What is Sphere Finance? Sphere Finance is a governance platform with the goal of becoming the governance center on the Polygon ecosystem. So, what is special and interesting about Sphere Finance? Let’s find out together in the article below.

To better understand Sphere Finance, people can refer to some of the articles below:

- What is Curve Finance (CRV)? Curve Finance Overview of Cryptocurrencies

- What is Convex Finance (CVX)? Overview of Cryptocurrencies Convex Finance

- What is Velodrome (VELO)? Velodrome Cryptocurrency Overview

- What is Lending & Borrowing? The Essential Borrowing and Lending Puzzle in DeFi

Sphere Finance Overview

What is Sphere Finance?

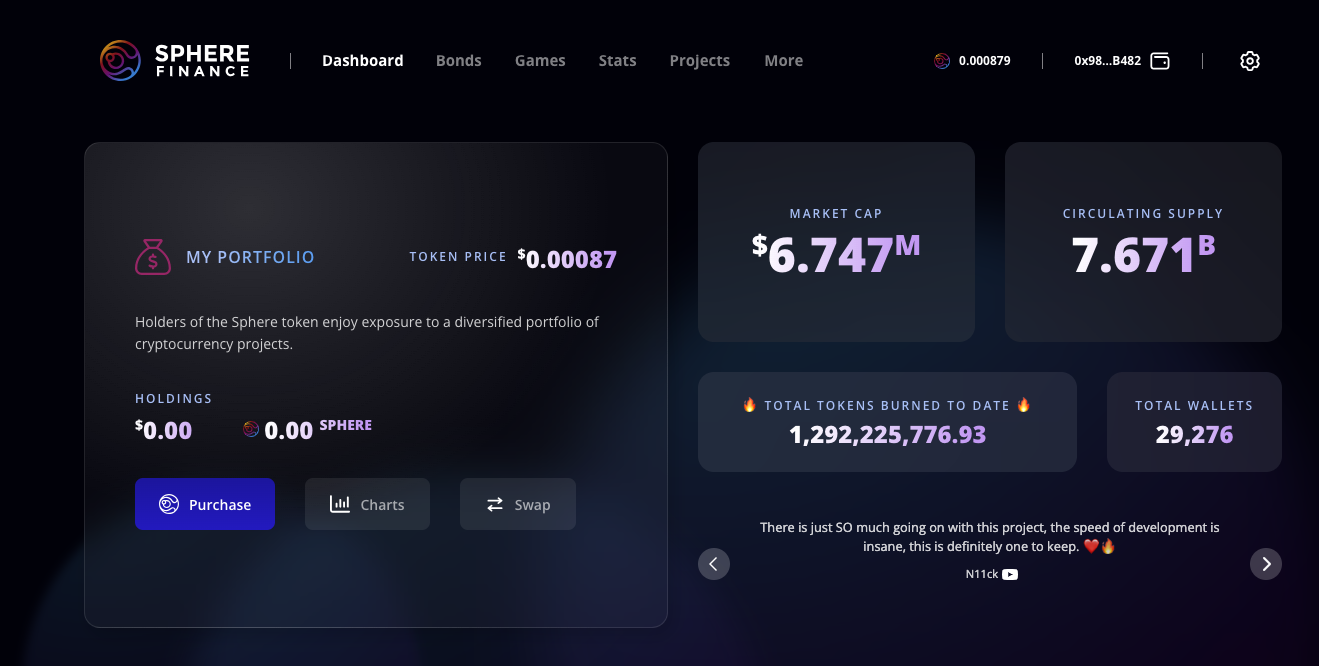

Sphere Finance is a governance hub for projects in its ecosystem. Through Sphere Finance, everyone can participate in governance and direct liquidity for projects to receive optimal profits.

In essence, Sphere’s operating model is extremely simple, people just need to buy SPHERE Tokens and lock them to vote on important decisions and receive profits.

To understand the income source from Sphere, let’s learn about the projects in its ecosystem: Dyson, Spherelend, Preon, Penrose, Unknow, Covenant.

