How to optimize profits when the market has too many trading pools and not everyone has time to research and find liquidity provision strategies that bring the highest profits. If so, today let’s learn about a very interesting project that helps solve the problem of liquidity management.

To understand more about Fluo Finance, people can refer to a few articles below:

- What is Yield Farming? Make Profits As People Become “Farmers” In DeFi

- What Are Derivatives? Powerful Profit Tool for Crypto Winter

- What is Yield Yak (YYAVAX)? Yield Yak Cryptocurrency Overview

Fluo Finance Overview

What is Fluo Finance?

Fluo Finance is a decentralized liquidity management protocol that helps people use their money effectively to get the highest profit, without having to do too much. Fluo Finance also helps projects attract more liquidity from users effectively.

Imagine, everyone just needs to deposit tokens into the Vault on Fluo Finance and receive Yield without having to care which Blockchain they are using, without having to go back and forth through chains to find the most profitable Pool, which is This will be extremely time-consuming and transaction fee-intensive. So how does Fluo Finance do these things? Let’s find out how the project works.

Mechanism of action

Vault is the main operating mechanism of the project, all activities will revolve around Vault.

There are 4 main project participants:

- User: People visit the project website and choose which Vault is most suitable for their profit purposes, then deposit tokens there and receive xLP (xLP here can be BlueChipLP, AltCoinLP depends on the Vault, so we collectively referred to as xLP). The reward for the user here is: Transaction fee, esFluo is an incentive from the project, funding fee can also be the trader’s loss if that Vault provides liquidity for Perp DEX.

- Fluo Staker: Are people who hold Fluo tokens and stake into the network to earn more profits. After staking Fluo, everyone will receive stFluo representing the amount of Fluo held. Stakers can receive rewards of transaction fees, Vault creation fees and FLuo rewards from the staking process.

- DEX, Protocol: DEX projects use Fluo to attract liquidity from users, generating more transaction fees. They can create incentives for Vaults and bribe esFluo to direct liquidity to their projects. Protocols looking to launch new tokens want more liquidity and trading volume, they can incentivize people with incentives for Vaults.

- Traders: They will be attracted to liquidity by DEXs that possess a lot of liquidity, low spreads and slippage, this will attract traders, increasing trading volume.

DEX, LP, Trader are the core of DeFi and Fluo is the platform to bring it all together to create a win-win scenario.

Fluo is currently deployed on Arbitrum, zkSync Era, and Carbon (a Blockchain platform on the Cosmos network) and will quickly expand to other chains for users.

Development Roadmap

- Research and development

- Cooperation with DEXs (currently the project is at this stage)

- Launching token sale

- Vault Launch

- Expand to multiple Blockchains

- Administration and voting

- Launched Bot Grid Beta version

Core Team

Update…

Investor

Update…

Tokenomics

Information about tokens

Currently the project has 4 types of tokens: Fluo, stFluo, es Fluo, veFluo. Fluo is the main token of the project.

- esFluo is an escrow token version of Fluo. 1esFluo = 1stFluo. People can receive esFLuo by depositing money into Vaults and receiving an incentive of esFluo. When you want to withdraw esFLuo, it will be locked linearly for 12 months, with half unlocked every half a year.

- stFluo is the token received when staking Fluo. Holder stFluo will receive incentives from Fluo as I mentioned above. People can own stFluo in 3 ways: Unlock stFluo from esFluo, buy stFluo from the market, Stake Fluo into the project. To cancel the stake received to Fluo, everyone will be locked for 14 days.

- veFluo is the margin version of stFluo. veFluo holders to increase rewards from staking, for LPs holding veFluo allows you to receive x2.5 times esFluo when depositing into Vault. In addition to holding veFluo, everyone can vote on important decisions of the project, while also directing liquidity for DEXs and AMMs. This will help veFluo holders receive bribes from DEXs and AMMs to direct liquidity for their projects. To receive veFluo, people deposit stFluo according to the ratio: 100 stFluo locked in escrow for 4 years receive 100 veFLuo, 100 stFluo locked in escrow for 1 year receive 25 veFLuo, 100 stFluo locked in escrow for 1 week receive 0.48 veFLuo .

