VMEX Finance platform Decentralized lending and borrowing. An independent liquid market, made up of a pool of assets. Users can participate as lenders or borrowers.

So what makes VMEX Finance stand out compared to existing lending and borrowing platforms on the market? Let’s find out with Weakhand.

Read more articles about Lending & Borrowing projects below to understand more about VMEX Finance:

- What is AAVE? Overview of AAVE Cryptocurrency

- What is Compound? Overview of Compound Cryptocurrency (COMP)

What is VMEX Finance?

VMEX Finance is a platform Lending & Borrowing is built and developed on the Ethereum ecosystem. VMEX provides users with independent pools, made up of assets with different levels of risk. Where users can participate as lenders or borrowers by securing assets.

In addition, VMEX Finance is also a Yield Farming platform that allows users to optimize profits with tokens and LP tokens on the Curve Finance or Convex Finance platforms.

The Difference Of VMEX Finance

VMEX helps users improve capital efficiency, the protocol uses a clustering structure to support efficiency.

- Lending and borrowing against asset classes have different levels of risk.

- The deployment of loan rounds is strictly controlled or completely free.

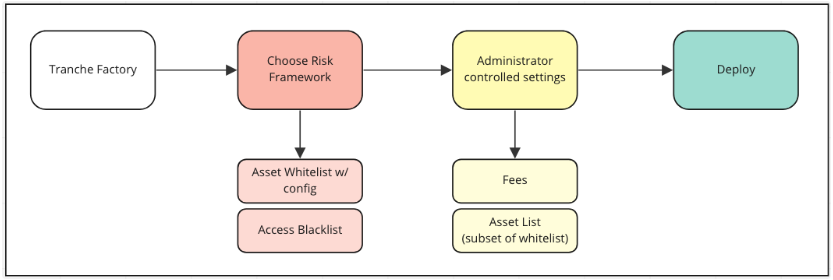

The VMEX protocol is likened to a “Distributed Factory” combined with VMEX DAO manages different risk frameworks. Through the DAO collateral/loans are approved and established parameter risk.

Lending pools are created and managed entirely by the DAO. VMEX’s asset group is divided into 2 levels: low level of risk and high level of risk.

VMEX Finance is built to maximize profits for a number of activities such as providing liquidity on Curve or participating in Staking on Convex Finance and receive rewards of CRV and CVX. CRV and CVX rewards tAutomatically merged into LP tokens.

Strategies deployed on VMEX:

- ETH + stETH Curve LP

- FRAX + USDC Curve LP

- FRAX + 3Crv Curve LP

- Tricrypto2 Curve LP

- 3Pool Curve LP

- CVX

Lending

Through VMEX, users can deposit any approved loan asset into the loan pool, divided into assets of different risk levels, with higher or lower APY levels, depending to the lender’s risk profile.

Borrowers choose to borrow with or without insurance through VMEX’s insurance mechanism. The APY paid for the borrower’s insurance will be deducted from the APY of the loan package.

When lenders deposit assets into the VMEX liquidity pool, they receive vTokens (uninsured) or ivTokens (insured vTokens), which are yield-bearing ERC 20 tokens. vTokens holders will receive continuous income from the APY that borrowers pay for their loans. If a lender holds ivTokens, they will receive ongoing income from the interest the borrower pays on their loan minus the APY paid for insurance.

Lenders can withdraw their vTokens and ivTokens at any time, as long as there is enough liquidity to withdraw (assets have not yet been borrowed).

Borrow

Assets used as collateral are managed by VMEX Finance and all collateral assets are managed independently of assets deposited into the Pool.

Each asset will be provided with a risk score (Risk Assessment Criteria) and assigned asset-specific risk parameters (such as LTV, liquidation milestone,…).

When users borrow against their collateral, they are issued non-transferable debt tokens. These tokens are minted when users borrow and burned when the loan is repaid.

Risk management and interest rate models

VMEX will proactively monitor the risk of all listed assets and loan tranches in real time, through a risk management dashboard. The risk management dashboard will be publicly visible on the VMEX website, allowing protocol users to view the risk level of available tranches. Through asset risk assessment criteria, assets are moved between tranches managed by VMEX or liquidated.

A given borrower’s APY will vary based on the assets they are borrowing and the utilization of the loan assets during the tranche.

Insurance

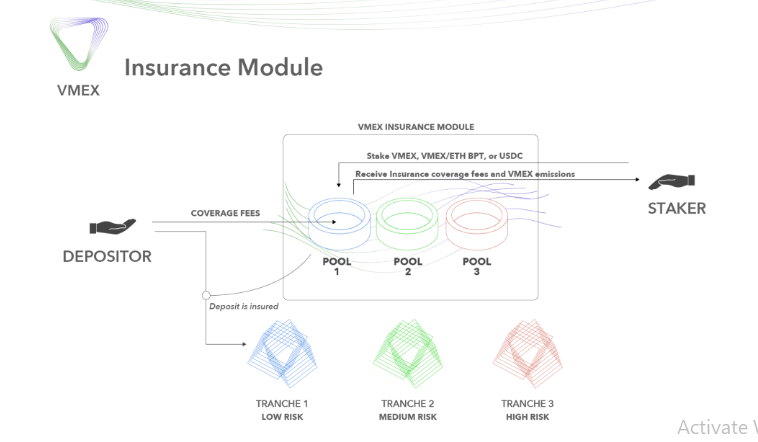

User deposit Assets entering VMEX must choose an insurance participation level, part of the user fee for participating in insurance is paid to participants who stake assets on VMEX. Participating in insurance helps users secure their assets and limit risks when staking assets on VMEX.

VMEX encourages users to deposit VMEX, USDC and ETH enter module of insurance smart contract. Stake into the insurance module is separated into separate insurance groups corresponding to user deposits.

When users deposit assets into certain loan tranches, VMEX will offer two separate APY levels: insured APY and uninsured APY, and they will receive a representative token called ivToken. If the APY of the user depositing the asset is negative (borrowing APY is lower than the insurance APY paid), they will be removed from the insurance position by paying off all the money they owe for insurance up to that point.

In case of risk, VMEX, USDC and ETH will be auctioned proportionally to compensate for the asset shortfall.

Liquidation

When collateral drops below 1, liquidation occurs. There are 2 levels for liquidation to occur:

- Collateral assets decrease compared to borrowed assets.

- Borrowed assets increase compared to collateral assets.

Development roadmap

Updating…

Core Team

Updating…

Investor

Updating…

Tokenomics

Update…

Token Use Case

- Token code: VMEX

- Function: Gsovereignty and utility

- Use participating in staking VMEX tokens will be granted points multiplied based on staked assets. The longer you stake, the more VMEX tokens you receive.

- The number of VMEX tokens issued to the market is based on the amount of market revenue. In addition, DAO also uses part of the funds to buy back VMEX and distribute.

Exchanges

Update…

Project Information Channel

- Website: https://vmex.finance/

- Twitter: https://twitter.com/vmexfinance

- Discord:

Summary

VMEX Finance is a decentralized Lending and Borrowing platform, managed by DAO. VMEX helps users maximize returns on their assets. The protocol divides loan tranches with different APY levels for users to choose from and has an insurance model to limit risks for users when participating in the protocol.

The article is intended to help readers gain more perspective on the Lending and Borrowing platform on VMEX Finance.