LSDFi is a narrative worth following next season. However, each project has a different way of designing the operating mechanism. Today, you and I will learn about a pretty good project in the LSDFi segment, Mori Finance.

To understand more about Mori Finance, people can refer to some of the articles below:

- What is LSDfi? The First Puzzle Pieces & Potential In The LSDfi Array

- Overview and Liquidity Flow in LSDfi

- What is Lybra (LBR)? Overview of Lybra Cryptocurrency

Overview of Mori Finance

What is Mori Finance?

Miro Finance is a stable asset generation protocol built on Ethereum. It creates low-volatility assets that are less vulnerable to market volatility by collateralizing ETH LSTs. Additionally, users have the option to create ETHC and ETHS asset pairs as a hedging mechanism against ETH price fluctuations.

Mechanism of action

Currently, the project is accepting stETH as collateral and may expand to other LST tokens in the future.

First, you will mortgage stETH into the protocol to mint two types of tokens ETHS and ETHC. Mint ratio is arbitrary.

- ETHS (ETH Stablecoin): Is the project’s stable token. Initially when it was founded, ETHS was set at a price of $1. However, over time it will be anchored to the ETH price at a ratio of 1:10. That is, when the price of ETH increases by 10%, ETHS will increase by 1%, when ETH decreases by 10%, ETHS will decrease by 1%.

- ETHC (ETH Coin): A token that absorbs most of ETH’s price fluctuations.

We have a general formula for calculating the number of ETHS and ETHC in the project as follows:

Neth(t)∗Peth(t)=Neths(t)∗Peths(t)+Nethc(t)∗Pethc(t)

=> Total value of ETH = Total value of ETHS + ETHC.

Therefore, when ETHS has low price volatility, ETHC will be the token with high price volatility. Everyone should pay attention to this to implement the right strategy for themselves:

For example: When people predict the market will continue to decline, mint ETHS tokens to minimize losses. When people predict that the market will increase in price in the long term, people can mint ETHC tokens to bring in maximum profits.

