At the present time, it is completely understandable that the Arbitrum ecosystem is taking the spotlight of the market. Users, investors, and researchers are not only interested in Arbitrum as the next big retroactive but also countless innovations in building and developing new models in DeFi such as Real Yield, Delta Neutral, …

So in recent times, Arbitrum in particular and the Arbitrum ecosystem in general have made a leap, let’s all find out through the article below!

On-chain Data Analysis

Number of newly established wallet addresses

|

Blockchain |

June 1, 2022 |

December 15, 2022 |

% growth |

|---|---|---|---|

|

Arbitrum |

668,646 |

2,221,508 |

232 % |

|

Optimism |

942,289 |

2,078,034 |

120 % |

|

Ethereum |

197,767,694 |

216.665.975 |

9 % |

|

BNB Chain |

165.512.047 |

232.237.811 |

40% |

If you compare Arbitrum with its competitor in the same industry, Optimism, and eliminate the growth cycle thanks to Optimism’s retroactivity, it is clear that the growth rate in the number of new addresses, or the possibility of new users, of Arbitrum is good. than Optimism. Not to mention the fact that Arbitrum has not yet launched tokens and retroactives to users.

Besides, if Arbitrum is placed next to established ecosystems such as Ethereum or BNB Chain, Arbitrum’s growth rate is much higher than Ethereum’s 9% or BNB Chain’s 40%.

About TVL (Total Value Locked)

|

Blockchain |

Protocols |

1M Change |

TVL |

|---|---|---|---|

|

Ethereum |

614 |

– 10.87 % |

$23.21B |

|

Tron |

twelfth |

+ 1.31 % |

$4.37B |

|

BNB Chain |

513 |

– 18.33 % |

$4.2B |

|

Arbitrum |

150 |

+19.27% |

$1.14B |

|

Polygon |

349 |

– 8.78 % |

$997M |

|

Avalanche |

277 |

– 13.7 % |

$804M |

|

Optimism |

92 |

+ 0.39 % |

$555M |

|

Fantom |

270 |

+ 4.02 % |

$437M |

|

Cronos |

eighty six |

– 16.76 % |

$413M |

|

Mixin |

9 |

+ 1.83% |

$258M |

In the past month, the market has been full of fluctuations such as FTX going bankrupt, DCG facing the risk of seeing its child Genesis Trading go bankrupt or BNB experiencing unexpected market events including BTC, ETH and many other assets. Others all dropped sharply, but Arbitrum’s TVL still grew strongly and surpassed Polygon to take fourth place.

Looking at the TOP 10 TVL and even looking at the TOP 50, Arbitrum is the ecosystem with the largest growth percentage in the past month, so it is difficult to deny that cash flow is pouring into the Arbitrum ecosystem.

Ethereum Bridges TVL Ranking

|

Bridge |

TVL |

7D Change |

|---|---|---|

|

Polygon Bridge |

$3B |

– 2 % |

|

Arbitrum Bridge |

$1,278B |

+ 1 % |

|

Optimism Bridge |

$847M |

– 5 % |

|

Rainbow Bridge – Near Protocol |

$276M |

+ 1 % |

|

Fantom Anyswap Bridge |

$226M |

– 4 % |

In the past 7 days, Arbitrum Bridge was also one of the bridges with the highest TVL if placed next to prominent ecosystems such as Optimism, ZkSync, Boba Network, Fantom,…