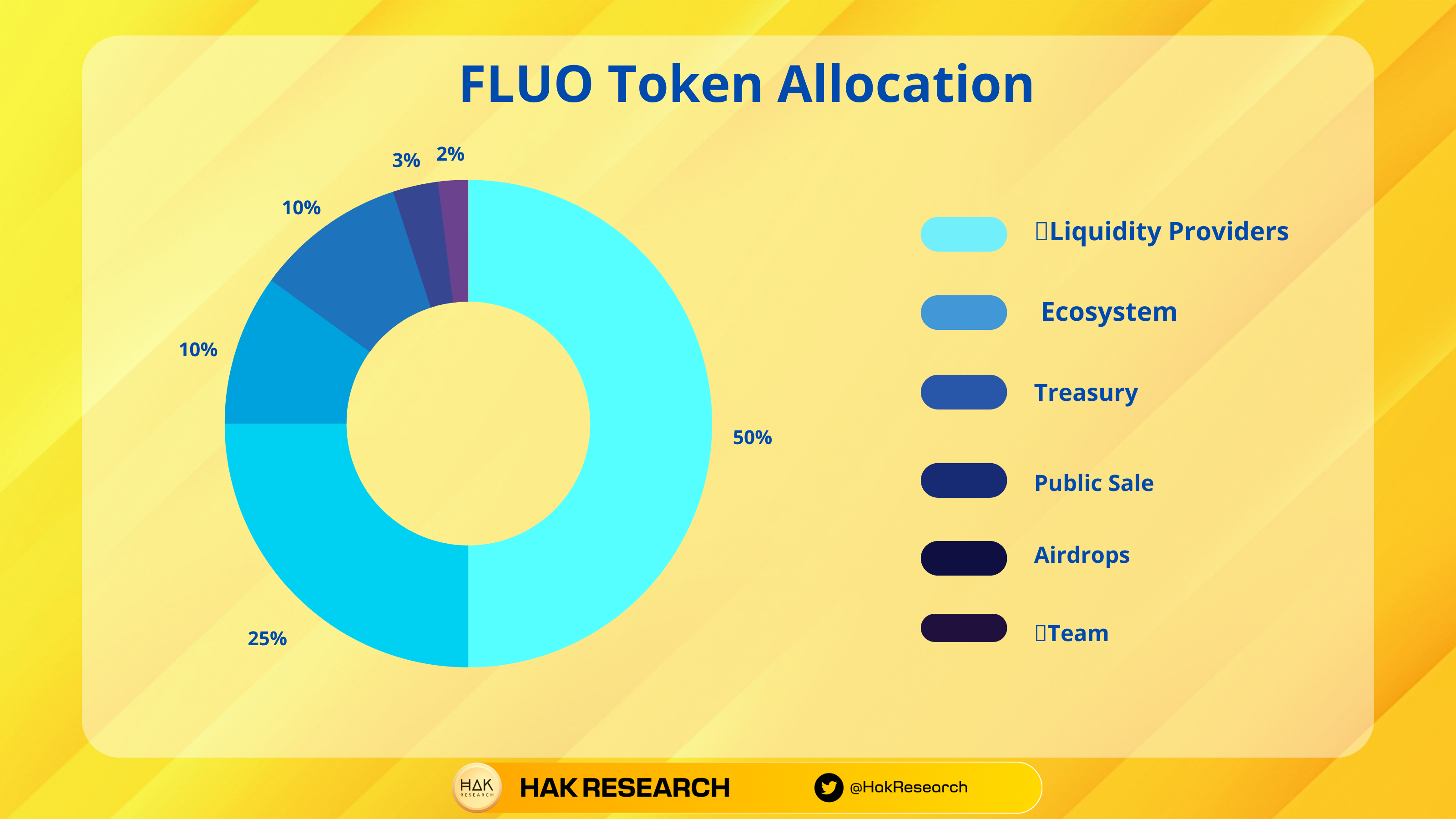

Token Allocation

- Liquidity Providers: 50,000,000 (50%)

- Ecosystem: 25,000,000 (25%)

- Treasury: 10,000,000 (10%)

- Public sale: 10,000,000 (10%)

- Airdrop: 3,000,0000 (3%)

- Team: 2,000,000 (2%)

Token Release

- Liquidity Providers: 50,000,000 (50%). Unlock gradually over 3 years

- Ecosystem: 25,000,000 (25%). Unlock gradually over 2 years

- Treasury: 10,000,000 (10%). Unlock gradually over 1 year

- Public sale: 10,000,000 (10%). Unlock immediately uponTGE

- Airdrop: 3,000,0000 (3%). Unlock immediately upon TGE

- Team: 2,000,000 (2%). Lock for 1 year, unlock gradually over 2 years

Exchanges

Update…

Fluo Finance Project Information Channel

- Website: https://fluofinance.com/

- Twitter: https://twitter.com/FluoFinance

- Discord: https://discord.com/invite/3fqe7937vh

- Telegram:

Summary

FLuo Finance is a pretty good project that follows Curve War’s Concept to stimulate projects to direct liquidity to themselves, while helping users make profits without too much manipulation and understanding of the technology. turmeric. If you are interested in the project, please follow me to update the latest information.