The Arbitrum ecosystem has officially launched the ARB token and has officially retroactived to users who have supported them during the past time. Besides, projects on the Arbitrum ecosystem also have many new updates in their products.

In recent times, the Arbitrum ecosystem has had outstanding changes and where the next opportunities are, everyone please follow along with us in the article below.

Arbitrum Ecosystem On-chain Parameters

Overview number of wallet addresses & transactions

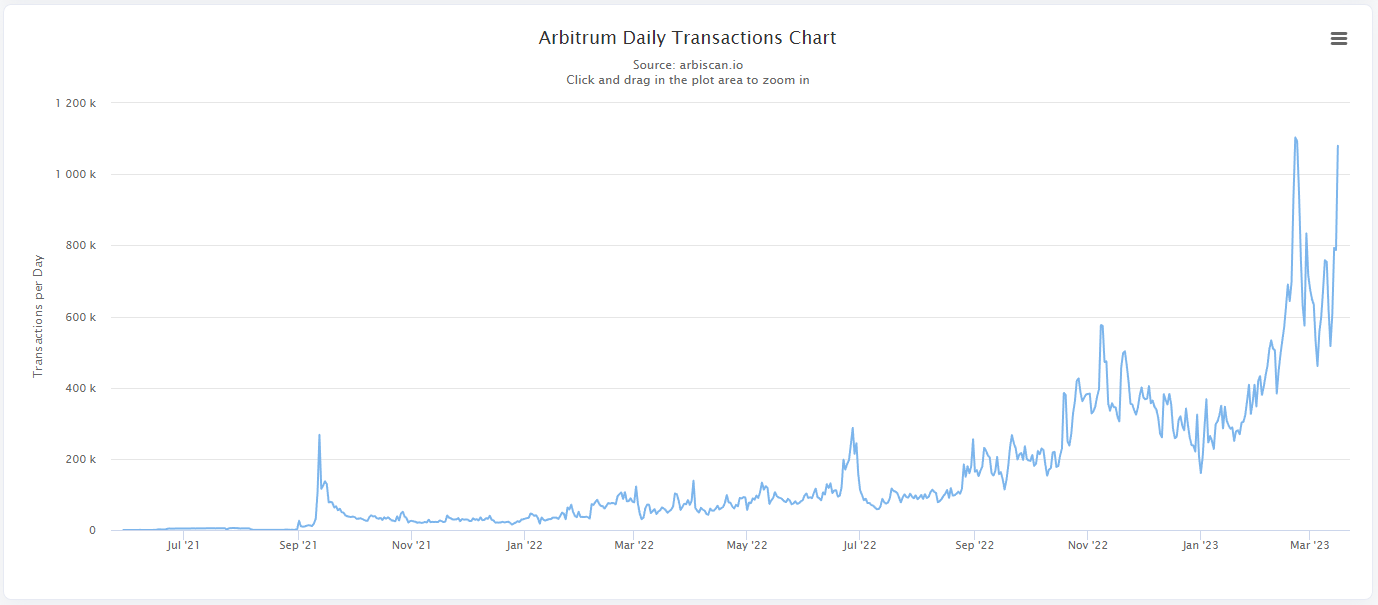

Arbitrum Daily Transaction Chart by Arbiscan

When the general financial market and crypto are both positive again after the US Treasury and FED decided to reach out to save all banks lacking liquidity if eligible, US stocks and Bitcoin will also form together. New peak in 2023.

Along with the really good market news, Arbitrum also quickly launched its token and immediately the number of transactions on Arbitrum has increased dramatically again, with a high possibility of reaching a new peak. than in February 2023.

Not only that, recently the number of newly established Arbitrum addresses has grown stronger than in Q3 – Q4/2022. This shows that users are really interested in the Arbitrum ecosystem with diverse projects in addition to a relatively sustainable yield source over the past time.