Arbitrum Ecosystem Update

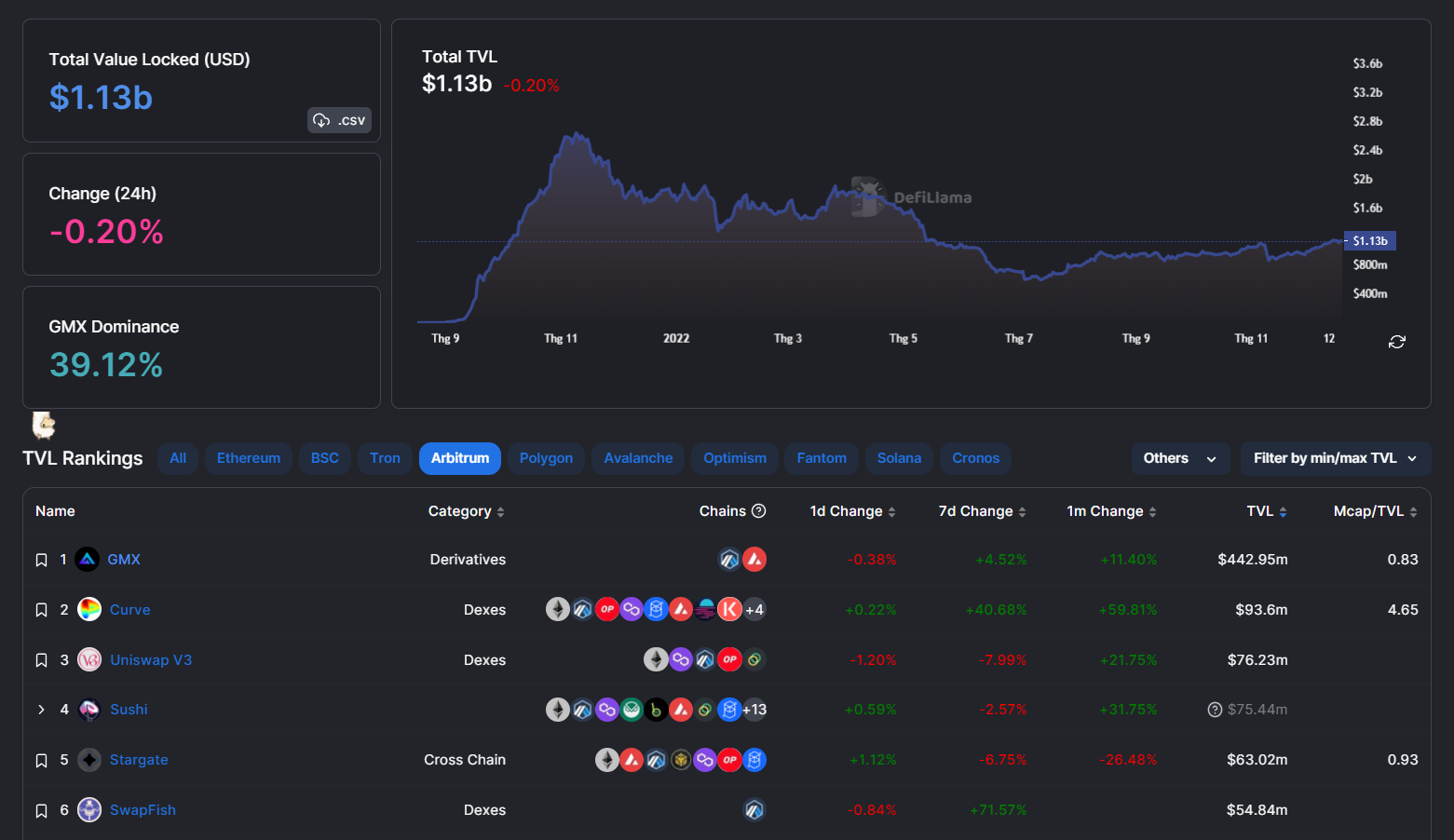

Up to now, GMX is the platform with the largest TVL in the Arbitrum ecosystem, accounting for nearly 40% of the system’s total TVL.

Right behind GMX are AMM, Lending & Borrowing, Yield Farming multichain platforms such as Curve Finance, Uniswap V3, SushiSwap, StarGate, AAVE V3, Synape,…

It can be seen that unlike other ecosystems where TVL has decreased sharply, Arbitrum’s TVL is maintaining its position and has even doubled compared to the decrease in July. However, in terms of In terms of efficiency, native projects have not really shown themselves except GMX. TVL still focuses on reputable multichain platforms such as Uniswap, Curve Finance or AAVE.

Native projects on Arbitrum still have a lot of work to do to truly attract users on the Arbitrum ecosystem.

GMX – The largest Perpetual platform on HST Arbitrum

|

Protocol |

1 Day Fees |

7 Days Avg. Fees |

|---|---|---|

|

Uniswap |

$454K |

$966K |

|

GMX |

$189K |

$450K |

|

AAVE |

$168K |

$160K |

|

SushiSwap |

$68K |

$127K |

|

Curve Finance |

46K |

$92K |

|

Compound

|

$46K |

$45K |

|

Maker DAO |

$30K |

$31K |

GMX has excellently surpassed many prominent DeFi projects such as AAVE, Curve Finance, Compound, Maker DAO in terms of daily fee consumption. This proves the attractiveness of users to GMX in particular and the Arbitrum ecosystem in particular.

