Cosmos is famous for its Internet of Blockchain concept with many successful projects such as Cronos, Kava, Injective,… However, Cosmos Hub – the center of the ecosystem is still struggling to solve the problem of how to collect prices. treatment for ATOM. Most recently, Atom Economic Zone was launched carrying the mission and hopes of the entire Atom community.

So What is Atom Economic Zone (AEZ).? What is the impact of AEZ on ATOM? Let’s find out through the article below.

Cosmos Hub Overview

Cosmos Hub (Gaia) is the first blockchain in the Cosmos ecosystem to be officially mainnet on March 14, 2019. Hub is built on the technologies that have made Cosmos famous such as:

- Bridge across the IBC chain.

- Cosmos SDK framework toolkit.

- Tendermint consensus mechanism.

Build a network connecting blockchains independence is the ideal of Cosmos, but Hub itself always has an important role in guiding development, improving technology and adding value to the entire Cosmos ecosystem.

Such an important role, but ATOM – the Coin representing Cosmos Hub is always considered an unattractive asset, with few features and does not regain value commensurate with the development of the ecosystem. . Indeed, ATOM is only used for staking and paying network fees for some simple tasks such as depositing, deligating and unbonding.

Looking at Ethereum, ETH is involved in every corner of DeFi activity such as as collateral for loans or mint stablecoins, used as an exchange trading currency or payment for NFTs, or becoming a participating synthetics asset. into the derivatives segment.

Being unattractive in the eyes of holders causes ATOM to reduce prices, directly affecting Hub operations, because:

- ATOM is considered a liquidity gateway to the Cosmos ecosystem. If ATOM is attractive, it will attract a lot of cash flow and users to help the entire ecosystem bloom.

- Cosmos Hub operates on a Proof-of-Stake mechanism. If the ATOM price is low, the Yield will become higher LEAST Attractive to stakers and validators, thereby reducing the amount of ATOM stake, making the network less secure and decentralized. In addition, the low price of ATOM means the “cost” of attacking the Hub will be cheaper for hackers.

Faced with the above practical problem, the Cosmos Hub development team has stepped up research to find solutions to help increase the value of the ATOM coin. As a result, in September 2022, at CosmosVerse, ATOM 2.0 was proposed to be launched with major but unexpected changes. failure in convincing the community.

ATOM 2.0 Proposal Fails

Whitepaper of ATOM 2.0 was written by Co-Founder Ethan Bunchman and 11 other members of the Cosmos development team. The proposal includes 27 pages with the idea of changing the entire tokenomic of ATOM as well as turning Cosmos Hub into a center specializing in providing Interchain services (quite similar to Chainlink providing Oracle services), specifically:

- Tokenomics: Proposal to mint more ATOM within 36 months to push inflation from 36.68% to 41.03%, then gradually reduce the amount of mint to 300,000 ATOM/month, equivalent to 0.1% inflation.

- Interchain Security: Providing “validator” rental services, blockchains only need to focus on developing the ecosystem while the consensus side of transaction authentication will be taken care of by Cosmos Hub. The protocols will pay a portion of the transaction fees to the Hub.

- Interchain Allocator: Providing support in both capital by ATOM and users for potential new blockchains built in the ecosystem helps strengthen ATOM’s role.

- Interchain Scheduler: Bringing an on-chain tokenized crosschain block space market, considered a solution for MEV.