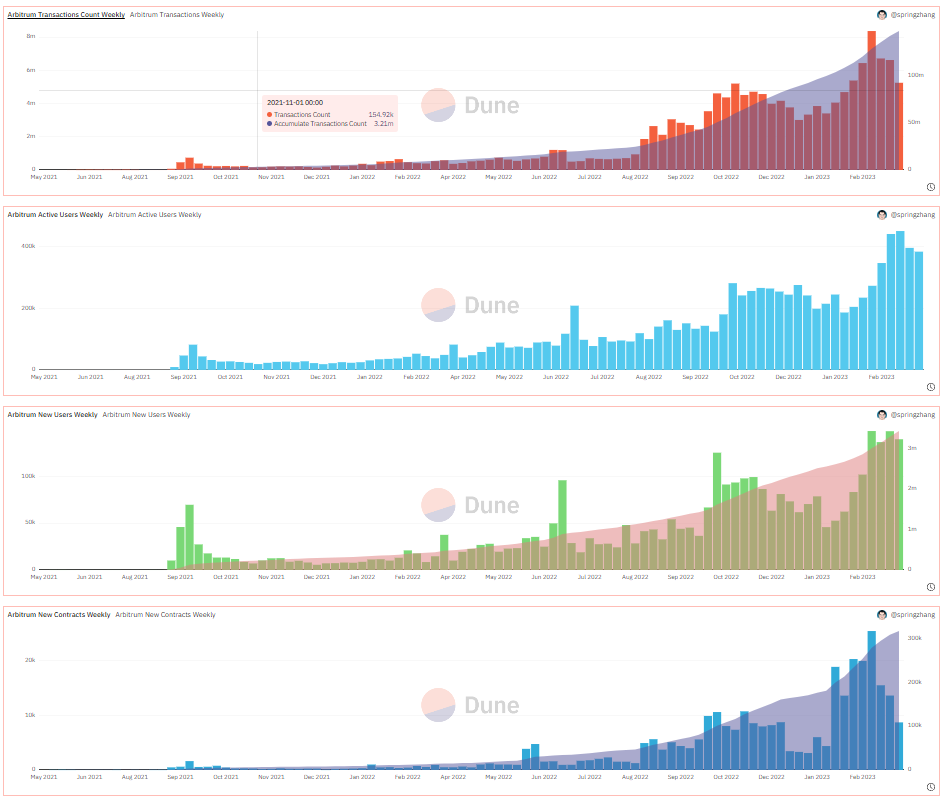

On-chain parameters on the Arbitrum network

All indicators reflecting the health of a Blockchain platform such as Active Users, New Users, Transaction Count, New Contracts, Gas Used, Blocks are all at a good level or better. In particular, indicators reflecting user activities such as Active Users and Gas Used are not inferior to the ATH level created in February 2023.

