What is Maker Knife? Maker Dao is a Lending & Borrowing platform built and developed earliest on Ethereum. Maker Dao allows users to mortgage their assets to mint stablecoin DAI for use in DeFi. So how does Maker Knife work? What stands out about the project? Let’s find out with Weakhand below in this article!

To understand more about Maker Dao, you can read the following articles:

- What is Compound (COMP)? Compound Cryptocurrency Overview

- What is AAVE (AAVE)? Overview of AAVE Cryptocurrency

- What is Venus Protocol (XVS)? Venus Protocol Cryptocurrency Overview

What is a Maker Knife?

Overview of Maker Knives

Maker Dao was launched in 2014, as one of the first platforms to best support capital efficiency on Ethereum. The platform allows users to mortgage assets into the protocol and get stablecoins to use for other things. This is similar to a bank but without a third party as an intermediary, users will interact directly with the platform. boulder. This helps users not need to sell their assets but still have money to use for other things.

Makeo Dao has 2 main and core parts of the project: DAI Stablecoin and Maker protocol (MKR token).

- DAI Stablecoin: Is a stablecoin collateralized by cryptocurrency and has a stable price corresponding to 1DAI = 1USD

- Maker protocol (MKR Token): Is the project’s governance token, used to manage and restructure the project’s capital.

Mechanism of action

Maker DAO Protocol

Maker DAO protocol is the largest DApp on the Ethereum blockchain platform. The Maker DAO protocol is governed by holders of the protocol’s governance MKR Token. MKR token holders will approve executive voting and governance. MKR token holders will govern the protocol and bear the financial risks of DAI, ensuring stability and efficiency.

One MKR token held in the voting contract is equivalent to 1 vote ticket.

Maker DAO is used to support and keep the price of stablecoin DAI stable, with the Collateralized Debt Positions (CDP) mechanism.

DAI Stablecoin

DAI Stablecoin is a decentralized, collateral-backed currency that is dynamically pegged to the USD. DAI is held in a wallet or held within the platform and is supported on Ethereum.

DAI will be created easily by users depositing collateral into the Maker Vault within the Maker protocol. This is how DAI is put into circulation within the platform as well as users gain liquidity.

Main features of DAI:

- Storage: DAI is an asset with full value, not depreciated over time, because DAI is a stablecoin that is stable even when the market fluctuates.

- Means of transaction: DAI is used to trade assets in DeFi.

- Calculation unit: In Maker, DAI is taken as the unit of calculation for dapp service value and accounted for in the protocol.

- Deferred payment standards: DAI is used to settle debt within the protocol (For example, users use DAI to pay stability fees and close their Vaults). This benefit sets DAI apart from other stablecoins.

Collateral: DAi is created, backed, and backed by collateral deposited into the Maker Vault within the protocol. Collateral is digital assets that MKR holders have voted to accept into the protocol.

Maker Vault

Maker Vault helps manage DAI debt positions, all accepted collateral can generate DAI in the protocol through smart contracts. A Vault is a debt position, users can provide collateral, borrow DAI,… and when repaying DAI with a stable fee to withdraw the collateral in the Vault.

Users will directly interact with Vault and the Maker protocol, users have complete and independent control over their collateral as long as the asset value does not decrease beyond liquidation.

Steps to interact with Vault:

- Step 1: Create and deposit collateral into Vault. (Users create a Vault through the Oasis Borrow portal or a community-created interface and deposit a specific amount of collateral into the Vault that will be used to generate DAI).

- Step 2: Generate DAI from Collateralized Vault. (The Vault owner initiates a transaction and has it confirmed, to create an amount of DAI in exchange for the user’s collateral in the Vault).

- Step 3: Pay off debt and stabilization fees in installments. (To get back part or all of the collateral, the user needs to pay in installments or return the entire DAI the user created plus a fee. This fee is paid in DAI).

- Step 4: Withdraw collateral. (After completely paying off DAI and a fee, users can withdraw all collateral from the Vault).

Each Vault will have its own collateral type, so each user can own multiple Vaults with different collateral types and collateral levels.

Liquidate assets on Maker Vault

To ensure there is always enough collateral in the protocol to cover any outstanding debt, any Vaults deemed too risky will be liquidated through an automated auction. The protocol will make a decision comparing the current liquidation and collateral-to-debt ratios of each Vault. The liquidation ratio is determined by MKR voters based on the riskiness of the collateral.

Maker Vault’s auction mechanism

To ensure DAI is stabilized at Peg $1, when the collateral in the Vault drops to the liquidation threshold. The protocol will then liquidate Vault’s collateral to repay the debt and then sell that asset using an internal auction mechanism. Called collateral auction.

Maker Dao will organize an auction with participating parties, to choose a winner as well as so that the Vault owner can repay the debt in full.

The winner will transfer DAI to Maker Dao, DAI will be used for two things: repaying the debt to the Vault owner and the rest will be burned. Including the liquidation penalty fee due to the Vault owner not ensuring enough collateral, affecting the stability of DAI (this fee will be paid to the project Buffer Maker).

Maker Dao will transfer the collateral to the winner, which will lead to the following 2 cases:

- The amount of DAI collected is enough to repay the debt in the Vault and the liquidation penalty: This is a good case for auctions, the remaining collateral will be returned to the original Vault owner.

- The amount of DAI collected is not enough to pay off the debt in the Vault and the liquidation fee: The initial debt of the Vault owner will be converted into the protocol’s debt. At this time, to repay the debt, the protocol will take money from Buffer Maker to pay. in debt. If the money in Buffer Maker is not enough to repay the debt, the protocol will activate a debt auction, mint will issue MKR tokens to auction, the proceeds will be used to repay MakerDao debt as above.