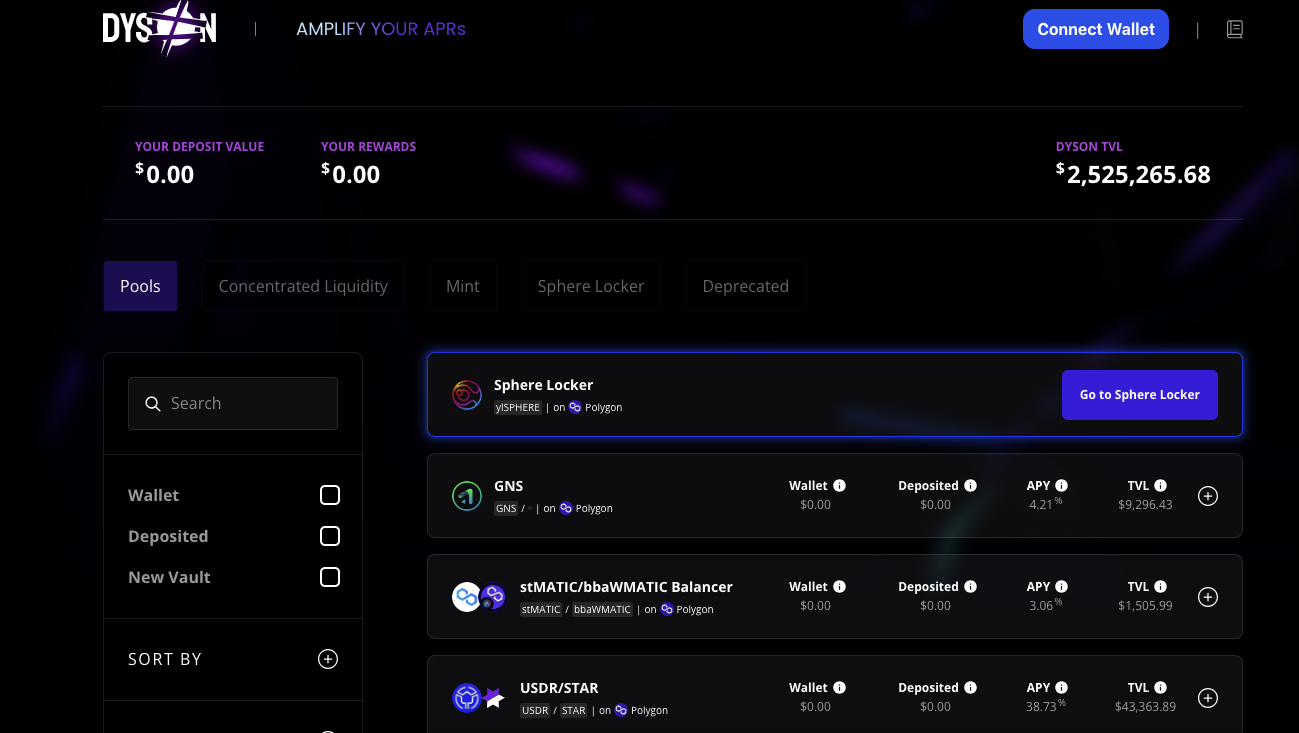

Dyson

- Is a branch in the Sphere Finance ecosystem. The project creates investment strategies on many different chains, everyone can choose investment strategies to suit their risk appetite.

- All strategies on Dyson are secured and implemented automatically using smart contracts, the project will also automatically harvest profits and reinvest to get the highest profit, everyone can withdraw capital at any time. any time if you want.

- Sphere Earning Pool is a Dyson vault. This vault serves to administer and share profits from Dyson’s fees. To join the vault, everyone only needs to lock the SPHERE Token in the vault for 17 days to receive ylsSPHERE. Use ylsSPHERE to perform administrative functions and receive profits.

Spherelend

- Is a lending marketplace of Sphere. Where people can lend their Stablecoins and receive interest. Borrowers can pledge ETH or Matic to borrow Stablecoins at zero interest.

- The project’s interest comes from the borrower’s use of ETH and MATIC to farm in other projects. The project is suitable for those who want to earn stable, safe interest rates with Stablecoin and those who hold ETH or MATIC but believe that the Token will increase in price strongly and want to buy more.