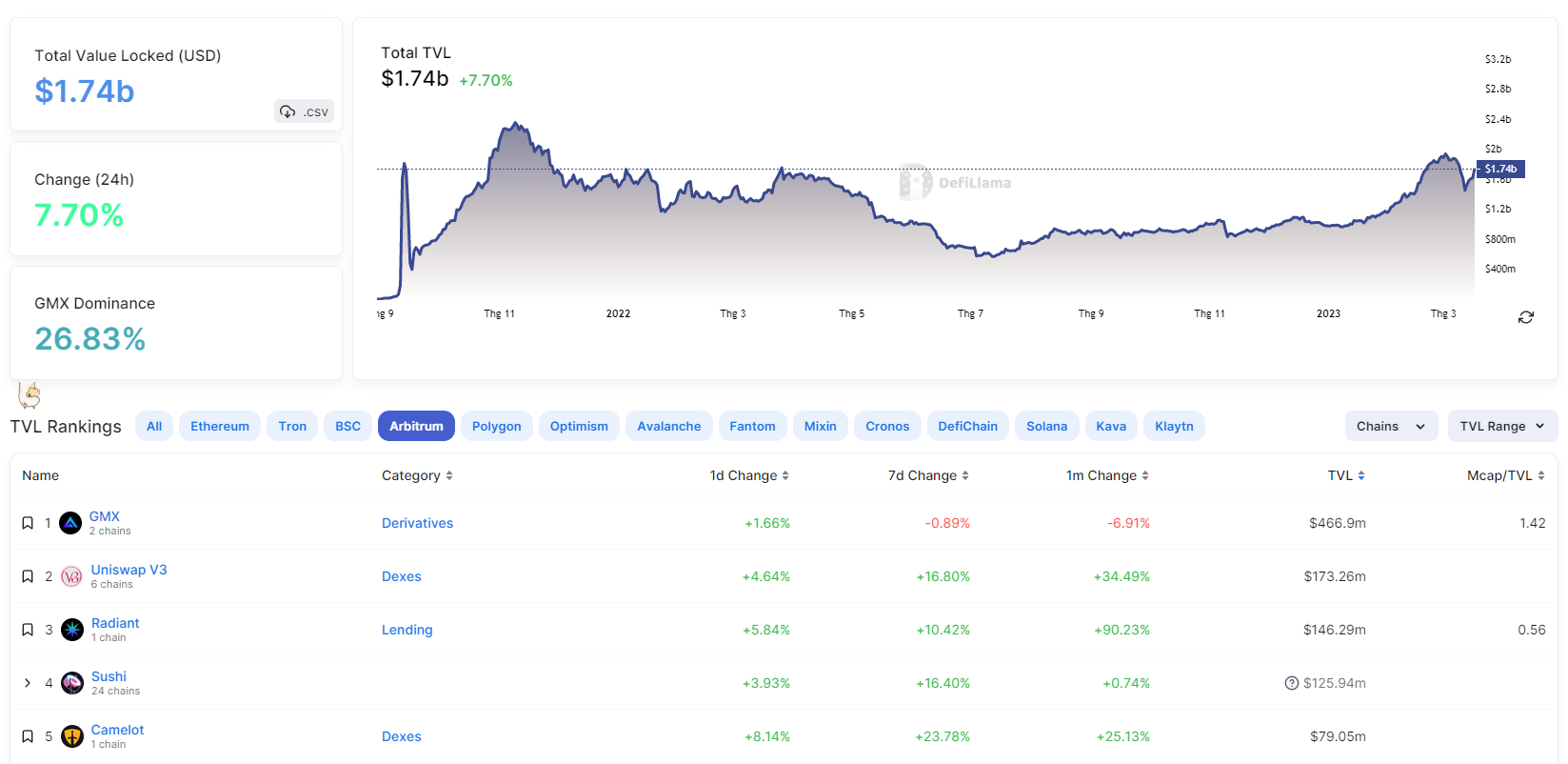

About Total Value Locked (TVL)

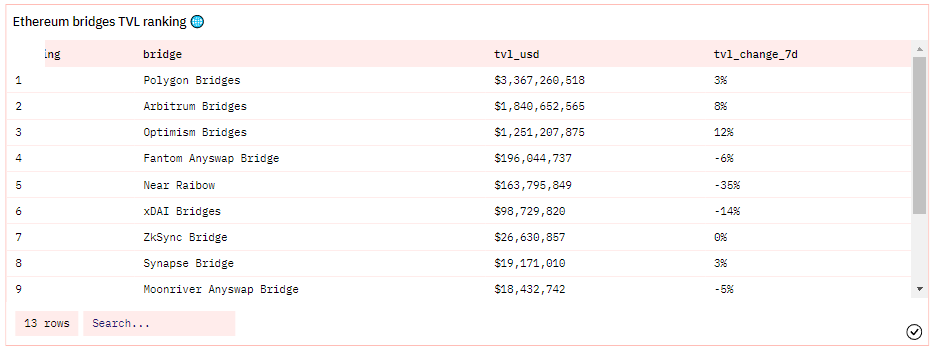

Ethereum Bridges TVL Ranking

Arbitrum Bridges’ TVL has had impressive growth over the past 7 days with an increase of 8%, somewhat lower than Optimism’s 12%, but compared to the Layer 1s that have influenced the crypto market such as Fantom, Near Protocol, … or some of the Layer 2s that are in the process of being developed, Arbitrum & Optimism is creating an extremely large gap.

In the near future, the duo Arbitrum and Optimism can fully use incentive advantages to attract cash flow from other ecosystems such as Ethereum, BNB Chain, Polygon, Avalanche,… Especially for Arbitrum. when their token amount is extremely abundant.

