What is Tsunami Finance? Tsunami Finance is a Perpetual platform built and developed on the Aptos ecosystem. Tsunami Finance has successfully called for capital from a number of reputable VCs such as Big Brain Holding and Mirana. So where does the attraction of Tsunami Finance lie? Let’s find out together in the article below.

To understand more about Tsunami Finance, people can refer to some of the articles below:

- What is Perpetual Trading? Top 4 DEXs Leading in the Perpetual Array

- What is GMX (GMX)? Overview of GMX Cryptocurrency

- What is Level Finance (LVL)? Overview of Cryptocurrencies Level

- What is Tethys Finance (TETHYS)? Tethys Finance Cryptocurrency Overview

What is Tsunami Finance?

Overview of Tsunami Finance

Tsunami Finance is a Perpetual & Swap platform with 0 spreads. Besides, Tsunami Finance also provides a fast trading platform, low trading fees and leverage up to 15 times.

Recognizing the problems of today’s popular AMM models such as AMM, vAMM or CLOB, Tsunami Finance built its own AMM model that is quite similar to Balancer with the use of Pyth Network’s Oracle model. and Switchboard.

Tsunami Finance’s operating mechanism

In essence, Tsunami Finance includes two main products: Perpetual – where users Long – Short many types of assets and AMM – where users exchange tokens.

For Perpetual products, the operating mechanism will be as follows:

- Step 1: Users use available assets to open leverage orders on Tsunami Finance.

- Step 2: User chooses Long or Short order, selects leverage level and Take Profit or Stoploss.

- Step 3: Close the transaction order.

For Tsunami Finance’s AMM product, the operating model will be as follows:

- Tsunami Finance’s liquidity pool is a liquidity pool that includes many types of tokens with different ratios.

- Users deposit their assets into the pool and the project will retrieve price information through two Oracle platforms and then return tokens to the user.

- To rebalance the pool after liquidity is withdrawn, the project will waive transaction fees for users to get back old assets.

Development Roadmap

Some of the project developments in the short term include:

- Accept NFTs as collateral so users can go Long – Short.

- Create a referral program for users.

- Organize Trading contests to attract Traders, Users,…

- Place limit orders, stop losses,…

Some of the project developments in the long term include:

- Accept more assets allowing users to Long – Short.

- Deploy Cross-chain AMM.

Investor

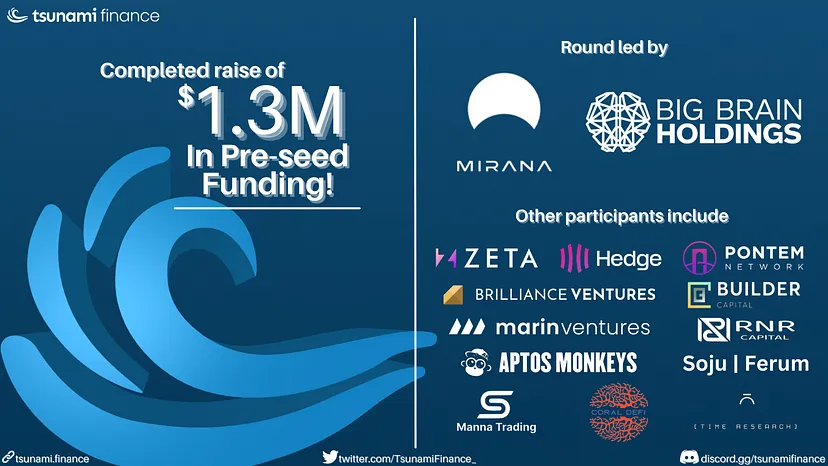

February 24, 2023: Tsunami Finance successfully called for $1.3M in funding led by Big Brain Holding and Mirana, with the participation of many projects such as Zeta Markets, Pontem Network, Marin Ventures,…

Core Team

Update…

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

- Website: https://tsunami.finance/

- Twitter: https://twitter.com/TsunamiFinance_

- Discord:

Summary

Many ecosystems already have outstanding Perpetual platforms, so can Tsunami Finance become one of the key DeFi protocols on Aptos?