In the DeFi 2.0 era, we have seen many decentralized exchange products being born and forming new trends. Today let’s learn about Crescent Network’s Dex model to see what’s different. So what is Crescent? Let’s find out through the article below.

To better understand the article What is Crescent Network, people can refer to some of the projects below to get an overview of Crescent Network.

- What is Stargaze (STARS)? Stargaze Cryptocurrency Overview

- What is Osmosis (OSMO)? Osmosis Cryptocurrency Overview

- Overview of the Cosmos 2022 Ecosystem

What is Crescent Network?

Overview of Crescent Network

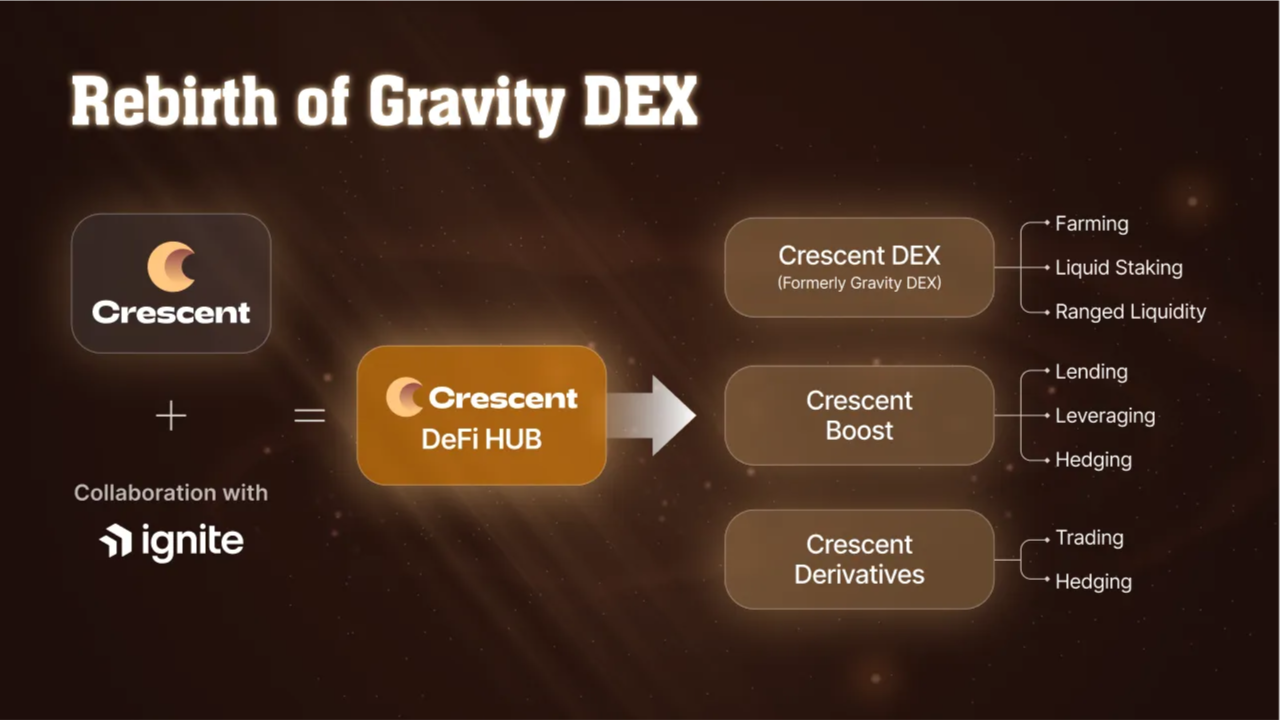

Crescent Network is a cross-chain Dex, considered a Defi-Hub built on the Cosmos ecosystem. Aims to improve the efficiency of capital use and effective risk management. Crescent is the product of a group of Cosmos cyber warriors called B-Harvest who in partnership with the Ignite team (Formerly Tendermint) had a vision of creating a DeFi experience like no other on the Cosmos Hub chain.

B-Harvest developed a working liquidity module called Gravity DEX, while Ignite created the frontend and Emeris web frontend. Crescent will significantly expand utility and connectivity within the blockchain by allowing users to bring investments from other chains to Crescent through IBC.

Users can experience products available on the platform such as: Swap, Earn, Staking, Farming.