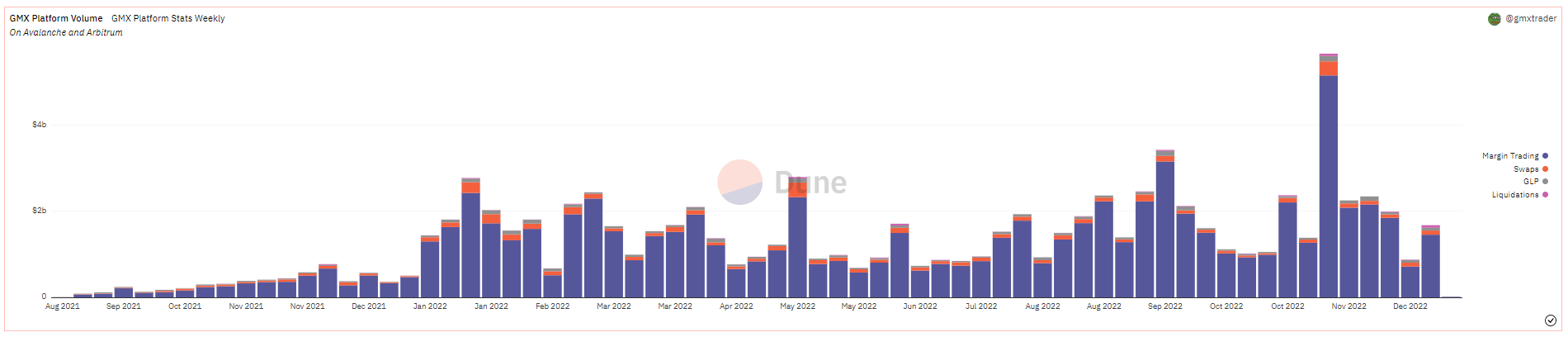

Trading volume on GMX calculated by week

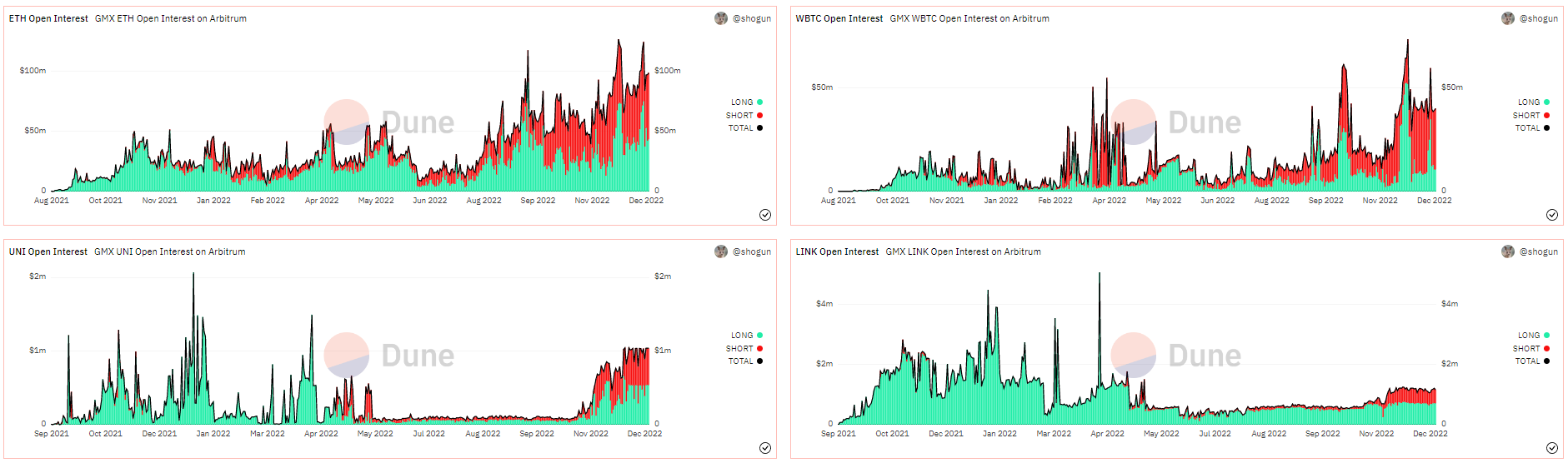

Number of leveraged orders with asset types: ETH, WBTC, UNI and LINK

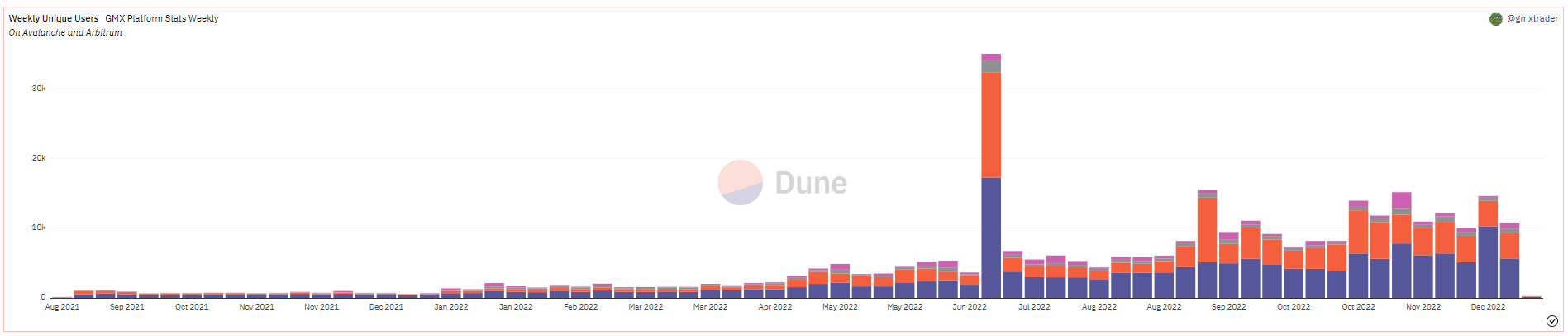

Number of users on GMX weekly

Indices representing a Perpetual project such as GMX’s Total Trading Volume, Open Interest and Total Users are all growing very well. In addition, operating trends around GMX such as Real Yield or Delta Neutral are also being implemented relatively well.