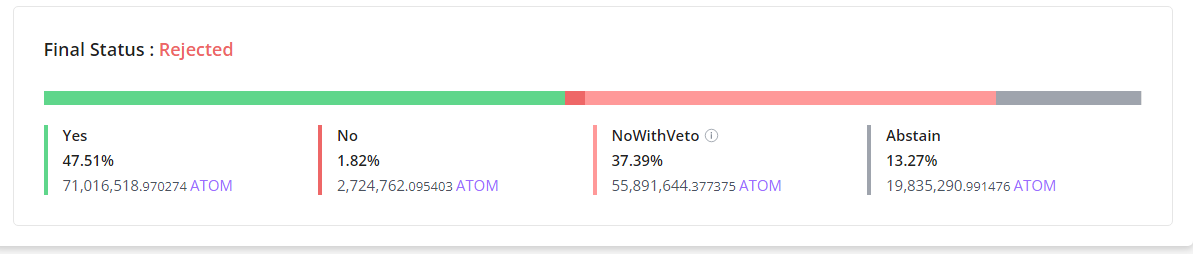

These are ambitious features and changes that the team behind Cosmos, however, ATOM 2.0 was not adopted when more than 37% voted No with Veto (This is an option that shows stronger opposition than NO, a proposal will be rejected if it receives 1/3 of the No with Veto votes).

The failure of ATOM 2.0 comes from many factors, most notably due to tokenomics changes having too great an impact without detailed calculations on the impact on current holders, and the community does not clearly understand the new innovations. and information on the use of Treasury’s allocated funds is still ambiguous….

These reasons are the basis for the team behind Cosmos Hub to reconsider the problem and find a more optimal approach to achieve their goals. give ATOM become an asset high applicability and big value.

ATOM Economic Zone (AEZ)

Recently, the hashtag #AEZ appears a lot on posts in the Cosmos community. AEZ is the acronym for Atom Economic Zone, a term that refers to the new economic model that Cosmos Hub built to help increase value for $ATOM and the entire Cosmos ecosystem.

