strategy is relatively similar to how Yearn Finance and Convex participated in Curve Wars.

But if the common part of LP is $AURA, it will easily lead to $AURA being sold out, the value will quickly decrease and LPs will lose interest in $AURA. Aura Finance has launched the $AURA lock program to receive decision-making authority related to the Aura Finance project. From this, $AURA Lockers will have the right to decide which pool has the most incentives on Balancer or how Aura’s budget will be handled,…

Currently, only Aura Finance is participating in this battle without the participation of other parties. Aura Finance also has the upper hand so it will be relatively difficult for any new side to join the fight.

Tetu – Yield Farming Platform on Polygon

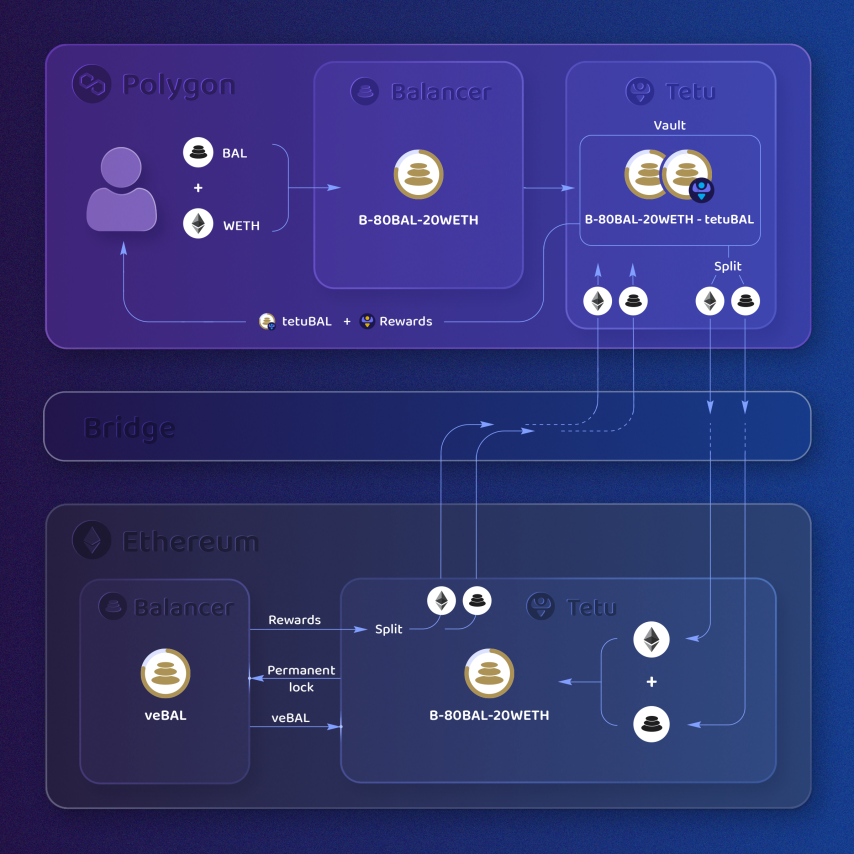

tetu provides many different products and strategies for users’ asset types, including tetuBAL, veBAL’s synthetic asset.

To receive tetuBAL, users will send both BAL and WETH to Tetu’s pool on Polygon to receive BPT, then continue to send BPT to Tetu’s pool to receive tetuBAL.

Users holding tetuBAL will receive all the equivalent benefits of holding veBAL to the fullest extent and can exit the tetuBAL position at any time the LP wishes. Up to now, Tetu has only held about 2% of veBAL, a very modest number compared to Aura Finance’s 22%.

Real war between whale and Balancer

A whale named Humpy started appearing as the largest LP in the BADGER – WETH pool. It was not until May when this whale interacted with the CREAM – WETH pool that people vaguely understood Humpy’s true intentions. After accumulating a large amount of veBAL and CREAM from the CREAM – WETH pool, Humpy created a proposal to establish the CREAM – ETH pool and set the pool’s transaction fee to 10%.

Taking advantage of the veBAL he owns, Humpy directs BAL rewards into the CREAM – ETH pool. Thanks to a smart strategy Humpy collected $1.8M BAL over 6 weeks, however, the CREAM – ETH pool did not attract too many users and the revenue generated for the protocol only stopped at $17K.

Realizing the incompatibility of the Humpy strategy with the development orientation of Balancer, there was a proposal, BIP – 19, with a number of goals such as:

- Tight alignment of veBAL’s design with Balancer protocol revenue means that 75% of fees generated will be reinvested.

- Remove CREAM – WETH pool to reorganize the system.

Despite owning 1.6M veBAL to oppose the proposal, Humpy still cannot resist Balancer’s community. However, Humpy still did not give up on his strategy, instead he found new groups with low volume to continue “recomposing the old one”, which caused this whale to get bogged down in a new battle.

This war revolves around tetuBAL – a Liquid Staking project for veBAL built on Polygon. The operating mechanism of tetuBAL is relatively simple: users will permanently lock their assets to receive tetuBAL. Besides, the project also deploys another 20 WETH – 80 BAL – tetuBAL pool at a point where this pool does not accept tetuBAL. Some of the requirements in proposal BIP – 19 mean that this pool will not be limited in terms of incentives.

Humpy quickly poured his money into the veBAL – tetuBAL pool, raising the TVL of this pool from $80,000 to $8,800,000 in just one night and as planned, the BAL inflation bonus poured into the pool 20 WETH – 80 BAL – tetuBAL. But due to flaws in his strategy Humpy was exposed to the risk of holding $8M of illiquid tetuBAL.

This led to a truce between Humpy and Balancer, which allowed Humpy to retain its tetuBAL count, while at the same time tempering its farming strategies so as not to be severely impacted by the protocol. Besides, there are a number of other “constraints” included that help the protocol become more secure.

Summary

Balancer’s revenue is not a very attractive number for more parties to participate in, and the assets that provide liquidity on Balancer are not too similar to those on Curve Finance (assets are at par with low risk). about IL) makes the veBAL war not as big as planned.

Currently, the war is relatively over as a large amount of veBAL belongs to Aura Finance, so it is relatively difficult for a few other parties to join the fight and win more than 25% of veBAL, so an explosive war about veBAL will be relatively difficult. It’s difficult to happen but we still need to closely monitor the project.

The actions of whales or Aura Finance will certainly have a big impact on the Balancer protocol. We can monitor the situation and find investment opportunities for ourselves.