However, the biggest limitation of GMX still lies in the very limited number of trading pairs, only stopping at assets such as BTC, ETH, LINK or UNI. If compared with dYdX or Perpetual, GMX needs to provide Provide new trading pairs.

Dopex – Waiting for the next updated version

In the early days of December, Dopex – the largest Option platform on Arbitrum, officially launched a new product for regular users on GMX and GLP holders, Atlantic Perp Protection.

With the Atlantic product suite, traders on GMX will not fall into the situation of liquidating assets or GLP holders do not need to worry when the GLP price drops.

After Atlas, the Dopex V2 update will be the most anticipated update but there is still no official update date. However, investors believe that after Atlatic arrives, Dopex V2 will soon be deployed. Dopex V2 has some outstanding features as follows:

- Launched stablecoin DPXUSD with collateral assets of LP Tokens (DPX/WETH, rDPX/WETH) and a number of other assets such as rDPX.

- Improved use case and characteristics of rDPX turn rDPX into a real asset on DeFi instead of just a reward from LP ILs.

- Increase the power of veDPX.

Rage Trade – Launched the Delta Neutral strategy

Weakhand has written a very detailed article about Delta Neutral and how the game is being built around GMX. You can read the article again here.

True to its promise, Rage Trade has launched Deltra Neutral Vault and allows users to deposit their assets into the vault to receive a relatively high APR. Rage Trade’s Deltra Neutral Vault was quickly filled by whales on Arbitrum and the rest of the users also quickly filled it up.

Currently Rage Trade’s total TVL is around $13M with Deltra Neutral Vault accounting for $10M and 80 – 20 tricrypto accounting for $3M.

After Rage Trade, there will be many projects implementing this strategy with GLP.

Jones DAO – Launching new product Metavaults

Metavaults was born with the purpose of limiting the risk of Liquidity Providers with Impermanent Loss.

Currently Jones DAO is allowing to add MP of 2 liquidity pairs: DPX – ETH and rDPX – ETH with a relatively modest TVL figure under $100K. This continues to be a game created by Dopex to help LPs of the above liquidity pair feel secure without worrying about IL, thereby participating more deeply in DeFi on the Dopex ecosystem.

It can be said that all of Dopex’s upcoming products will revolve around DPX – ETH and rDPX – ETH, so the projects are about Options or Yield Farming.

