What is SuiPad? SuiPad is the Launchpad platform for new projects on the Sui ecosystem. SuiPad focuses on partners who are Tier 1 projects, i.e. large projects of the Sui system. The platform is also a partner and receives much support from Mysten Labs.

So what is SuiPad, an indispensable piece in the Sui ecosystem? Let’s find out in this article!

You can read more articles about the Sui ecosystem below:

- What is Cetus Protocol (CETUS)? Overview of Cetus Protocol Cryptocurrency

- What is MovEX Exchange (MOVEX)? MovEX Exchange Cryptocurrency Overview

- What is Turbos Finance (TURBOS)? Turbos Finance Cryptocurrency Overview

- Overview of the Sui Blockchain Ecosystem in 2022

- Point Of View #2 | Sui Ecosystem Behind Struggling Mainnet

What is SuiPad?

Overview of SuiPad

SuiPad is the Launchpad platform for new projects on the Sui ecosystem. SuiPad focuses on partners who are Tier 1 projects, i.e. large projects of the Sui system. The platform is also a partner and receives much support from Mysten Labs.

SuiPad offers a solution that helps Launchpad participants need to monitor IDO time, adjust their schedule to ensure they participate in IDO on time. SuiPad will have a team specializing in project evaluation and updating information about projects participating in Launchpad so that participants can best understand . And cIDO investors need to know what is happening behind the scenes.

The SuiPad difference

- Easy IDO Launchpad: NQualified participants will have 48 hours to pledge USDC or SUI to the IDO pool and automatically receive tokens after the IDO ends, while also accessing friendly UI and UX.

- Sui Tank:

The 6 panelists are ready to debunk project owners from the ground up so that participants can see the real problems behind each project. - SuiPad Shield Insurance:

An innovative insurance feature to protect participants’ principal, tailored to everyone’s risk appetite.

Mechanism of action

Products on SuiPad:

- Initial Sui Offering: Help projects code review, legal, audit, marketing and product development support. In addition, IDO projects on SuiPad are completely free.

- SuiPad Shield: As insurance created to protect IDO investors, participants can choose to buy insurance or not. After IDO, if the average price within 7 days is below the IDO price, investors will be compensated.

- SuiPad Staking & Tiering: The more SUIP Tokens investors bet, the higher their level will be, and the higher their level, the more IDO Tokens they will be able to buy.

- SuiPad Lock & Multiplier: When locking SUIP, investors can choose the appropriate time frame to multiply the SUIP lock amount. The maximum is 12 months and you will receive a multiplier of 2 for the number of locked SUIP Tokens.

- Project Onboarding: SuiPad focuses on the human factor to evaluate an IDO project. In addition, other factors are considered such as investment funds, finance, products, economics, Tokenomics, Marketing, community, liquidity, market makers, legal and listing plans.

- SuiTank: This program includes a panel of experienced VCs and people who participate in questioning the project and revealing all its strengths and weaknesses so that IDO investors have the most realistic overview.

- SuiPad Academy: SuiPad Academy is a 16-week, fully online Web3 coding bootcamp that trains people to become Web3 developers.

Development Roadmap

Q4 2022

- Base platform launch: new website, tradable Launchpad UI

- Build community

- Mass marketing

Q1 2023

- SuiPad on Tesnet

- Integrate multiple wallets

- Tesnet IDO for many projects on Sui

- Promote ongoing marketing and community building

Q2 2023

- SuiPad on Mainnet

- IDO $SUIP

- Staking pool and SuiPad Shield

- IDO phase 1 (4 projects)

Q3 2023

- Production of SuiTank first season (8 Episodes)

- SuiTank first season airs

- IDO phase 2 (8 projects)

- The first cohort of the SuiPad Incubation Program

Q4 2023

- SuiPad Academy’s first cohort

- SuiPad Incubator 2nd Cohort

- IDO phase 3 (8 projects)

- Production of SuiTank (second season)