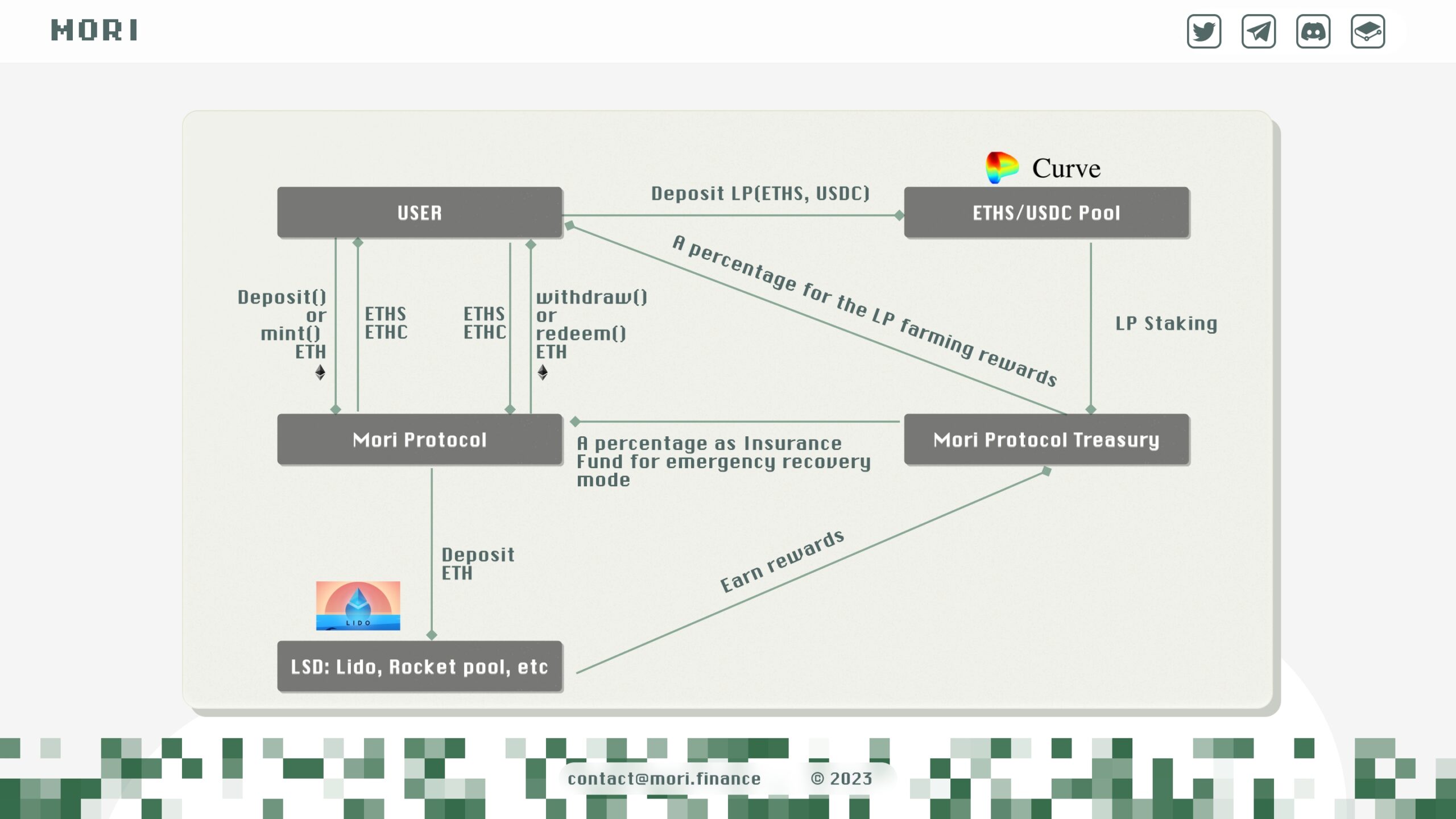

The project’s operational process will be:

Everyone deposits ETH and Mint releases ETHS and ETHC at the rate they like. The project will bring everyone’s ETH to deposit at Lido Finance (if everyone deposits stETH, there is no need to deposit anymore, directly profit from it). Profits earned from Lido will be sent to the Mori Protocol Treasury. Treasury will send 80% of the profits earned to ETHS and ETHC holders, the remaining 20% will be deposited into the Insurance fund.

In addition, for ETHS, after minting, everyone can provide liquidity on Curve with the ETHS/USDC pair to receive rewards from the farming process.