The Crescent difference

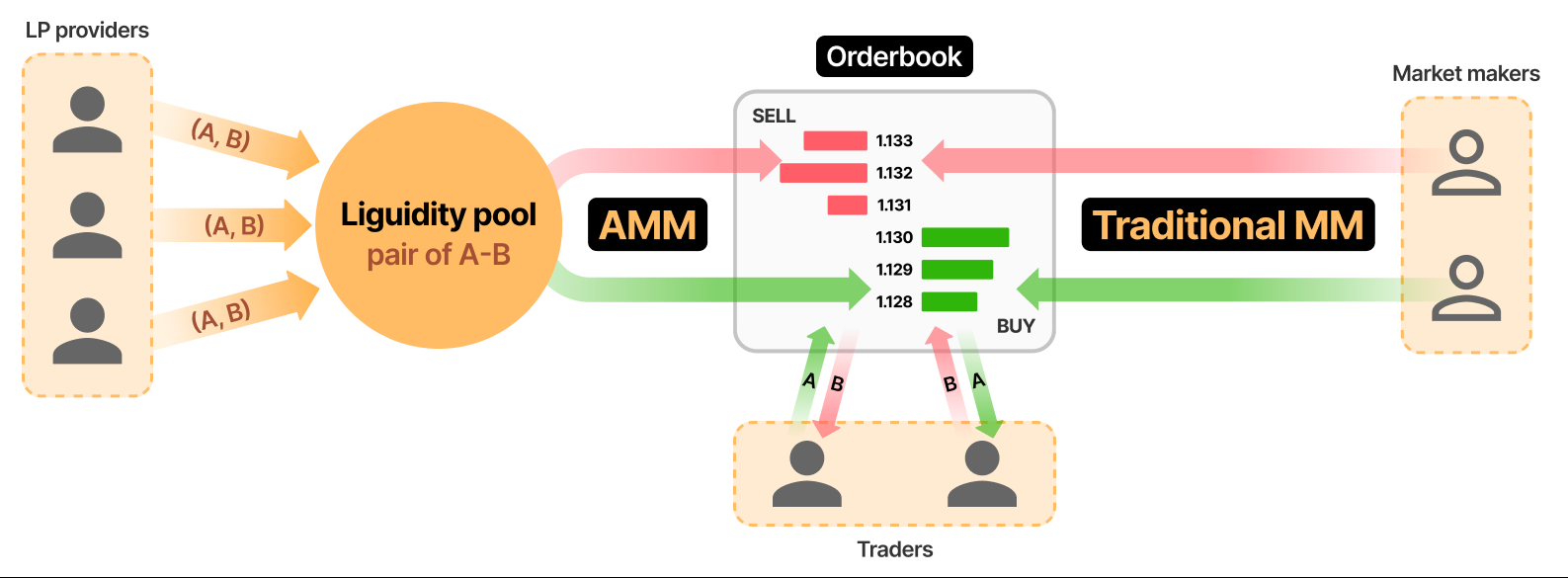

Crescent focuses on 3 main functions: Crescent DEX, Crescent Boost, Crescent Derivatives.

- In particular, DEX will maximize capital use through the Hybrid AMM/Orderbook method through a fair order matching mechanism.

- Prioritize security when handling asset exchanges. No transaction fees will be charged until a good and reasonable reason is presented.

- Like other Liquid Staking mechanisms on the market, Stake CRE tokens to receive bCRE, helping users both receive staking rewards and use bCRE for further farming.

- With two products Crescent boost and Crescent Derivatives, Crescent will cover the Lending segments. Hedging, Trading. In particular, at the time of launch Crescent DEX will not collect any swap fees.

Components that make up Crescent Network

- Liquidation Providers: Are liquidity providers on the pool with allowed assets on the system such as bCRE, CRE, ATOM.

- Stakers: These are traders who deposit their CRE assets into the system in exchange for bCRE corresponding to the amount deposited. bCRE can then be used to use other DeFi platforms in the ecosystem to bring in more profits.

Mechanism of action

- Step 1: After selecting a wallet, users can receive and send tokens via IBC.

- Step 2: Then select the token you want to convert and fill in the quantity.

- Step 3: Once you have deposited money into your wallet, experience the products on the platform.

Development roadmap

On April 27, the Crescent team updated the roadmap for 2023. The new roadmap will focus on issues such as: User Experience, user interface, Horizontal Expansion, Token Economic, Security and will have products newly released. Team Hak will update more when there is the most accurate time.

Core Team

As mentioned above, the team behind Crescent are mainly engineers and creators from B-Harvest and Ignite. They are veteran experts of the entire Cosmos Hub ecosystem.

Investor

In the July 2022 seed round, the Crescent team raised $5.0M from Nathan McCauley, Co-Founder and CEO of Anchorage Digital, a digital assets platform and related infrastructure provider. holding, investment and infrastructure for cryptocurrencies and crypto products.

Tokenomics

Overview information about Cre token

- Token Name: Crescent Network.

- Ticker: $CRE.

- Blockchain: Crescent Network.

- Token Standard: Native token.

- Contract: Updating..

- Token Type: Governance.

