What is Helio Protocol? Helio is a liquidity protocol that allows users to borrow and mortgage assets to earn profits on HAY, which is a “Stablecoin” built and developed on the BNB chain. Currently, Stablecoins are no longer strange in the market. So what’s different about Helio Protocol? Let’s find out through the article below.

To better understand Helio Protocol, people can read some of the articles below:

- What is Venus Protocol (XVS)? Venus Protocol Cryptocurrency Overview

- MakerDAO (MKR) Operating Model

- Overview and Liquidity Flow in LSDfi

What is Helio Protocol?

Overview of Helio Protocol

Helio Protocol is a CDP platform built and developed on the BNB Chain ecosystem. Helio Protocol allows users to collateralize crypto assets to mint stablecoin HAY and use HAI in DeFi protocols on the BNB Chain ecosystem. Helio Protocol’s operating model is similar to Maker DAO, Venus Protocol,….

In addition, Helio Protocol also provides products that help users earn profits from holding the OR stablecoin such as providing liquidity for the pairs HAY – BUSD, HAY – USDT, HAY – BNB,…

Helio Protocol’s operating mechanism

The Helio Protocol’s operating mechanism takes place in a number of basic steps as follows:

- Step 1: Users deposit assets into Helio Protocol. Currently, Helio only accepts BUSD and BNB.

- Step 2: Mint users issue stablecoin HAY.

- Step 3: Users use OR in the Earn section of Helio Protocol or bring in other DeFi protocols to earn profits.

- Step 4: Users burn OR to receive collateral.

Helio Protocol includes 1 main product to earn profits for OR holders: Earn:

- Staking: users holding Destablecoin OR can participate in staking on Helio protocol to receive APR. Rewards from staking activities can be claimed immediately. Helio Protocol currently has more than 55 million USD total value locked (TVL – Total Value Locked) in the platform.

- Boosted vaults: Helio’s bonus store, which users can take advantage of to receive compound interest by compounding profits.

- Farming: in Helio provides many DEXs that support users to farm assets (HAY), supported DEXs include PancakeSwap, Magpie, Thena.

The Helio Protocol difference

Helio Protocol has 2 main differences when it comes to the crypto market including:

- Helio Protocol accepts decentralized assets as collateral and a number of highly decentralized asset types in the market.

- Helio Protocol aims for mass adoption in the crypto market rather than keeping the peg at $1.

HAY’s special model makes its value very difficult to peg to the USD price at a 1:1 ratio compared to regular stablecoins. If the value of OR changes, the protocol will still have a way to ensure stability in the following two cases:

- If the OR value increases above 1 USD: Helio Protocol will encourage borrowers to continue borrowing more OR to sell other types of assets. From there, the protocol can take advantage and gain differential profits from users borrowing more OR.

- If the OR value falls below 1 USD: Borrowers will be encouraged to purchase additional OR to repay the platform. This will help the OR value return to its original stable level.

Helio Protocol enters the LSDfi market

In the early stages of July 2023, Helio Protocol had many new updates when increasing its collateral from ankrBNB to many other collateral assets such as snBNB, BNBx, stkBNB and wBETH to be able to mint stablecoins. HELL. It can be said that with Helio Protocol, there are clear moves in entering the LSDfi segment.

