What is InfinityPools? How is InfinityPools’ new leverage mechanism different from previous liquidity protocols? Will this become a formidable force in Defi compared to previous AMM platforms?

Imagine when users have the advantage of 10x more assets, 10x faster listings, and up to 100,000x leverage on correlated collateral assets.

Join Weakhand to learn information about a market making protocol with these new improvements through the article below.

For articles on related topics, readers please visit:

- What is UniswapX? Uniswap Is Ready To Be The Best AMM On The Market

- What is Uniswap V4? Will Uniswap Continue to Lead the AMM Field?

- What is TWAMM? Why Was TWAMM Developed In Uniswap V4

Overview of Infinitypools

What is InfinityPools?

InfinityPools is a Defi platform with a New AMM mechanism that allows users to use unlimited leverage and no liquidation. InfinityPools is also an Oracle-free decentralized perpetual contract exchange.

With InfinityPools, traders take out fixed-term loans against positions just like the existing Uniswap V3. They pay an upfront fee to cover the fees throughout the period. If at the end of the transaction their position has a negative balance, the assets will be returned in kind to the LP. However, if the transaction is profitable, they can extend the loan term and continue paying interest or can close it and take a profit.

Imagine, when you enter a trade with a leverage position of X1000, what will happen? InfinityPool launches a completely new trading protocol for any type of Token, asset on ERC-20.

Mechanism of operation of InfinityPools

InfinityPools still uses Uniswap’s AMM auto-coin market making mechanism but in a new and improved version.

The InfinityPools protocol is built on the centralized liquidity automated market making (AMM) principle of Uniswap V3. At a high level, the protocol works by requiring DEX liquidity providers (LPs) to deposit their LP tokens into the protocol, which is then aggregated and allowed to traders who are Looking for leverage to borrow again. Leverage (loan) is created by withdrawing a portion of the underlying LP assets to purchase additional leveraged assets of the trader.

Typically, leveraged positions are created by borrowing assets such as cash (USDC) from another party. Therefore, the loan is expected to be repaid with the borrowed assets. This creates problems when trading turns down and the position needs to be liquidated as leveraged assets must be sold for the exact amount of borrowed USDC, otherwise the protocol will incur bad debt. To ensure there is liquidity for safe liquidation, protocols must put in place safeguards such as margin and leverage limits, which limit scalability and user experience. But InfinityPools’ use of LP tokens as a lending source has had a subtle yet huge impact on how liquidations are handled within the protocol.

Cabbage Outstanding progress of Infinitypools

Infinitypools uses Uniswap V3’s mechanism to provide traders with great trading opportunities. Traders receive fixed-term loans on the same positions that Uniswap V3 borrowed. An upfront fee covers transaction time. At the end of the period, if the market is green continue to enjoy profits – if it is red it means the position has been closed.

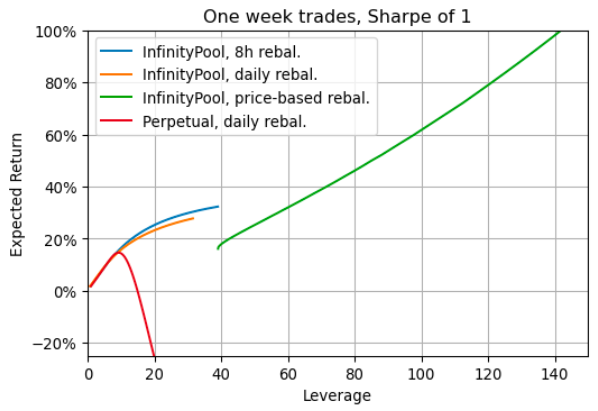

According to Matthieu Gavaudan Co-founder of Infinitypools and Lemma Labs. Infinitypools features 5 tenfold (10X) improvements to the on-chain leveraged trading experience.

- More assets

- List faster

- Higher leverage (2x to 5000x).

- No liquidation required.

- No more counterparty risk (no Oracle).

Development Roadmap

Update…

Core Team

Update…

Investors And Partners

Update…

Tokenomics

Update…

InfinityPools Information Channel

- Website: https://infinitypools.finance/

- Twitter: https://twitter.com/InfPools

- Discord: https://discord.gg/fr95mvx9xK

- Docs:

Summary

Infinitypool is the latest Defi protocol that offers unlimited leverage, no counterparty (oracle) risk, and no liquidation risk. InfinityPools uses and supports Uniswap V3 liquidity.

While DeFi has evolved, many new protocols do not bring real innovation, leading to a hypothetical innovation cycle. InfinityPools breaks this cycle with innovations that truly bring value to users: High leverage, more assets, faster listings and less risk from external factors.

InfinityPools is one of the few protocols that can bring about an unprecedented moment in DeFi, similar to what Uniswap did before.