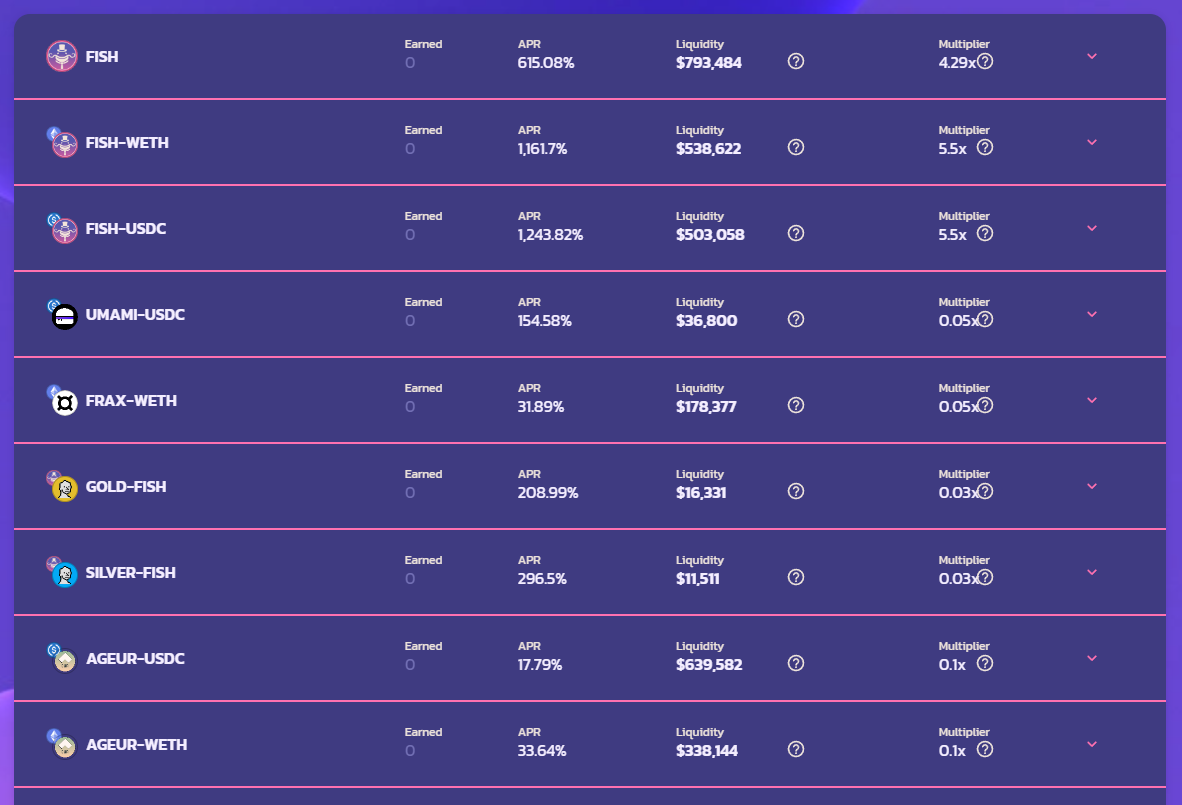

SwapFish – Attract TVL thanks to the Liquidity Mining program

SwapFish is a native AMM platform built and developed on Arbitrum. Currently, the project is implementing the Liquidity Mining program to attract liquidity. With this program, LPs provide liquidity to farm FISH coins and FISH is also under relatively large selling pressure from LPs.

Currently, the farming APR on the SwapFish platform is at a relatively high level, especially with the trading pairs FISH – USDC and FISDH – WETH.

Vesta Finance – Launching new products to stabilize liquidity

Also in December, Vesta Finance is introducing Vesta Safety Vault. With Vesta Safety Vault, Vesta Finance will have some additional features as follows:

- Users can deposit VST (Vesta Finance’s Stablecoin) into the vault to receive a reasonable interest rate.

- Vesta Finance has the right to use the funds in the vault to upgrade and develop the protocol. For example, Vesta can use the assets in the vault to increase the liquidity of the assets in the Stablility Pool to help liquidate collateral more quickly.

- The expected lock-up time for assets in the vault is 3 months.

With Vesta Safety Vault, VST’s peg is expected to stabilize at $1.

Treasure DAO – Game World on Arbitrum

Treasure DAO’s magic native token has continuously been listed on two major exchanges, Coinbase and Binance. Magic’s price has grown very strongly when it was listed on these two exchanges. There are many rumors that after GMX and MAGIC, the next token listed on Binance is DPX.

Currently, there are many outstanding games built in Treasure DAO’s ecosystem with the common currency MAGIC. Currently, I am playing the game The Beacon, which is a role-playing game with quite challenging gameplay. There are also many other games that everyone can experience.

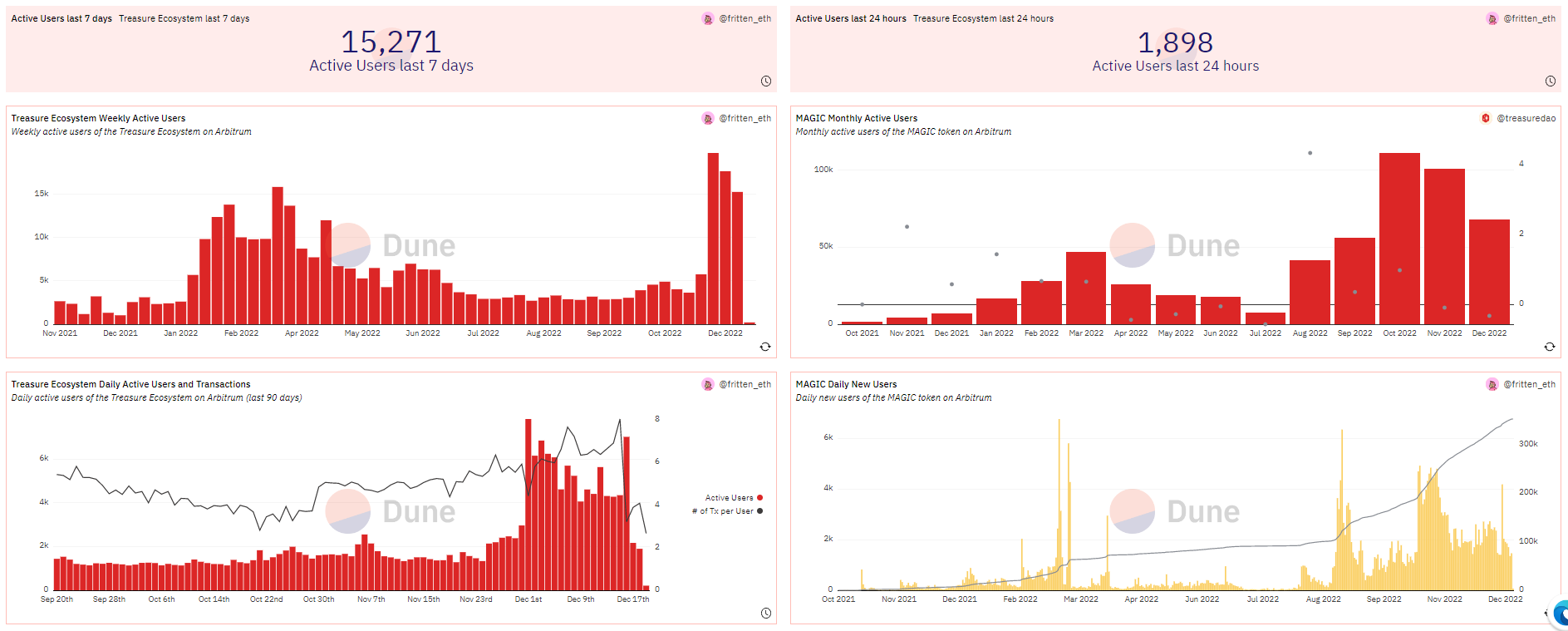

Some outstanding systems on Treasure DAO

The number of regular users on Treasure DAO’s ecosystem has been growing strongly recently.

