Liquid Staking is becoming a lucrative piece of cake after the Shanghai update of Ethereum Blockchain when the amount of ETH still circulating outside the market is very large. Join Weakhand to learn about what Swell Network is? Can the project capture the majority of the Liquid Staking market?

These articles will help you understand more about Liquid Staking:

- What Are Liquid Staking Derivatives (LSD)? Top 5 LSD Projects with Great Growth Potential

- What is Lido Finance (LDO)? Overview of Electronic Conveniences Lido Finance

What is Swell Network?

Overview of Swell Network

Ethereum’s network was originally built as a proof of work (POW) Blockchain, so to participate in authenticating transactions on this network, it is necessary to have strong enough computers at a huge cost. . So after many years of research, Ethereum has officially switched to a new form of copper called proof of stake (POS) to eliminate the problems of POW.

However, nothing is perfect and neither is POS. When users stake their ETH into the network, they need a minimum of 32 ETH and the withdrawal time is also very long. From there, Liquid Staking was born to solve the above problems by creating a liquid token for the amount of ETH staked and removing the minimum limit of 32 ETH.

Swell was born to take over the market share of the fertile Liquid Staking pie when more than 80% of the ETH circulating in the market has not been staked with the following advantages:

- Higher profits: After staking ETH and Swell’s protocol, users will receive swETH tokens back at an APY of about 4% per year. The swETH token can also be used in other DeFi protocols such as providing liquidity, lending, etc. thereby earning more profits.

- There are no staking fees: Swell does not charge fees when users participate in staking on the network.

- Simplify staking: Normally staking requires a lot of knowledge related to programming, Swell has simplified staking on the platform to help users easily use the product.

- High security: Some protocols choose to prioritize rapid development thereby eliminating security measures that endanger users, Swell chooses security-oriented development.

Swell Network’s operating mechanism

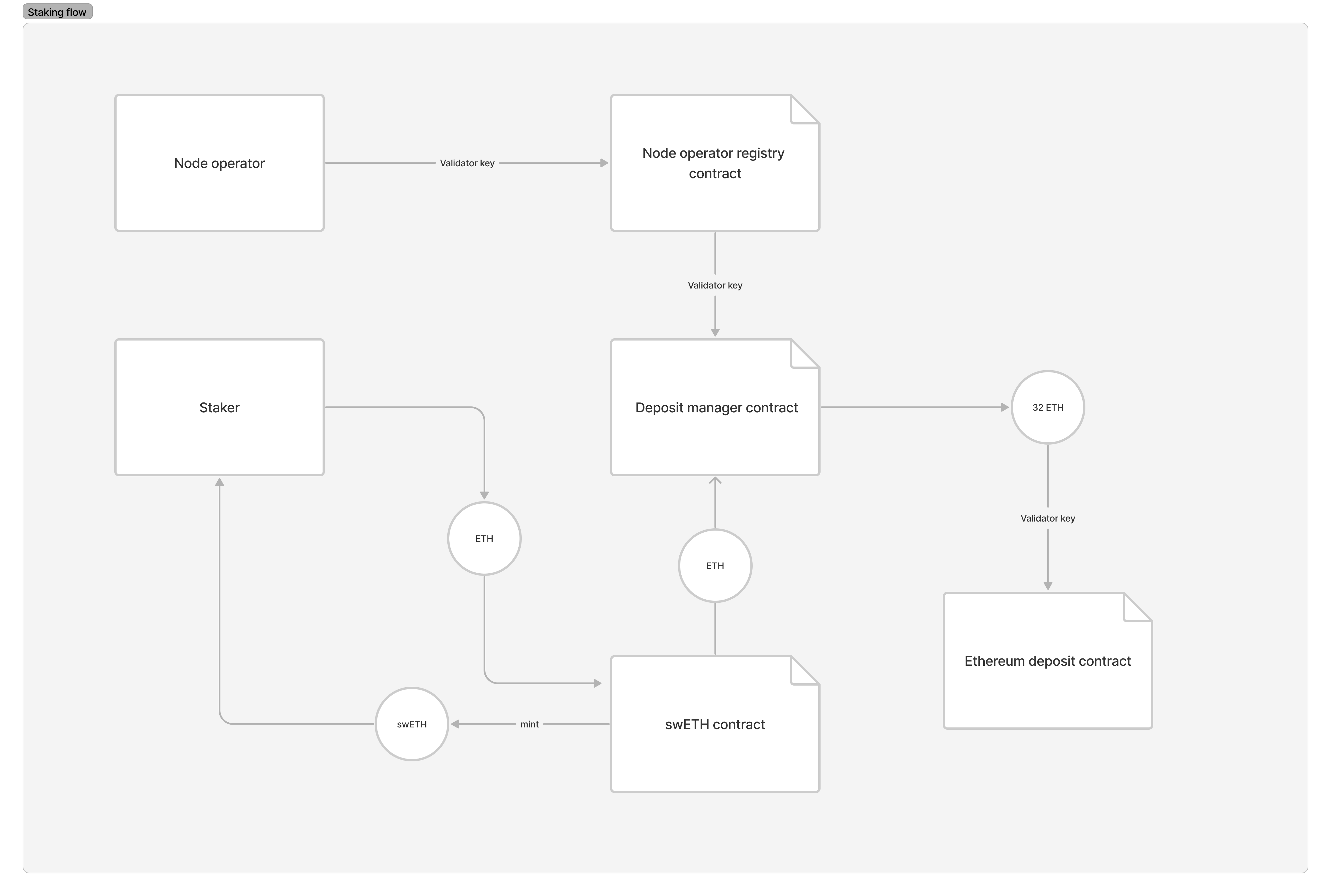

The operating mechanism of Swell Network is participated by two main components: Node operator and Staker (user) with the following process:

- Users deposit ETH into the swETH contract, the contract will return a corresponding amount of swETH.

- ETH will then be deposited into the Deposit manager contract and wait until 32 ETH is reached.

- After reaching 32 ETH, the Node operator will create a Validator key through which to stake ETH.

Instead of paying fees to users through synthetic tokens like Lido’s stETH, Swell Network adds interest to the value of the swETH token. This causes the price of swETH in some cases to be higher than the price of ETH on the market.

This initial development strategy of Swell will likely cause swETH’s liquidity pool to be strongly withdrawn when users stake ETH to receive swETH and bring it to DEXs to sell to capture the price difference, but it also helps the amount of ETH to be saved. Stake more and more into the protocol if the arbitrage persists.

Development Roadmap

Update…

Core Team

Update…

Investors

Swell Network successfully raised $3.75M on March 14, 2022 with the leadership of IOSG Ventures and Framework along with the participation of a number of angel investors such as Mark Cuban, Ryan Sean Adams,…

Tokenomics

Update…

Exchanges

Update…

Cega Finance’s Information Channel

- Website: https://www.swellnetwork.io/

- Discord: https://discord.com/invite/swellnetwork

- Github:

Summary

Swell Network will still have a lot of market share in the Liquid Staking industry to dominate in the future as the Ethereum network develops, people can follow the project to find retroactive opportunities as well as future investments.