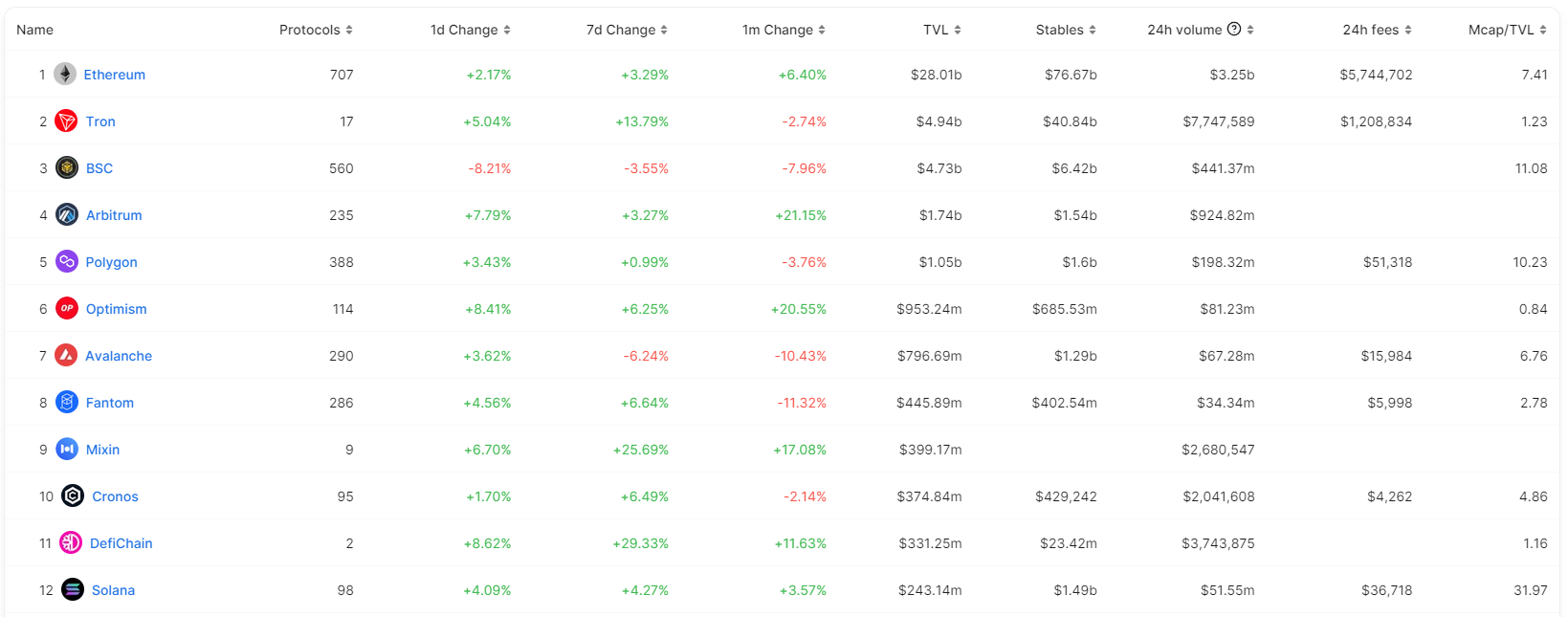

TVL Of Prominent Blockchains

When the market recovered, Arbitrum also quickly grew and continued to widen the gap in TVL compared to competitors below such as Polygon, Optimism, Avalanche, Fantom and narrowed the gap with BNB Chain or Tron.

With the current growth rate and certainly there will be abundant incentive sources in the near future, whether Arbitrum’s TVL can grow x3 in the near future to surpass Arbitrum, we only need to wait. Only time can prove it. But there is absolutely a basis for Arbitrum to surpass BNB Chain in the long-term future when this ecosystem has real innovations.

TVL in the Arbitrum ecosystem

An interesting point and also an effort of the Arbitrum ecosystem is the reduction of dependence on GMX. I still remember the times in Q3/2022 when Arbitrum’s TVL was occupied by nearly 50% by the popular Perpetual platform GMX. But up to now that level of dependence has decreased to less than 30%.

This proves that later platforms are also gradually growing to attract cash flow to their projects such as Radiant Capital, Camelot, Dopex, Jones DAO, Vela Exchange,… Not only that in the early days. Multichain projects almost dominate the TVL rankings, but now many native projects are rising and taking leading positions.

Update About Arbitrum & Offchain Labs

March 16, 2023: After much speculation about Arbitrum will launch ARB token Offchain Labs also took advantage of the ETHDenver event to officially launch the ARB token and many plans around ARB such as airdrops to users, announcement of Tokenomics, Token Telease, Token Use Case,… All information If you have any questions about this event, you can refer to Arbitrum’s Airdrop and Tokenomics Analysis article.