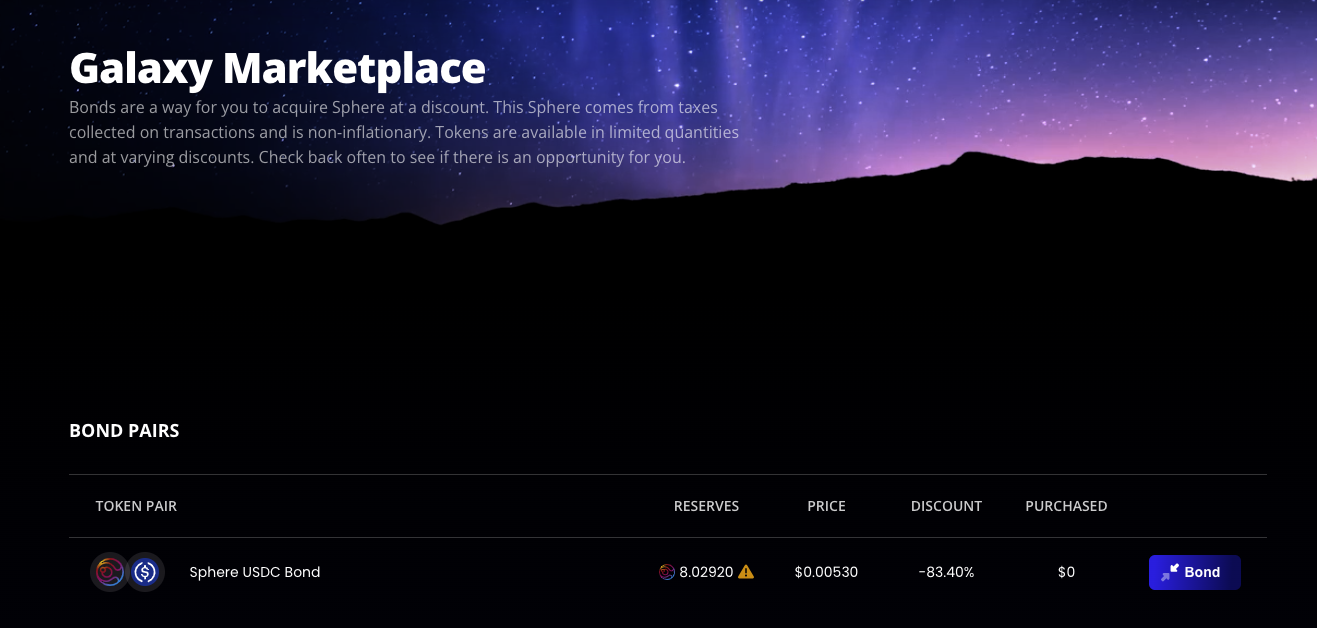

Galaxy Market

- Quite similar to OlympusDao allowing users to buy OHM at a discounted price, Galaxy Market also has the same way of working. Users can purchase Sphere at a discounted price from the project’s treasury. Currently the project is accepting USDC or MATIC as payment assets. The discounted price will be based on The Bond Oracel. It is a smart contract that decides when the bond will be issued and how much the discount will be.

- Once the bond is purchased by a user, the sale proceeds will be split 80/20. Of which 80% will be deposited into the Treasury to develop the project, the remaining 20% will be used by Fred bot (an automatic bot of Galaxy Market) to buy back SPHERE Tokens on the market and burn or use. to provide liquidity for the SPHERE Token.