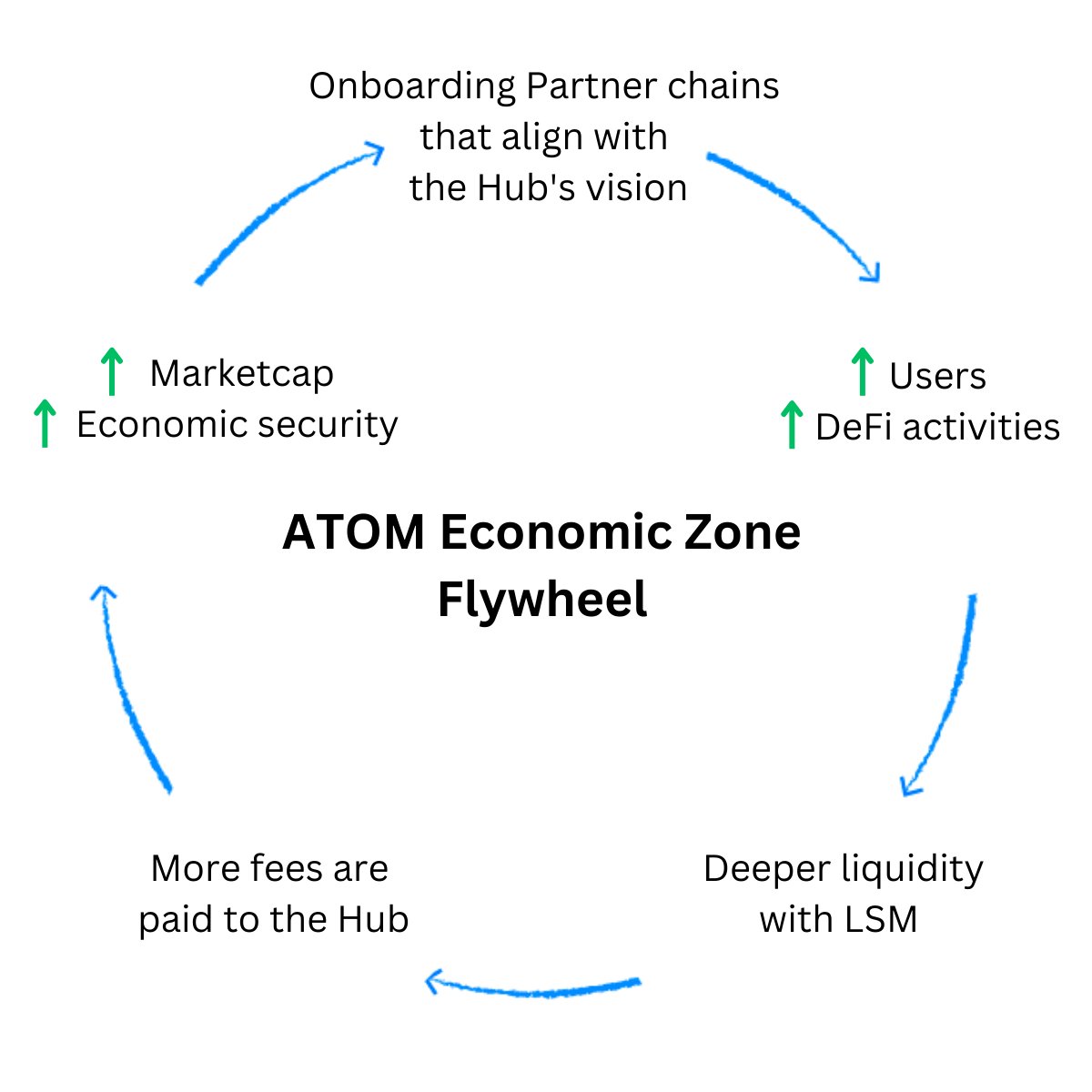

The essence of AEZ is relatively simple: Increase on-chain activity (DeFi, liquid staking & NFTs) -> Generate more Fees (Revenue Cosmos Hub) -> Increase ATOM Marketcap -> Attract Users & Liquidity –> …. Continue spinning.

Atom Economic Zone Flywheel (Src: Le Thang)

In theory, AEZ is very simple, however, the actual implementation is the opposite because:

- Cosmos Hub does not currently support smart-contracts (the development team itself has refused to integrate CosmWasm into the Hub #Prop69), which means DeFi dApps, NFTs,… cannot be built directly on the Hub and brought revenue for ATOM itself.

- ATOM increasing its price too quickly will be the reason for delegators and unstake validators to take profits, reducing the security of the network.

Faced with the above problems, 3 pillars have been designed by Hub to help AEZ operate smoothly.

