What is Vycolend? Vycolend is a Lending & Borrowing platform built and developed on the zkSync Era ecosystem. So, if there is anything special about Vycolend, please join me in learning about the project in the article below.

To better understand Vycolend, people can refer to some projects with similar operating models such as:

- What is AAVE (AAVE)? Overview of AAVE Cryptocurrency

- What is Compound (COMP)? Compound Cryptocurrency Overview

- What is Solend (SLND)? Solend Cryptocurrency Overview

- What is BENQI (QI)? Overview of BENQI Cryptocurrency

What is Vycolend?

Overview of Vycolend

Vycolend is a Lending & Borrowing protocol built on the zkSync ecosystem, where users can borrow and lend in Isolated Lending Pool – Independent borrowing and lending pools similar to the way Solend is implementing relatively successfully on the Solana platform.

Some of the main features of Vycolend include:

- Lending & Borrowing: Lenders can deposit funds into the protocol to earn yield from borrowers.

- Open Governance: Vycolend is led by a unified, decentralized DAO.

- Staking: Provides special incentives for those participating in staking on the Vycolend platform.

The Vycolend difference

There are 2 things that Vycolend brings different to its users:

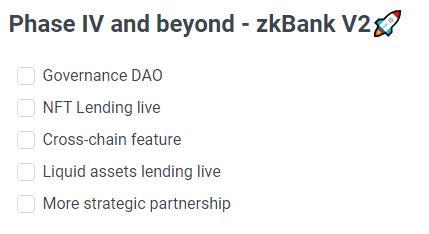

- In the upcoming V2 version, Vycolend is expected to accept it NFTs as collateral.

- Isolated Lending Pool: Asset pools will be independent of each other, avoiding this pool being hacked and affecting the entire protocol.

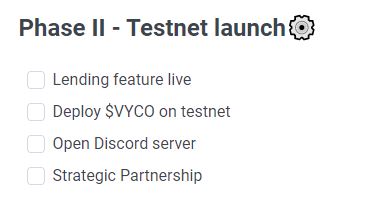

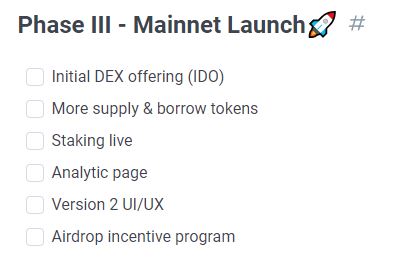

Development Roadmap

Vycolend’s development roadmap in the near future will still have a lot of important work to do. However, from my personal perspective, putting NFTs as collateral on a new ecosystem like zkSync is relatively difficult to do at the present time.

Investor

April 17, 2023: Vycolend officially successfully called for a modest amount of only about $500K with the leadership of Aura Ventures and the participation of Lumina Capital and Cardinia Ventures.

Core Team

Update…

Tokenomics

Overview information about Vycolend tokens

Update…

Token Allocation

- Loan Mining: 40%

- Yield Farming: 20%

- Core Team: 8%

- Investors & Advisors: 15%

- IDO & Liquidity: 10%

- Airdrop: 2%

- Partnership: 5%

Token Release

With a total supply of 100M CVY tokens, Covylend will pay all of these tokens within 4 years with some notes as follows:

- Core Team is paid in installments within 1 year.

- Investors & Advisors are paid in installments within 1 year.

- IDO, Liquidity & Airdrop will be 100% paid at the time of TGE.

- Loan Mining, Yield Farming and Partnership do not have information about unlocking and returning tokens.

From my perspective, Core Team, Investors & Advisors being paid all the tokens in 1 year is relatively fast and will be a big selling pressure for native tokens. If the Token Use Case is not strong enough, it will be relatively difficult for the project. . Besides, a large amount of tokens do not have a clear payment schedule.

Token Use Case

The project applies Curve Finance’s veToken model. Users can lock CVY to receive stCVY with many advantages in rewards, voting and incentives when participating in using the protocol.

Exchanges

Update…

Project Information Channel

Summary

Vycolend is a project that still has many doubts ahead.