What is Yieldification? Yieldification is a yield farming platform that delivers real profits using a unique combination of ERC20 tokens and NFTs. Let’s find out what is special about this project with Weakhand in this article.

What is Yieldification?

Yieldification overview

Yieldification is a Yield Farming platform deployed on Ethereum. Yieldification brings real profits to users with a completely new combination of ERC20 tokens and NFTs in the form of certificates of deposit.

What is Yieldification?

Yieldification deploys 2 main products on the platform including:

There are 2 forms of Staking:

- Single Sided Staking: Users Stake YDF tokens to receive sYDF and NFTs representing the user’s shares in the Pool. Users can claim rewards earned every 7 days. In addition, users can transfer their shares through selling NFTs on open markets such as: OpenSea, ….

- Liquidity Staking: Users can Stake the YDF – ETH token pair to earn even higher returns than the Single Sided Staking mechanism. Similar to sYDF, users also receive slYDF and NFTs that can be licensed and sold on NFT Marketplace markets such as: OpenSea, Blur,…

Perpetual Futures Trading: Users use YDF tokens as collateral to play long/short with leverage up to x200.

What is the difference of Yieldification?

Yieldification applies the Zap liquidity function to help streamline the Staking process so that more new people can access the platform. With the Zap function, users only need to Stake ETH, YDF or both ETH – YDF and the rest is handled by the platform. Users still receive slYDF and NFT with the same returns as manual liquidity provision.

Core Team

Yieldification was developed by an anonymous group. However, all team members are KYC through AssureDefi.

Investor

Update…

Tokenomics

Basic information about tokens

- Token Name: Yieldification

- Ticker: YDF

- Blockchain: Ethereum, Arbitrum

- Contract: 0x30dcba0405004cf124045793e1933c798af9e66a

- Token Type: Utility, Governance

- Total Supply: 696,900,000 YDF.

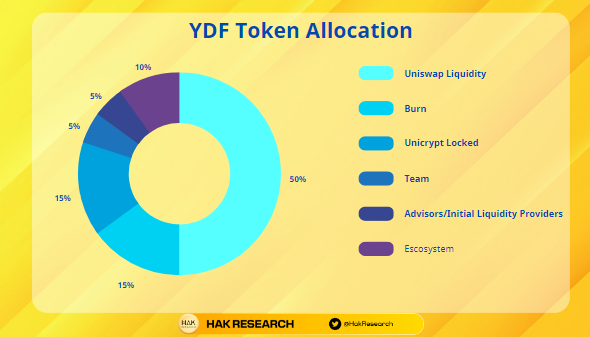

Token Allocation

YDF Token Allocation

Token Release

- Team: Allocated for 240 days.

- Advisors: Allocated for 240 days.

Token Use Case

YDF tokens are used for:

- Use for Staking on the platform.

- Used as collateral in Perpetual Futures transactions.

Exchanges

YDF tokens are traded on both Dex and Cex products such as: Uniswap, MEXC, Camelot, SushiSwap, CoinEx.

Yieldification Project’s Information Channel

- Website: https://yieldification.com/

- Twitter: https://twitter.com/yieldification

-

Telegram:

summary

Yieldification has a flexible combination of Defi and NFT that helps users not only earn profits through Staking but can also franchise their shares through selling NFTs on NFT Marketplace exchanges.