What is Arcton? Arcton is a platform The next generation crowdfunding with the ambition to bring Web2 and Web3 closer together in its own way. Arcton has something interesting when it comes to opening up the IPO trend in the Crypto market. Everyone, let’s find out in the article below.

To understand more about Arcton, people can refer to some of the articles below:

- What is Arbitrum (ARB)? Arbitrum Cryptocurrency Overview

- What is Layer 2? Complete Guide to Layer 2 Solutions

- What are ICO, IEO, IDO? Differences in Capital Calling Models

Arcton Overview

What is Arcton?

Arcton is a next generation capital raising platform. The difference is that while regular Launchpad projects will deploy and support projects on Web3, Arcton provides Launchpad solutions for Web2 companies on Web3 where stocks (Real World Assets) are tokenized. .

To put it simply, Arcton allows Web2 startups to IPO on Web3 and then the tokenized shares will be traded on the Camelot platform. Investors on Web3 will participate in the IPO with assets such as USDC or cash.

Some of Arcton’s ambitions include:

- Allows everyone to invest in startups without stopping at Angel Investors.

- Providing investors with a deep and sustainable level of liquidity for their investments.

- Allows investors in Web3 to invest in companies Web2 startup by buying real stocks of real companies.

- Enables startups to raise capital and liquidity in a completely decentralized and community-driven way.

- The shares will be tokenized before being posted to the Blockchain. These stocks can be considered as a form of Real World Assets.

- Providing investors with a secure legal framework for their investments, using the new Swiss DLT Bill created to tokenize shares

IPO process

When a Web2 business IPOs on Arcton, it will go through several processes as follows:

- Tokenization: Shares of startups are legally tokenized under Swiss Law.

- Offer for sale: Shares of startups are offered to the public on Arcton.

- Buy IPO: Investors will participate in buying the IPO using USDC or FIAT.

- Register: The newly created shares will be entered into the Commercial Registry, following the approval of the Swiss notary and the Commercial Registry.

- Liquidity: The startup will set up a liquidity pool on the Camelot platform.

- Claim & Sell: Investors can claim their shares and sell on the Camelot platform.

Development Roadmap

Update…

Core Team

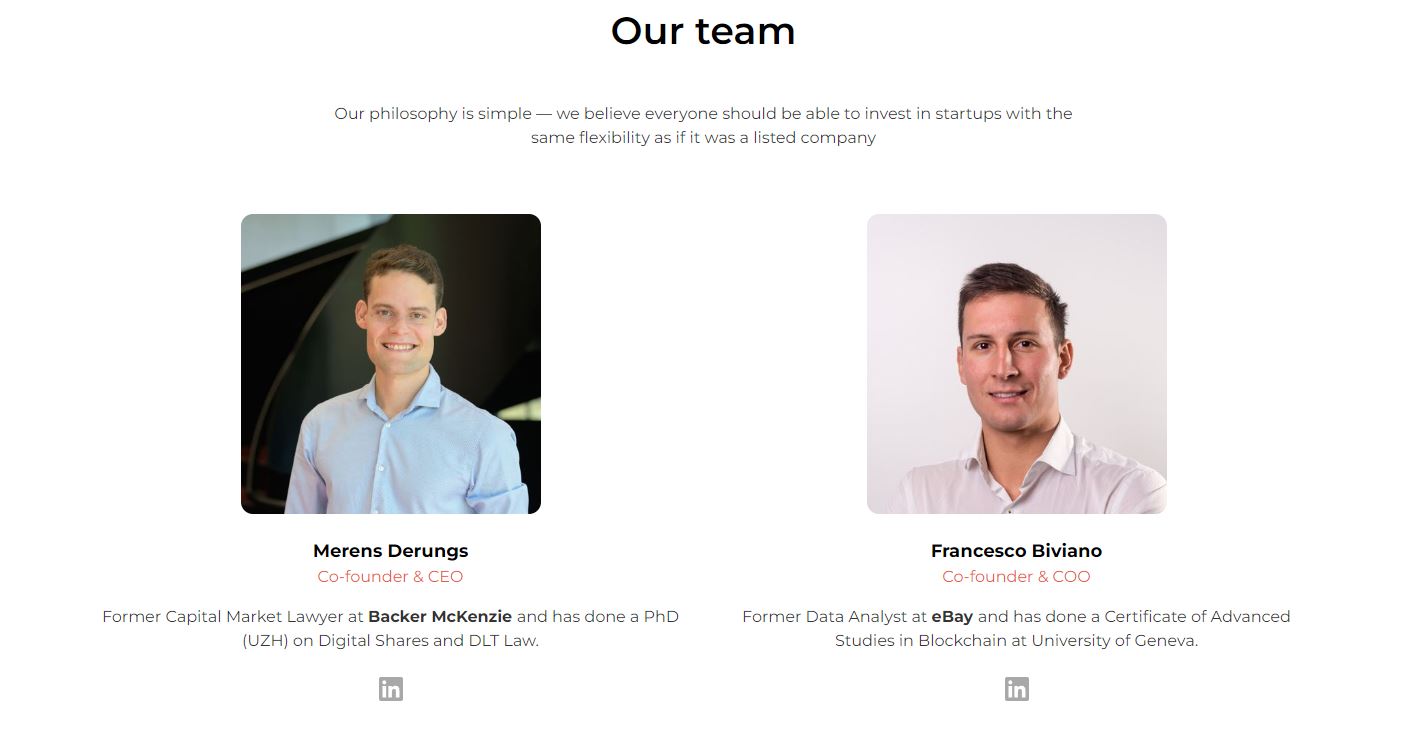

Merens Derungs: Co Founder & CEO

- Merens earned a Bachelor of Arts (BA), Law and Economics then went on to earn a Master’s degree in Law and Economics. Finally, Merens earned a PhD in Law and Blockchain from the University of Zurich.

- Immediately after graduating, Merens worked as a lawyer intern at Baker McKenzie in the areas of capital mobilization, mergers & acquisitions, project management, business law,…

- After working as a research assistant and teaching for more than 3 years at the University of Zurich, Merens officially started her business with Arcton.

Francesco Biviano: Co Founder & COO

- Francesco earned a Bachelor’s degree in Economics at the University of Deli Studi di Trieste, then a Master’s degree in Finance – General at the University of Lausanne and finally a certificate of advanced studies in Blockchain at the University of Geneva. .

- Francesco used to work in Data Analytics at many large organizations such as eBay, The Global Fund, Capomondo SA,… then together with Merens started a business with Arcton.

Investor

Update…

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

Summary

Arcton is a relatively notable new project on the Arbitrum ecosystem in the near future. Will Arcton open a trend to help Web2 platforms easily raise capital in the future?

Hopefully through this article everyone can understand more about what Arcton is?