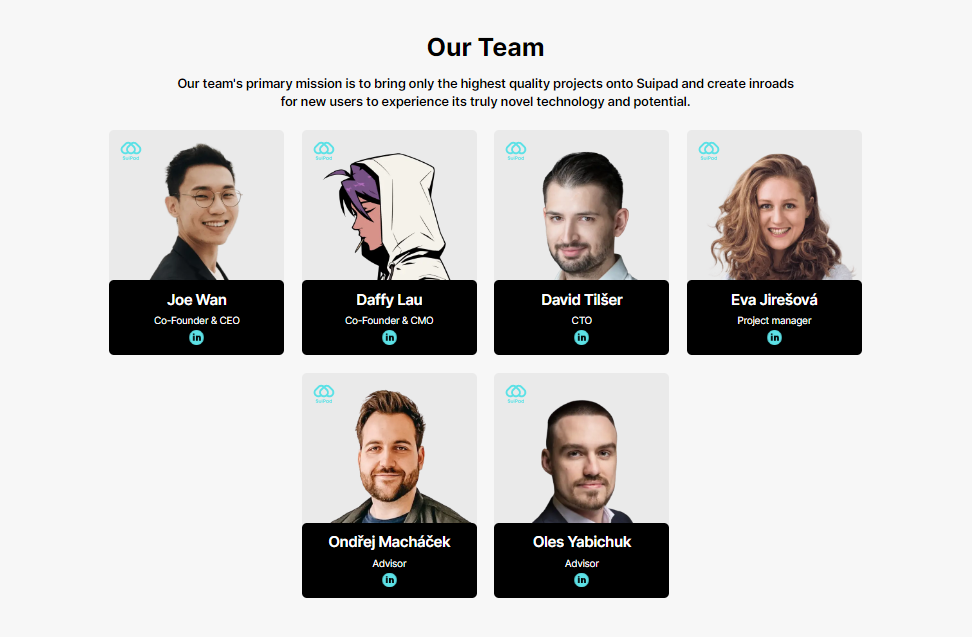

Core Team

Daffy Lau: Co-Founder & CMO

- In 2018, Daffy Lau graduated from Nanyang Technological University Singapore.

- In 2016, Daffy worked as Director Of Brand Marketing at Goldenway Group, responsible for the entire brand marketing case of Goldway Group’s three trading floors in Hong Kong.

- After that, Daffy started working for DigiFinex Global, where he worked for nearly 5 years. And he has held positions such as Listing Advisor, Business Development Manager, Marketing Director.

- Currently, Daffy is Co-Founder & CMO at SuiPad and Business Development Manager at BTCEX.

Joe Wan: Co-Founder & CEO

- In 2014, Joe Wan graduated with a Bachelor’s degree in Petroleum Management from UCSI.

- In 2018, Joe Wan worked as Business Development Manager at DRI Malaysia.

- In 2021, Joe worked as Senior Business Development Manager at XT.COM Exchange, a centralized exchange headquartered in Singapore.

- After that, Joe moved to work at Phemex, where he held positions such as Head of Spot Trading & Listing, Investment, Launchpad, and Listing Manager.

- Currently, Joe is Co-Founder & CEO of SuiPad.