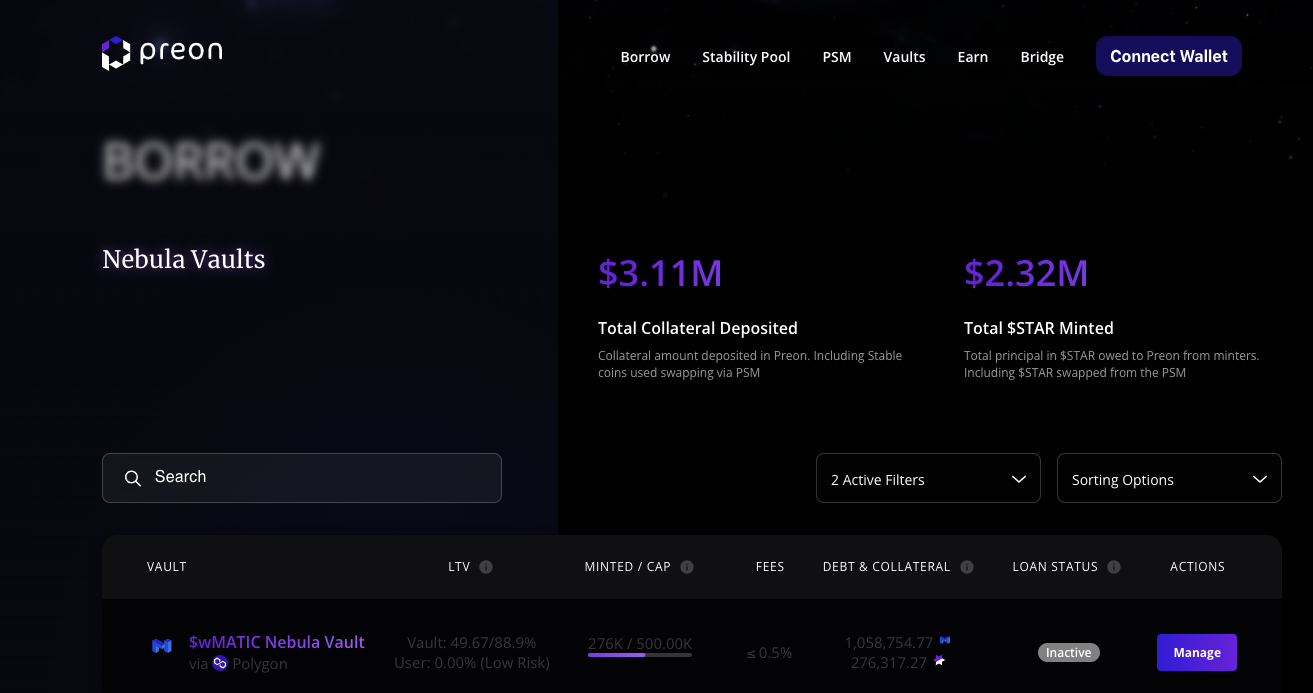

Preon

- Preon is also a Sphere lending marketplace. However, unlike Spherelend, users will now use their collateral assets to borrow the project’s Stablecoin STAR.

- The project accepts quite diverse collateral from LPs to many different types of tokens.

- Profits from transaction fees will be sent to the project’s Treasury and partly to the Sphere Earning pool (shared with ylsSphere holders).

Penrose and Unknown

- I grouped the two projects together because they have quite similar operating models. If everyone has studied Curve WAR, they will understand that Convex is the project that has won in controlling the allocation of CRV Tokens to pools. For Sphere Finance, Penrose is Convex and Dystopia is Curve on the Polygon network. Penrose will be an aggregator where people can deposit Dystopia or veDystopia tokens into Penrose to receive better interest rates and receive in return PenDystopia tokens that can be traded on the secondary market without being locked for 4 years.

- Similar to Penrose, Unknown is Convex and Cone Exchange is Curve. The project operates on the Binance chain network.

- Penros’ relationship with Sphere Finace is that Sphere Finace has administrative rights for Penrose operations, similar to Unknown.

Covenant

- So how do projects incentivize veToken holders to vote in favor of their liquidity pools?

- Sphere Finace built Covenant, the main purpose of the project is to provide protocols with a set of tools to incentivize vetoken holders to vote for their pools.