Development Roadmap

Quarter 2/2023

- Test net

- Community development

Quarter 3/2023

- Audit

- IDO

- Mainnet

- List tokens on Dex

- Join Curve war

Quarter 4/2023

- Deployed on Layer 2

- Cross-chain development

- Derivative is based on ETHC and ETHS

Core Team

Update…

Investors and Partners

Update…

Tokenomics

Information about Mori Finance token

- Token name: Mori token

- Ticker: MORI

- Total supply: 1,000,000

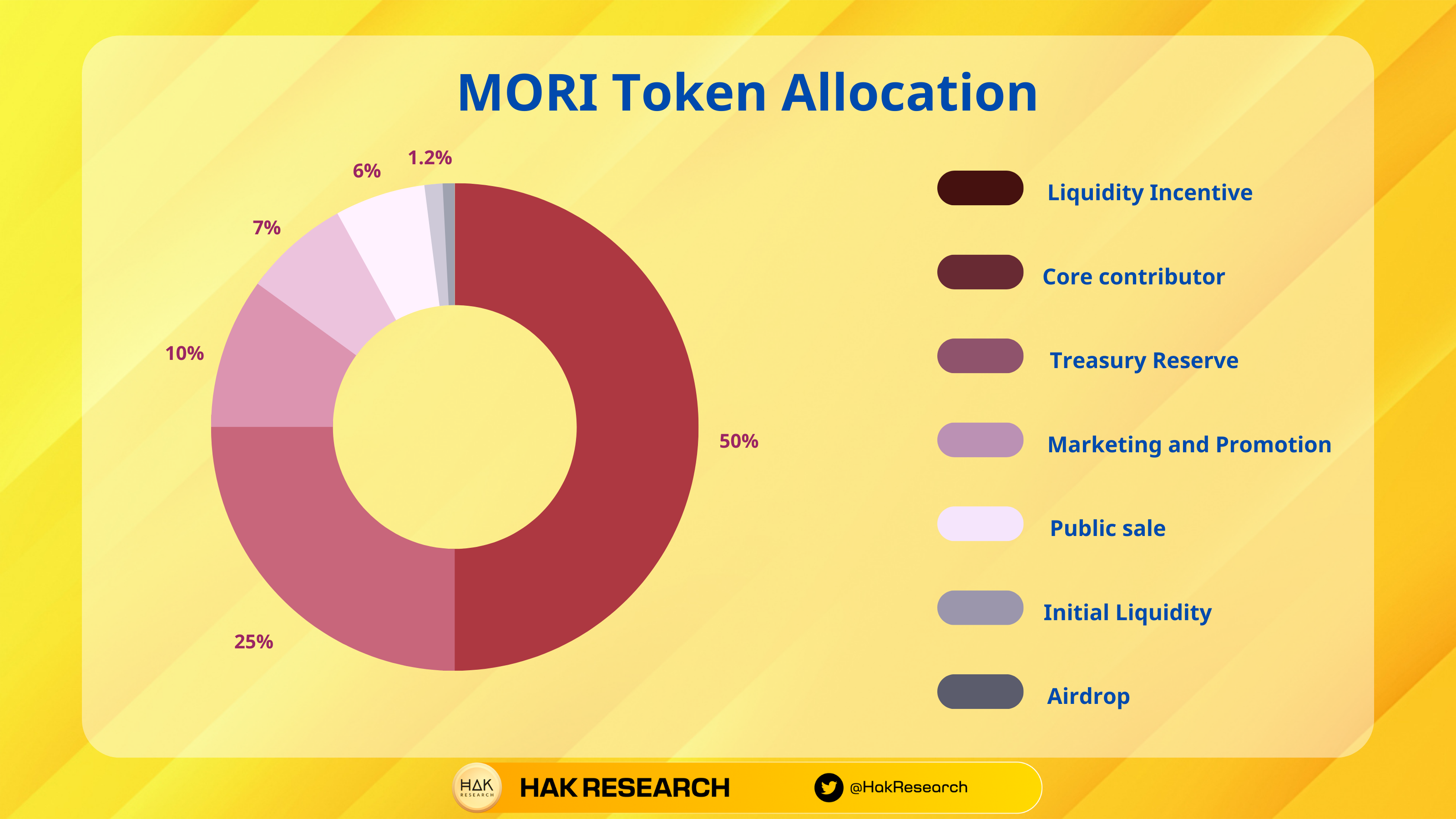

Token Allocation

- Treasury Reserve: 10%

- Core Contributor: 25%

- Liquidity Incentives: 50%

- Marketing & Promotion: 7%

- Airdrop: 6%

- Initial Liquidity: 1.2%

- Public Sales: 0.8%

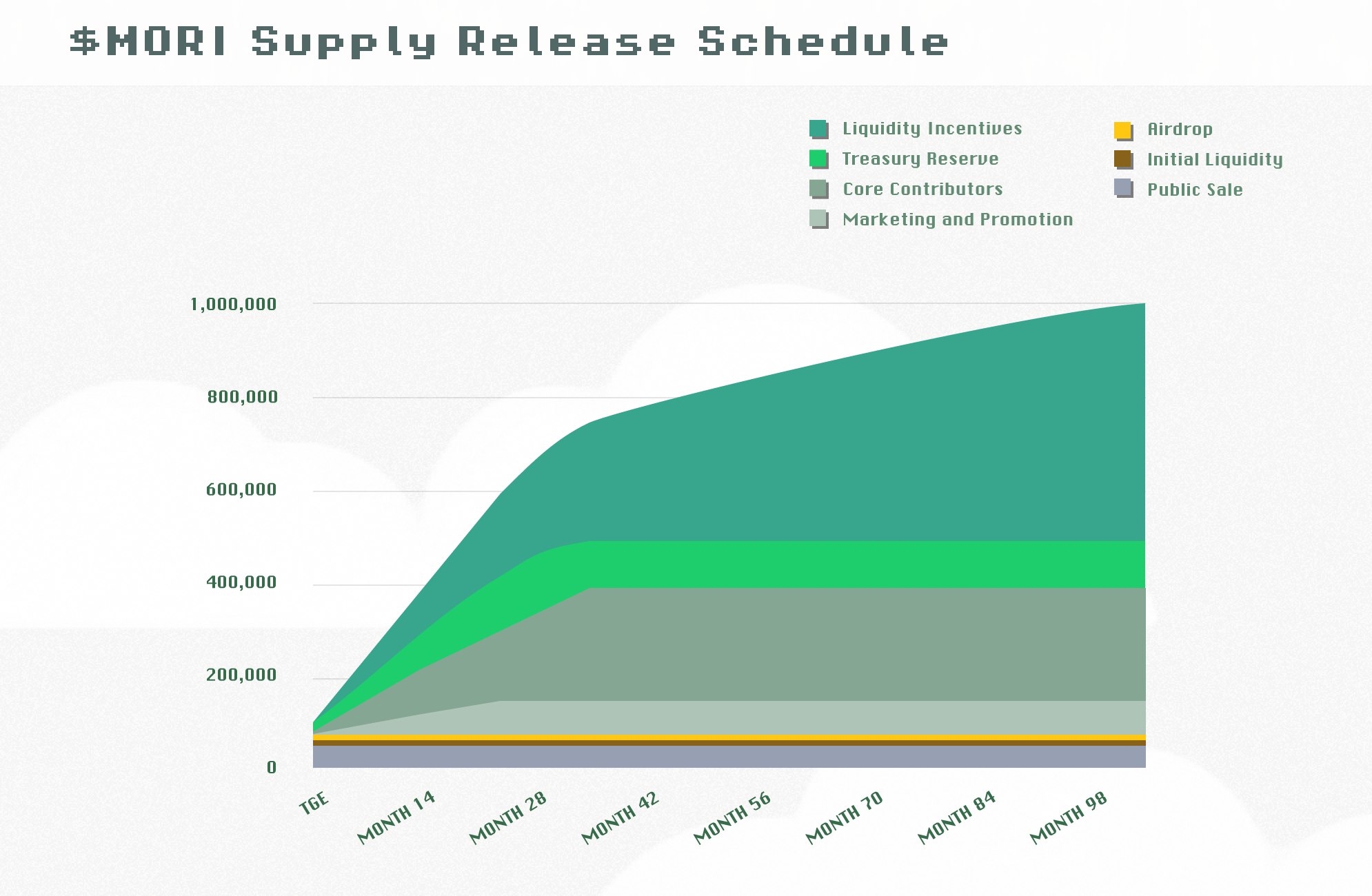

Token Release

- Airdrop, Initial Liquidity & Public Sales are all 100% paid at the time of TGE.

- Marketing & Promotion will be opened 10% at the time of TGE and then paid in installments over the next 2 years.

- Treasury Reserve will be amortized over 2 years and will be open 4.17% at TGE.

- Core Contributor will be paid in installments over 3 years and 2.78% at the time of TGE.

- Liquidity Incentives will be open 1.67% at TGE, 20% in the first year and 15% in the next 9 years.

Token Use Case

MORI is used as the project’s transaction fee and to stake for xMORI. xMORI holders can:

- Receive revenue share from the project

- Project management

Exchanges

Update…

Project Information Channel

- Website: https://mori.finance/

- Twitter: https://twitter.com/Mori_Finance

- Discord: https://discord.gg/SDA3zZtYbZ

- Telegram:

Summary

Currently, there are more and more projects working on LSDFi, each project has its own unique concept to unlock liquidity for stETH. But most projects have not created new points, people have to trade the profits earned from Lido to give a portion to the project to be able to use their services. Hopefully through this article, everyone will have more information about the project. If you are interested, please follow me to update the latest information.