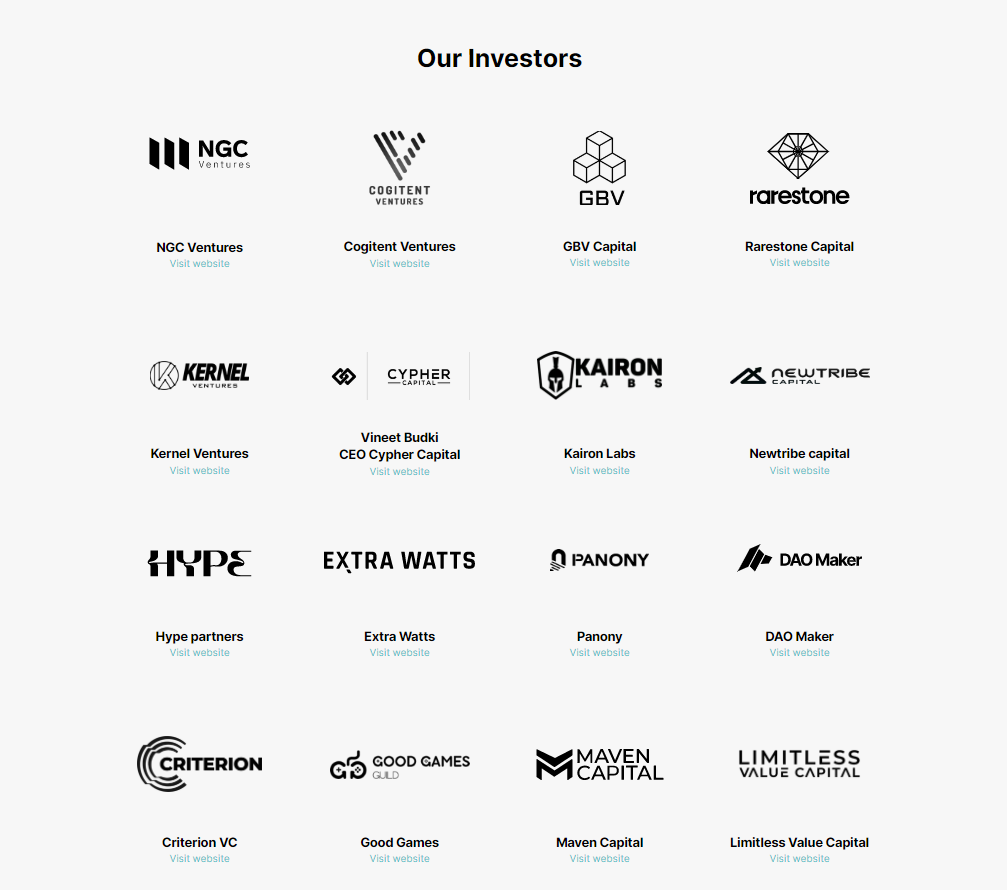

Investors And Partners

Investors

April 26, 2023: Funding round successfully raised $1.15M from investment funds such as NGC Ventures, GBV Capital, DAO Maker, Maven Capital, Rarestone Capital, Kernel Ventures, Moonrock Capital, Extra Watts, PANONY, Cogitent Ventures, Limitless Crypto Investments, Autonomy Capital, Kairon Labs, NewTribe Capital, Criterion VC.

Partners

SuiPad is a very important partner for Mysten Labs because it is the platform that supports the launch of Bluechip projects of the Sui ecosystem. In addition, SuiPad also has other partners such as Moonrock Capital and Cleevio.