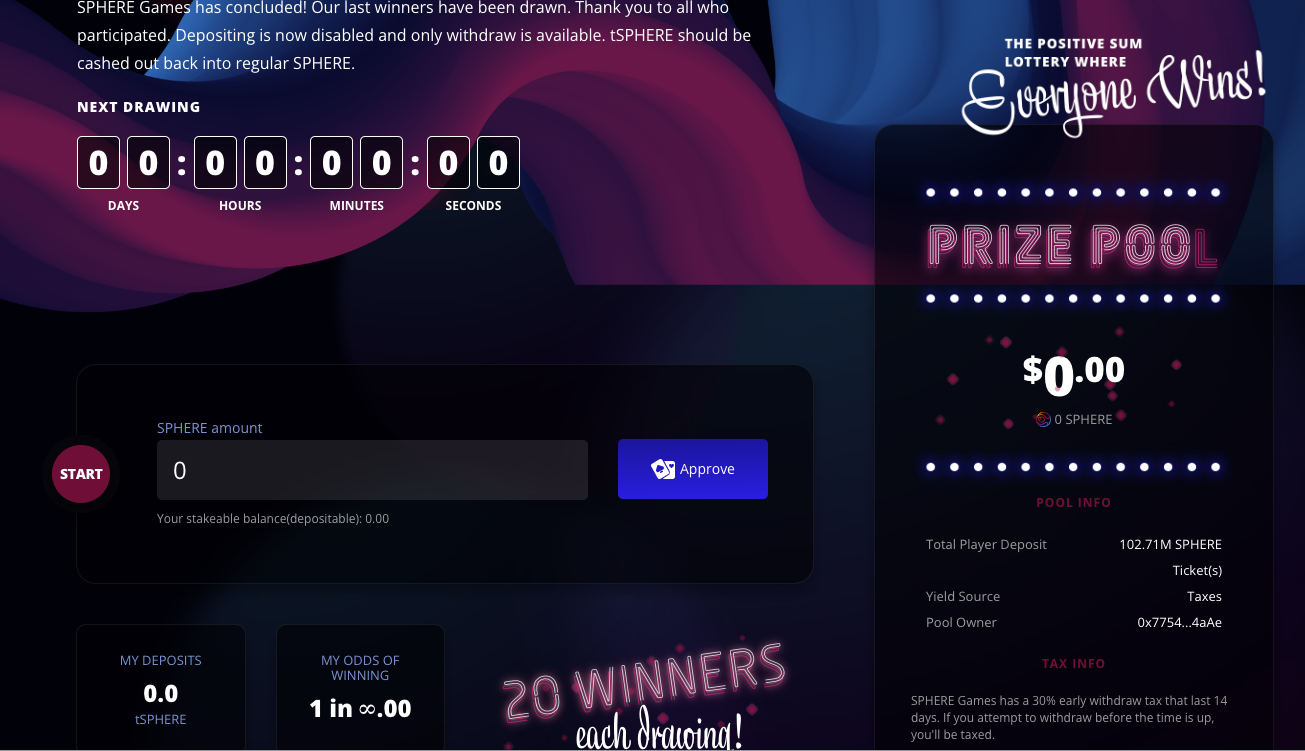

Sphere Game

- A project that I initially intended to ignore because I was afraid that people would feel overwhelmed by the large number of projects in the ecosystem, but I thought the concept was quite good so I introduced it to everyone. This is a lottery project on Sphere.

- People can deposit their Sphere tokens into the project for 14 days to receive a chance to win a prize of Sphere tokens without any fees. The prize comes from the project using everyone’s Sphere tokens to deposit into the Sphere Earning Pool to earn profits.

Development Roadmap

Update…

Core Team

Update…

Investor

The project has gone through two rounds of public sale and raised about $900,000 from retail investors in the market.

Tokenomics

Token information

- Token name: Sphere

- Ticker: SPHERE

- Ancestral palace: 5,000,000,000

Token Allocation

Currently, I have not found the project’s token allocation table on the website.

Exchanges

Currently, everyone can participate in buying Sphere tokens on the project website via Galaxy Market.

Sphere Finance Project Information Channel

- Website: https://www.sphere.finance/

- Twitter: https://twitter.com/SphereDeFi

- Discord: https://discord.gg/spheredefi

- Youtube:

Summary

Sphere Finace has a fairly large ecosystem. Instead of focusing on the Ethereum market where Curve has taken the number 1 position, the project focuses on other markets including Polygon and Binance Chain. Projects in the Sphere Finance ecosystem greatly support and influence each other.

If you are interested in the project, please follow me to update the latest news.