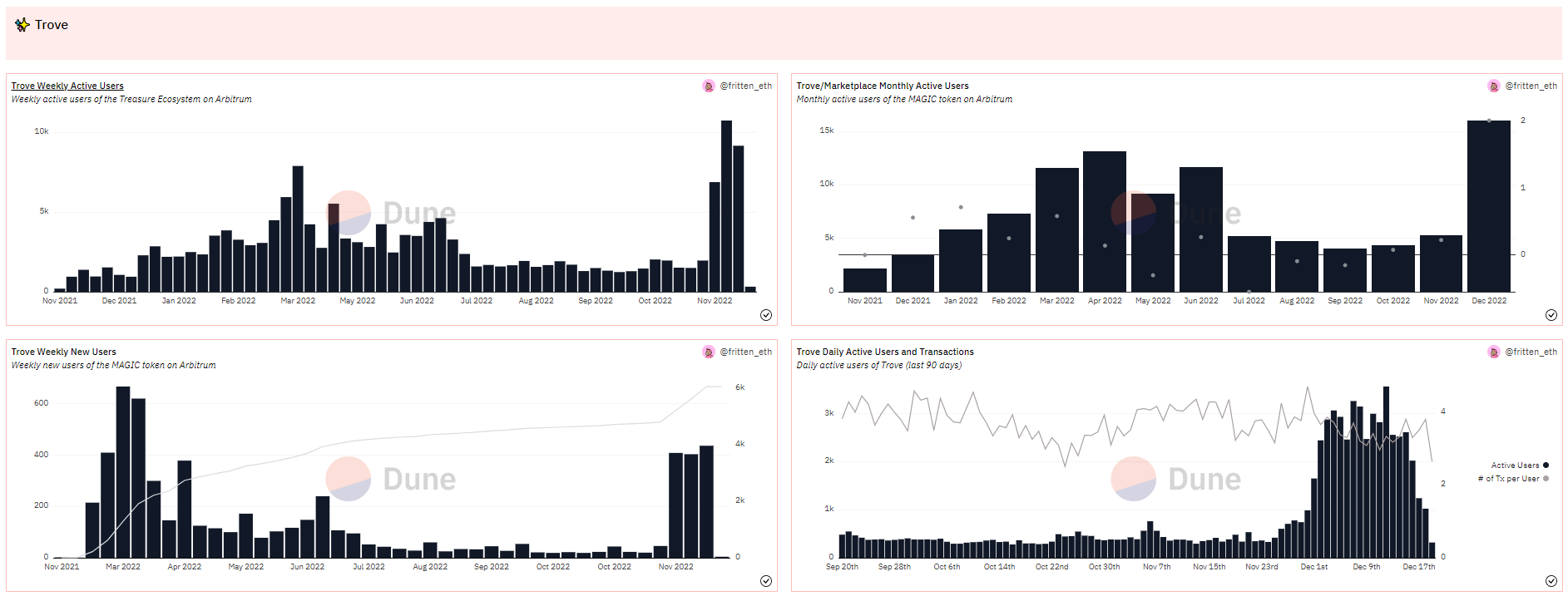

Highlights on Trove – Treasure DAO’s NFT Marketplace

The number of regular users on Trove – Treasure DAO’s NFT Marketplace also grew rapidly because some games like The Beacon allow users to sell their whitelist eggs. The profitability of the eggs in the game The Beacon is also surprising when the mint fee is about $80 – $110 but when listed on Marketplace it is 3 – 4 times the mint price.

