Layer 2 has become one of the keywords mentioned a lot recently. To meet the need to create Layer 2 in the simplest way possible, the Rollup-as-a-Service segment has been launched. life with the most prominent name listed in Binance Launch Pool being AltLayer. In this article, Weakhand will give everyone the price prediction of AltLayer exchange with ALT token.

AltLayer Overview

AltLayer is a Rollup-as-a-Service (RaaS) protocol that all developers can use to create a simpler Layer 2. To put it more simply, AltLayer provides available toolkits to allow creating a Layer 2 with just a few simple buttons instead of having to spend time rewriting the source code from scratch.

The AltLayer toolkit contains all the components to create a Layer 2:

- Sequencer: People responsible for validating and packaging transactions on Layer 2.

- Rollup SDKs: Available source code designed from AtlLayer itself and other Layer 2s.

- Data Availability: Layer responsible for storing data from Layer 2 after authentication.

- Interoperability: The layer responsible for Layer 2 interoperability with each other and with Ethereum.

- Settlement: These will be Layer 1 responsible for authenticating evidence and resolving disputes.

Factors Affecting AltLayer Price

Tokenomics

|

Allocation Section |

allocation amount % |

number of allocated tokens |

VESTING |

|---|---|---|---|

|

Binance Launch Pool |

5% |

500M |

100% TGE |

|

Team |

15% |

1.5B |

Locked for 6 months |

|

Investor |

18.5% |

1.85B |

Locked for 6 months |

|

Advisors |

5% |

500M |

Locked for 6 months |

|

Protocol Development |

20% |

2B |

Unlock 3% at TGE |

|

Community |

15% |

1.5B |

Unlock 3% at TGE |

|

Treasury |

21.5% |

2.15B |

Open monthly |

We can see that AltLayer’s tokenomics is quite basic as all tokens belonging to Team, Investors, and Advisors will be locked for a minimum of 6 months. Therefore, before this time or more specifically TGE, the ALT token will not have any selling force outside the community.

However, the large portion of tokens used by AltLayer for the Binance Launch Pool may have a negative impact on the ALT price in the 1-2 or even 24 hours after TGE. Because those who received the most tokens after the Binance Launch Pool were whales holding a lot of BNB or FDUSD, they could dump ALT at TGE to get back BNB or stablecoins.

ALT is also used for many different purposes in AltLayer such as:

- Economic bonds: ALT will be used for Staking similar to ReStaking assets.

- Governance: ALT will be used to administer the AltLayer protocol.

- Protocol Fees: ALT can also be used to pay the Layer 2 creation fee on AltLayer.

- Incentives: Operators in AltLayer will receive rewards in ALT.

Backer

AltLayer has gone through 2 different funding rounds including:

- Seed Round: Raised $7.2M on February 17, 2022 from Polychain Capital, Jump Crypto,… at a valuation of $80M.

- Funding Round: Raised $15.6M on August 4, 2023 from Binance Labs at a valuation of $180M.

AltLayer’s Backers are all large investment funds in the Crypto market, especially when Binance Labs invested more than $15M. In addition, there are also many OG faces in the investment market such as Balaji Srinivasan, Gavin Wood, Sean Neville,…

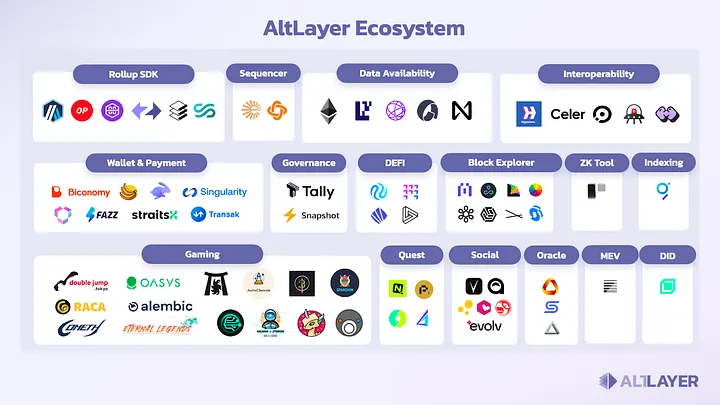

AltLayer ecosystem

If we ignore the parties that have integrated the service and only count the parties that have used the service, AltLayer’s ecosystem currently has up to 7 Layer 2 projects:

- Double Jump Tokyo

- Cometh

- Oasis

- Avive

- Deri Protocol

- Automata

- Allo protocols

In the future, when the trend of Layer 2 or even Layer 3 becomes more popular, one thing is certain: ALT will be used more to pay service fees. Therefore, this will be one of the significant price increase drivers for ALT in the future.

AltLayer’s story

The most notable point in AltLayer’s usecase token is that ALT will be used for Staking similar to ReStaking assets. It can be understood that users can Stake ALT to operate a data storage network for other Layer 2s.

And AltLayer’s story will be quite similar to EigenLayer with ETH or Celestia with TIA when those participating in Stake ALT can receive airdrops from Layer 2 users of the service. That is exactly what they will also do as the development team has mentioned airdrops for ReStaking users on EigenLayer and Staking on Celestia.

AltLayer Floor List Price Prediction

The truth is that AltLayer is the first project in the RaaS segment to launch and list its token, so we will not have any competitors in the same segment to easily compare. Therefore, we will take another common point of AltLayer which is its listing on Binance Launch Pool to compare with recent projects.

|

Project |

FDV ATH |

Current FDV |

ALT PRICE |

|---|---|---|---|

|

NFP |

$1.16B |

$550M |

$0.11-$0.055

|

|

WHO |

$1.6B |

$1.1B |

$0.11-$0.16 |

|

XAI |

$3B |

$2.15 |

$0.21-$0.3 |

|

MANTA |

$2.7B |

$2.3B |

$0.23-$0.27 |

If you compare AltLayer with NFPrompt or Sleepless AI, it is quite clear that ALT will be much better than NFP or AI. Because one simple thing is that AltLayer is a project that belongs to a more infrastructure-oriented segment and targets a customer base with higher needs, not to mention the fact that ALT raises a higher amount of capital with its valuation. higher.

If you compare AltLayer with Xai Network or Manta Network, these will be more balanced opponents in many aspects. Therefore, it is very likely that at the initial time, ALT’s valuation will be on par with XAI or MANTA at $0.2-$0.3 per token.

Summary

Above is the AltLayer exchange list price prediction from Weakhand. Hopefully through this article, everyone will be able to sell the ALT received from the airdrop and participate in Binance Launch Pool at the best price.