Besides, Arbitrum also introduced and officially participated in the Layer 3 race named Arbitrum Orbit. With this information, the Layer 3 battle gradually becomes clearer with Optimism having OP Stack & Superchain, zkSync having Hyperchain & Hyperbridge and StarkNet with Layer 3 being Layer 2 of Layer 2.

As Offchain Labs describes, all Layer 3 (L3) will be optional depending on the needs of the development team. These L3s will be built on top of Arbitrum Nitro, meaning all transactions will take place on L3 but will be stored and confirmed at L2, Arbitrum Nitro, and then these transactions continue to be packaged for sending. about Ethereum.

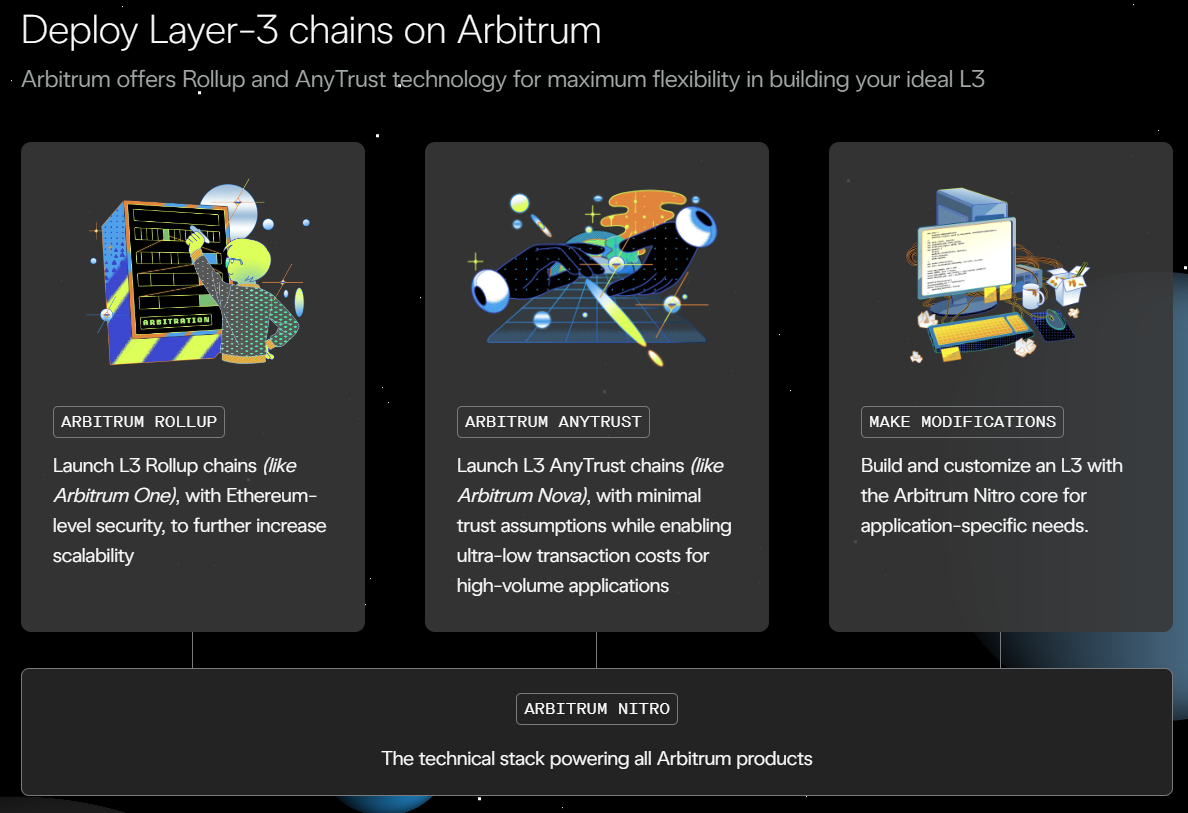

Layer 3 will include the following options:

- Arbitrum Rollup: Allows L3s to build a Layer 2 similar to what Arbitrum One did. This construction method will be suitable for development teams that want to build a Layer 2 based on the complete technology of Arbitrum One & Nitro.

- Arbitrum Anytrust: Allows L3s to build blockchains similar to Arbitrum Nova. Anytrust technology will often be suitable for NFT, Gaming, Metaverse projects with the need for fast transaction speed at extremely low costs.