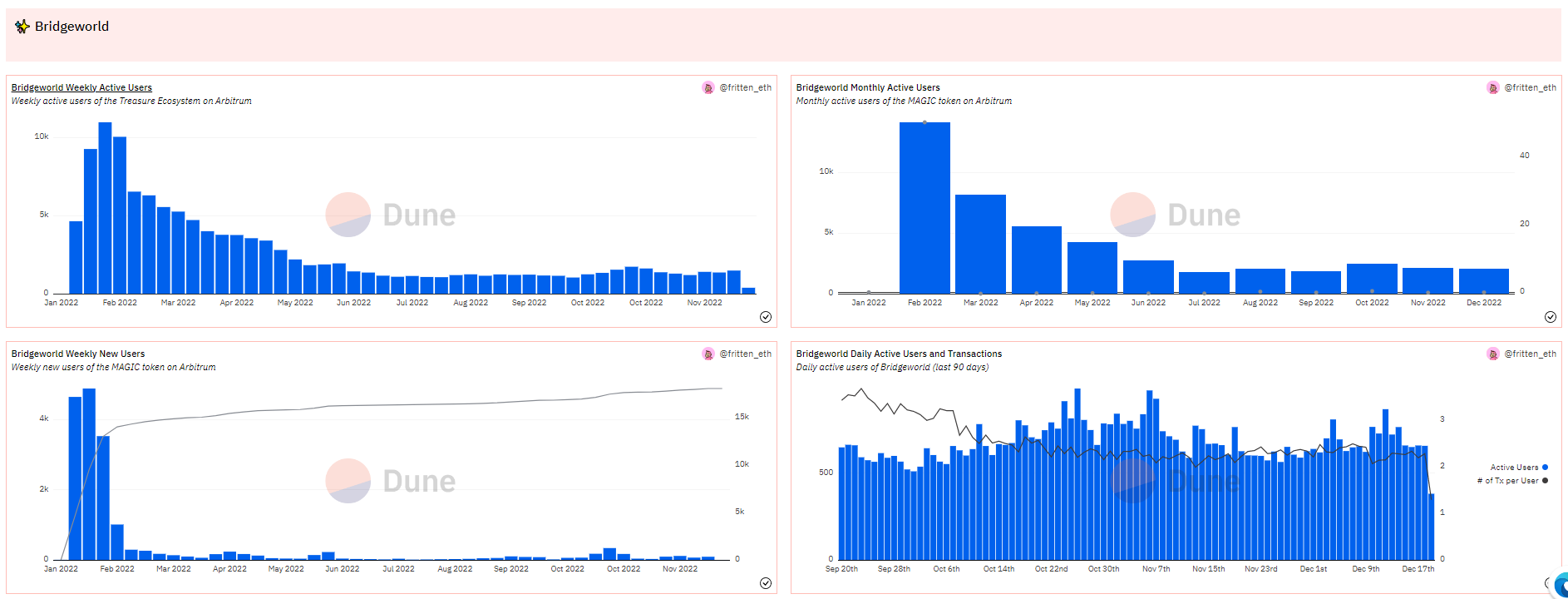

Some outstanding parameters of the game Bridge World

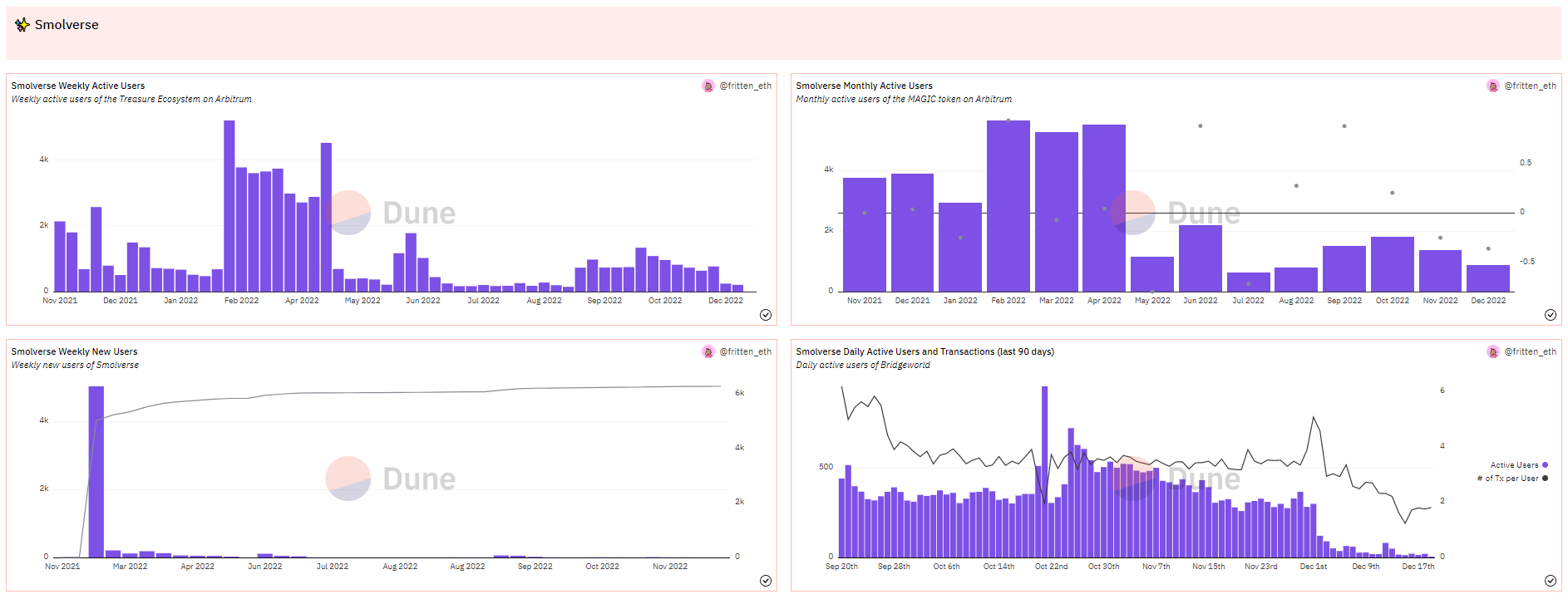

Some outstanding parameters of the game Smolverse

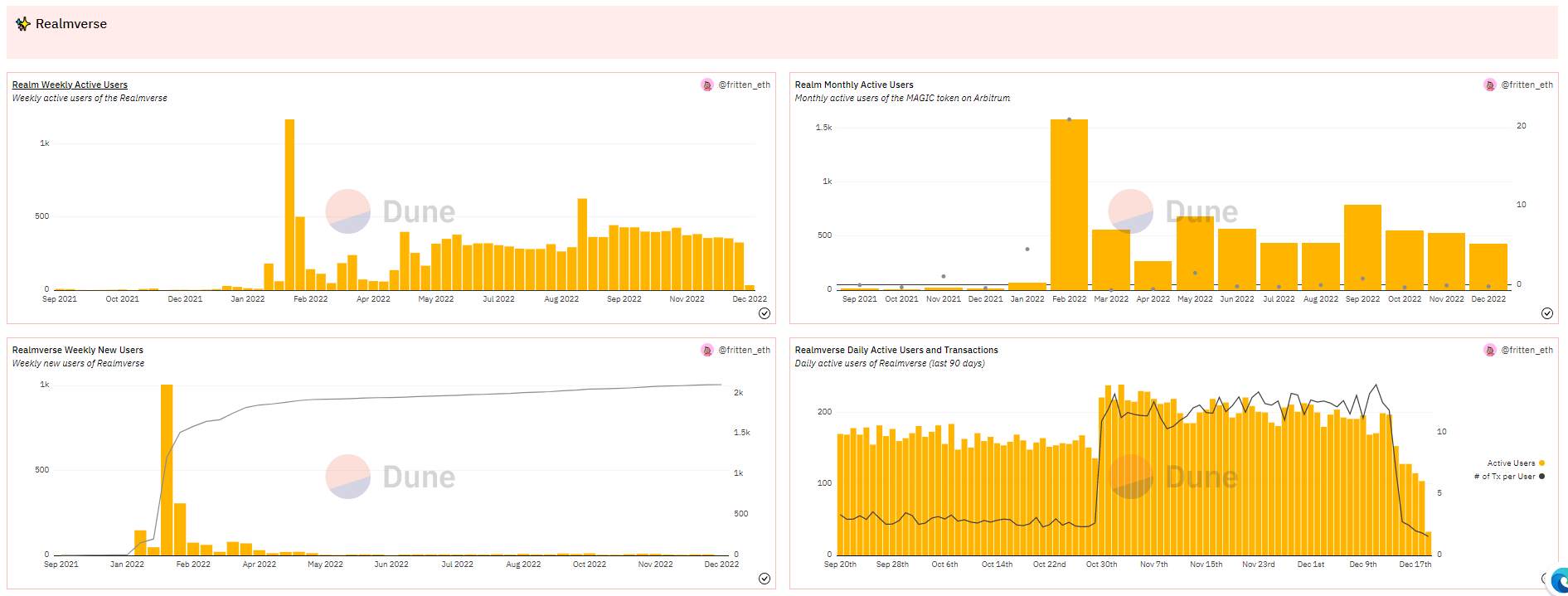

Some outstanding parameters of the game Realmverse

The above parameters show that most games on Tresure DAO cannot retain players in the long term. Therefore, the project really needs a game to change its position, can The Beacon do it?

Some new projects

GammaSwap – New AMM on Arbitrum, is offering a new strategy for LPs to eliminate IL which is expected to be the next innovation after Uniswap v3. Currently, the project is still in the process of construction and development.

Orbital – AMM is being built and developed with the support of the Dopex team. The project doesn’t have much information yet, but with the guarantees of Dopex and Plutus, this is a new project worth waiting for.

3xcalibur continues to be a newly launched AMM and lists the 3XCL token built with inspiration from Curve Finance and Solidly. However, what is worth noting here is that the token price is currently /10 compared to the peak of $1.

With a similar model, 3xcalibur and Camelot are also supported quite a lot by Arbitrum. Camelot is also a DEX developed based on Solidly’s open source code.

However, recently, the number of projects showing signs of shady and fraudulent has increasingly appeared on Arbitrum, so investors need to be careful when participating in learning and investing in this ecosystem. .

Summary

It can be said that the game on Arbitrum is being built around GMX and next time it could be Dopex. Understanding how the game is built helps us determine where the ecosystem’s trigger is.

It can be said that Arbitrum’s trigger lies in deploying tokens and implementing the Liquidity Mining program as implemented by Optimism. However, if the projects on Arbitrum are strong enough, they can develop on their own without the need for a detonator above.