Tokenomics

Overview information about Token SuiPad

- Token Name: SuiPad

- Ticker: SUIP

- Blockchain: Sui

- Contract: 0xe4239cd951f6c53d9c41e25270d80d31f925ad1655e5ba5b543843d4a66975ee

- Maximum supply: 100,000,000

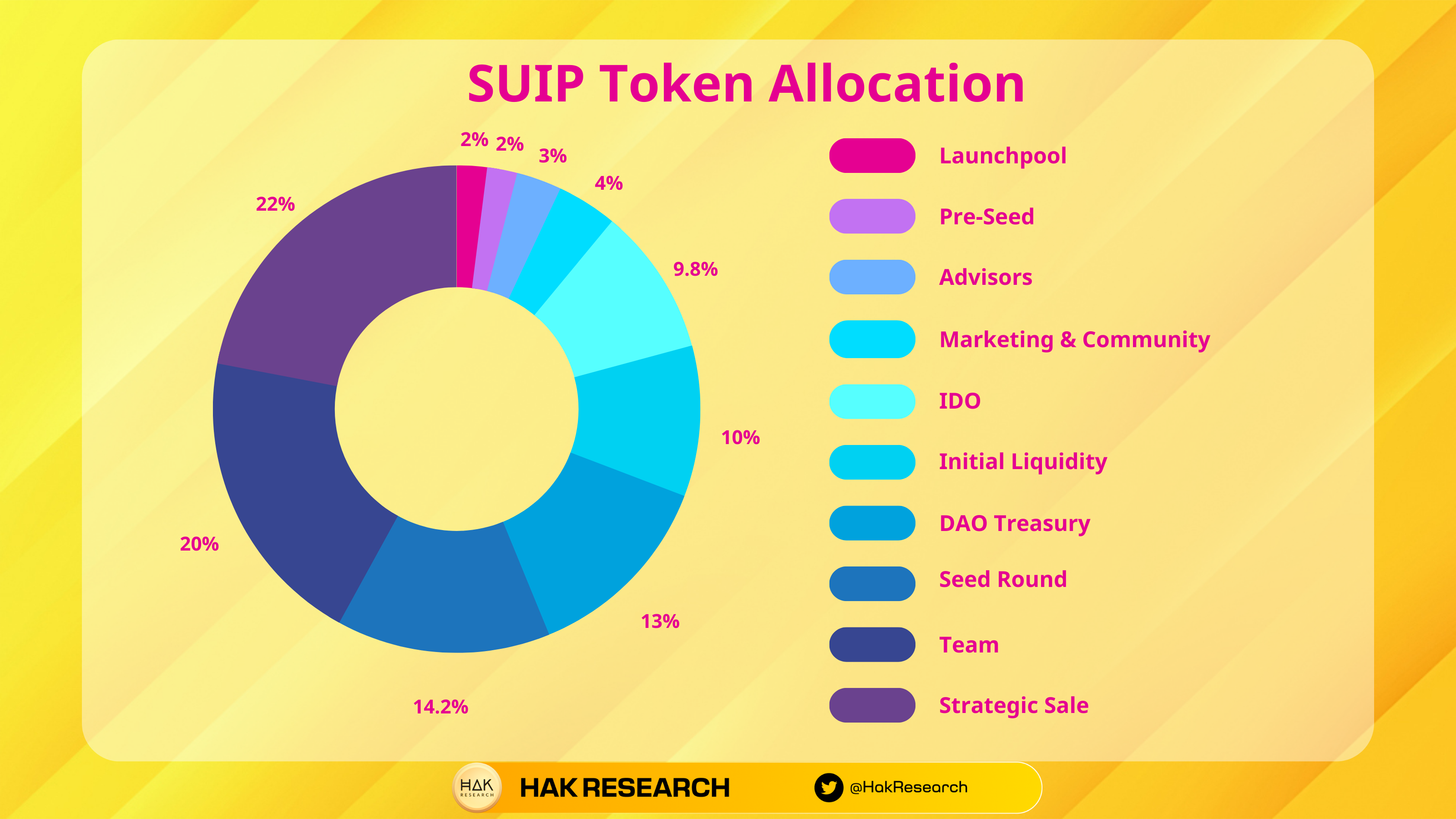

Token Allocation and Token Release

- DAO Treasury: Allocated 13% of supply and locked by default, usage determined by DAO.

- Initial Liquidity: Accounts for 10% of total supply as an initial source of liquidity.

- Marketing & Community: 4% is reserved for campaigns and product marketing. Of which 50% will be unlocked at TGE, the remaining will be unlocked 10% every month until the end.

- Launchpool: 2% is allocated to Launchpool, of which 20% will be unlocked at TGE, the remaining will be unlocked 25% every month.

- IDO: Take 9.8% of the supply and pay 50% TGE, the rest will unlock 25% every month.

- Advisors: 3% of the supply will be distributed to advisors, this portion of Tokens will be locked for the first 6 months after paying 10% each month.

- Pre-Seed: Accounts for 2% of supply, of which 3% TGE then lock for 3 months and pay 10% each subsequent month.

- Seed Round: Accounting for 14.2% of supply, of which 8% TGE then lock for 3 months and pay 10% each subsequent month.

- Team: 20% is distributed to project builders and developers, where Tokens will be locked for 12 months and paid 5% per month thereafter.

- Strategic Sales: 22% was allocated to the strategic sale round, of which 10% TGE, then lock for 3 months and pay 10% every month after that.

Token Use Case

SUIP tokens are used to participate in protocol governance Voting, ecosystem incentives and Staking to participate in IDO.

Exchanges

SUIP tokens are traded on exchanges such as Kucoin, Gate, Cetus, MEXC.

SuiPad Information Channel

- Website: https://suipad.xyz/

- Twitter: https://twitter.com/SuiPadxyz

- Discord:

Summary

SuiPad is the Launchpad project of Bluechip projects for the Sui ecosystem, bringing extremely new solutions to protect retail investors. In particular, SuiPad is an extremely important piece of the Sui ecosystem. But the Launchpad segment on Sui is also quite competitive when many Dex exchanges also provide this service.

So I have clarified what SuiPad is? SuiPad cryptocurrency overview. Hope this article brings you a lot of useful information and knowledge.