- Make Modifications: By choosing to build L3 based on the Arbitrum Nitro platform (you will have x2 Nitro), these L3 platforms are usually allpications that specialize in serving specific and fixed goals such as dYdX specializing in Perpetual , Immutable X specializes in mint NFTs,… This is a product that directly competes with StarkWare.

Remember that Arbitrum Nitro is not an upgrade point for the Arbitrum network, but Arbitrum Nitro will upgrade to Arbitrum Stylus in the near future.

With Stylus and Rust, projects built on Arbitrum will have an execution speed 10 times faster than the current Arbitrum Nitro, along with transaction fees that will continue to decrease 10 times. Not only will DeFi on Arbitrum benefit, but games on Arbitrum Nova will also benefit similarly. When Arbitrum Stylus is born, the L3s on Arbitrum will be much faster and cheaper.

It’s interesting to see that not only is the Arbitrum ecosystem rescheduling debt, but the Offchain Labs development team itself is also diligently working to upgrade the Arbitrum network.

Arbitrum Ecosystem Update

Outstanding projects on the Arbitrum ecosystem

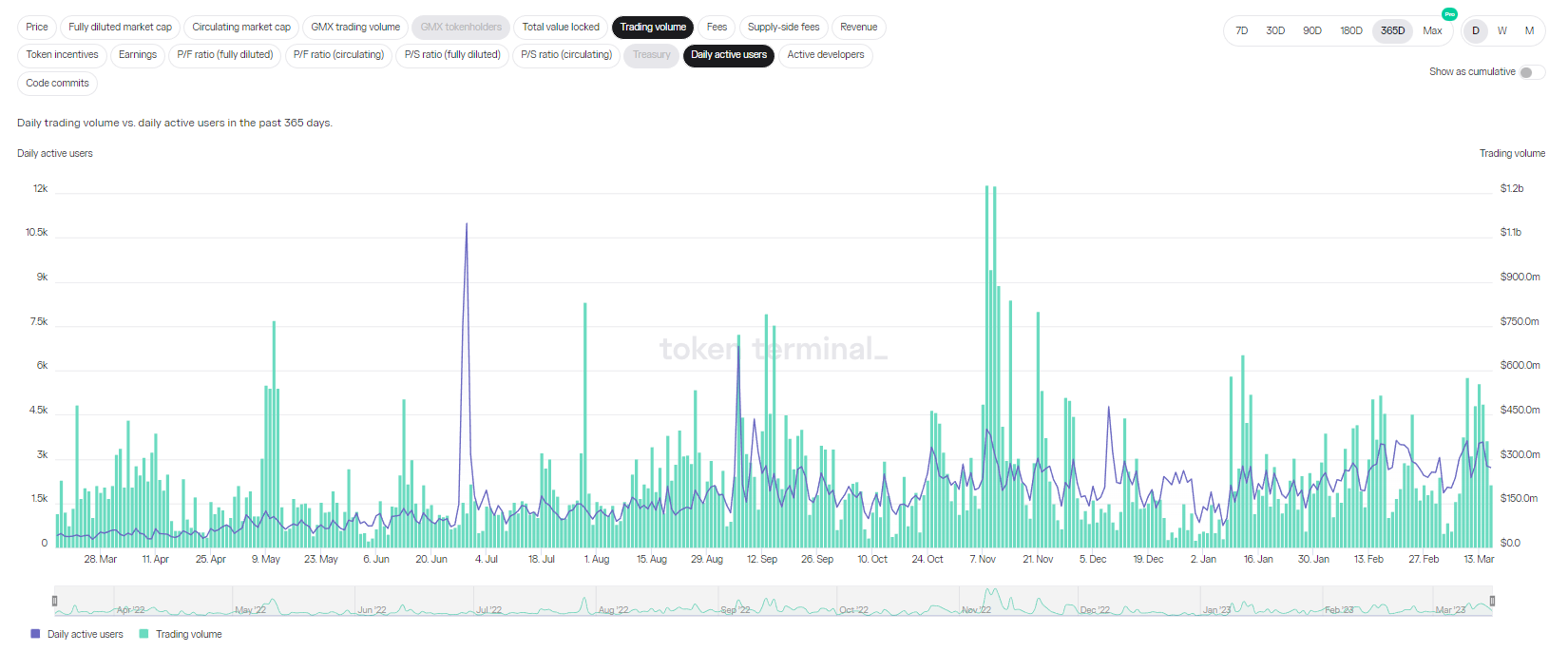

GMX – The platform needs innovation to grow

Daily Active User & Trading Volume on GMX platform

All indicators of Daily Active Users, Trading Volume, Revenue, Fes, Active Developers,… on the GMX platform continue to maintain at a high level and have not had too many fluctuations. GMX itself continues to play a core role in supporting the growth of the GMX ecosystem.