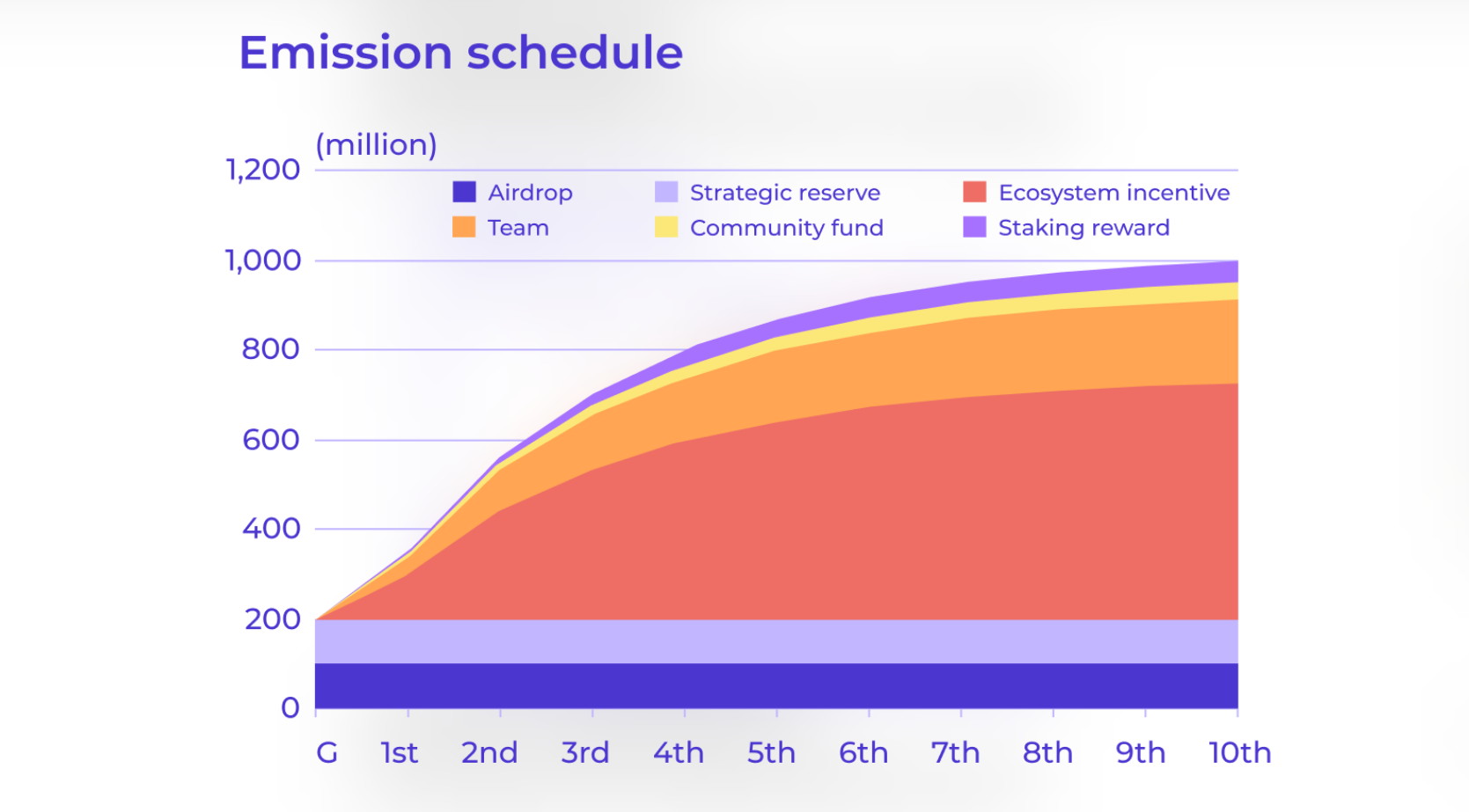

- Total Supply: 1,000,000,000 CRE.

- Circulating Supply: 231,874,541 CRE.

Token Allocations

- Team: 20%

- Staking Reward: 5%

- Community Fund: 2%

- Ecosystem Incentive: 53%

- Initial Distribution: 20%

Token Release

The project reserves 20% of the total supply (200M CRE) for the initial distribution divided equally between Airdrop (100M) and strategic reserves (100M).

Token Usecase

- Vote on administrative decisions

- Farming and receiving rewards from pools

- Stake to become a validator of the network

- Used to pay for gas fees when making transactions

Exchanges

CRE can only be traded on Crescent DEX.

Project information channel

- Twitter: https://twitter.com/CrescentHub

- Telegram: https://t.me/crescentnetwork

- Discord:

Summary

That’s all the latest information about Crescent Network that the Hak team has updated up to now. If you have any comments, please leave them below in the comments section.