What is Blend? Blend is a Lending protocol for NFTs deployed on the Blur platform that allows users to use NFTs as collateral to borrow a corresponding amount of ETH.

Since its launch, Blend has quickly attracted a large number of participants, surpassing a series of other NFT Lending platforms to reach the No. 1 position in terms of lending volume and users at the present time. So what is so special about this protocol that makes it so attractive? Let’s find out with Weakhand in this article.

Before jumping into the article, everyone can learn more about some of the following projects to better understand this article:

- What is Blur? Blur cryptocurrency overview

- What is NFTfi? Overview of NFTfi cryptocurrency

- What is BendDAO? BendDAO cryptocurrency overview

- NFT Lending: Models, Efficiencies & Opportunities

What is Blend?

Overview of Blend

Blend is a lending protocol for NFTs implemented on the Blur platform. Blend applies the model Lending P2P allowing users who want to borrow against their NFT collateral with any lender willing to offer the most competitive rates for the loan.

Blend is short for Blur Lending, the reason Blending is called Perpetual Lending is because Blend provides loans with no term, allowing loan positions to be maintained indefinitely until liquidated at market-determined interest rates. identify.

What is Blend?

In addition, Blend also does not apply Oracles to get price data to determine the user’s position in the loan as well as to determine the interest rate. This was answered by the team that each NFT has its own characteristics and is very difficult. to measure and apply across all NFTs in the same collection. Blend avoids any dependencies in the core protocol. Interest rates and loan-to-value ratios are determined by whatever terms the lender is willing to offer, liquidation is triggered by the failure of a Dutch auction (this I will further explanation later).

Blend is developed by Blur Core Contributor along with cooperation with Paradigm. In addition to implementing the Lending model on Blur, the team also develops additional products BNPL (Buy Now Pay Later) allows users to purchase Blue Chip NFTs upfront for a small amount of money.

Introducing Blur

Blur is the foundation NFT Marketplace Aggregator designed for NFT Traders and Collectors. Blur aggregates data from many different NFT exchanges such as: OpenSea, LookRare, X2Y2,… to help users search for suitable NFTs on a single platform.

Operating Model

Blend’s operating model follows these steps:

- Step 1: The lender places an off-chain order to lend a certain amount of ETH at a specific interest rate against any NFT in a specified collection. The interest rate offered by the lender will remain stable throughout the loan process.

- Step 2: Borrowers who own NFTs can browse available Offers and choose one that matches the terms they are interested in. They then accept the lender’s Offer by depositing NFTs onto the platform to receive an amount of ETH in return.

- Step 3: The lender can call back his loan at any time. Borrowers have 6 hours to request loan refinancing in the form of a Dutch auction. If a new lender cannot be found after this period, the borrower has 24 hours to repay the loan.

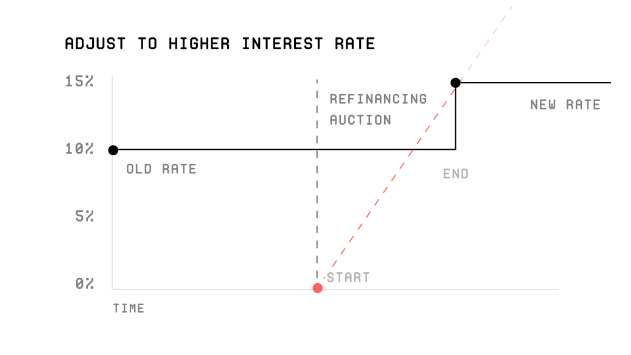

Refinancing auction: At expiration, if the borrower has not repaid the loan, a refinancing auction begins at a 0% interest rate with the rate increasing steadily. When the auction reaches the interest rate at which the new lender is interested in lending, the new lender can accept it by submitting their offer on the chain. The new lender pays the old lender the full repayment amount calculated at the time the auction is completed and takes over the loan.

The interest rate will gradually increase until the new lender takes over the loan

When the interest rate reaches 1000% without a new lender taking over the loan, the lender’s NFT will be liquidated and transferred to the lender.

Evaluating Blend’s Lending Model

Advantages of Blend’s Lending model

For Blend, I see some advantages as follows:

- By participating in Blend as a lender or borrower, users will receive x2 Points, which Blur will later use to airdrop BLUR tokens to users. This also partly explains why Blend is the No. 1 NFT Lending protocol in terms of both volume and users at the present time.

- In addition, applying the refinancing method helps the borrower basically maintain the loan permanently without having to fear liquidation, and the lender can exit the loan at any time they want. . This creates flexibility for both borrowers and lenders.

Disadvantages of Blend’s Lending model

- Applying only 24 hours to repay the loan makes it difficult for the borrower and the refinancing process to be successful. If the new lender receives an interest rate that is too high compared to the original interest rate, the borrower will have to manage to repay the total loan amount + interest if they do not want to pay a large amount of interest to the lender later.

- If the refinancing process fails, the collateral NFT will transfer to the lender. This also does not really benefit the lender in case the amount of money spent to lend is greater than the value the collateral NFT brings them.

summary

Blend has been very successful in attracting a large number of users to the platform since its launch. With more than 3000 loans and more than 75% market share in the NFT Lending market, it shows the huge attraction that Blend has brought. Although there are still some disadvantages in the Lending model, with what Blur has done, I am confident that these disadvantages will soon be overcome in the near future. Above is all the information that I want to send to everyone in this article. I hope everyone has interesting knowledge about Blend.