The main task that GMX needs to focus on at the present time is to maintain a steady revenue source for the project because with more revenue sources, the number of liquidity providers is increasing, making the experience of the project more and more difficult. Traders are also getting better and better. Therefore, when GMX’s revenue source shows signs of decreasing, it is also an alarm for GMX, the GLP ecosystem and the Arbitrum ecosystem.

In the near future, I think there will be a few ways for GMX to break through in terms of Trading Volume and Revenue, including:

- Long – Short support adds many types of assets instead of currently only BTC, ETH, UNI & LINK.

- Multichain development outside of Arbitrum can go to the Optimism network or some of the Layer 2 zkRollup that are being built, but moving to other Layer 1s at the present time is relatively difficult to finance.

- Integrate Layer Zero to bring native assets from other blockchains over for traders to play Long – Short.

It can be seen that GMX is entering the saturation phase and the project itself needs many breakthrough changes to transform. However, with GLP’s ecosystem, GMX’s steps should be carefully calculated to avoid causing the collapse of the entire ecosystem.

Some updates of other platforms

Perpy Finance – a copy trading platform, where users connect with highly profitable traders on the GMX exchange, is currently being sold to Public Sales on the platform. Camelot. However, unlike the usual fomo, currently Public Sales projects on Camelot are no longer attracting users. We can completely predict this.

Vesta Finance Introducing the VRR and Saving Module mechanisms helps the platform’s stablecoin, VST, return to the peg at $1. Thanks to that, the project’s native token, VSTA, is experiencing outstanding growth recently, increasing 100% in just a few short days.

Through many rounds of voting such as RFP-3, RFP-4, RFP-5, RFP-6, RFP-7 & RFP-8besides, PeckShield & Solidity also participated in the audit Radiant Capital It is expected to soon release the next upgrade, Radiant V2, whose details I mentioned in the article GLP Wars: Development Focus on Arbitrum Ecosystem.

Jones DAO started collaborating with partners such as Rodeo Finance and Vendor Finance to provide Lending & Borrowing, Leverage Yield Farming, Fixed Yield,… services for jUSDC and jGLP. These are 2 LP Tokens for users to participate in vaults on Jones DAO. This is a completely correct strategy of Jones DAO for its customers.

Vela Exchange It was quite a challenge to collect $4B Trading Volume on its platform in the ongoing Liquidity Mining program. Vela Exchange is also a Perpetual platform backed by many large VCs such as Big Brain Holding, Jade Protocol, Quantstamp, Orange DAO,…

Plutus KNIFE – a Convex platform built on Arbitrum, is also expected to launch the updated version of tokenomics V2 in the direction of sharing a portion of the project’s revenue to the community. Many people hope that with this update, the project’s native token, PLS, will have strong growth in the near future. Plutus itself also integrates with many platforms to increase use cases for its plsAsset and plvAsset.

Rage Trade It is also expected to soon launch its next Perpetual V2 version after the V1 version has many limitations in transaction speed, transaction fees, and time price differences, which is expected to fall in Q3 – Q4/2023. . Besides, Rage Trade will also introduce GLP V2, including revealing their token expected to launch in Q2/2023.

The next growth scenario of the Arbitrum ecosystem

Surely everyone is thinking about a scenario similar to Optimism: when Arbitrum launches tokens, there will be a large portion of tokens for projects to implement and submit Liquidity Mining with ARB tokens to attract users and liquidity on the platform. all other blockchains.

Similarly, on Arbitrum, more than 40% of the total token supply is devoted to Tresury & DAO with the purpose of bootstrapping liquidity across the entire ecosystem. With this scenario, I have also analyzed many times and is expected to open a major growth phase for the Arbitrum ecosystem in the near future.

Summary

Above are some important updates on the Arbitrum ecosystem recently. Most projects are actively developing according to their proposed guidelines. The community is also extremely hopeful for the next growth of the ecosystem when Arbitrum starts launching its incentives.