HELIO development roadmap

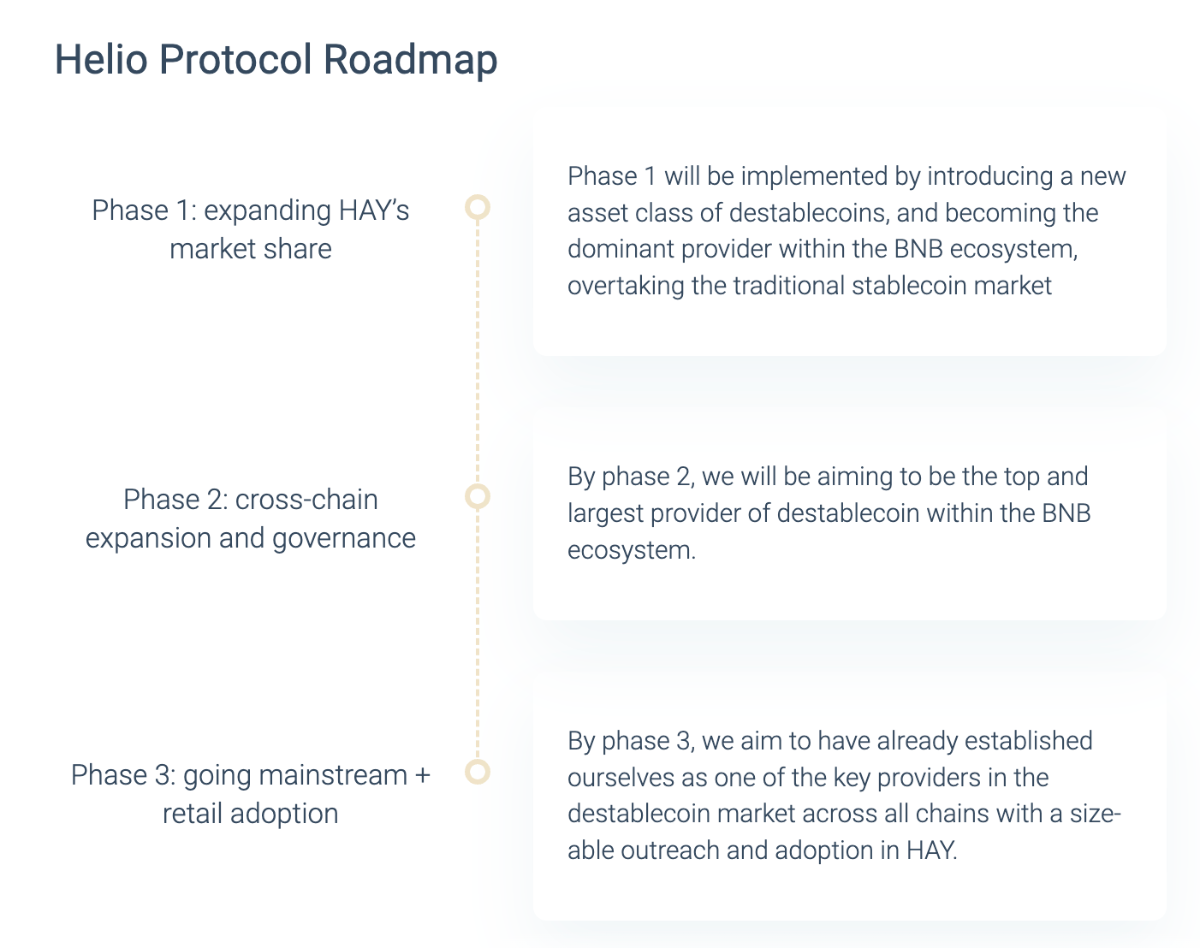

Helio Protocol’s development roadmap will include 3 stages:

- State 1: Helio will introduce HAY and try to expand the market share of this destablecoin on the BNB Chain ecosystem.

- Phase 2: Helio will expand and govern cross-chain with destablecoin HAY.

- Stage 3: Helio will expand the operation of destablecoin OR on Multichain.

In delving into the LSDfi segment, Helio Protocol also has some plans to accept ETH or LP Tokens such as SnBNB-BNB & ETH-wBETH as collateral to be able to mint HAI. Most importantly, Helio Protocol will aim for a multichain vision as it expands to Ethereum, Arbitrum, and zkSync.

Investor

- August 11, 2023: Binance Labs announced a $10M strategic investment in Helio Protocol with the goal of promoting LSDfi on BNB Chain and expanding to other Blockchains.

Core Team

Update…

Tokenomics

Information about Helio Protocol tokens

- Token Name: Helio Protocol

- Ticker: HELIO

- Blockchain: BNB Chain

- Token Contract: Update…

- Total Supply: 1,000,000,000

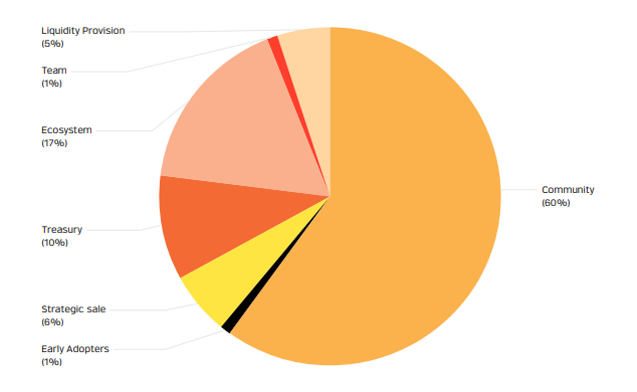

HELIO Token Allocation

- Community: 60%

- Ecosystem: 17%

- Treasury: 10%

- Liquidity Provision: 5%

- Strategic Sale: 6%

- Team: 1%

- Early Adopters: 1%

Token Release

Token Use Case

As a liquidity protocol, Helio owns 2 types of tokens including:

- HELL: plays the role of stablecoin and transaction method on platforms such as lending & borrowing, mint…

- HELIO: is the governance and management token of Helio Revenue Pool, used to incentivize users in the protocol and liquidity mining.

Exchanges

OR will be created through mint or purchased on the decentralized exchange (DEX): PancakeSwap (BNB Chain)

HELIO does not have a trading market yet. According to Helio’s docs, in the future it will be used as a reward when borrowing, but currently it is not available.

Project Information Channel

- Twitter: https://twitter.com/Helio_Money

- Telegram: https://t.me/helio_money

- Discord: https://discord.gg/k5JZVQYpUn

- Medium: https://medium.com/@Helio-HAY

Summary

Helio Protocol is designed to provide users with a new way to generate long-term income and unlock liquidity for their crypto assets. Helio Protocol also aims to become a trusted reference rate enabler and a leading destablecoin issuer in the BNB Chain ecosystem.

Through this article, you probably have some basic information about the Helio Protocol project to make your own investment decisions, and leave comments and suggestions for yourself in the next articles. Please !