What is Liqwid Finance? Liqwid Finance is a Lending & Borrowing platform built and developed on the Cardano ecosystem. Users participate as liquidity providers for tokens on Cardano. So what’s special about the project? How does it work? Let’s find out below in this article!

To understand more about Liqwid Finance, people can refer to some of the articles below:

- What is Jet Protocol (JET)? Jet Protocol Cryptocurrency Overview

- Morpho Labs – Potential Next Generation Lending&Borrowing Platform

- What is Lending&Borrowing? The Essential Puzzle Piece in Defi

What is Liqwid Finance?

Overview of Liqwid Finance

Liqwid Finance is a Lending & Borrowing platform on the Cardano ecosystem. With Liqwid Finance, users can deposit idle assets into the protocol to earn additional profits or provide collateral to borrow their desired assets.

Liqwid Finace’s mechanism of action

Lending

The lending mechanism takes place on the Liqwid Finance platform as follows:

- Step 1: Users deposit their idle assets into the Liqwid Finance platform.

- Step 2: Liqwid Finance platform will spread back qToken representing users’ assets deposited into the platform.

- Step 3: qToken can be used to earn profits in many DeFi protocols on the Cardano ecosystem or owners can trade qToken. The holder of qToken will be the holder of the profits of the asset represented by qToken.

- Step 4: Users will burn qToken to receive the original asset along with interest.

Borrowing

Users who borrow on the Liqwid Finance platform will go through the following steps:

- Step 1: Borrowers will deposit collateral into the Liqwid Finance platform.

- Step 2: Users will borrow the asset they desire with high collateralization rates for stablecoin assets and lower for altcoins.

- Step 3: Users pay principal and a portion of interest to the protocol.

- Step 4: The protocol will return the user collateral.

When the loan assets and collateral exceed the previous mortgage rate, the borrower’s assets will be liquidated.

Borrower interest rates are not fixed and change according to the market. The borrower needs to pay back the loan asset plus the loan interest at that time.

Development Roadmap

Update…

Core Team

Dewayne Cameron: Co Founder & CEO

- Dewayne graduated from Holy Cross College with a Bachelor of Arts & Psychology then went on to earn a Master of Science & Financial Management degree from Durham University.

- When he first graduated, Dewayne worked as an intern at SmartStart Pediatrics.

- After that, Dewayne spent more than 3 years working with MFR Conssultants Inc as a Consultant.

- By January 2021, Dewayne started with his colleagues to build Liqwid Labs

Joshua Akpan: Co Founder

- Joshua Akpan Has 3 years of experience at Proof of Africa as Co-Founder & CEO

- After 2 years and 8 months, Joshua Akpan worked at African Blockchain Center for Developers as Co Founder

- In August 2022, Joshua Akpan and his colleagues co-founded Liqwid Labs

- In February 2009, with more than 5 years, Forian Volery worked at Ernst & Young as Financial Audit Services.

- In September 2014, Forian Volery worked at Generali Switzerland as Senior Internal Auditor.

- In November 2015, Forian Volery was promoted to Manager, Financial Services Consulting at Ernst & Young.

- In March 2018, Forian Volery worked as Interim Managing Director at Coramaze Technologies GmbH.

- In January 2020, Forian Volery worked at MTIP AG as Chief Financial Officer.

- In February 2021, Forian Volery worked at SPIRIT Blockchain Capital Inc as Head of Operations.

- October 2020: Forian Volery and his partner co-founded Liqwid Labs.

Investor

December 1, 2022: Liqwid Finance successfully raised $2.7M in a Seed round led by cFund with the participation of Double Peak, Animoca Brands, Genblock Capital, Altonomy, ShimaCapital, Optim, Bitrue.

Tokenomics

Overview of Liqwid Finance tokens

- Token name: Token Liqwid Finane

- Ticker: LQ

- Blockchain: Cardano

- Token classification: Native Cardano Token

- Contract: 8e420ce194ca84040ba6971e6ab816e3d76ee9ee

- Total Supply: 21,000,000

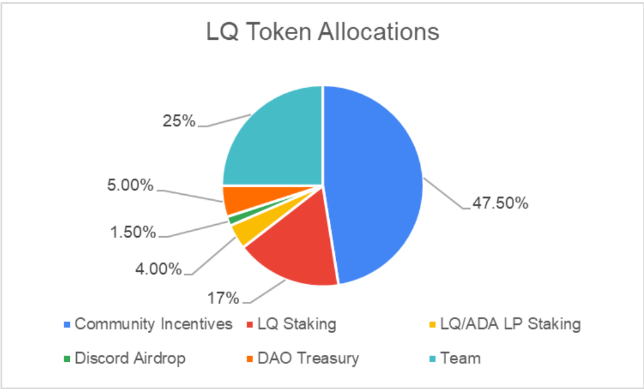

Token Allocation

- Community Incentives: 47.50%

- Team: 25%

- LQ Staking: 17%

- LQ/ADA LP Staking: 4%

- Discord Airdrop: 1.5%

- DAO Treasury: 5%

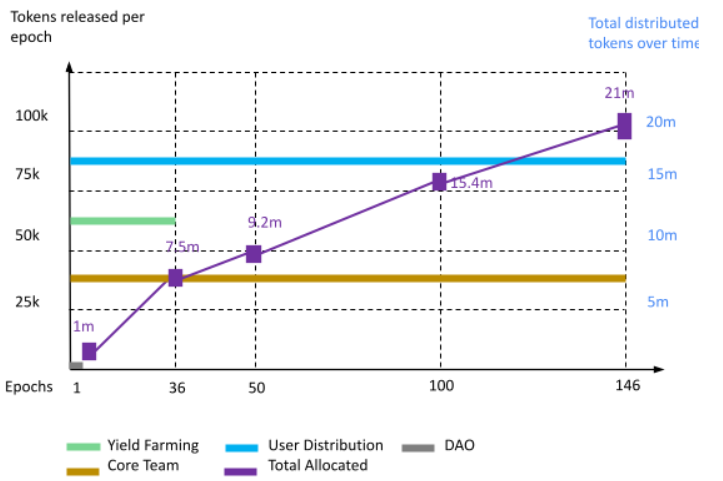

Token Release

Token payment schedule for Team is 25% vested within 2 years and paid monthly.

Token Use Case

Users can stake LQ tokens to earn interest from borrowers paying interest.

LQ tokens will operate according to a buyback mechanism, every 15 days (3 epochs) the platform’s transaction fees will buy back LQ tokens and divide them back to:

- 50% for holders holding LQ tokens

- The remaining 50% goes to the community fund to develop the project.

LQ token is also used for the main purpose of voting on proposals on the platform.

Exchanges

Currently LQ tokens are being traded on exchanges: Minswap, WingRiders, Sundeaswap,..

Project Information Channel

Summary

Liqwid Finance is a pioneering project working on Lending&Borrowing on the Cardano ecosystem. Users participate in the protocol as borrowers and lenders.