When the amount of DAI obtained from auctions and settlement fee payments exceeds the limit set by Maker governance, the balance will be redeemed for MKR. The MKR purchased into the protocol will be burned, thereby reducing the total supply of MKR.

DAI Saving Rate

DAI Saving Rate allows any DAI holder to earn additional passive profits by locking DAI in the protocol contract, Buffer Maker will pay fees to DAI holders. This feature helps Maker DAO’s admin department stabilize DAI’s exchange rate against market fluctuations, specifically as follows:

- If the market price of DAI > $1: Holder MKR can choose to gradually reduce DSR, which will reduce demand as well as reduce the market price of Dai to the target price of 1 USD.

- If the market price of DAI is < $1: Holder MKR can choose to gradually increase DSR, which will stimulate demand while increasing the market price of Dai towards the target price of 1 USD.

Important external factors

In addition to smart contracts and infrastructure, the protocol also involves external actors to maintain operations:

- Manager: Being market participants helps DAI maintain its $1 target price. They sell Dai when the market price is higher than the Target Price and buy Dai when the market price is lower than the Target Price.

- Oracle on price: The Maker Protocol requires real-time information on the market price of the collateral assets in the Maker Vault to know when to trigger the Liquidation process. Decisions regarding the Emergency Oracle and the duration of the price delay will be made by the MKR holders.

- Emergency Oracle: MKR holers will vote and act as the last line of defense against attacks on the governance process or on other oracles. The emergency oracle helps mitigate the risk of a large number of users attempting to withdraw assets from the protocol in a short period of time.

- DAO team: The DAO team is comprised of individuals and service providers who may be contracted through Maker Governance to provide specific services to MakerDAO. DAO teams are independent market actors.

Highlights of Maker DAO

Maker DAO is one of the first projects to solve the problem of making the most efficient use of capital on DeFi. The platform allows users to mortgage assets into the protocol and mint stablecoin DAI to use for other purposes, this helps us not need to sell assets but still have money.

When DeFi explodes strongly in 2021, users buy assets and then wait for price increases to sell. Users also want to hold stablecoins to earn passive profits, or as a way to increase capital efficiency. At this time, MakerDAO is the only solution, so it has grown strongly since then.

Development Roadmap

Update…

Core Team

Run Christensen – Founder & CEO

- 2011 – 2013: Run Christensen studied international business at Copenhagen Business School.

- 2013 – 2014: Run Christensen studied at university Københavns University biochemistry.

- 2011 – 2014: Run Christensen was Co Founder at Try China, a company specializing in customer recruitment and business administration.

- March 2015: Run Christensen and his colleagues founded Maker DAO.

Investor

The project successfully raised $79.5M through 4 funding rounds with 23 investors:

- December 15, 2017: The project successfully called for $12M from 9 investors and led by A16Z.

- September 24, 2018: The project successfully called for $18M from A16Z.

- April 26, 2019: The project successfully called for another $25M from 8 investors and led by CoinD.

- December 19, 2019: The project successfully called for $27.5M from 3 investors, led by Dragonfly and Paradigm.

Tokenomics

Overview of the Maker DAO token

- Token Name: Token MakerDAO

- Ticker: MKR

- Blockchain: Ethereum

- Token classification: ERC20

- Contract: 0x9f8f72aa9304c8b593d555f12ef6589cc3a579a2

- Total supply: 977,631

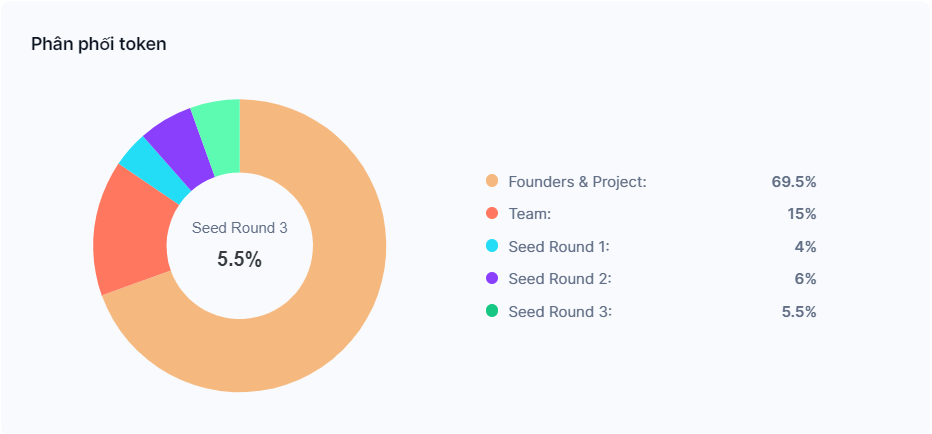

Token Allocation

Token Release

Up to now, MKR tokens have almost been unlocked.

Token Use Case

MKR token holders will have the following rights:

- Participate in voting on changes to the protocol, also known as project governance.

- Get a proposal vote and an executive vote regarding protocol changes.

- Protocol refinancing role.

Exchanges

Currently MKR tokens are being traded on major exchanges such as: Binance, Kucoin, Coinbase, Uniswap,..

MakerDAO Project Information Channel

- Website: https://makerdao.com/vi/

- Twitter: https://twitter.com/MakerDAO

- Telegram:

- Youtube:

Summary

Above is information about the Maker DAO project, the leading project in the Lending CDP segment. Maker DAO is also the oldest and most capital efficient platform on DeFi. With the above characteristics, can DAI rise above Tether to become the leader in the field of stable coins, let’s follow the project further.