Interchain Security

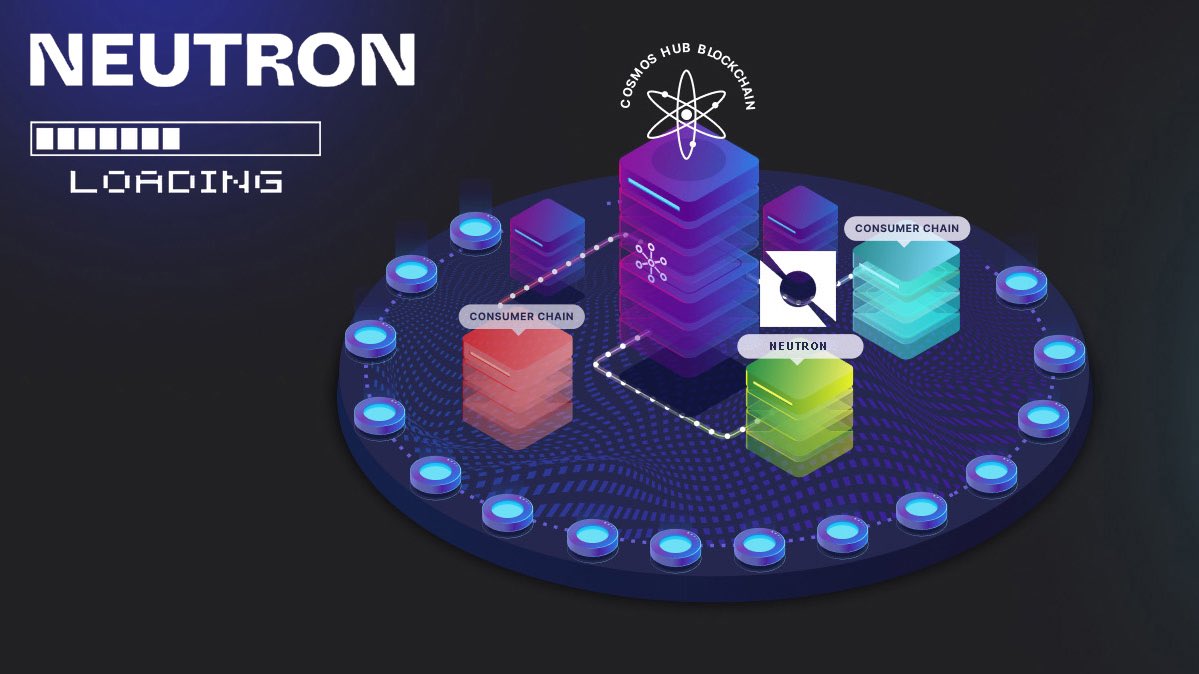

Interchain Security creates conditions for the new blockchain (Consumer Chain) to save costs and effort in building its own validator system by deducting a portion of network transaction fees to RENT validators available on Cosmos Hub. This means that Cosmos Hub directly benefits from the development of dApps, users and transactions from the Consumer Chain.

The final upgrades of Interchain Security have been completed and are ready for use. As of May 2023, there are a total of 3 blockchains: Neutron, Stride and Noble are lining up to integrate this service one by one.

The above mentioned blockchains are also three strategic cards supported by Cosmos Hub to realize the AEZ cycle, specifically:

- Neutrons: Built by the P2P validator team (a strong tech team involved in building Lido). Neutron’s mission is to build a CosmWasm integrated blockchain that supports optimal smart contracts for DeFi. Neutron is integrated with new Cosmos technologies such as Queries or Interchain Account, making it easy to bring liquidity from the entire Cosmos ecosystem to Neutron to serve users.

- Stride: Liquid Staking blockchain has mainnet and has a TVL of $30M. Similar to LSDs on Ethereum, Stride solves problem #2 by ensuring the amount of ATOM is staked in the network while still unlocking liquidity from them through the stATOM (LST) asset layer.

- Noble: Blockchain is responsible for the issuance of Circle’s USDC stablecoin on the Cosmos ecosystem. Combined with the mainnet of dYdX v4, the current Top 1 Perpetual Dex exchange, perhaps the demand for USDC on this ecosystem will grow dramatically.

Liquid Staking Module (LSM)

The second pillar mentioned in AEZ is the Liquid Staking Module, a tool developed to support delegators in converting the amount of ATOM staked at validators to Liquid Staking immediately with one click. Compared to before, users will have to wait 21 days to receive ATOM after unstaking before depositing into Liquid Staking blockchains.

LSM, when applied, will ensure stability for the entire network by maintaining a stable amount of staked ATOM, and immediately unlock a huge amount of liquidity for DeFi in general and Neutron in particular.

ATOM Accelerator DAO

The third pillar and also the vision of the development team, ATOM Accelerator DAO operates as a fund to support projects and research that bring value to Cosmos Hub. Maybe in the short term, this DAO will not have much impact, but in the long term, if used effectively, the DAO will ensure the development of the entire ecosystem surrounding ATOM.

In addition to the above 3 pillars, Hub’s development team is still cherishing the idea of revising Tokenomic for ATOM (pillar number 3.5).

Conclude

Hopefully this article has partly answered your question Atom Economic Zone (AEZ) as well as its effects on the ATOM token in the near future.

In my personal opinion, we can track this development through the Neutron blockchain because this will be the first cog of the machine. Although there have been quite a few DeFi protocols confirmed to be available on Neutron in the near future such as Astropod or Mars, I think the tipping point for DeFi will be when native USDC is minted on this ecosystem.